Who is best Google or Meta ai? Check AI strategy, monetisation, and growth cues to visualize the possibility of an AI race of redefining GOOGL versus META stock returns.

Introduction

The increasing rate at which artificial intelligence is being adopted, in fact, has reshaped the strategy agenda of the technology giants in the world. The question arising in the mind of many investors, analysts and industry observers is an open-ended one as it goes, namely, who is best Google or Meta ai? This is not a question that reaches chatbot performance or headline innovation, but the deeper issue of using artificial intelligence to create sustainable economic value. The answer can ultimately decide long-term outcomes for the shareholders in the GOOGL and META stock analysis.

The Google AI and Meta AI comparison in the article is clearly divided further into (1) AI chatbots and product ecosystems and (2) the effect of the AI on valuation, quantified in terms of operating performance and capital efficiency. The analysis of the characteristics of the AI strategy to redefine AI-driven valuation and long-term GOOGL vs META stock returns is based on the analysis of the characteristics of the AI strategy.

AI Chatbots and Product Ecosystems: Google vs Meta

Google AI Products and Ecosystem

The AI product stack positioning of Google is not only strategic, but also covers the Search, YouTube, Android, Workspace, as well as cloud-based services. Generative AI and increased large language model features make searching, optimising advertising, developer tools, and enterprise workflow more relevant. Google does not use a single flagship chatbot but, rather, deploys AI throughout its ecosystem and builds on scale and retention of users.

It is an ecosystem-based approach that will make Google conquer its platforms in the long run, which is consistent with its overall Google AI growth outlook (Alphabet, n.d.).

Meta AI Products and Consumer Integration

The Meta AI strategy has a more limited focus on consumer interaction and communication with consumers on its core services, i.e., Facebook, Instagram, WhatsApp, and Messenger. Ad targeting solutions and recommendation engines are artificial intelligence-driven and directly integrated into the user interfaces, along with conversational assistants. The breadth of the ecosystem, unlike the example of Google, is not aimed at the service as a means of progression into monetization but at gaining efficiency in terms of engagement within the Meta AI business model.

The official statements provided by Meta show that one of the most significant tools that are employed to boost content discovery, advert relevance, and creator monetization is the AI (Meta Platforms, n.d.-a).

AI Chatbot Comparison and Strategic Implications

Comparatively, on chatbot and product, the debate of who is best Google and Meta ai, is dependent on the strategic priorities. Google performs well in AI breadth, infrastructure scale, cross platform integration, but in AI depth of engagement and social ecosystems monetisation, Google is trailing the field, and Meta is a winning competitor in the field. This is a direct follow-up of the fact that AI monetization impact on stocks since the path of innovation to profitability differs in the two companies.

Transition: From Products to Valuation

The notion of product leadership is appealing to a certain extent, although investors are concerned about the influence of AI on valuation in the final. The second part of this paper evolves into capabilities, which could be used by individuals in AI-driven valuation, in which it discusses the variation in capital structure, operating efficiency and sensitivity of intrinsic values as a consequence of AI investment.

