Introduction

Are you looking for Best cheap stocks to buy now in consumer staples sector that are available for purchase right now? Dollar General (DG), Kraft Heinz (KHC), and General Mills (GIS) are the subjects of this evaluation because they are inexpensive stocks that boast robust income streams.

When it comes to providing investors with financial stability and consistent cash flows, consumer staples stocks are a reliable option for those investors who are looking for dividends that offer a regular income. When investment prices fall below 25.68, which is the average price-to-earnings ratio for the industry on March 16, 2025, stock valuation measures imply that opportunities are significantly undervalued.

This bog post examines three notable stocks, Dollar General (DG), The Kraft Heinz Company (KHC), and General Mills (GIS), each with significant financial value and potential growth metrics. DG maintains resilience despite market turmoil due to the consistent demand for critical products. Kraft Heinz generates value through its premium brand collection, while General Mills expands its product base. Dollar General generates value through its extensive retail presence, and each equities has a substantial possibility of prolonged ownership.

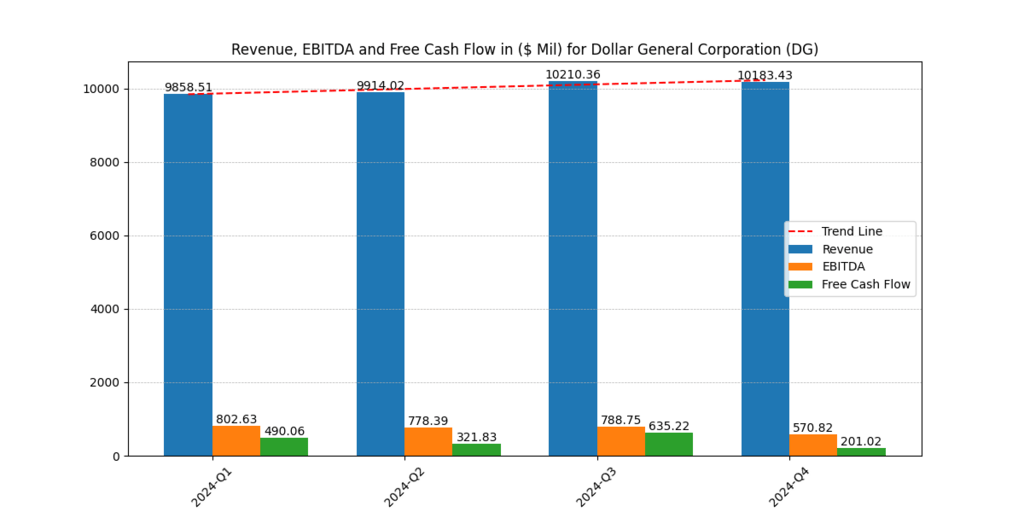

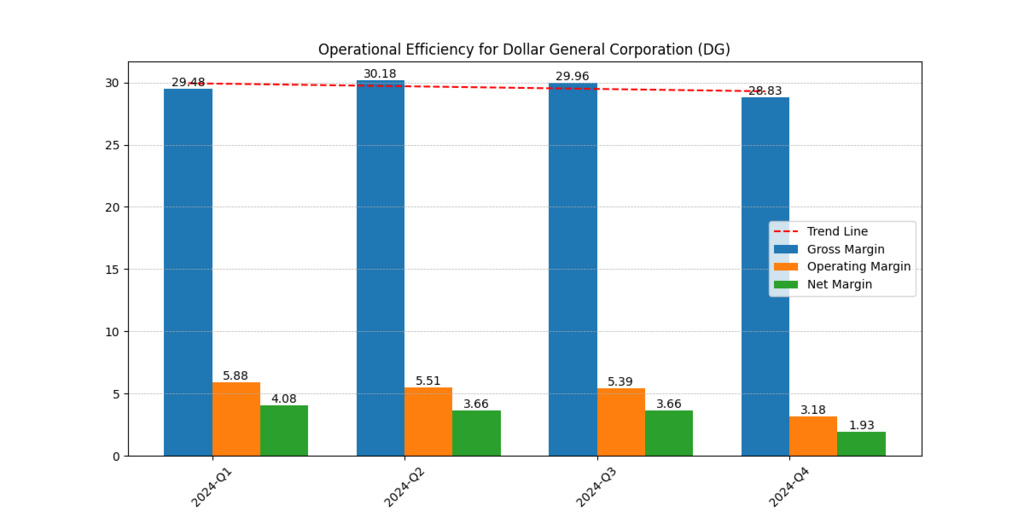

Dollar General (DG) – A Value Play with Margin Challenges

Dollar General positions itself as a price-leader discount retailer specifically targeting budget-focused consumers which provides important benefits in current economic conditions. The company experiences reduced profitability because increasing operational expenses combine with diminishing profit margins.

