The top AI dividend stocks in 2026 will be ranked in terms of the dividend yield, the sustainability of dividends, and AI exposure. Discover actual dividends, not hype AI leaders like Microsoft, IBM, Broadcom, and TSMC.

Introduction: Why Top AI Dividend Stocks Matter in 2026

Artificial intelligence continues to dominate the stock markets across the world, yet the priorities of investors are clearly shifting by 2026. Although the initial investment in AI was almost entirely on the grounds of growth prospects, the upsurge in interest rates, valuation discipline, and market maturity is making investors more intrigued with the certainty of income, cash-flow robustness, and concrete returns on the shareholders. The strategy places the top AI dividend stocks at the middle of income-oriented and balanced portfolios.

Unlike the speculative AI companies, dividend-paying AI companies make no cash payments to the stockholders, but the companies have a stable stream of revenues, and operating cash flows are predictable. These companies will be able to invest in the development of AI and simultaneously pay dividends to the investor regularly. They are, therefore, a more defensive way of subjecting themselves to artificial intelligence, especially in cases where the investor is seeking AI stocks for passive income.

This is particularly tempting in 2026. The dividend-paying AI stocks remove the reliance on capital gains and help to offset the valuation risk of paying real and repeated income. The AI stocks with dividends are a middle ground between income and retirement, and conservative portfolios, such as the need to participate in the long-term creation of AI, and also get insurance on income and downside risks.

Top AI Dividend Stocks Ranking

Table 1: Top AI Dividend Stocks Ranked by Dividend Yield

| Rank | Company | Dividend Yield | Payout Ratio | Dividend Growth History | AI Exposure | Recent AI Initiatives | 2026 Catalysts | Upcoming Ex-Dividend Dates |

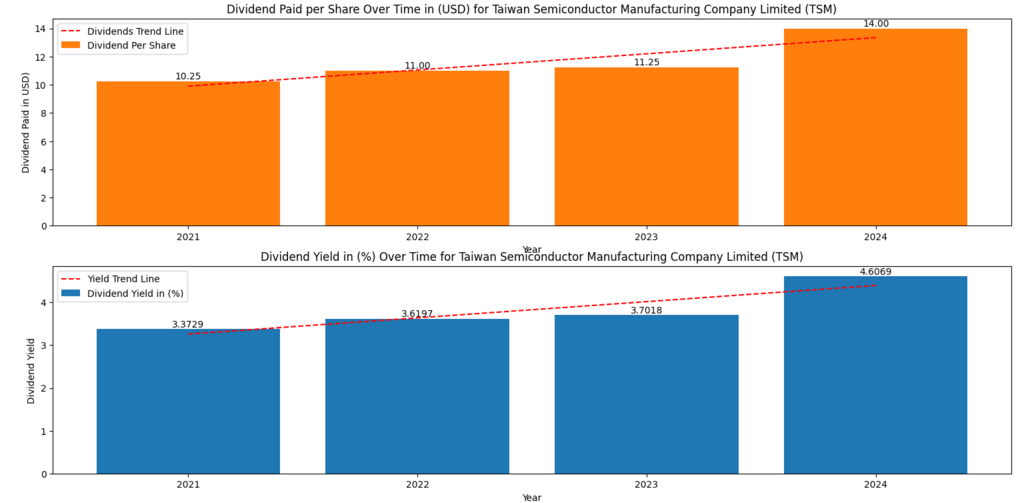

| 1 | TSMC (TSM) | 2024: 4.6069% | 28.73% | Dividend/share rising 10.25 → 14.00 (2021–2024) | AI chip manufacturing (foundry capacity for AI accelerators) | Scaling advanced-node production supporting AI compute demand | AI server demand + advanced packaging momentum | 17.03.2026 |