Valuation Effects of AI Investment

Google: Net Operating Assets and Capital Intensity

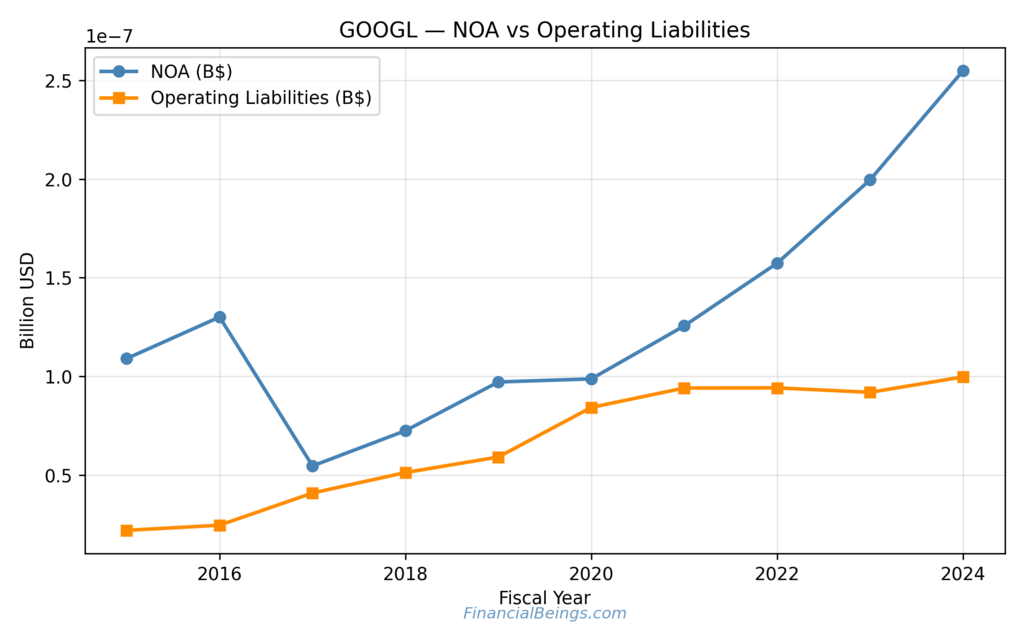

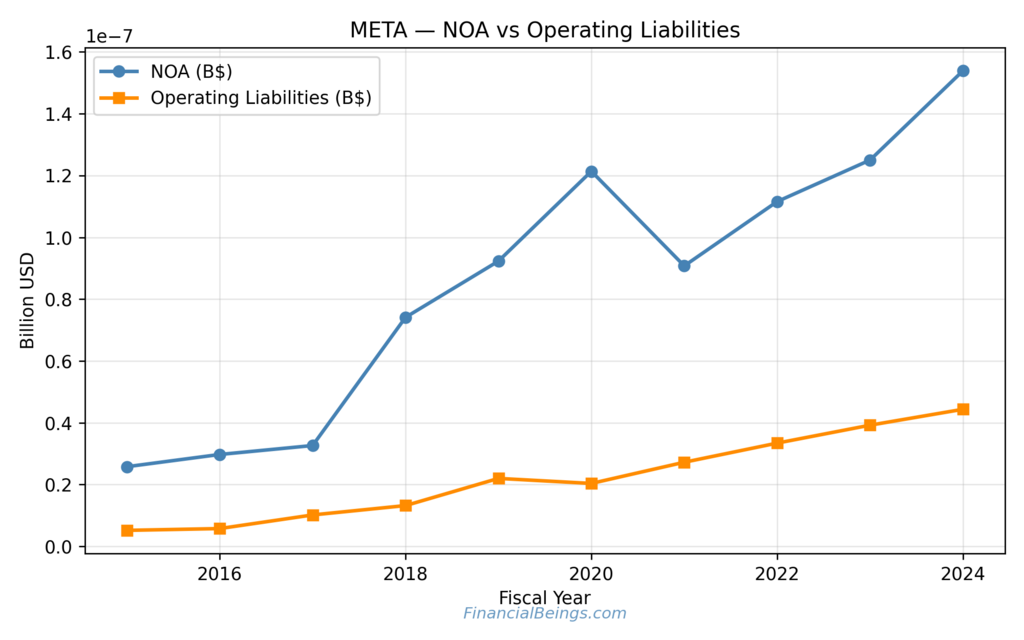

Figure 1: GOOGL — Net Operating Assets vs Operating Liabilities

It shows that the net operating assets of Google grow in the long term as compared to the operating liabilities, which implies the growth of the capital intensity of the platform and AI investment.

This shows a clear upward trend in the net operating assets of Google over time and a slow increase in the operating liabilities. The growing difference is a measure of the growing capital intensity. In terms of valuation, the investments made in AI raise the quantity of capital that will be needed to generate returns beyond the cost of capital, so as to proceed to generate value.

Table 1: Google Capital Structure Trend

| Phase | NOA Trend | Operating Liabilities Trend | Valuation Insight |

| Early | Moderate | Low | Asset-efficient growth |

| Mid | Accelerating | Rising | Scaling investment |

| Recent | Strong | Stable | Higher return hurdle |

This structure contributes to driving the point further that the AI leadership at Google needs to be transformed into sustainable operating efficiency to ensure that it can justify further capital expenditure, which is one of the central themes in GOOGL vs META stock analysis.

