Introduction

The Q4 2024 Nvidia earnings show substantial growth that stems from AI technology and data center operations. Is Nvidia a buy in 2025? This in-depth analysis of Nvidia’s earnings will provide all necessary details.

Nvidia Corporation (NASDAQ: NVDA) leads the world through its graphics processing unit (GPU) and artificial intelligence (AI) and high-performance computing operations. Since its foundation in 1993 the company has transformed the gaming industry through GeForce GPUs thus expanding its business to AI technologies as well as data centers automotive tech and professional visualization solutions. The technology developed by Nvidia now functions as the foundation that enables impressive gaming experiences along with artificial intelligence operations within cloud computing environments so the company has earned status as one of the world’s most powerful semiconductor organizations.

Rapid growth became a defining characteristic of Nvidia’s operations because of accelerated usage of AI and machine learning applications. GPU technology established by Nvidia serves as the fundamental component for AI models which now underpin ChatGPT together with autonomous driving systems. The Data Center segment at Nvidia has taken over as the company’s primary revenue generator because of escalating AI infrastructure requirements despite its origins in traditional gaming.

This research study gives a thorough evaluation of Nvidia’s Q4 2024 financial results which includes important metrics alongside segment performance and wider business trends. The remarkable increase in Nvidia stock during 2024 prompts investors to ask whether buying Nvidia stock in 2025 would be profitable. A thorough evaluation of the company will include revenue expansion data alongside its profitability metrics and projected market developments.

This analysis will help both seasoned investors and newbies who are thinking about investing in Nvidia to grasp the company’s financial stability together with its ability to grow. A detailed analysis of Nvidia’s current earnings report assists our investigation of its investment value through 2025.

Key takeaways

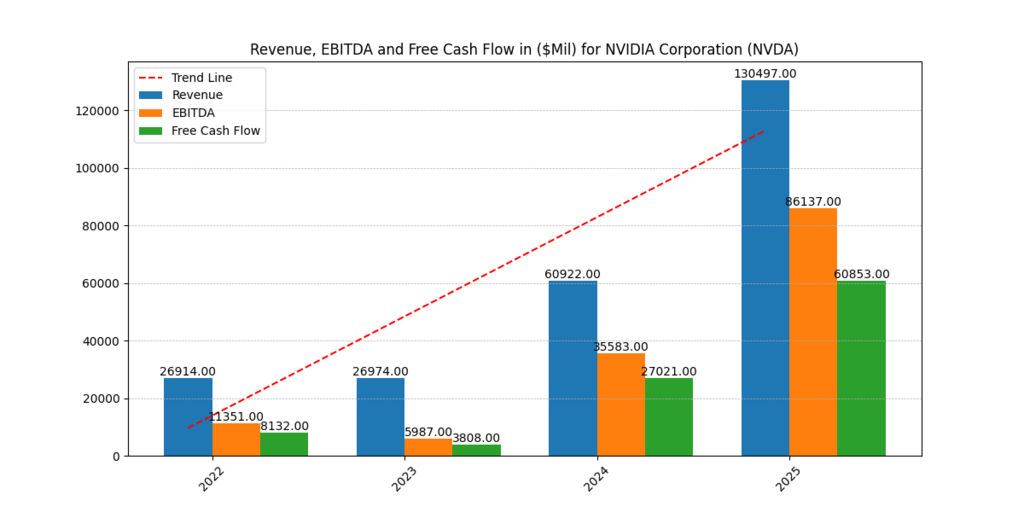

1. The company’s revenue hit $60.9 billion in 2024 after experiencing a 200% growth increase compared to 2023 and researchers expect $130.5 billion revenue for 2025. The Data Center segment generated most revenue growth because organizations implemented AI technology at an increasing rate.

