Meta Stock Forecast for 2030 – A fact-based forecasting that separates sustainable economic returns and market hype. Revise valuation drivers, long-term growth assumptions, and what META will have to do to justify the price today.

Introduction

The dilemma of Meta stock forecast for 2030 is now more a question of the capability of company to generate long-term value to facilitate the positive assumptions that the market valuation holds. The world operates some of the most influential digital platforms that are managed by Facebook, which is the Meta Platforms that includes Facebook, Instagram, WhatsApp, and Messenger. These services constitute the basis of the Meta global advert infrastructure and the narrative of the long-term investment (Meta Platforms, n.d.-a).

However, intrinsic value is not determined by the market influence and size alone. The ability of Meta to earn economic profits that are beyond the cost of capital in the long run should be the basis on which long-term investors should base on. This article is premised on a Meta stock forecast of 2030 pegged on the residual income valuation, net operating assets (NOA), operating liability leverage (OLLEV), and the return on net operating assets (RNOA).

It is not directed at predicting the short-term that the frenzied market and the sustainable economic profitability might be put at a definite distance, to the investment-disciplined Meta Platforms long-term valuation model, that the Meta stock intrinsic value 2030 will be assessed. Investors can find a detailed analysis of Meta’s price prediction after we analysed the complete 2025 results. We have dissected META for it’s true value instead of market hype.

What is META Stock Prediction for 2030?

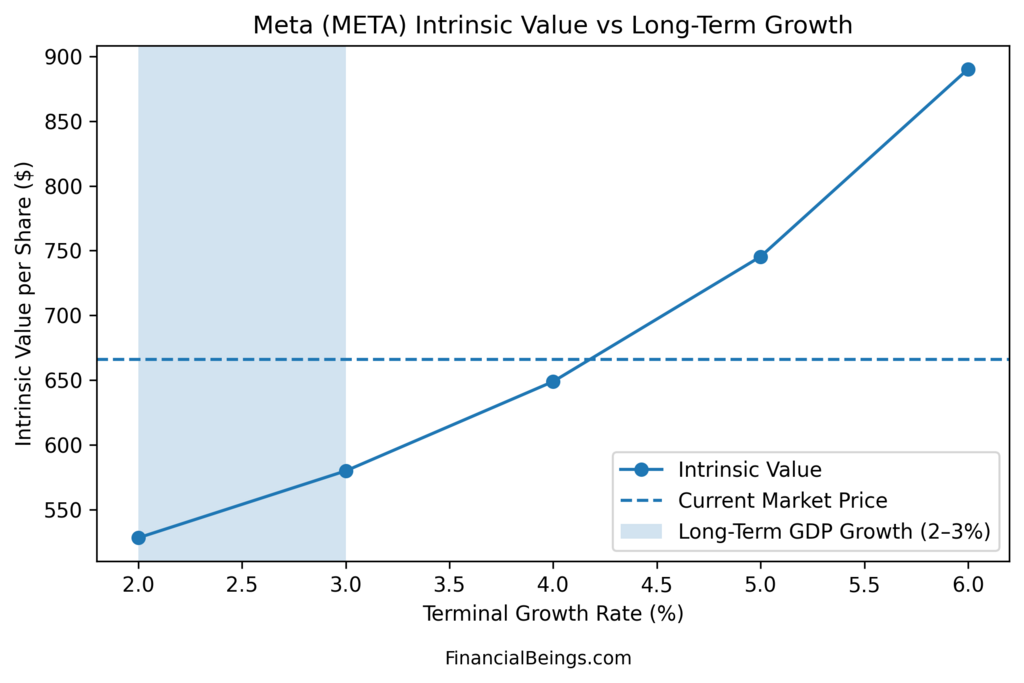

Figure 1: Meta Intrinsic Value per share vs. Terminal Growth rate (%)

It is an indication of the intrinsic worth of Meta to the variation of long-term terminal growth assumptions, with a bold band depicting long-term GDP-like growth.

The intrinsic value curve reveals the internal problem with any Meta stock forecast 2030 analysis: the valuation is tied to the terminal growth assumptions. At growth expectations, which prove lower than GDP, intrinsic value is vastly lower compared to results in the case of further growth. As the number of terminal growth assumptions is increased, the intrinsic value will skyrocket to indicate that market-implied growth Meta stock assumptions are dominant in the determination of the outcome of valuation.

This prudence shows that the valuation of Meta does not depend on its short-term performance but on the potential of the possibility of the company to continue to grow beyond the macroeconomic levels in the long run. Is Meta stock overvalued? which is more or less of whether this type of long-term growth assumption is achievable without diminishing the profitability of the economy (Meta Platforms, n.d.-b).