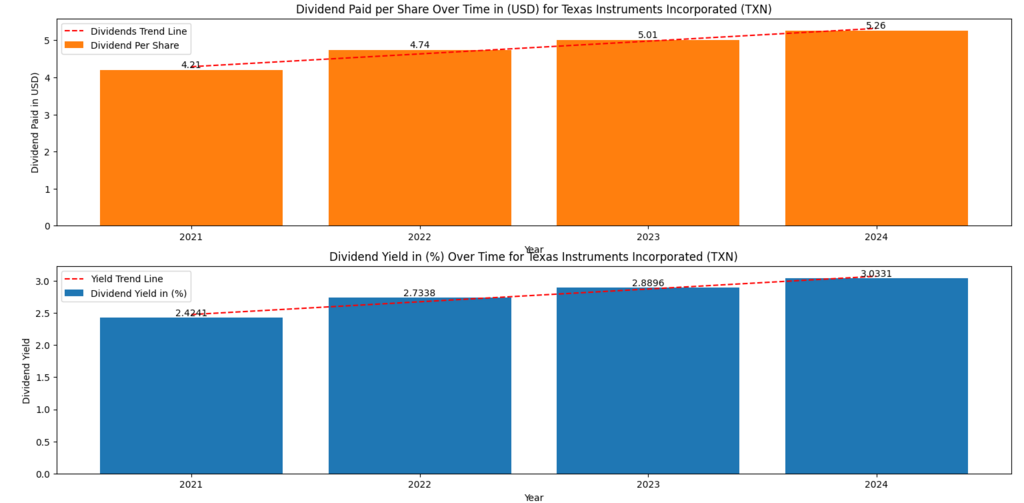

| 2 | Texas Instruments (TXN) | 2024: 3.0331% | 99.09% | Dividend/share rising 4.21 → 5.26 (2021–2024) | Industrial/embedded AI via analog & power chips | Expanding capacity to support long-cycle industrial demand | Industrial cycle recovery + inventory normalization | 30.01.2026 |

| 3 | IBM (IBM) | 2024: 2.2404% | 79.86% | Dividend/share stable/slightly rising 6.54 → 6.64 (2021–2024) | Enterprise AI + hybrid cloud services | Enterprise AI solutions integrated into services & cloud workflows | Enterprise IT spending discipline + AI adoption in services | 10.11.2025 |

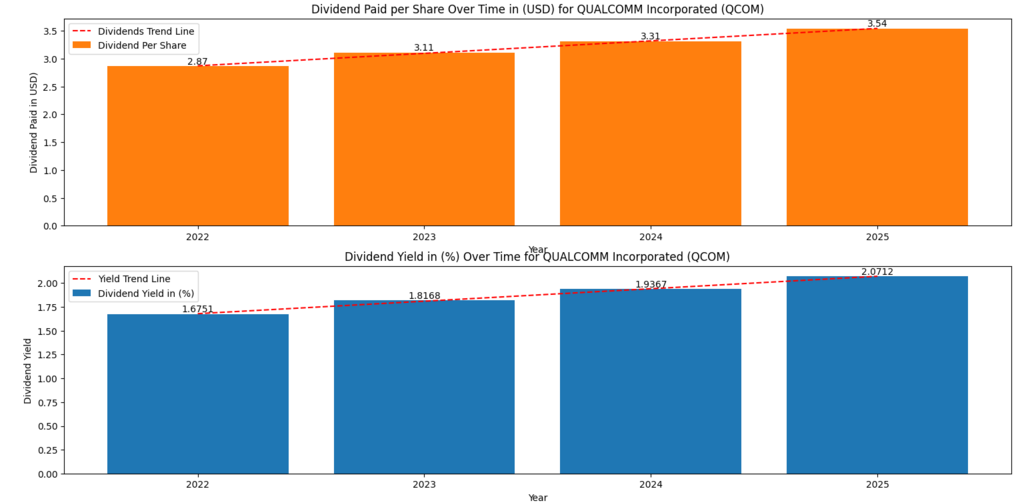

| 4 | Qualcomm (QCOM) | 2025: 2.0712% | 69.46% | Dividend/share rising 2.87 → 3.54 (2022–2025) | On-device/edge AI (mobile, PC, auto) | Edge AI rollout across premium devices and compute platforms | Device replacement cycle + AI-enabled hardware upgrades | 05.03.2026 |

| 5 | Analog Devices (ADI) | 2025: 1.4492% | 85.31% | Dividend/share rising 3.03 → 3.93 (2022–2025) | Industrial AI exposure via sensors, signal processing | Supporting automation, sensing and intelligent industrial systems | Industrial recovery + automation investment cycle | 08.12.2025 |

| 6 | Broadcom (AVGO) | 2025: 0.6790% | 49.48% | Dividend/share rising 1.68 → 2.35 (2022–2025) | AI infrastructure (networking/connectivity for data centers) | AI networking stack supporting scaling of AI compute clusters | Data-center buildout + AI networking demand | 22.12.2025 |

| 7 | Microsoft (MSFT) | 2025: 0.6698% | 23.61% | Dividend/share rising 2.43 → 3.24 (2022–2025) | AI platforms + cloud + productivity AI | AI embedded across cloud services and productivity ecosystem | Enterprise AI adoption + cloud AI scaling | 19.02.2026 |