The company’s operating margin decreased from 5.88% during Q1 2024 to 3.18% throughout Q4. The stock presents excellent potential for growth because operational costs are under control and pricing remains competitive but management needs to reduce inefficiencies. Income investors can rely on steady dividend payments from DG even though the cash flow patterns show volatility. The stock has potential for a powerful rebound if the company achieves stable margins. [1]

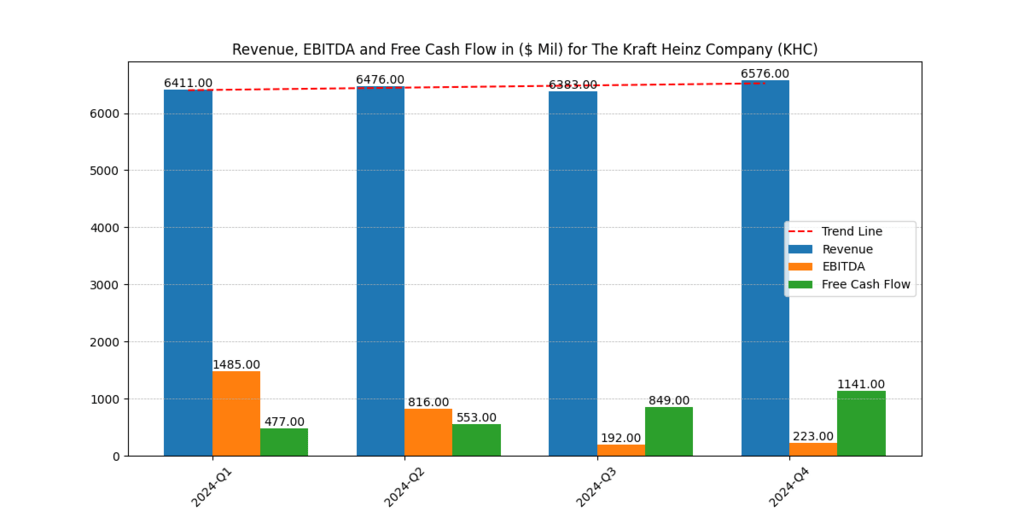

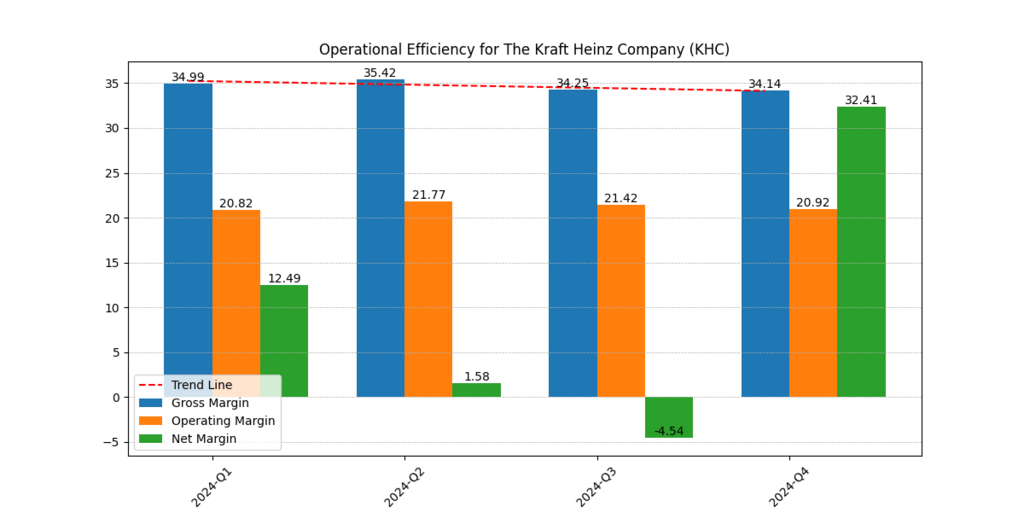

The Kraft Heinz Company (KHC) – A Turnaround Story in Progress

As one of the biggest global packaged food businesses Kraft Heinz maintains possession of renowned brands among them Heinz, Kraft and Oscar Mayer. Kraft Heinz stock maintains its undervalued position because it trades at levels below what the sector typically commands in terms of P/E ratios.

The company maintains stable revenue streams despite inconsistent results in its earnings reports. During Q3 2024 Kraft Heinz experienced a considerable decline in net margin which reached -4.54% but delivered a substantial recovery to 32.41% during Q4 2024. Kraft Heinz allocates resources to enhance operational efficiency and brand innovation development as potential drivers of upcoming business expansion. Kraft Heinz provides investors who seek dividend income with an attractive opportunity through its robust dividend payout ratio. [2]