Google: Operating Liability Leverage

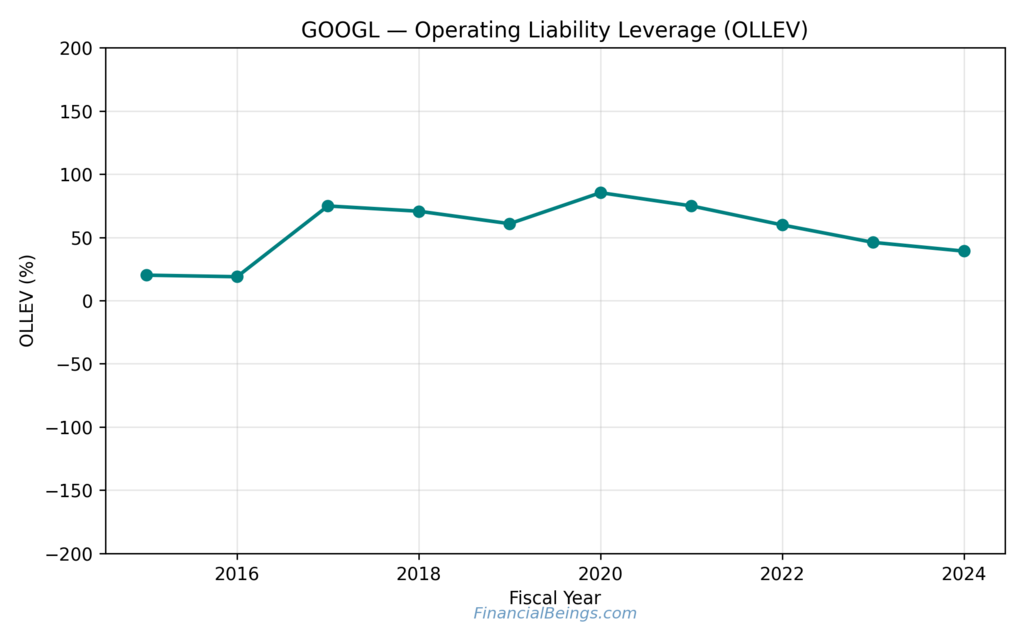

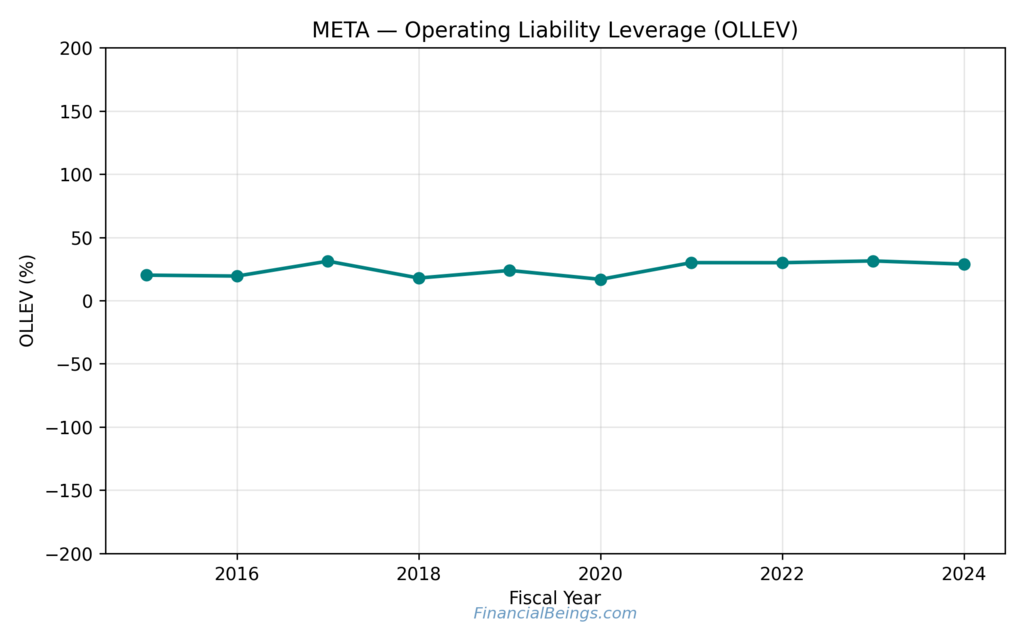

Figure 2: GOOGL — Operating Liability Leverage (OLLEV)

OLLEV indicates the level of operating liabilities in supporting operating assets and how it determines the volatility of returns.

