The Top Artificial Intelligence Stocks for Portfolio Diversification in 2025

The search for artificial intelligence stocks to add to your portfolio should focus on BABA or ASML because of their solid financial performance and competitive market stance. ASML and Alibaba (BABA) represent top AI stocks for 2025 because they demonstrate healthy financial performance together with ideal market positions.

Artificial Intelligence through its transformative power shapes different business sectors including autonomous vehicles and cloud computing. The increased adoption of AI has made AI stock investments an optimal approach to achieve stability along with enduring growth potential. The AI space includes leading organizations ASML together with Alibaba (BABA) which excel in different areas of AI hardware and software technology.

Key Takeways

- The current wave of digital automation and business transformation makes AI stocks promising investment opportunities.

- ASML maintains control over semiconductor technologies which establishes it as an essential force in developing AI hardware.

- Cloud computing and e-commerce leadership positions under BABA make Alibaba the foundation for AI applications.

Is Investing in AI Stocks a Good Idea?

AI stocks represent a solid investment potential for 2025. AI remains in its introductory stage because the industry faces constraints in broad usage which enables early AI technology leaders to generate growth. Companies that lead in AI technology would benefit from long-term growth due to economic uncertainties which drive the need for diversification in global AI leaders across various regions. The best AI stocks to buy during the current market dip.

ASML: The Backbone of AI Chip Manufacturing

As a global market leader ASML provides essential extreme ultraviolet (EUV) lithography machines that drive production of high-performance AI chips. This company controls effectively the entire EUV lithography machine market while delivering crucial semiconductor equipment to major technology firms including NVIDIA and Intel and AMD.

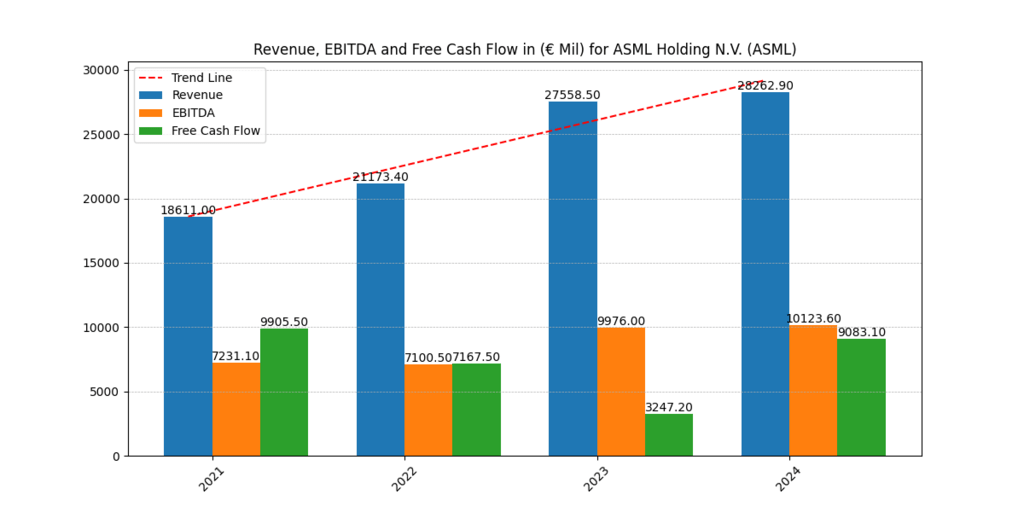

Financial growth at ASML has been outstanding as their revenue has increased from $18.6 billion in 2021 to $28.2 billion in 2024. EUV lithography machine manufacturer ASML maintained steady profitability through the 2024 fiscal year with EBITDA surpassing $10 billion because of its effective operations across global semiconductor market changes. The company demonstrated operational success and capital expenditure control through improved free cash flow which declined in 2023 but recovered substantially in 2024. [1]

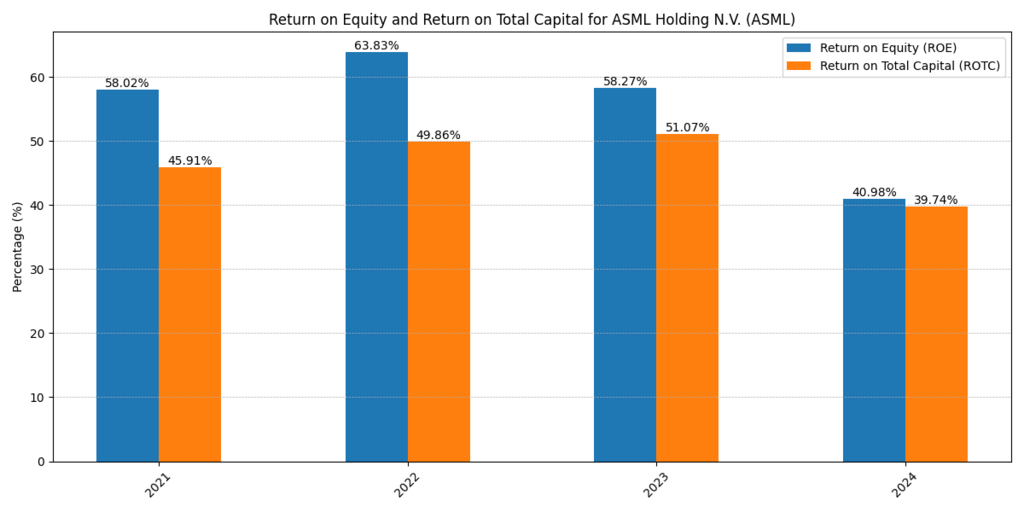

ASML preserves a healthy gross margin level that continues recording values above 50%. The company maintained effective cost control by showing a recovery of its operating margin between 2022 and 2023. ASML remains highly profitable as a market-leading company despite recorded net margin reductions between 2021 and 2024.