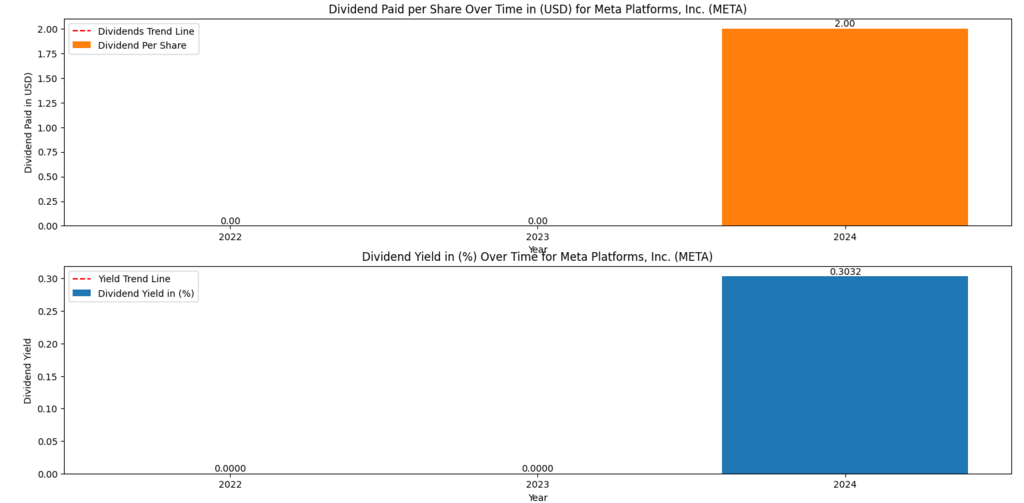

| 8 | Meta Platforms (META) | 2024: 0.3032% | 9.18% | Dividend initiated 0 → 2.00 (2022–2024) | AI-driven advertising + recommendation systems + generative AI | AI for ad targeting efficiency and consumer-facing AI tools | Monetization efficiency + AI product scaling | 15.12.2025 |

The top AI dividend stocks are not always attributed to the highest AI dividend shares. Semiconductor companies and mature enterprise technology are the 2026 dividend leaders, and not hype around consumer AI.

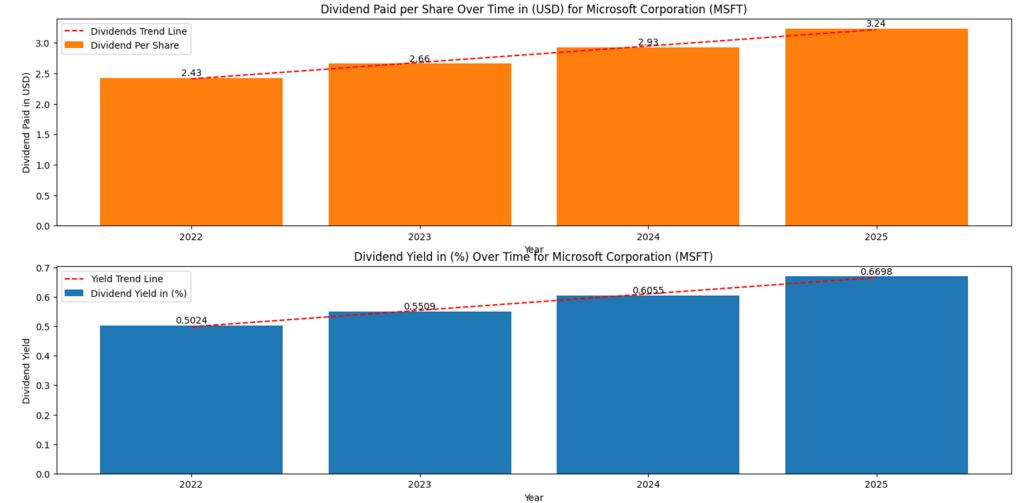

Microsoft (MSFT): AI Growth with Dividend Discipline

In the list of the top AI dividend stocks, Microsoft is a low-yielding but highly reliable stock. This shows that the dividend per share is growing consistently from 2022 to 2025, and the dividend yield is also rising at a slow pace.

