By 2026, the Cheap Oil Stocks will be positioned to spill over in large amounts. Research about the underperforming energy business stocks whose cash flows are good, operating style is good, and its growth potential is also good.

Overview

The re-emerging interest in the market, with the investors returning to value-driven markets, is what is triggering Cheap Oil Stocks. The past few years have seen the capital flow being biased to grow and technology, without the good energy companies being traded at a lower valuation when compared to the strength of cash flows and asset support. It is this that price is not correlated to intrinsic value, which contributes to the fact that undervalued energy stocks 2026 are a compelling addition to a portfolio in the long run. Firms that are well operationalised are normally re-rated higher in situations when the oil demand stabilises, and supply becomes constrained.

Research has noted that when the sentiment is low, traditional energy is mispriced and it generally provides good entry points to value-based investors (SeekingAlpha, 2025).

Besides a valuation appeal, the structural position of oil in the global economy continues to add to the demand. The bulk of the infrastructure development, owing to petroleum, airlines, shipping, chemical industries, agriculture, and infrastructure development, cannot be migrated to conventional energy in the near future (ECMarkets, 2025). This creates an effective bottom base demand in most of the macro conditions.

In the case that investors are seeking cheap oil stocks to buy, they will most of the time concentrate on the firms with the capability to convert the working resources into long-term earnings rather than investing in the volatility of the commodities. It is here that RNOA comes in. It puts an accent on operational discipline, asset productivity, and efficiency and helps distinguish between those companies that survive only due to the cycles and those that are prepared to grow via the cycles. The analysis that follows is an analysis of five companies, namely COP, EOG, XOM, ENB and EPD as per RNOA performance data as an indicator of long-term strength of investments.

Why RNOA Matters When Evaluating Cheap Oil Stocks

RNOA is also relevant especially when analyzing Cheap Oil Stocks not all the companies can make economic profit equally. Two firms could achieve the identical level of revenue yet the company that would achieve a greater payoff on net operating resources is using its wells, pipelines and infrastructure in a more productive way. This means that it will have more revenue with fewer resources that would otherwise translate to higher free cash flow, high dividend yields and survival during difficult situations. The trend in RNOA is a positive sign since it can be construed to mean that the discipline in operation is growing but a negative trend could mean cost increase, reduced production or ineffective capital distribution.

To give credit to investors, RNOA will be used to filter out stocks that really look interesting cheap oil, and those that only seem interesting because they perform badly. When a business has recorded a good or improving RNOA even when the crude prices are varying, then it is a good sign and not just an accident. No wonder analysts have a tendency to employ RNOA to predict the low-valuation oil producers have long-term competitiveness, in addition to defining which names would perform better, were a positive energy market forecast 2026. Additionally, in brief, RNOA helps to identify the underestimated energy reserves that have the operating quality that enables them to survive cycles and remunerate the patient shareholders.

RNOA Trend Analysis

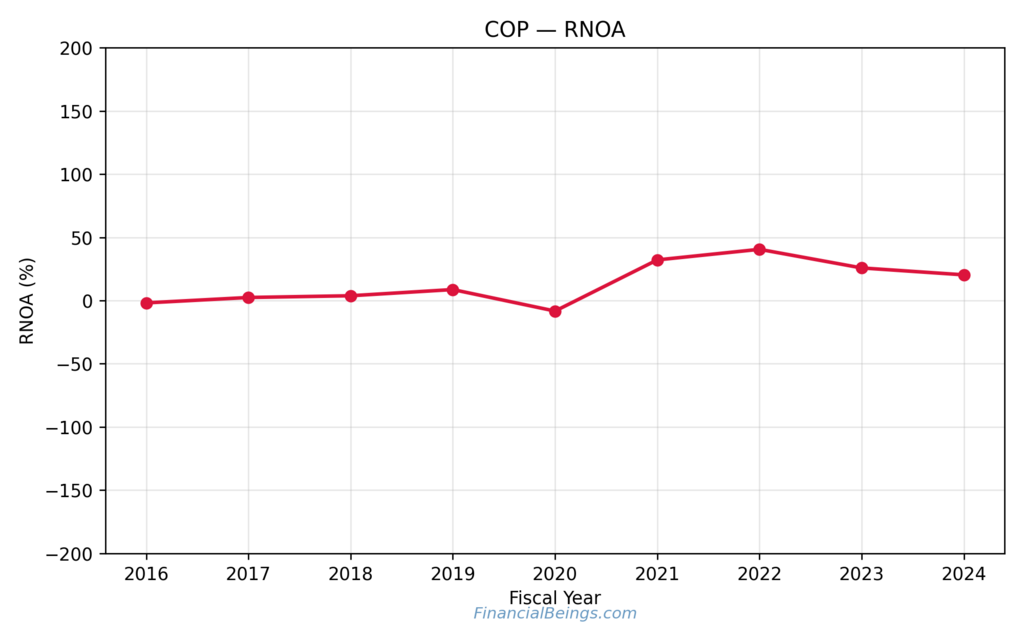

ConocoPhillips (COP)