Alibaba (BABA): AI-Powered E-Commerce and Cloud Computing

The Chinese e-commerce giant Alibaba operates through its cloud computing services to deliver advanced AI solutions across various sectors such as logistics operations and tailored recommendations alongside financial services. The AI-powered applications across multiple sectors receive their computational strength from the cloud computing branch of Alibaba known as Alibaba Cloud.

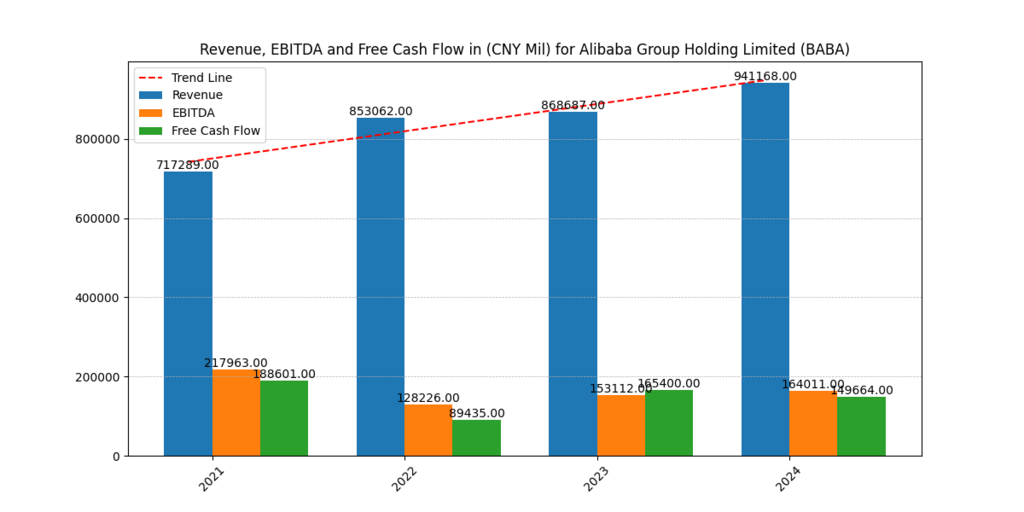

The revenue generated by Alibaba has expanded continuously since 2021 reaching $941 billion in 2024 regardless of Chinese regulatory obstacles. The company demonstrates economic uncertainty management strength through its recovery of EBITDA performance in 2023 and 2024 after its decline in 2022. Alibaba recorded a decline in free cash flow during 2022 which progressively improved throughout subsequent years because of its robust cash generation capabilities. [2]

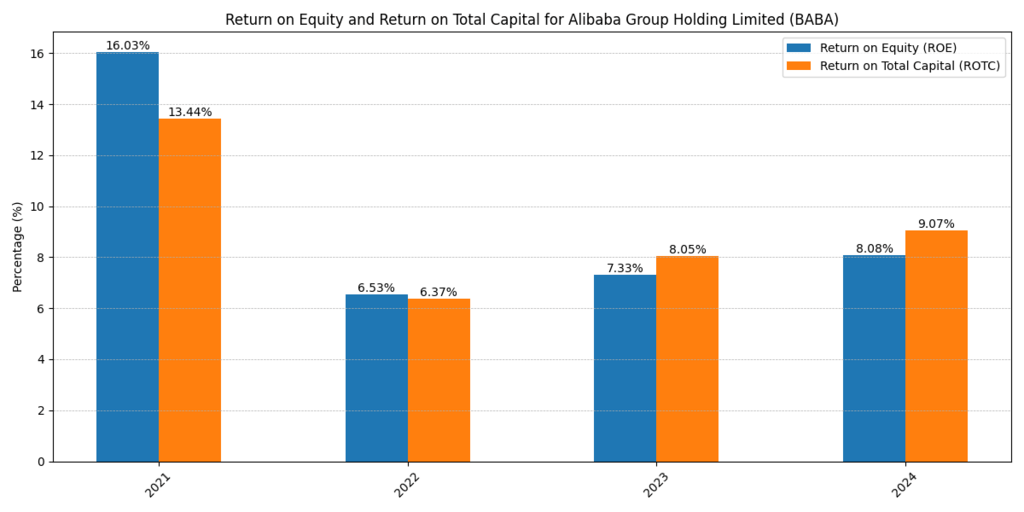

The profit margins from Alibaba demonstrate a strong financial state because gross margins remain at approximately 37% through 2024. The operating margin slightly shifted yet expanded to exceed 13% during 2024 since cloud computing contributed to its growth. Alibaba’s previous year-low net margins are showing improvement because the company directs its efforts towards high-margin AI-powered services.

AI Market Growth Projections (2024-2030)

| Year | Global AI Market Size ($ Billion) | AI Adoption Rate (%) |

| 2024 | 305 | 45 |

| 2025 | 400 | 52 |

| 2026 | 510 | 60 |

| 2027 | 650 | 68 |

| 2030 | 1,500 | 85 |

The AI industry is expected to grow exponentially, with adoption rates increasing as businesses integrate AI solutions across industries. [3]

Conclusion

Stocks from the artificial intelligence industry constitute an essential foundation for creating a diversified investment portfolio in 2025. The backbone of AI chip manufacturing belongs to ASML while Alibaba maintains dominance in both AI e-commerce and cloud computing operations. A list of ideal AI stock choices for investors contains these organizations because they demonstrate solid financial results and extended growth forecasts.

**Please be informed that the content is informational and by no means serve as a buy or sell signal. The company is not responsible for the loss of capital.