The increase in dividends has been gradual and consistent, and a positive sign that the management does not have the fear making huge investment on AI. The Microsoft AI dividend exposure platform is broad in terms of cloud infrastructure, enterprise software, and productivity tools based on AI.

Microsoft needs to be long-term dividend growth investors as opposed to high-yield seekers in terms of income. This is proved by the consistency that showed Microsoft as a foundation stock in artificial intelligence stocks that pay dividends and not a yield maximizer (Yahoo Finance, 2025).

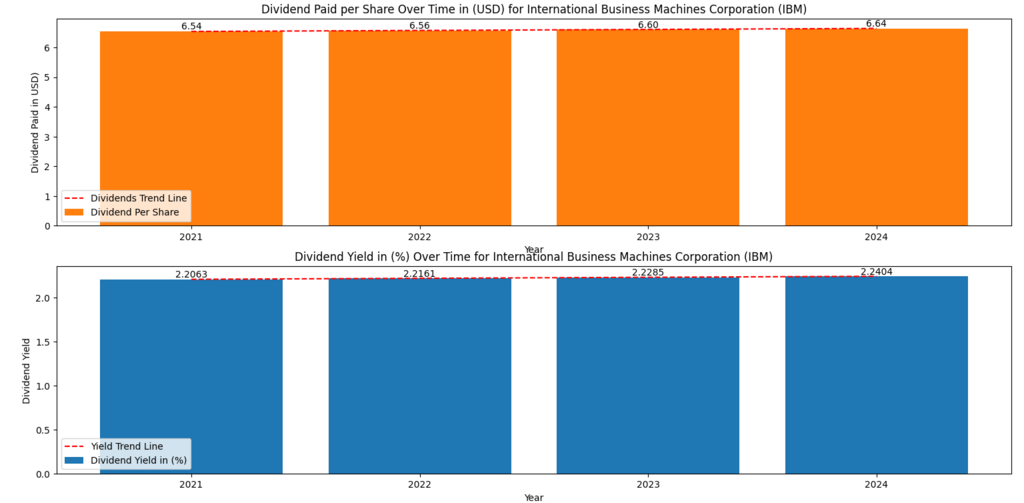

IBM: One of the Most Reliable AI Income Stocks

Compared to the high growth, IBM has a stable dividend yield, and this qualifies it to be among the top AI dividend stocks. This reminds us that dividend payments are nearly flat, and that they are very high, and remain high with dividend yield being superior to most of the large-cap technology.

IBM AI dividend growth history is not aggressive, and dividend yield reliability is an income-attracting characteristic of the company to investors. Enterprise AI, automation, and hybrid cloud integration are the destinations of AI projects, rather than products directed at consumers.

IBM is appropriate in the portfolio with fixed dividend payment of artificial intelligence dividend stocks, especially since capital growth is not a major concern in priority (Yahoo Finance, 2025).

