Introduction

When evaluating electric vehicle stocks BYD vs Tesla is the biggest rivalry, investors must determine which choice provides the most valuable return. The decision about your investment requires you to understand essential financial measurements along with market trends and innovative developments.

Both BYD and Tesla are currently engaged in a fierce electric vehicle market competition to establish their leadership position. BYD has outrun its main industry rival Tesla by efficiently expanding its operations through affordable vehicle models and securing global sales leadership. Global EV market growth has piqued investor interest as they seek to identify which stock will generate superior long-term returns.

As the leader of Tesla Elon Musk brings to the company its innovative technology combined with committed customer relationships and impressive profit yields. BYD obtained competitive advantages through Warren Buffett’s support of Berkshire Hathaway and its affordable EV lineup along with its own vertically integrated battery operation.

Resolving the matter requires an analysis of Tesla’s stock versus BYD’s stock. The assessment includes a financial performance evaluation along with a market position analysis and an investigation of innovation capacity to determine which stock between Tesla and BYD would make the best EV purchase in 2024.

A Financial Comparison Between Tesla and BYD

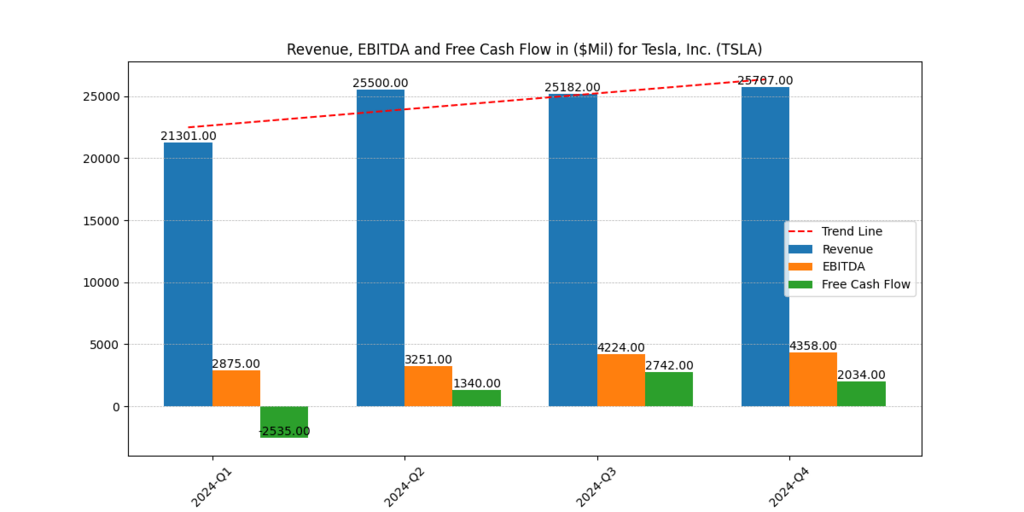

Revenue, EBITDA and Free Cash Flow for Tesla

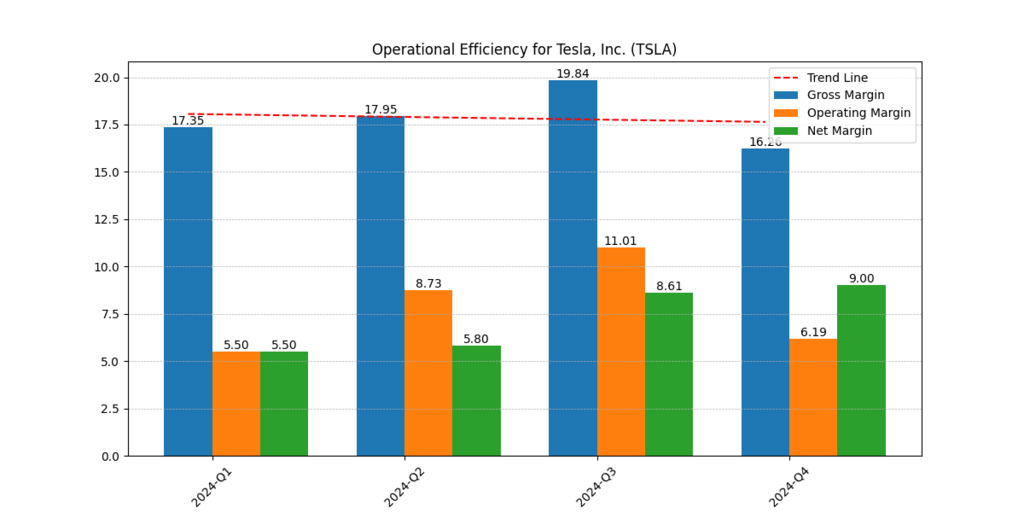

Operating Margins for Tesla

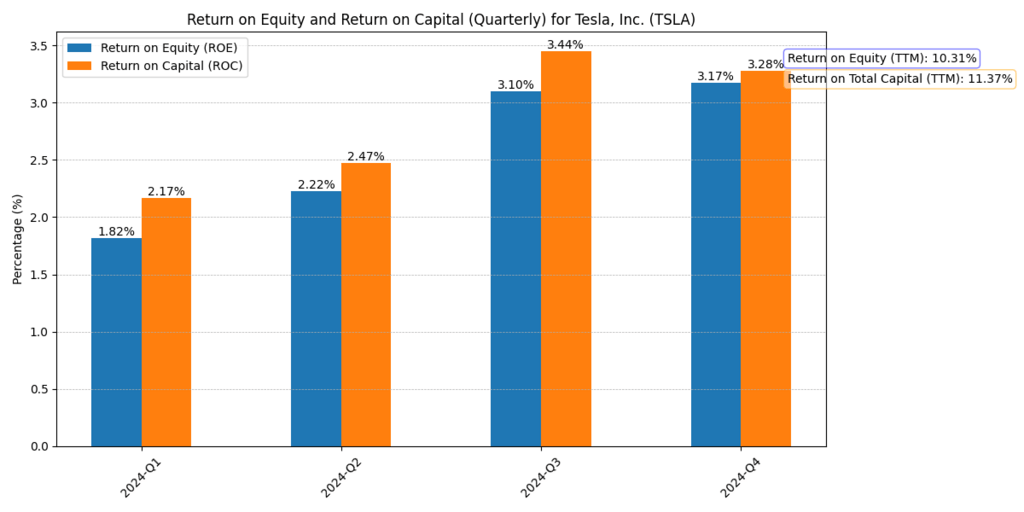

Return on Equity and Return on Total Capital for Tesla

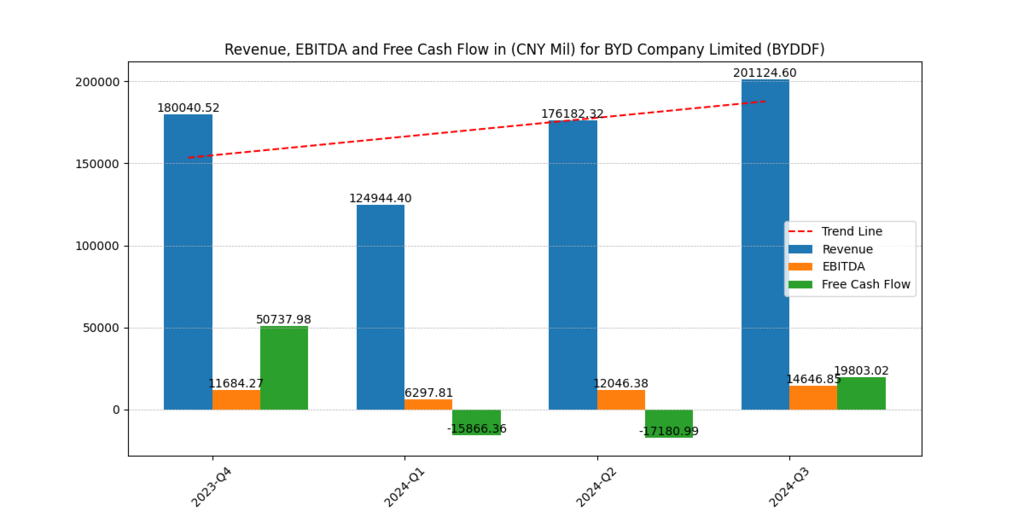

Revenue, EBITDA and Free Cash Flow for BYD

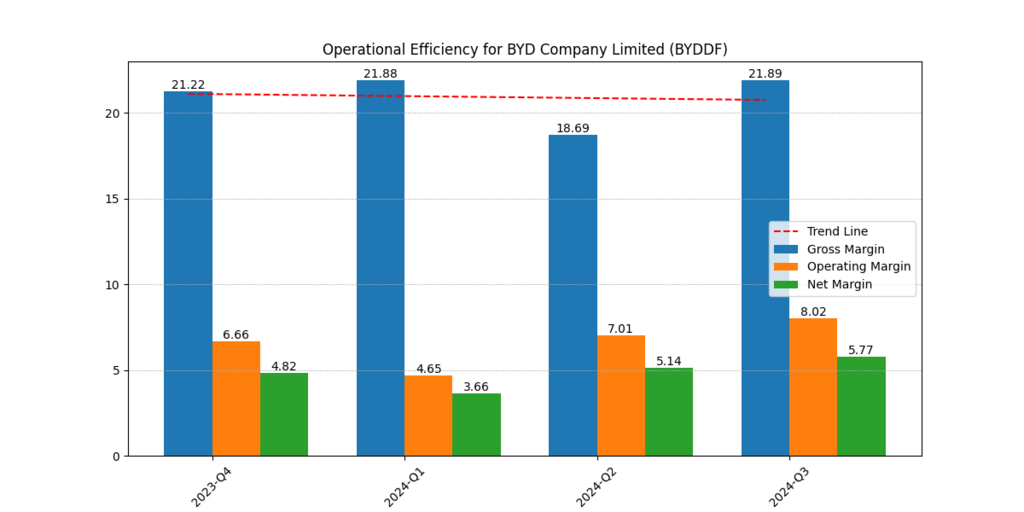

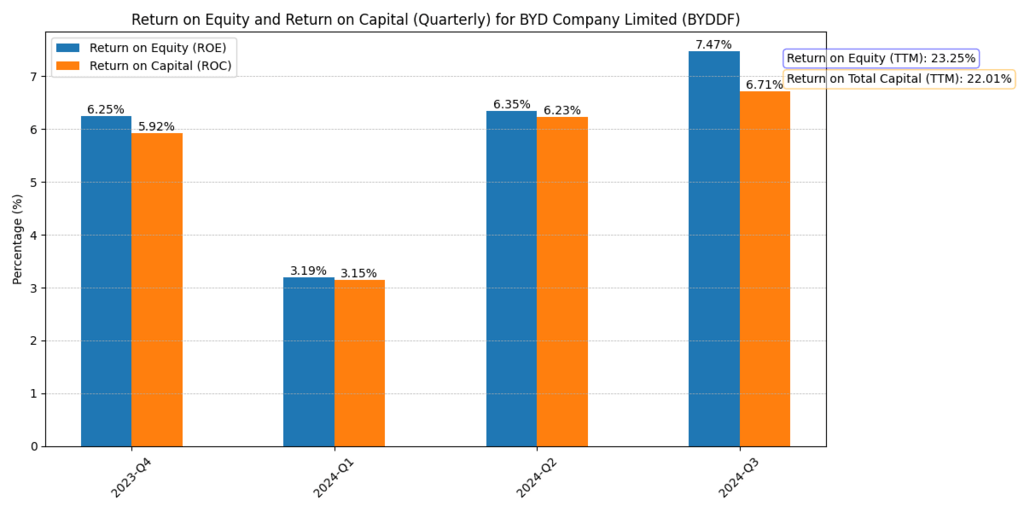

Operating Margins for BYD

Return on Equity and Return on Total Capital for BYD

Market Trends: Tesla Struggles While BYD Expands

Sales from Tesla show significant drops in their important markets throughout the world in markets that previously supported the company the most. Last month Tesla saw an enormous decrease in vehicle sales amounting to 76.3% in Germany and recorded 71.9% sales reduction in Australia.

Market research demonstrates Tesla confronts mounting competition in the evolving EV marketplace because it has difficulty sustaining its market position. Ionna emerges as a new competitor in EV charging infrastructure as it aims to deploy 30,000 charging stations across the world during the next decade despite Tesla’s once-dominant ownership of the Supercharger Network. The increasing rivalry against Tesla puts its preeminent charging system at risk since it served as a vital selling feature for its cars.[3]

Find out about Tesla (TSLA) Earnings and Fair Value Analysis (2025).