The OLLEV of Google increases drastically before levelling off, indicating that there was initial dependence on the operating leverage and then transitioning to balance-sheet stability. This trend minimises downside risk yet minimises amplification of returns. According to an AI-driven valuation, Google focuses on stability, rather than leveraged aggressiveness.

Google: Return on Net Operating Assets (RNOA)

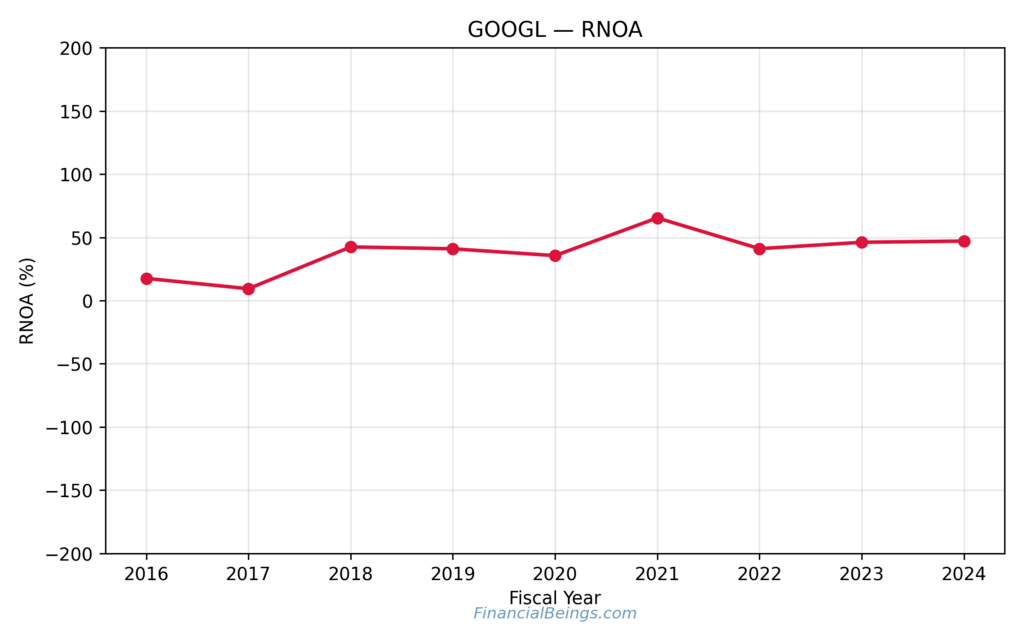

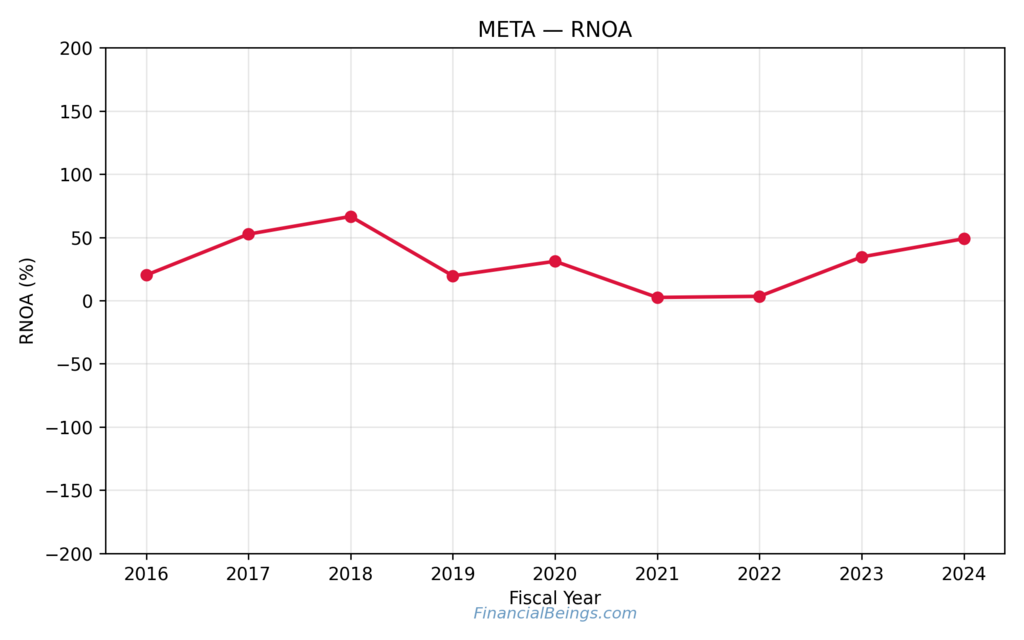

Figure 3: GOOGL — Return on Net Operating Assets (RNOA)

RNOA measures operating efficiency relative to invested operating capital.