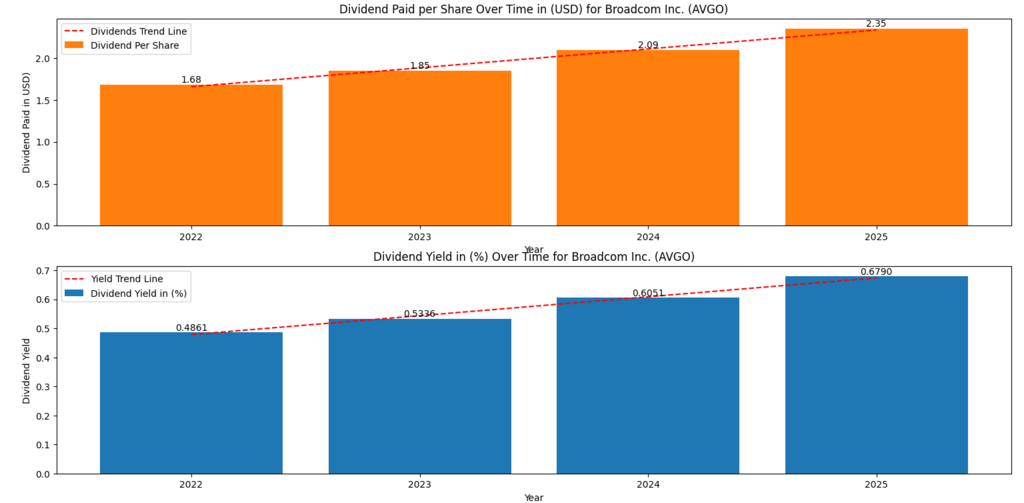

Broadcom (AVGO): Dividend Momentum Powered by AI Infrastructure

The trend of rising dividends at Broadcom is one of the clearest upward dividend trends among the best AI dividend stocks 2026. The dividend per share is rising with each passing year, and the yield of dividends is rising slowly.

Broadcom is an AI enabler behind the scenes, as the exposure sources of AI are primarily in networking chips, data-center connectivity, and AI infrastructure hardware. The dividends growth also appears to be more than most of the peers, and this implies the growth in income in 2026.

Broadcom dividend yield is a firm that achieves the investment objectives of dividend growth AI companies, in contrast to direct leadership in yield (Yahoo Finance, 2025).

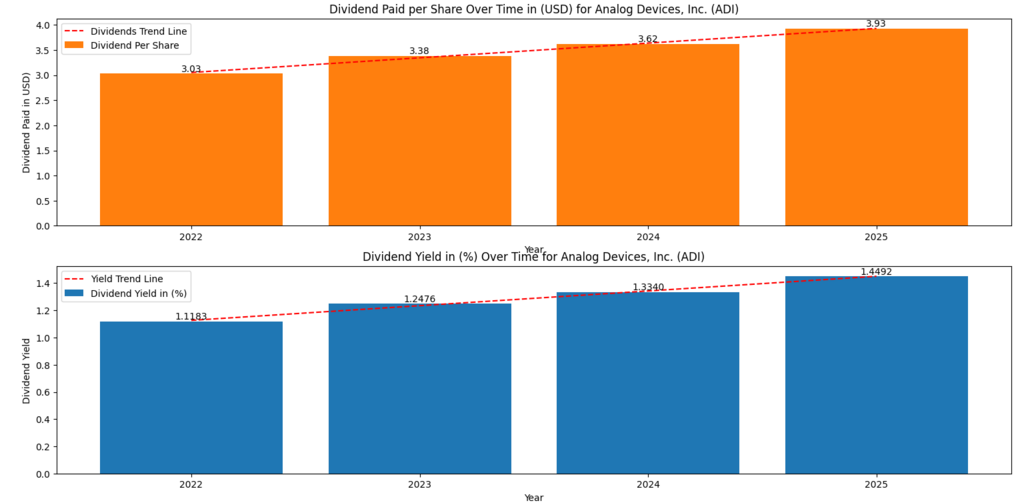

Analog Devices (ADI): Quiet Consistency in AI-Driven Industry

Analog devices offer decent but steady growth of dividends, as shown by the steady rise of the dividend per share and the dividend yield. Analog devices AI exposure is a less industry-specific and less volatile AI dividend stock that is one of the best.

Its penetration of AI is indirect but necessary- supplying analogous components in automation, sensing, and industrial intelligence systems. The track record on dividend growth development is a sign of incremental gains and not aggressive gains, which is in line with conservative income policies.

ADI is an investment that would fit well with investors who would like to ownsustainable dividend tech stocks that pay dividends but have low volatility (Yahoo Finance, 2025).

Qualcomm (QCOM): AI at the Edge with Rising Income

The growth in dividends and the increase in the dividend yield are observable. Qualcomm AI dividend is also one of the top AI dividend stocks, with AI being transferred to the devices and not just the servers in the clouds.

The history of increased dividends shows that the management has confidence in the cash flows as long as the cycling semiconductor demand is involved. AI efforts are now focusing on mobile AI, automotive intelligence, and edge computing.

Qualcomm is a balanced AI income stock in the case of 2026; it is a stock that offers an exposure to growth and does not undermine the dividends (Yahoo Finance, 2025).