| Year | RNOA % |

| 2016 | -1 |

| 2017 | 3 |

| 2018 | 4 |

| 2019 | 9 |

| 2020 | -8 |

| 2021 | 32 |

| 2022 | 41 |

| 2023 | 27 |

| 2024 | 21 |

Figure 1. RNOA Trend for ConocoPhillips (2016–2024)

COP is associated with rebound strength. RNOA came back in 2022 with a robust recovery of 41% against 2020, when it was at -8 with favourable crude prices. It is a performance that makes COP a high-upside energy stock to the cyclical investors. Scalability may be indicated where good performance in the market is depicted by peak year performance.

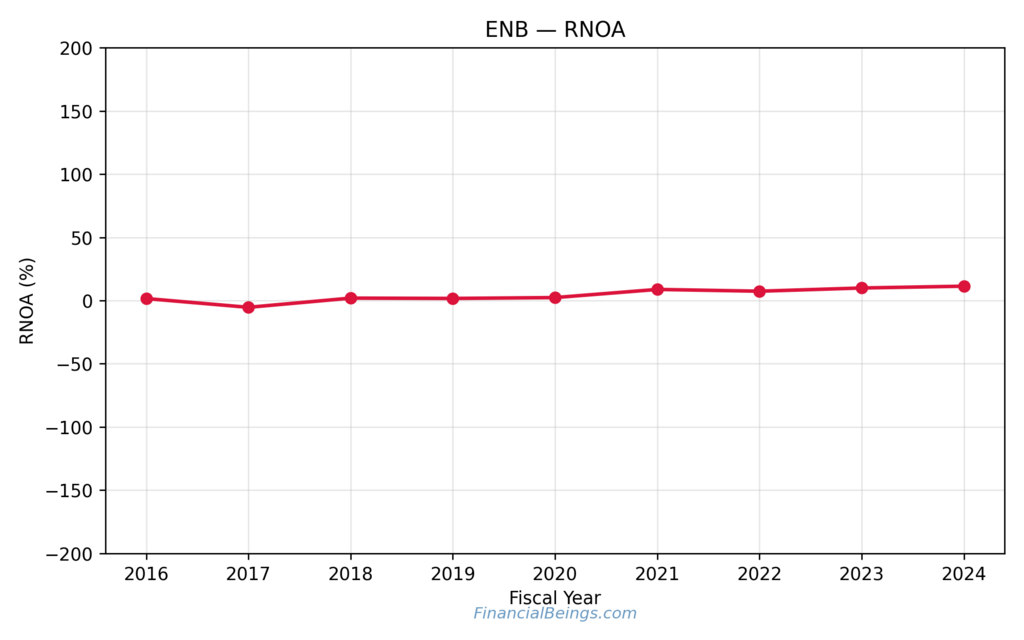

Enbridge (ENB)

| Year | RNOA % |

| 2016 | 2 |

| 2017 | -5 |

| 2018 | 1 |

| 2019 | 1 |

| 2020 | 2 |

| 2021 | 8 |

| 2022 | 7 |

| 2023 | 9 |

| 2024 | 11 |

Figure 2. RNOA Trend for Enbridge (2016–2024)

ENB is not volatile as an upstream peer. Slow, yet consistent growth rate of between 2% to 11% in 2016 and 2024, respectively, represents a stable cash flow of the pipeline. Midstream infrastructure returns do not provide much information as to the price of crude (Morningstar Energy Analysis, 2024). ENB is a recommendable income portfolio among such investors who would like to have long-term oil investment ideas with less risk.