BYD advances its global expansion strategy alongside its market expansion plans. The company successfully acquired $5.6 billion through its latest capital boost to support its international expansion. This funding initiative will drive BYD’s market expansion because Latin America and European demand for cheap electric vehicles continues to grow. BYD directs its efforts to achieve affordability through mainstream electric vehicles while Tesla concentrates on high-end luxury models which appeal to premium EV consumers.[2]

The financial performance at Tesla Company faces significant challenges. The company faces diminishing profit margins because of reduced prices along with growing market competition. The gross margin reported by Tesla reached 17.4% in its latest earnings report which proved lower than the previous year’s 25.1%. The company’s revenue growth has shown decreasing momentum and shareholders monitor price wars’ alleged negative effects on Tesla’s profitability potential. The strong financial stability of BYD exists because the company benefits from vertical integration through its battery production while taking advantage of economies of scale production methods.

The competitive landscape between BYD and Tesla has become more heated as BYD expands its presence more rapidly while Tesla experiences rising market pressure.

Innovation: BYD’s ‘God’s Eye’ vs. Tesla’s FSD

The Full Self-Driving (FSD) software from Tesla stands as a primary point of innovation yet remains blocked by regulatory challenges especially throughout Chinese regulatory landscapes. Many regions have not fully authorized FSD software despite the years of research because of regulatory uncertainties which impede its mass market use. BYD includes their “God’s Eye” self-driving system as standard equipment across their entire product line including the inexpensive Seagull which costs just $9,600. BYD’s implementation of “God’s Eye” will probably reshape the current competitive field within autonomous driving.

The decision by BYD to incorporate ‘God’s Eye’ into all its vehicles allows self-driving capabilities to spread among budget-conscious consumers. Tesla maintains FSD at the premium level forcing customers to pay initial costs and ongoing subscription fees for the feature. The camera-based vision technology Tesla uses instead of LiDAR technology creates safety and reliability concerns specifically in China because government officials demand stringent data protection measures. The challenges Tesla faces in this vital market where BYD continues to enlarge its market share create difficulties for the company. [1]

The successful financial performance of BYD allows it to pursue transformational innovation through its ambitious plans. Through its record-breaking financial results in 2023 BYD generated $1.4 billion in net profits for the first six months of the year after experiencing a 204% increase over the previous annual performance. The company uses its strong financial position to direct heavy funds toward R&D operations at the same time it maintains affordable product prices. The aggressive reduction of prices combined with rising market competition results in Tesla’s deteriorating profit margin performance. The change in gross margin from 25.1% to 17.4% indicates weakening profitability prospects for the company.

The combination of accessible prices and regulatory approval support positions BYD to gain substantial market advantage compared to Tesla as it develops self-driving technology in price-sensitive areas.

Projects Undertaken By Tesla and BYD

| Company | Project | Description | Date |

| Tesla | Megafactory in Texas | Tesla plans to build a new Megafactory near Houston, Texas, to expand its production capabilities. | March 2025 |

| Tesla | Megapack Project in Puerto Rico | Tesla secured a contract to supply Megapacks for a 430 MW energy storage facility in Puerto Rico. | February 2025 |

| Tesla | Dojo Supercomputer Expansion | Tesla announced a $500 million investment to build a Dojo supercomputer cluster at Gigafactory New York in Buffalo. | January 2024 |

| BYD | 1,000 kW Fast Chargers | BYD unveiled new 1,000 kW chargers capable of adding 400 km (approximately 250 miles) of range in just five minutes, addressing charging time and range anxiety issues for EVs. | March 2025 |

| BYD | Saudi Arabia Energy Storage Project | BYD signed a contract with Saudi Electricity Company to build the world’s largest grid-scale energy storage project, totaling 12.5 GWh across five sites. | February 2025 |

| BYD | Energy Storage Project in Poland | BYD partnered with Greenvolt Power to develop a 1.6 GWh battery energy storage system in Poland, marking its latest adoption of energy storage technology in the international market. [1] | March 2025 |

Final Verdict

Investors focusing on growth should purchase BYD stock because of its steady profitability and technological innovations combined with its rising market control. The competition has intensified for Tesla as the company struggles to maintain top status along with declining sales figures.

**Please be informed that the content is informational and by no means serve as a buy or sell signal. The company is not responsible for the loss of capital.