Texas Instruments (TXN): High-Yield Leader Among AI Semiconductors

The Texas intruders make it to the list of the top AI dividend stocks in terms of yield. This shows that the growth of the dividend per share is very high, and the yield is one of the highest in the group.

It does not have a direct and long-term application with robotics used in industries, and embedded intelligence. Dividend growth history appears to be long-term and strong that makes TXN a promising investment as an AI income investment.

TXN is appropriate for investors who concentrate on premium funds in the high-yield AI stocks rather than vigorous expansion of capital (Yahoo Finance, 2025).

TSMC (TSM): The Highest-Yield AI Powerhouse

It is clearly seen that TSMC is winning the list of the top AI dividend stocks based on the yield. This trend shows a booming growth in dividends as well as a sharp increase in the dividend yield.

As the primary company in the supply of AI chips in the world, TSMC’s revenue potential is its strategic place in the supply of AI hardware. Past dividend growth is not stagnant; it has increased; this facilitates the sustainability of income.

TSMC would be the most appropriate combination of AI applicability and dividend payment in the industry in 2026 (Yahoo Finance, 2025).

Meta Platforms (META): A New Dividend Entrant

The newest among the top AI dividend stocks is Meta. There is no dividend before initiation, which is followed by a single step to dividend payment.

The dividend yield is low, but the very beginning of the same is an indicator of a change in strategy. The recommendation systems, advertisement optimization, and generative AI tools can also expose AI.

The reason is that the meta-AI dividend is an investment that appeals to AI stock passive income growth optionality investors rather than current yield prevalence (Yahoo Finance, 2025).

Final Investment Perspective for 2026

The cash-flow and consistent dividend stocks will form the most successful AI dividend stocks in 2026, in comparison with the hypothetical AI narratives.

In this respect, the strongest options are both TSMC and Texas Instruments when the investor is concerned with the dividend yield because of the dominating position in the sphere of AI hardware and long-term manufacturing demand. They are less predictable and volatile and might thus appeal to conservative investors who would like to be guaranteed with regard to stability in their income in terms of predictable dividends rather than high growth. The most interesting dividend growth will be provided by Broadcom and Qualcomm, as they will capitalize on the expansion of AI infrastructure and the implementation of edge-computing. The best long-term investment is Microsoft, which has a steady growth of dividends and a broad range of AI in cloud services and software. Even though Meta Platforms remains an early dividend-paying firm, it is a pointer that is still moving towards a direction of shareholder returns triggered by the growing efficiency of monetization.

The AI income-focused investments can be viewed as a narrower way of getting into the AI economy in 2026. By making dividends and cash-flow sustainability a priority, investors will get an opportunity to own AI without being motivated by the optimistic growth outlook and valuation growth, and the best AI dividend stocks will be a suitable addition to the balanced and income-oriented portfolios.

Frequently Asked Questions (FAQs)

What are AI dividend stocks?

AI dividend stocks are companies that engage to a certain extent with artificial intelligence technologies and pay their shareholders regular cash dividends. The companies combine artificial intelligence-based growth with stable cash flows and established business models.

Are AI stocks safe for income investors?

Such features make income investors more likely to buy AI stocks that have dividends than non-dividend-paying AI companies because dividends show the maturity of the financial structures and the strength of the cash flows. The sustainability of dividends and business stability are however dependent on the safety.

How should investors evaluate AI dividend yields?

The investors shall consider the AI dividend yield, history of dividend growth, sustainability of dividend payments, and the company based on the ability to meet AI investments without compromising cash flows. Yield must be viewed as something and not in isolation.

Should investors reinvest AI stock dividends?

This can be enhanced through re-reinvestment of AI stock dividends since such a dividend will compound income at a higher rate among those investors who have a longer horizon. Nevertheless, income-based investors may have the desire to get dividends in the cash form to enable them to meet the immediate needs of income.

Usama Ali

Usama Ali is the founder of Financial Beings and a self-taught investor who blends classic valuation study with insights from psychology. Inspired by works from Benjamin Graham, Aswath Damodaran, Stephen Penman, Daniel Kahneman, and Morgan Housel, he shares independent, data-driven research to help readers connect money, mind, and happiness.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.