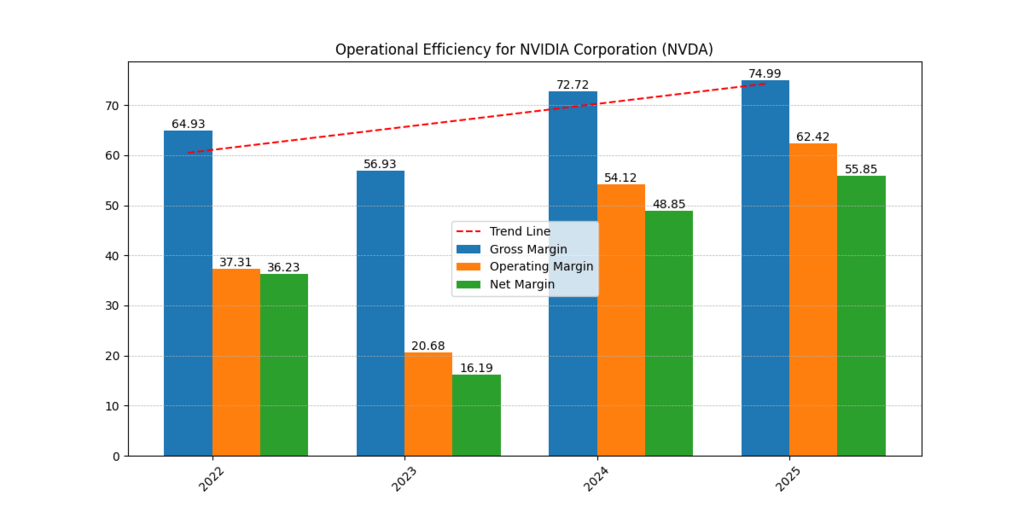

2. Nvidia sustained its dominance of the AI market by experiencing gross margin growth to 72.72% while net margin reached 48.85% in 2024 because of their strong high-performance computing and AI markets pricing power and operational efficiency.

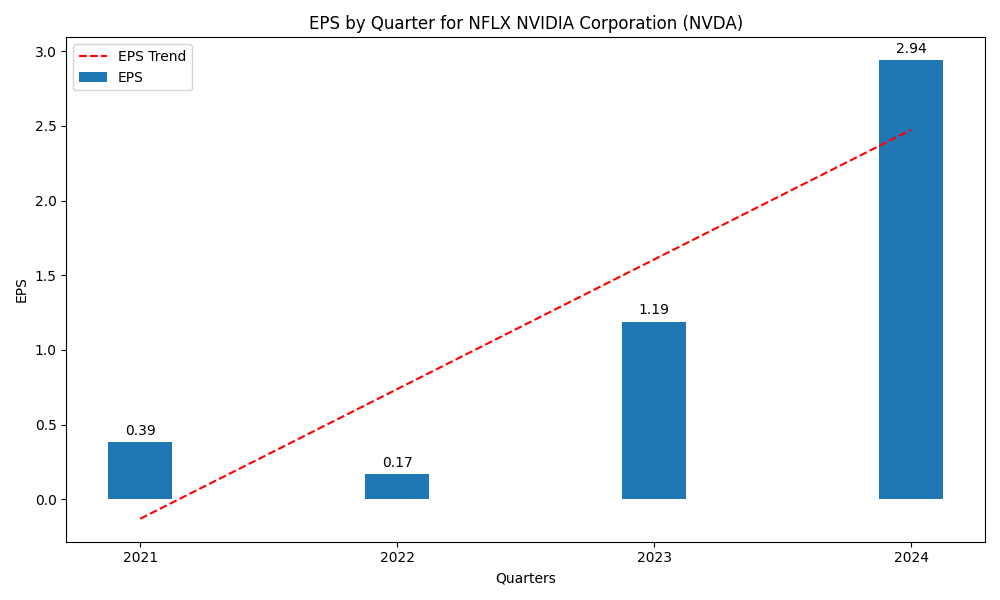

3. The earnings per share (EPS) reached $1.19 in 2024 before projecting a substantial increase to $2.94 in 2025. This indicates predictable growth in shareholder earnings.

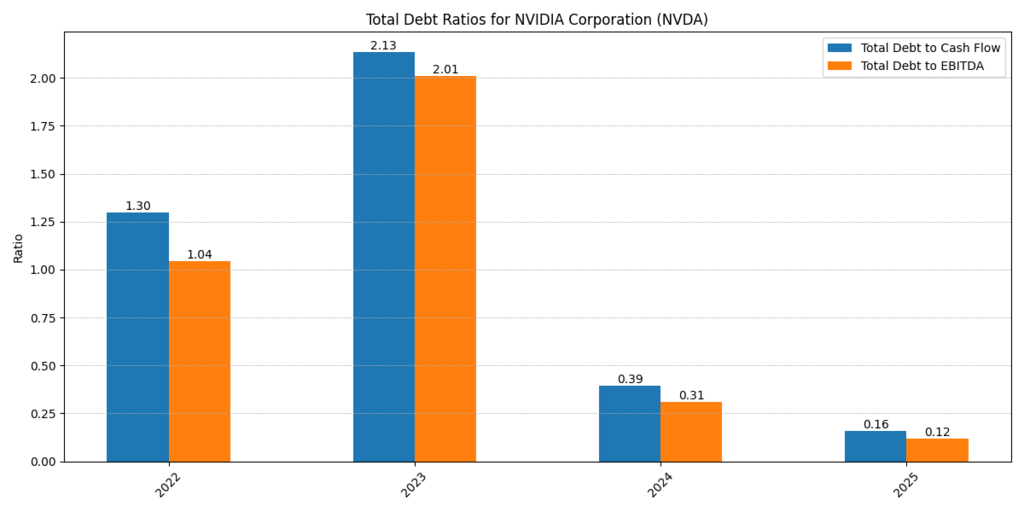

4. Free cash flow (FCF) reached $27 billion in 2024 which enabled Nvidia to fund research and development and acquisitions while distributing benefits to shareholders and minimizing total debt-to-capital ratio to 0.20.

