What are the risks of investing in AI in 2026? Explore valuation risk, concentration, regulation, and why AI investing may be overhyped.

Introduction: Why “AI = Growth” Is a Dangerous Shortcut

Artificial intelligence has been commonly described as the most powerful driver of modern economic development. Over and over again, investors are being told that AI is going to revolutionize industries and will make them more productive and generate new income they have never experienced before. This narrative has informed most market players that investing in AI-related stocks is equivalent to long-term returns and high returns.

There is even a more dangerous supposition. Shareholder value is not always a result of technological changes. The future returns are realized at very long distances, and the financial markets make decisions based on the future returns. Optimism is widespread before the economic fundamentals are realized, and the prices become disconnected from the economic fundamentals. This is the reason as to why it is of utmost importance to understand the risk of investing in AI in 2026, when the expectations will already be elevated.

As of now, many AI-driven technology companies have been appraised as near-perfect. The rates of return are not high until after several years, when the high rate of growth is unusual. This shows that AI investment can be overhyped, not because of the irrelevance of AI, but because much of its future success is already predetermined in the present prices.

Key Valuation Results

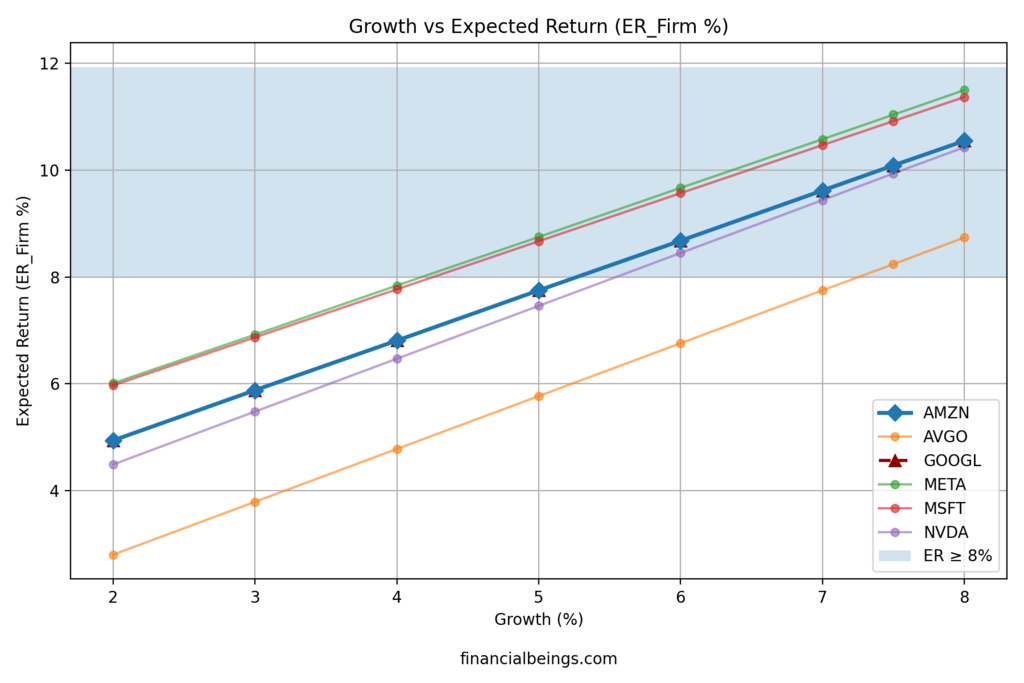

The assumptions of the assumed growth in the long term are very sensitive to the investors on the expected returns of the major technology companies exposed to AI. The expected returns are minimized significantly in cases where growth is anticipated to be low, even by a slight margin. Projected returns of most AI-correlated stocks are less than 8 percent, which some investors consider to be a respectable equity return, even with lower assumptions of growth of 2-4 percent.

The data obtained by use of the direct valuation show that expected return of Amazon will be determined by the rate of growth and that the expected return of Amazon will be approximately 5.0% at 2% growth rate and approximately 10.6% at 8% growth rate and the expected return of Broadcom will be approximately 2.8% at 2% growth rate and 8.8% at 8% growth rate. Alphabet, Meta, and Microsoft have only reached the 8% level of returns after the growth assumptions hit single digits. The same applies to NVIDIA, which has to achieve a high growth to warrant reasonable returns.

This is an implication. In the long run, returns are likely to decline substantially when AI development picks up on more generic economic processes. It is among the simplest answers to the question of what are the risks of investing in AI today.