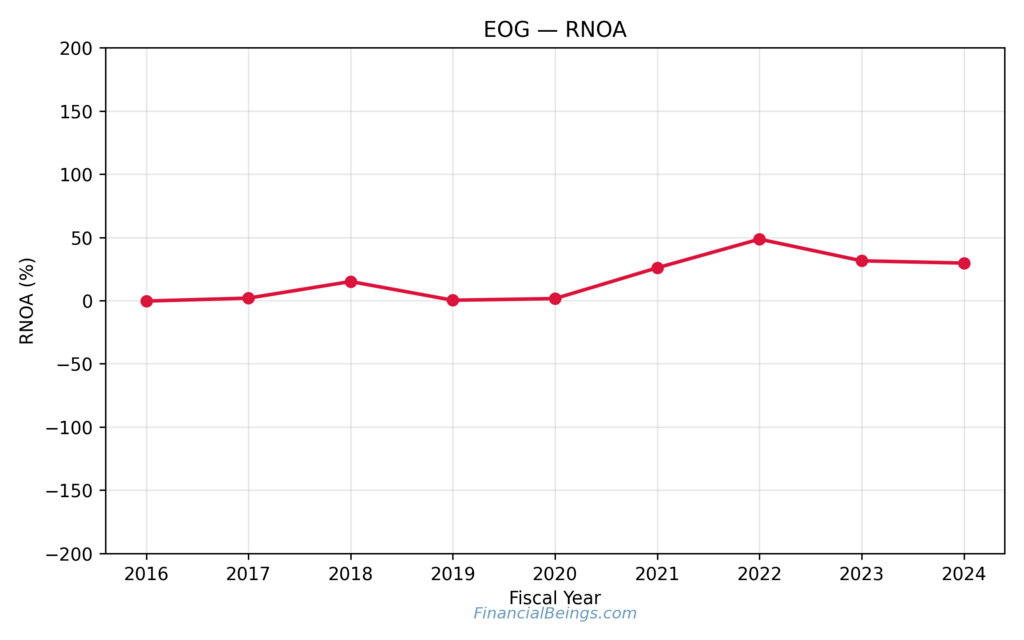

EOG Resources (EOG)

| Year | RNOA % |

| 2016 | 1 |

| 2017 | 3 |

| 2018 | 17 |

| 2019 | 1 |

| 2020 | 2 |

| 2021 | 26 |

| 2022 | 48 |

| 2023 | 33 |

| 2024 | 31 |

Figure 3. RNOA Trend for EOG Resources (2016–2024)

EOG dominates in efficiency. RNOA in 2022 also rose to 48% and is the highest, by comparison to all the companies taken into account. It also leads in the best oil and gas value stocks, in terms of operational excellence, low breakevens and shale cost discipline (YahooFinance, 2024). EOG would suitably fit investors who desire aggressive growth prospects.

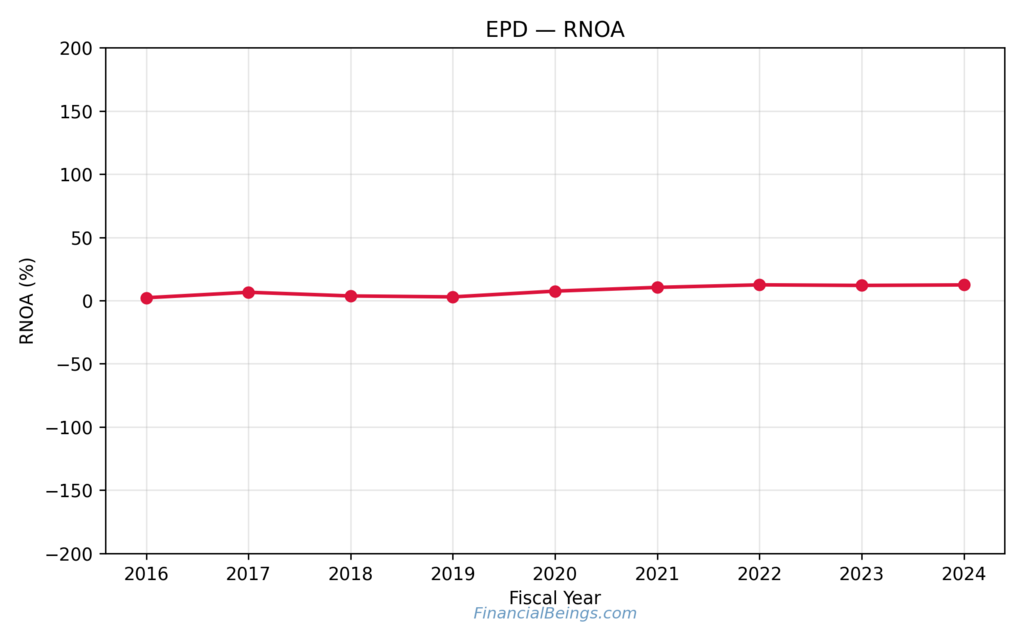

Enterprise Products Partners (EPD)

| Year | RNOA % |

| 2016 | 2 |

| 2017 | 7 |

| 2018 | 4 |

| 2019 | 3 |

| 2020 | 8 |

| 2021 | 11 |

| 2022 | 13 |

| 2023 | 13 |

| 2024 | 14 |

Figure 4. RNOA Trend for Enterprise Products Partners (2016–2024)

From 2016 to 2024, GDP increased by 2 per cent to 14 per cent, and stable delivery. Midstream assets include the repeated turnover of transportation and storage and are not exposed to spot prices (Nasdaq Market Insight, 2024). This has positioned EPD as one of the low PE oil and gas companies that passive dividend income investors are interested in.