It is worth noting that the Meta stock intrinsic value 2030 is not an absolute value, but a growth realism. Even slight changes in the terminal growth lead to enormous adjustments in the estimated value, and this increases the risk of downside if expectations have to be normalized.

Net Operating Assets and Capital Intensity

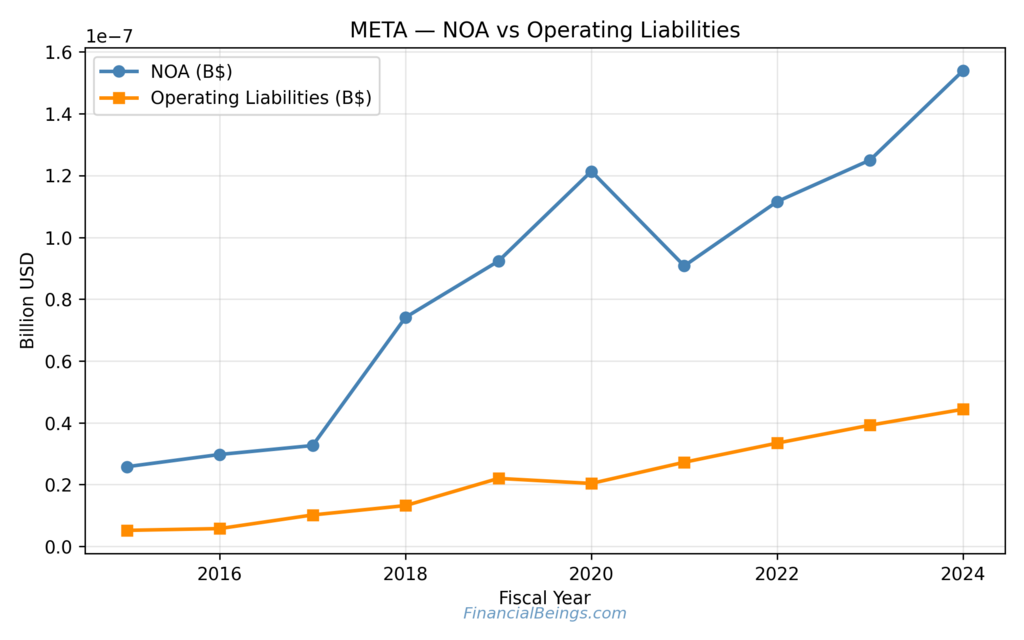

Figure 2: Meta Net Operating Assets (NOA) vs Operating Liabilities.

This is the number that traces the development of the operating base of assets of Meta in comparison to operating liabilities.

Trend in the NOA is an upward trend with constant growth, which indicates that the firm is still investing in platforms, infrastructure, and technology. Though the increase in the operating liabilities is the same in the same direction as the increase in the assets, the difference is widened, and hence the capital base of the company is increasing at a higher rate compared to the increase in the operating leverage of Meta.

In the Meta residual income valuation method, an increase in NOA will improve the capital that will be required to generate returns that exceed the cost of capital. This relationship heightens the quality of future value generation: growth will be unsatisfactory unless the growth in returns is high (Meta Platforms, n.d.-c).

Table 1: Capital Structure Trends

| Period | Net Operating Assets | Operating Liabilities | Interpretation |

| Early period | Lower | Lower | Asset-light growth phase |

| Mid period | Rising | Rising | Scaling investment phase |

| Recent period | Higher | Moderately higher | Capital intensity increasing |

This trend suggests that operational efficiency is increasingly becoming a prerequisite of meta-economical profitability and not on its growth alone.