RNOA is a volatile indicator that is sensitive to investment cycles and expenses in the field of AI. The high levels of efficiency would also come at intervals, but the closer the degree of asset intensity, the more difficult it would be to sustain high returns. This underpins the understanding that Google’s AI strategy is scale-effective, but efficiency has time normalisation.

Meta vs Google: Intrinsic Value Sensitivity to Growth

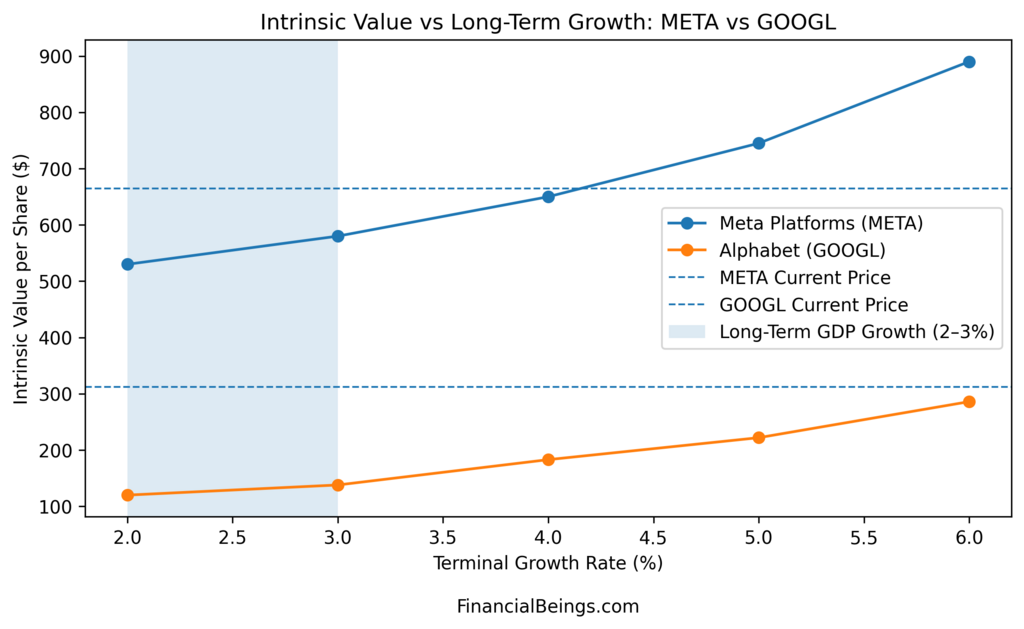

Figure 4: Intrinsic Value vs Long-Term Growth — META vs GOOGL

This is contrasted to intrinsic value, responsiveness to changes in the long-term growth prospects of Meta and Google.

The intrinsic value overlay represents a single significant divergence. Increased growth assumptions are more sensitive to the increased intrinsic value of Meta, where the curve of Google is far slower. It implies that the valuation of Meta is less conditional upon the success of the monetization of AI services, whereas the valuation of Google is more predictable growth.

This is the point of difference, and this is at the heart of who is best Google or Meta ai, in the mind of an investor. Meta is more advantageous in cases when AI will increase the degree of economic profitability, and is more vulnerable in those cases when the expectations are not achieved.

Meta: Balance Sheet Strength and Asset Coverage

Figure 5: Assets-to-Liabilities Ratios for Meta Platforms

This illustrates Meta’s total assets-to-liabilities and net tangible assets-to-liabilities trends.

Table 2: Meta Balance Sheet Ratios

| Period | Total Assets to Liabilities | Net Tangible Assets to Liabilities |

| Early | Lower | Lower |

| Recent | Higher | Higher |

The positive trend is an indicator of enhanced balance-sheet resilience, which affirms the capacity of Meta to finance AI projects without a strain on its financial resources (Meta Platforms, n.d.-b).