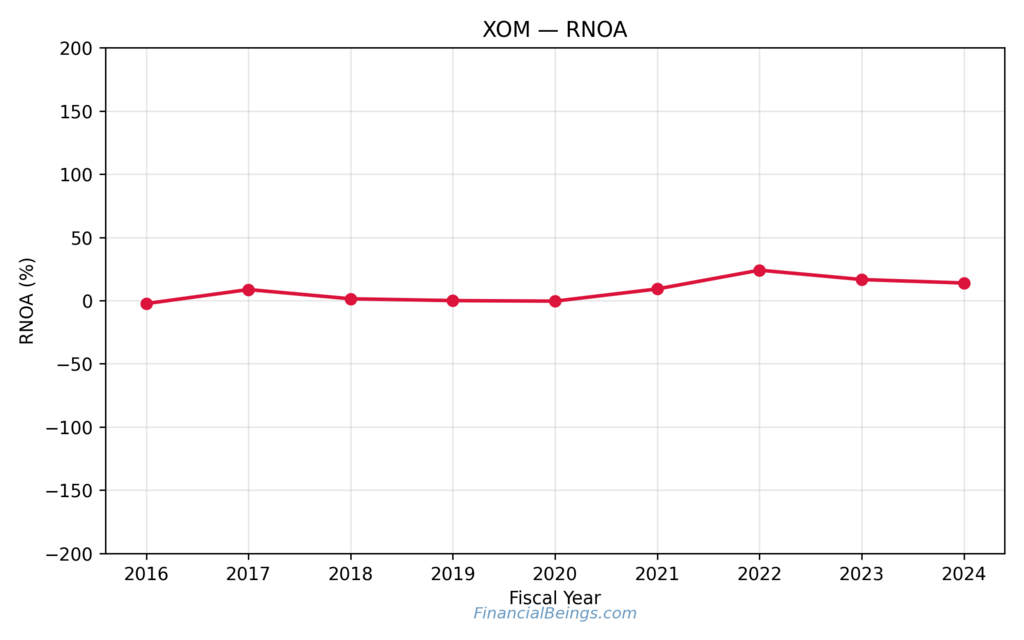

Exxon Mobil (XOM)

| Year | RNOA % |

| 2016 | -2 |

| 2017 | 9 |

| 2018 | 3 |

| 2019 | 1 |

| 2020 | 0 |

| 2021 | 9 |

| 2022 | 24 |

| 2023 | 17 |

| 2024 | 14 |

Figure 5. RNOA Trend for Exxon Mobil (2016–2024)

XOM is yet an equal oil major. The change in RNOA was near 0% to 24% in 2020 and 2022, respectively. It has also combined the upstream, refining, petrochemicals, and global assets; this makes it a lower risk as compared to pure E&P names. XOM is a good investment in the hands of the balanced investors who do not like aggressive volatility but stability.

Comparative Insight

| Company | Peak RNOA | Nature |

| EOG | 48% | High return, high potential |

| COP | 41% | Cyclical rebound leader |

| XOM | 24% | Balanced cash-flow model |

| EPD | 14% | Stable midstream income |

| ENB | 11% | Long-term infrastructure play |

The investors often use the blend allocation in the pursuit of oil sector deep-value picks:

These high RNOA will imply that the companies are at a different strategic position in a portfolio. When the oil markets are healthy, EOG and COP deliver the highest return potential and are hence attractive to investors who are seeking growth and undervalued stocks. XOM is ideally positioned as an integrated company with a sustained refining and chemicals middle and upstream operation. On the other hand, EPD and ENB generate a consistent income in the middle stream and cash flows are supported by the pipeline and transport contracts as compared to the unpredictability of the oil prices. It is this difference that makes investors accord them different names of drivers of returns; others are drivers of income stabilisers.

Investors tend to select a mixed portfolio due to those characteristics in an attempt to find deep-value stocks in the oil industry without overreliance on a single stock. Balancing of XOM, EPD and ENB creates equilibrium and provides income, and COP or EOG provide acceleration upside and a rise in crude prices. Such diversification makes volatility null and also acquires multiple drivers of returns across the cycles that enable portfolios to hold well during a downturn and simultaneously gain during a period when commodity markets perform well.