Operating Liability, Leverage, and Risk Absorption

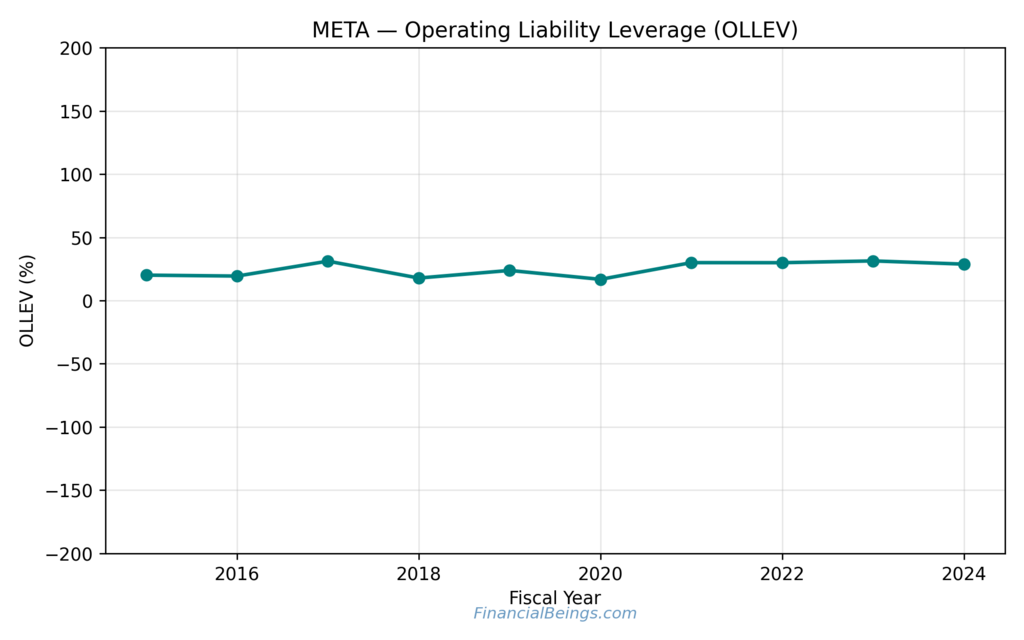

Figure 3: Meta Operating Margin Sustainability (OLLEV).

The extent to which operating liabilities fund the operating assets is the measure of OLLEV, and it affects the volatility of returns.

OLLEV is good and relatively stable, which indicates that Meta is leveraging the operating liabilities to fund the operations partially without excessive balance-sheet risk. This construction promotes the flexibility and limits volatility of down sides in earnings.

However, this absence of growing OLLEV is also indicative of the fact that Meta is not currently striving to leverage its operating structure to maximize returns, and this justifies the requirement of bringing operational performance to bear and not financial engineering. This means that it is stable, but the acceleration of the upside through leverage is limited only to the investor who believes Meta long-term investment thesis.

RNOA and the Sustainability of Operating Performance

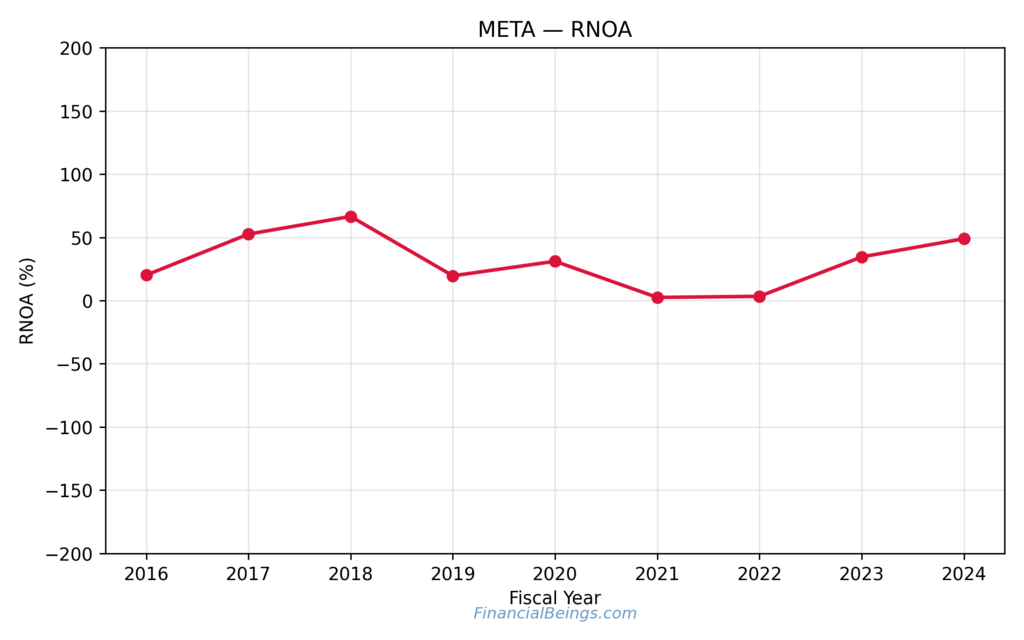

Figure 4: Meta Return on Net Operating Assets (RNOA)

RNOA demonstrates efficiency in its operations relative to the operational capital invested.

The RNOA trend is what Meta’s operating margin sustainability is all about. RNOA can indicate high monetization and cost discipline and low investments at any point, indicating it is sensitive to the investment cycles and strategic expenditure.

The recovery periods that follow are reflective of higher productivity, although instability can still be observed. This is why one of the points, which is central to the Meta stock forecast 2030: sustainable valuation, is to stabilize RNOA at rates significantly higher than the cost of capital during its boom and not merely periodic booms.

Residual Income and Long-Term Value Creation

The residual income takes the Capital intensity and RNOA as a value creation. With excess RNOA compared to the required return, the excess income turns out to be positive; vice versa, when it decreases, there is the chance of value being destroyed by growth.