General Mills (GIS) – A Strong Dividend Player

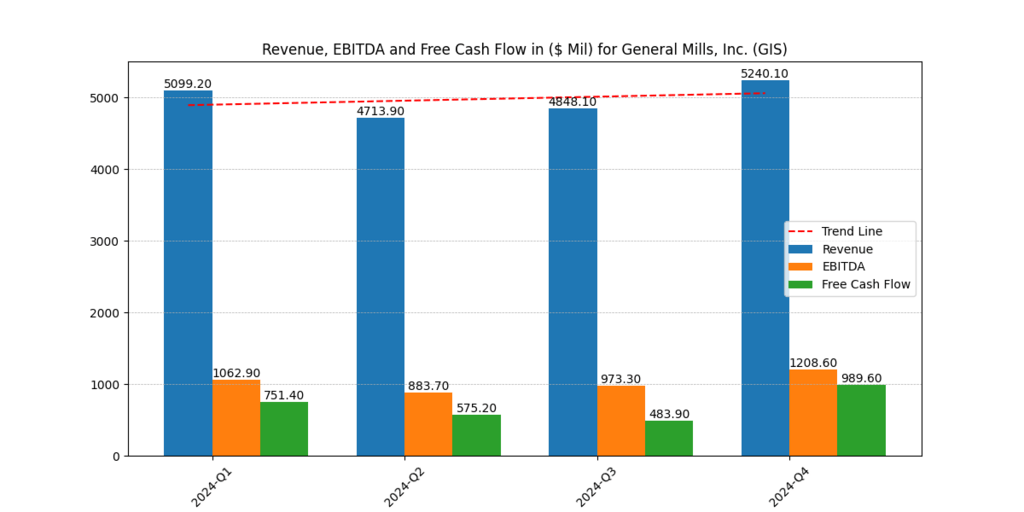

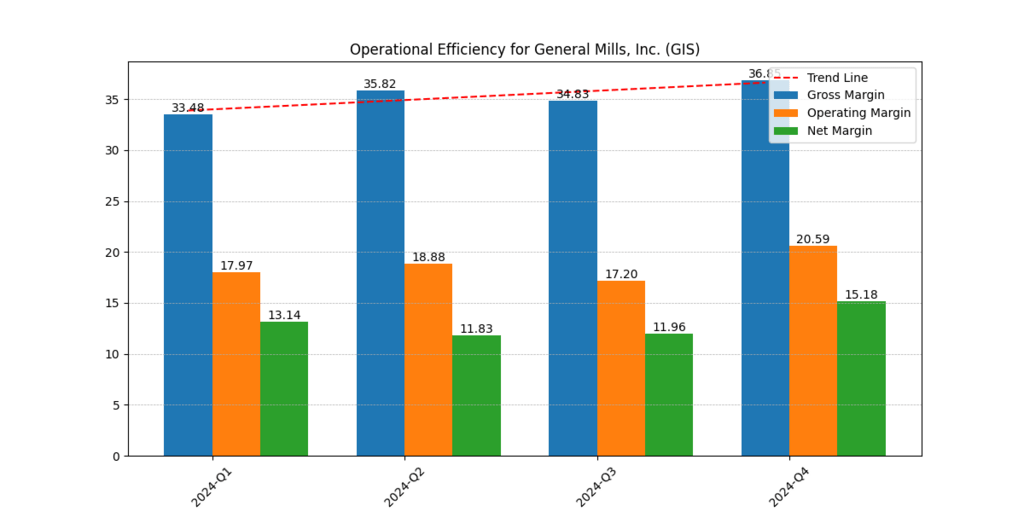

The multinational consumer foods corporation General Mills continues to provide attractive income potential through its leading cereal and snack and frozen food brands. The financial performance of General Mills demonstrates steadier margin stability compared to KHC and DG. Gross margin performance at the company strengthened by 3.37 percentage points throughout Q1 2024 to Q4 2024 due to successful cost management and pricing strength.

The company has shown positive net margin performance in double digits to maintain strong financial stability. The business success of General Mills stems from its diverse product range combined with valuable pricing strategies and regular cash flow generation. The combination of dependable dividends and moderate market expansion makes General Mills (GIS) an appealing stock choice for investors. [3]

Latest AI Developments in Consumer Staples

| Company | AI Product | Use Case |

| Dollar General | AI-driven Inventory Optimization | Enhances supply chain efficiency and reduces stockouts |

| Kraft Heinz | Smart Pricing AI | Dynamically adjusts product pricing based on demand trends |

| General Mills | AI-powered Consumer Insights | Predicts flavor trends and product innovations |

Artificial intelligence systems revolutionize consumer staples operations by enhancing company operational functions while transforming their product pricing and customer interaction programs. The innovative strategies drive continued long-term expansion possibilities for all three companies DG, KHC, and GIS. Interested in Best AI stocks with strong financials to buy now? look no further!

Conclusion

Dollar General, Kraft Heinz, and General Mills are attractive investments for investors seeking affordable stocks. Despite Kraft Heinz’s turnaround plan and General Mills’ stable dividend payments, Dollar General needs to recover its margins for dividend growth. These companies offer specific benefits and low price-to-earnings ratios, making them attractive for long-term performance and consistent dividends. Therefore, they should be considered in developing investment strategies beyond 2025, as they offer specific benefits and potential for long-term performance. Therefore, stockholders should consider these companies when developing their investment portfolios.

**Please be informed that the content is informational and by no means serve as a buy or sell signal. The company is not responsible for the loss of capital.