5. The company is advancing AI leadership through Project DIGITS and RTX AI PCs and Cosmos Platform which establish its role as the fundamental foundation of AI infrastructure.

6. Stock Outlook – A Strong Buy for 2025? The company presents an appealing long-term investment opportunity through 2025 since it shows explosive revenue growth and high margins as well as AI-driven leadership supported by strong financials.

Nvidia’s Major Revenue Segments

| Revenue Segment | Q4 2024 Revenue ($ Million) | YoY Growth (%) | Key Drivers |

| Data Center | 18,400 | +217% | AI workloads, cloud computing, enterprise AI |

| Gaming | 2,900 | +56% | RTX 40 series GPUs, increased gaming demand |

| Professional Visualization | 463 | +105% | AI-enhanced design & rendering |

| Automotive | 281 | +24% | AI-powered self-driving & in-car computing |

| OEM & Others | 90 | +5% | AI-powered edge computing solutions |

The Data Center segment drives Nvidia’s maximum growth because of growing Artificial Intelligence use and developing cloud infrastructure. The Gaming segment achieved solid recovery because GPU market demand increased. Various other parts of Nvidia’s business including automotive along with professional visualization markets continue to expand at a sustainable rate.

Analysis of Nvidia Earnings

Revenue Growth

Nvidia achieved unprecedented revenue growth in 2024 when it brought in $60.9 billion three times more than its previous revenue in 2023. The Data Center segment drove the extensive revenue expansion of 2024 because AI-driven computing requirements surged significantly. The gaming revenue segment showed stability during this period as other sectors such as automotive and professional visualization delivered minimal contributions. The company benefits from AI development opportunities and GPU leadership positions to solidify its standing as an important semiconductor organization. The prediction for 2025 shows revenue exceeding $130.5 billion for the company as the market continues to require AI infrastructure.

Another thriving semiconductor company that can challenge Nvidia in the future is AMD and it’s in-depth analysis can be found HERE!

Profitability: Gross, Operating, and Net Margins

Nvidia achieved exceptional profitability growth in 2024 so gross margins reached 72.72% operating margins reached 54.12% and net margins reached 48.85%. For 2024 Nvidia demonstrated substantial margin advancement when compared to 2023 since supply chain obstacles and lower demand in gaming had initially decreased both gross and operating and net margins. AI and data center operations serve as the primary factor behind margin growth because they deliver higher profitability than other business segments. Analysts expect margins at Nvidia to strengthen further in 2025 because the company will achieve gross margin targets of 74.99% together with net margin goals of 55.85%. This outlook demonstrates Nvidia’s potential to sustain pricing strength and operational efficiency.

Earnings Per Share (EPS) Growth

Nvidia’s EPS expanded to $1.19 in 2024 from 2023’s initial rate of $0.17 because its revenue rose significantly while its margins increased substantially. Operational efficiencies together with an increased proportion of high-margin business segments contribute to further growth in the company’s profitability. The forecasted EPS for 2025 at $2.94 reveals an ongoing pattern of earnings expansion for Nvidia Corporation. Nvidia positions itself as a strong candidate for stock market investment because its AI and accelerated computing demand segment remains under development and indicates continued EPS expansion. [1]

Free Cash Flow (FCF) and Capital Efficiency

Total Debt to Cash Flow and Total Debt to EBITDA ratios from Nvidia signify improved overall financial condition and decreased financial leverage of the company. The financial year of 2023 marked the highest recorded values in both metrics because earnings and cash flow lowered due to macroeconomic difficulties. When revenues and profitability increased dramatically in 2024,

these financial ratios swiftly decreased. Total Debt to Cash Flow decreased to 0.16 and Total Debt to EBITDA reached 0.12 in 2025, which demonstrates that Nvidia produces substantially more cash and earnings than its debt requirements. The strong financial position allows the company to make advantageous investmentsand acquire new assets alongside rewarding shareholders while maintaining a small risk footprint.