The trend in the residual income of Meta based on the relationship between the increasing NOA and oscillations of RNOA indicates that the capability to generate future value of the company will be conditional upon the capacity of the company to be operationally efficient as it develops in scale. It is a direct response to the problems of Meta free cash flow outlook since the higher the capital requirements are high the more the discipline of reinvestment becomes important (Meta Platforms, n.d.-e).

Meta AI Growth Impact on Valuation

The official messages of Meta are also centered on artificial intelligence as a platform participation, advertisement effectiveness, and monetization engine of the future (Meta Platforms, n.d.-f). Even though AI can enhance the likelihood of revenue growth, it shows that AI-based growth would need to be translated into the growth in the sustainable increase of RNOA to support intrinsic value.

Regarding the Meta stock growth assumptions, AI is a potential lever of the uptick, but it can be used in those cases only when improving the returns in the economy, and not when the asset base is necessarily broadened. Without this kind of translation, market-implied growth Meta stock expectations could then overcharge intrinsic value.

Investment Implications for 2030

What is the Meta stock price forecast for 2030? It points at the fact that the valuation of the Meta stock is sensitive to the long-term growth prospects of the stock, rather than the short-term performance of the earnings. The intrinsic value is also very sensitive to any change in market expectations, as very minor variations in the rates of the supposed terminal growth cause huge variations in intrinsic value.

In the meantime, the increase in the net operating assets of Meta reflects the increment in the capital intensity, which leads to the increased risk of execution because the high level of returns is required to be retained as economically viable. In the framework of the capital commitment expansion, Meta must maintain operating performance at a high rate regularly to avoid devaluation of the values.

Operating efficiency now becomes the characteristic of long-term value. The amount of residual income should come as a continued growth in returns on net operating assets at a comfortable level over and above the cost of capital. Despite the positive investments in artificial intelligence and platform capabilities, which have the potential to drive an upward trend, both projects can only form the basis of valuation in case they bring about sustainable upgrades in economic profitability rather than scaling up.

The biggest risk that must be taken into consideration by investors appraising the long-term valuation of Meta Platforms is not that they will lose their competitive relevance, but rather the fact that incremental development will not bring returns of sufficient amounts as the provider’s base will expand. In this case, the long-term investment potential of Meta depends on the element of disciplined reinvestment and the ability of the company to convert innovation into long-term economic profits by the year 2030.

However, the risk-reward portfolio for META is good with adequate margin of safety built in the current market price. Our long term investment analysis beyond 2030 show that META has a significant upside opportunity if they can maintain their current operational performance. Other detailed articles on META’s valuation are mentioned below.

Conclusion

To obtain an austere Meta stock forecast of 2030, it must exclude the narrative optimism of the economy. Intrinsic value of the company does not necessarily rely on the dominance of a platform but on the additional opportunities to generate residual income in the company.

Meta is an excellent company that has excellent strategic resources, but the valuation is optimistic. The long-term investors will be curious whether the consistency in the RNOA, capital discipline, and profit increases due to AI will be observed on a routine basis. Absence of such correspondence suggests that the current valuations do not have to be pegged on the market hype, and not on economic gains that can’t be sustained.

Frequently Asked Questions (FAQs)

what will meta stock price be in 2030?

The discussions surrounding the investment debate center on the growth in earnings and the multiple the market will pay for such earnings. The five-year yearly forecasts for the share price of the company Meta, as of the previous year, 2030, are to start with trailing-12-month earnings per share of $27.62 and are expected to increase by 10 to 15 percent annually until 2030. That spectrum is flourishing within the robust sales pressure on advertisements and products with enhanced artificial intelligence, though it does not overlook the reality that huge infrastructural investments may curb the growth of margins in the upcoming years. At that level, 2030 earnings per share would be within the range of $45 and $56. The price per share can be between $745 to $890 if META can continue the growth steady.

Can Meta stock reach $1000?

Meta Platforms (META) is making heavy investments in artificial intelligence (AI). The company management recently suggested that the capital spending that the firm may have in the next 2025 to 2030 would fall between 66 to 72 billion dollars. It is estimated to be 30 billion dollars more than the last year, and much of this capital would be used in scaling its AI infrastructure at a high rate. If META can continue at the growth rate of 6.5% after the year 2030, it can reach the price of $1000 per share.

All calculations and valuation estimates are FinancialBeings’ own, based on data sourced from SEC filings META (10K and 10Q), use or reproduction before prior approval is prohibited.

Usama Ali

Usama Ali is the founder of Financial Beings and a self-taught investor who blends classic valuation study with insights from psychology. Inspired by works from Benjamin Graham, Aswath Damodaran, Stephen Penman, Daniel Kahneman, and Morgan Housel, he shares independent, data-driven research to help readers connect money, mind, and happiness.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.