Figure 1: Growth vs. Expected Return Sensitivity in AI tech stocks. The presence of the valuation risk and the absence of the margin of error can only be attributed to assumptions of aggressive long-term growth leading to the expected returns.

Table 1: Expected Firm-Level Returns (%) Across Growth Assumptions for AI-Driven Stocks

| Growth Assumption (%) | Amazon (AMZN) | Broadcom (AVGO) | Alphabet (GOOGL) | Meta (META) | Microsoft (MSFT) | NVIDIA (NVDA) |

| 2% | ~5.0% | ~2.8% | ~6.0% | ~6.0% | ~6.0% | ~4.5% |

| 3% | ~5.9% | ~3.8% | ~6.9% | ~6.9% | ~6.9% | ~5.5% |

| 4% | ~6.8% | ~4.8% | ~7.8% | ~7.9% | ~7.8% | ~6.5% |

| 5% | ~7.8% | ~5.8% | ~8.7% | ~8.8% | ~8.7% | ~7.5% |

| 6% | ~8.7% | ~6.8% | ~9.6% | ~9.7% | ~9.6% | ~8.5% |

| 7% | ~9.6% | ~7.8% | ~10.5% | ~10.6% | ~10.5% | ~9.5% |

| 8% | ~10.6% | ~8.8% | ~11.4% | ~11.5% | ~11.4% | ~10.5% |

Valuation Risk: When AI Growth Is Already in the Price

The nearest and most measurable aspect of the risk question of investing in AI is valuation risk. The existing AI-related stock prices show that the increase will continue at high rates and continue over a long-time span, which in most instances would be well beyond what history could project as a sustainable company of this dimension.

The market-implied perpetual growth rates of the significant AI-related companies are between 6 and 9 percent. This is extremely challenging when dealing with big established firms where the growth can barely be maintained indefinitely. The more valuations are built on these assumptions, the lower the earnings yield and the lower potential returns on the future will be, although the operation implementation may be good.

The worst thing with this risk is that a big portion of the current estimations is not supported by actual operating assets. Relative to AI leaders, the net operating assets are a small fraction, which means that the remainder of it depends on the opportunities of future performance rather than the present balance-sheet strength. Companies such as Broadcom and NVIDIA have net operating asset weights of slightly less than 1%, and Alphabet, Meta, and Microsoft have less than 10%.

When the stocks are being valued on pure expectations, the stocks are extremely sentimental. Even unsuccessful mini expansions can cause disproportional price drops. This is why investment risk in AI is actually becoming more and more valuation fragile, whereas technological failures are not. Generally, it is stated on many occasions that a substantial portion of the AI narrative has already been priced in and the rise in the future is not likely to be a surprise (Financial Times, 2025).

Concentration Risk: AI Portfolios Are Less Diversified Than They Look

Even the concentration in the market by these AI-driven tech giants is a cause of concern as far as portfolio risk is concerned. These six companies (and a few associates) have been enjoying an unequal profit in the market during the recent past. At its finest, in 2025, the S&P 500 had gained approximately 16 percent, and AI conquerors Nvidia, Alphabet, Broadcom, and Microsoft would dominate the market. NVIDIA, Microsoft, Alphabet, Amazon, Broadcom, and Meta are together contributing to about 30 percent of the market capitalization of the S&P 500. It is the largest percentage of 40 percent in the top 10 stocks since the 1960s.

The risk is that should there be a bear market or a disillusionment with the AI investment story, the selloff of these leaders would likely proportionately impact broader indices. In effect, the market is gambling on AI at scale, and any drop can be vicious on the index.

Moreover, such companies are investing in AI at a rate never seen before, e.g., Microsoft, Google, Amazon, and Meta are projected to raise capex on AI by 34 percent to as much as 440 billion in the upcoming year. Such active expenditure will signify high confidence in AI-based growth, but it raises risks. Over-investment is a conventional bubble metric: when the economic payback of AI falls short of the investment, it will have a detrimental impact on earnings and returns.

The circles of financing AI (i.e., big tech financing AI startups that, in their turn, use the platform of big tech) simply introduce additional mud into the actual ROI. Institutional investment in the form of a hype cycle needs to consider that initial returns are exaggerated by the hype cycle – an aspect that is a fact in previous technological booms (since railroads through dot-com). Even though it is clear that AI will be the bearer of the actual progress, the steep curve is involved in the valuations now, which leaves very little time to make an error.