Meta: Net Operating Assets and Capital Intensity

Figure 6: Operational Efficiency for Meta Platforms

Gross, operating and Net Margins that indicate Meta can convert revenue into profit.

The long-term structural effectiveness is also great; in other words, profitability is supported by efficiency gains based on AI. This is to the advantage of the Meta AI business model, where AI enhances the monetization efficiency, which is not capital-intensive.

Meta: Operating Liability Leverage

Figure 7: Revenue, EBITDA, and Free Cash Flow for Meta Platforms

This leads to the spotlight of cash-generating capability and the trend of revenues of Meta.

It is becoming increasingly unstable; however, the cash flow of Meta remains high, which allows it to invest in AI and maintain shareholder value. This would reinforce the AI monetization impact on stocks in case the AI improves the operating leverage.

Meta: Return on Net Operating Assets (RNOA)

Figure 8: Return on Equity and Return on Total Capital for Meta Platforms

The RNOA trend indicate the ability of Meta to generate returns on operating assets.

When positive returns are found, it indicates that capital is well utilised, which enhances the correlation between AI innovation and economic profitability.

Further Reading : Meta Stock Forecast for 2030: Separating Sustainable Economic Profits from Market Hype

Further Reading : GOOGL Stock AI Driven Growth Explained – Why Alphabet’s AI Ecosystem Could Redefine Long-Term Returns

Conclusion

So, who is the best Google or Meta AI? In terms of products, Google leads in the scope of the ecosystem, and Meta leads in the scope of monetisation. The AI approach of Meta appears to be more accretive to economic profitability, whereas Google’s strategy is centred on durability and scale.

Lastly, the AI race will restructure GOOGL vs META stock returns not according to the technological news headlines, but according to the success of AI to turn into sustainable returns on capital. The investors who hold a more AI-driven valuation rather than an AI-based narrative hype among investors will be in the most favourable position to assess the results in the long term.

Frequently Asked Questions (FAQs)

Which is better, Meta AI or Google?

The valuation evidence shows that the answer to who is best Google or Meta ai, is dictated by the investor on the risk preference. The AI-based strategy, suggested by Meta, is more closely related to the efficiency of operations and the increase of residual income, has a greater upside, and is more susceptible to changes in valuation. The AI strategy of Google values the breadth and stability of the ecosystem far more than volatility, which requires long-term efficiency to finance the capital intensity growth.

Will Meta AI replace Google?

No, it is hard to believe that Google will be replaced entirely by Meta AI, but it is a serious competitor that is redefining the search landscape. Both companies are implementing the utilisation of AI in their products to revolutionise the user experience, and Google is not a new firm, being a dominant search engine.

Is Google the best AI in the world?

No single AI is said to be the best in the world. The existing AI models/systems are the most effective in numerous aspects, and new advances are being realised too. The most popular of the AI models of Google, the Gemini in particular, is considered the state-of-the-art in the plethora of benchmarks and multimodal understanding, but is competing favorably with other leading systems.

Which company is better, Google or Meta?

There is no clear-cut winner between Alphabet and Meta platforms as the two companies excel in various spheres. Google has broader ecosystem strength and financial sustainability, wherein AI is incorporated in search, cloud and consumer platforms. Meta, in its turn, is more efficient in terms of AI monetisation, where the direct positive effect of AI is observed on the advertising performance and operating margins. The better company, therefore, depends on whether an investor is more stable and diversified (Google) or has a higher upside with more execution risk being powered by AI (Meta).

Is it smart to buy Meta stock?

Analysts typically believe that Meta is a smart long-term investment, although it has a high presence in AI, a strong cash flow, and growth potential, despite the recent volatility, high spending on AI, and short-term sell indications. Some consider the stock to be underpriced, and our internal price target is between $745-$890.

All calculations and valuation estimates are FinancialBeings’ own, based on data sourced from SEC filings META (10K and 10Q)and Alphabet Inc (GOOGL) (10K and 10Q) use or reproduction before prior approval is prohibited.

Usama Ali

Usama Ali is the founder of Financial Beings and a self-taught investor who blends classic valuation study with insights from psychology. Inspired by works from Benjamin Graham, Aswath Damodaran, Stephen Penman, Daniel Kahneman, and Morgan Housel, he shares independent, data-driven research to help readers connect money, mind, and happiness.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.