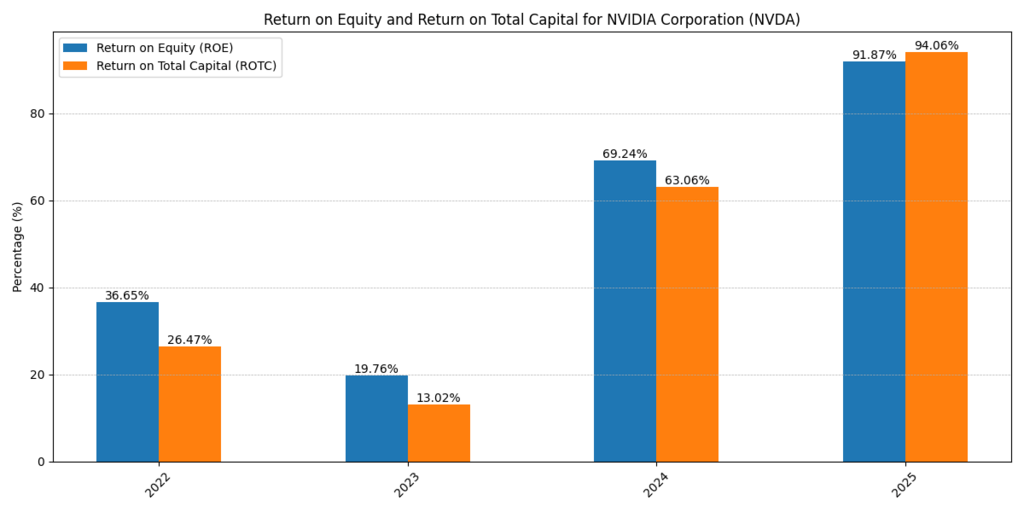

Return on Equity (ROE) and Return on Total Capital (ROTC)

Nvidia achieved remarkable profitability gains in 2024 after its ROE rose to 69.24% while its ROTC reached 63.06%. This showed impressively high levels of profitability alongside effective capital usage. The implementation of AI-driven growth strategy by the company produced substantial improvements in financial returns which positioned it among the most profitable semiconductor companies worldwide. The company maintains its focus on maximizing shareholder value through projected increase of ROE to 91.87% in 2025 and ROTC to reach 94.06% by the same year. The strong financial performance data indicates that Nvidia effectively transforms business investments into lucrative returns which makes it an appealing investment opportunity for investors aiming for long-term results.

Nvidia’s Recent AI Projects

| Project Name | Description |

| Project DIGITS | A personal AI supercomputer priced at $3,000, designed to bring AI capabilities to individual users and small enterprises. |

| RTX AI PCs | Introduction of foundation models running locally on NVIDIA RTX AI PCs, enhancing digital humans, content creation, productivity, and development. |

| Cosmos Platform | An autonomous vehicle platform unveiled at CES 2025, aiming to advance self-driving technology with integrated AI solutions. |

| Jetson Orin Nano | A compact generative AI supercomputer offering increased performance at a lower price point, targeting developers, hobbyists, and students. |

These projects underscore Nvidia’s commitment to advancing AI technology across various sectors, from personal computing to autonomous vehicles. [2]

Unique Insights on Nvidia’s Future Prospects

The company advances its market position by emerging as the essential foundational element for AI infrastructure. The CUDA platform from Nvidia combined with AI chips has established itself as the preferred solution for all AI training and inference operations thus gaining total market domination. The company continues to build its presence in AI robotics alongside healthcare through its newly developed products.

Through its Clara AI platform, Nvidia brings significant revolutionary changes to medical imaging and drug discovery and genomics which places the company at the core of healthcare innovation. The adoption of Nvidia’s Omniverse tool for industrial digital twins grows at a rapid pace since it enables businesses to use AI-driven analytics for simulating real-world environments.

Nvidia has launched custom AI chip development for prominent cloud providers Microsoft Azure and AWS to fully integrate its presence within AI technology platforms. Nvidia continues its dominance of the industry through strategic network expansions beyond GPUs into establishment of comprehensive AI ecosystems across separate business sectors as AI demand continues to climb. [3]

Conclusion

Nvidia’s Q4 2024 earnings delivery makes them a dominant force in AI computing alongside high-performance GPU leadership through their unprecedented revenue increases alongside robust financial results. Data Center operations within the company sustain its extraordinary profit growth because of escalating AI and cloud service needs in the market. AI has become instrumental in sustaining strong performance across gaming, professional visualization and automotive business units across multiple sectors. Nvidia’s profitable stance is demonstrated through its 72.72% gross margin with 48.85% net margin alongside $27 billion in free cash flow which creates flexible resources for innovation along with return opportunities for shareholders.

Project DIGITS along with the RTX AI PCs and Cosmos Platform represent ongoing investments by the company that establish its leadership position in the sector. Numerous industry experts view Nvidia’s projected 2025 EPS forecast at $2.94 while simultaneously acknowledging its dominant return potential through an ROE figure of 91.87%. The company maintains potential for additional growth because AI technology continues to increase its reach across global markets. Nvidia presents itself as a powerful investment for AI revolution exposure in 2025 after demonstrating its technological advantages combined with its financial capability and consistent AI solution market demand.

**Please be informed that the content is informational and by no means serve as a buy or sell signal. The company is not responsible for the loss of capital.