Recent stance of Ed Yardeni, the veteran strategist, cautioned that at that concentration, technology could not be overloaded. We take the risk analysis in accordance with that caution. It is all that renders a weak state situation where any deviation or any hiccup in development by AI will lead to a robust reassessment of these stocks and consequently the market (Fortune, 2026).

Expectation Risk: The Gap Between AI Hype and Monetization

The pace at which AI is being embraced in the industries is extremely high, and it appears that businesses have not been able to turn the embrace into consistent and sustainable revenues. This disconnect is a contributor to the risk of expectation, and the enthusiasm of the market regarding the transformative potential of AI is growing faster than the real generation of streams of sustainable cash.

Big tech firms are spending colossal amounts of money on AI-related infrastructures, including data centers, special chips, and software development. Such investments might develop long-term competitive advantage, but in the short term, it takes a financial burden. The capital expenditure results in deferral of the free cash flow and also an increase in the execution risk, especially in situations where returns on such investments are future-based, depending on the demand, which is not yet clearly established.

In the meantime, the competitive dynamics are increasing. The growing supply of open-source artificial intelligence and the entry of new competitors reduce the pricing power and make the situation more difficult for the incumbents as they aim to gain an outsized number of economic rents. As more and more AI capabilities become available, differentiation will become more of a challenge, and margins may be challenged. In this regard, it becomes even harder to transform AI leadership into sustainability in profits.

The operating and capital expenditures on AI continue to grow, and the contribution to the profitability in the near future remains disproportional in the companies (Yahoo Finance, 2025). Such a discrepancy in the pace of adoption and slower payoff confirms the existence of an expectation mismatch in what are the risks of investing in AI. In case of market expectation changes, downward adjustment can be followed in case cash flows have not yet materialized, even when the adoption of AI continues to grow.

How Smart Investors Manage AI Investment Risk

AI itself is not the problem. This is because the main risk is overpaying and over-timing the growth that may take longer to be actualized or may not be as lucrative as it is expected. Even smart investors in which technology is involved are the ones that require a sense of discipline in valuation by intelligent investors.

The strategy of dealing with the AI risk of investment is to listen to the headlines and not to dwell on the economic basics. Investors who pay attention to sustainable cash flows, return on capital, and realistic growth premises have an advantage of establishing whether the present prices incorporate adequate compensation for risk. The plan helps to separate the actual long-term value creation from short-term enthusiasm not based on narratives.

The most disciplined investors also get to know that innovation cycles are usually oversensitive during the first phases. Markets are known to forecast success in the future and make favorable predictions on prices well ahead of economic outcomes. Investors are also able to mitigate the effect of volatility when expectations are bound to revert to the fundamentals by basing investment choices on them, and not on sentiment.

Lastly, an efficient AI investor should be patient, picky, and willing to disagree with the general opinion. The better people are at exposing AI with valuation savvy, rather than narrative faith, the more they can sail through the ambiguity that is presented with overrated investment themes.

Conclusion: Why AI Investing May Be Overhyped in 2026

The fact of valuation speaks to a certain conclusion. Being an investor in many AI-related stocks, future growth opportunities are predicted to be above average and sustainable, and one will have no reason to be unhappy about it. Until such positive assumptions are fulfilled, the returns are expected to be minimal, and this is greatly downplayed in case of any decline in growth or tightening of the level of competition, or market sentiment being wrong.

The largest risk in responding to the question of what are the risks of investing in AI, is not the failure of the AI technology, but this is that investors will over-optimize the potential. The intensive technological advance will not automatically be followed by the intensive payback of the investment since AI will continue to influence the industries and drive the innovations forward.

The risk of valuation in the form of high expectations is the biggest threat to AI investors in 2026. Long term investment in AI will become less and less dependent on the faith in the narrative, but not on the discipline of valuation, realistic assumptions, and emphasis on economic value creation.

All calculations and valuation estimates are FinancialBeings’ own, based on data sourced from SEC filings NVDA (10K and 10Q), AMZN (10K and 10Q), GOOGL (10K and 10Q), META (10K and 10Q), MSFT (10K and 10Q), and AVGO (10K and 10Q), use or reproduction before prior approval is prohibited.

Usama Ali

Usama Ali is the founder of Financial Beings and a self-taught investor who blends classic valuation study with insights from psychology. Inspired by works from Benjamin Graham, Aswath Damodaran, Stephen Penman, Daniel Kahneman, and Morgan Housel, he shares independent, data-driven research to help readers connect money, mind, and happiness.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.