Further Reading : Best Stocks to Buy for Long Term Growth Before 2025 Ends, Not Just Tech Stocks!

Further Reading : APA vs. ConocoPhillips (COP): Which Oil Stock Offers Better Value in 2025?

Further Reading : ConocoPhillips Stock Forecast 2025: Can COP Outperform as Oil Prices Cool?

Why 2026 Could Be a Breakout Year for Cheap Oil Stocks

The energy companies are trading below reasonable multiples (SeekingAlpha, 2025). The slow rise of the price floor is as the recovery in the global environment takes over, and the demand is even. Cheap Oil Stocks that are about to be appreciated in the long run may increase as capital returns to energy. The visibility of the shareholders is assured by the dividend and buyback increments (ECMarkets, 2025).

As long as the crude does not decline, undervalued energy stocks 2026 will have a significant rerate, especially cost-disciplined. Crude oil demand outlook 2026 is not high, as individuals will not abandon their industrial and transport consumption (Morningstar, 2024).

Risks to Consider

There are several risks involved in investing in oil which investors must consider before investing capital. The biggest risk is the price volatility of commodities especially among the upstream producers like EOG and COP. They make more or less profits depending on the crude prices that can be volatile during international crises or with OPEC decisions or due to economic crises leading to the decline of demand. In addition to price risk, the regulatory pressure increases, and governments promote decarbonization, EV, and emission policies.

The researches stress the importance of the fact that ESG-related restrictions may reduce the appeal of long-term investments in fossils (MDPI ESG Risk Paper, 2024). This could limit the project approvals, increase compliance costs or cripple growth in production. Market sentiment is also in charge of it. Fundamentals are good with energy that can be undervalued in the long run because investors will flock to tech, renewables, or any other narratives.

However, these challenges, downturns in oil to provide attractive entry points to patient value investors. Historically, the majority of long-term returns in the energy sector were best at operating during pessimistic cycles where the stock prices were lower than fair value, and the cash flow was not affected. The intermediary companies like ENB and EPD mitigate the risk by offering fee-based sources of revenue that survive even in the case of poor pricing conditions that offer portfolio stability. On the other hand, high-paying producers like COP and EOG become the majority profitable as the cycles resume growing.

Conclusion

The Cheap Oil Stocks themselves remain to be neglected in contrast to the fast-moving technology industries, yet the financial welfare of the majority of the oil corporations has been improving accidentally. The 2016-2024 trends of RNOA show that the operation profits have been volatilized in the post-2021 cycle, and in particular with the upstream players. The EOG and COP turn out to be good sources of returns, and they go well when the price of the crude is high, whereas the EPD and ENB provide consistent midstream income, even during periods when the commodities are declining.

XOM is placed in the centre of the line between size, diversification, and constant cash flow, and therefore, it is one of the main anchor holdings in most portfolios.

An array of these names will lower the downside risk and increase exposure to a range of different drivers of returns to investors seeking cheap oil stocks to buy now. The growth stocks like COP and EOG go up with the boom markets, and the ENB and EPD offer a constant capital yield. XOM disposes of the portfolio as a diversified energy investment in the world. These undervalued energy stocks 2026 may be rewarded in the long run at the moment of attractively valued cash flows as the mood moves back to value and improving crude prices.

All calculations and valuation estimates are FinancialBeings’ own, based on data sourced from SEC filings (10K and 10Q), use or reproduction before prior approval is prohibited.

Frequentlay Asked Questions (FAQs)

What is the most undervalued oil stock?

The most undervalued term would be based on the type of returns that an investor wishes to have. EPD and ENB appear to be undervalued in matters of cash-flow and income, and that is the reason why they are the more preferable ones to be stable and to yield. EOG and COP seem to be underrated in growth and RNOA efficiency, especially in efficient crude cycles. They also contribute to a good in different ways, and thus they have to be selected on the income vs growth preference basis. However, we rate EOG and COP to be the undervalued opportunities.

Which oil share is best?

There is no single best oil stock that can be possessed by any investor. Among all of them, XOM can be deemed the most appropriate, as it is a global corporation whose sources of income are diverse. Investors who have a higher priority towards dividends and stability can use ENB or EPD, but not the rest and this is where EOG or COP can serve as a better addition to undervalued growth-oriented portfolios.

Usama Ali

Usama Ali is the founder of Financial Beings and a self-taught investor who blends classic valuation study with insights from psychology. Inspired by works from Benjamin Graham, Aswath Damodaran, Stephen Penman, Daniel Kahneman, and Morgan Housel, he shares independent, data-driven research to help readers connect money, mind, and happiness.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.