Unlock the best stocks to buy for long term growth before the year 2025 ends. Discover why META, GOOGL, UNH, EOG, and COP offer sustainable multi-year value creation not only in the tech stocks, but also in the fields of healthcare, AI and energy as well, with growth curves ranked in a descending order.

Overview

The majority of investors only need the names of techs when thinking about the best stocks to buy for long term growth. The market has rewarded AI leaders, and some of the largest multi-year opportunities have since been found in both healthcare and energy. Companies are possible that have sustainable earnings power and stable operations are Meta, Alphabet, UnitedHealth, EOG Resources, and ConocoPhillips. They also offer the investors a choice of developing a portfolio of long-term growth stocks 2025, where both the tech and non-tech sectors will work.

The companies that are listed in this list are all operating on a good foundation. They have predictability in their performance, their drivers of demand are clear, and their performance has been improving. The trends of the residual earnings and returns on the operating assets over several years are given in the figures below. These values are used to rank and select the best stocks to buy before 2025 because they wish to have simplicity and stability on a cycle basis.

The list is ranked using the long-term growth rate:

| Company | Growth Rate | Strategic Position |

| META | 4.6% | AI-powered efficiency |

| GOOGL | 4.5% | AI monetization |

| COP | 2.1% | Capital efficiency |

| UNH | 1.4% | Stable compounding |

| EOG | 0.4% | High-quality operator |

These stocks are the best stocks to buy for long-term growth because they have repetitive fundamentals with repetitive demand. They can also provide diversification through multi-sector growth investing that eliminates the concentration risk to the investors who are seeking to hold the stocks till the next decade.

Meta Platforms (META)

This is the reason why Meta can be considered as one of the strongest long-term growth stocks 2025 because it is now more disciplined to generate earnings. The company is focused on low costs, higher margins and better capital allocation. The management is also consistent in its balanced expenditure rationalisation and revenue increase in all its apps due to its latest 10-K filing (Meta Platforms, 2024).

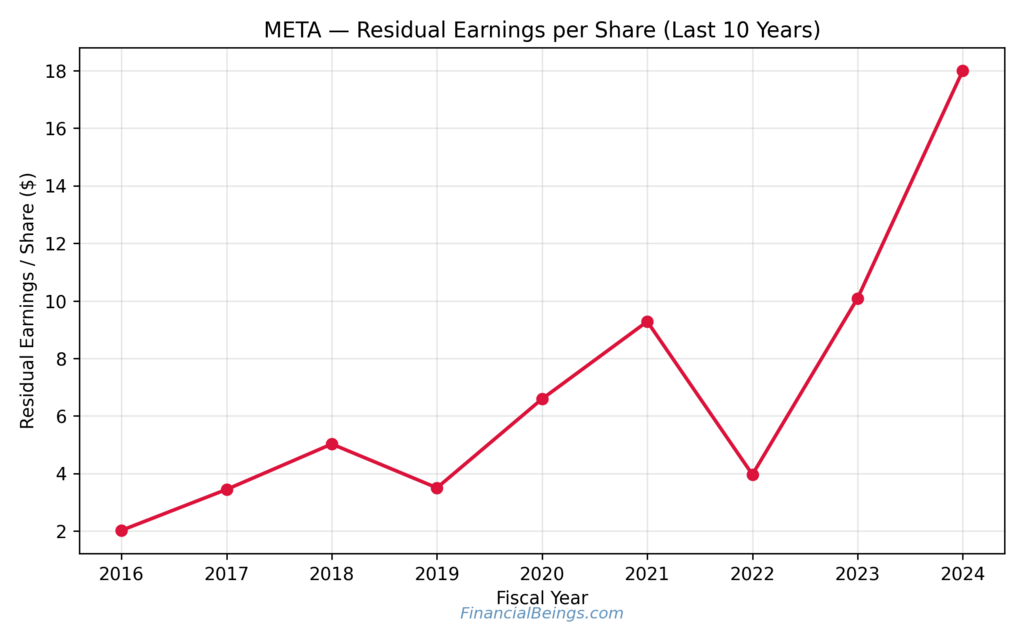

Figure 1. META residual earnings per share from 2016 to 2024.

Meta has the following calculations:

- Residual earnings growing to approximately 2.0 in 2016

- Moving up to around 9.3 in 2021

- A decline to roughly 4.0 in 2022

- A sharp rebound to 10.1 in 2023

- A strong jump to 18.0 in 2024

The point is that this improvement adds to the efficiency of Meta as the operating efficiency is significantly enhanced. High revenue per user and strict control over the expenses also represent a clear increasing trend in the eyes of the investors.

Why META ranks first

Meta enjoys the benefits of a greater operating leverage. The management has long-term investments in AI infrastructural setups, which lowers the marginal costs of adding new features. The growth in operating income, as reflected in the latest updates to Meta’s investors, indicates a structural and ongoing trend (Meta Platforms, 2024).

META is the first in the list of the best stocks to buy long long-term growth because it is involved as it improves its main business of advertising and reducing superfluous spending. The company offers the stockholders long-term growth without fast assumptions. The given stock appears stable to a shareholder who is creating a portfolio of the finest investments over the long term.

Alphabet (GOOGL)

Alphabet is close to Meta regarding long-term earnings power. The revenue base of Alphabet continues to grow, and there is further reinforcement that is linked with a new monetisation of AI tools. According to its annual report, Google Cloud is profitable, and it is turning out to be a reliable source of operating income (Alphabet Inc., 2024).

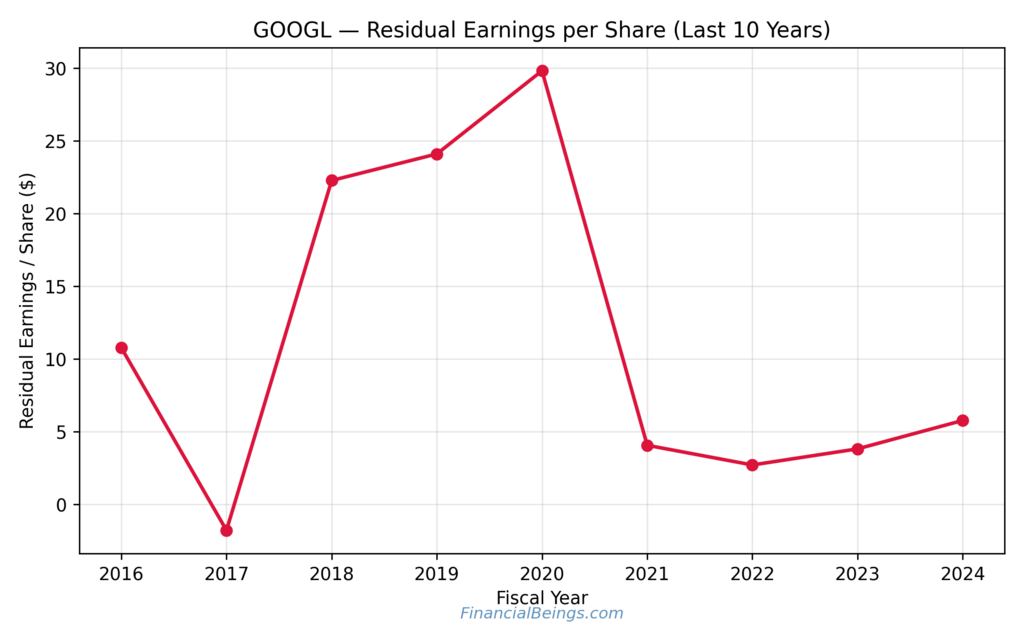

Figure 2. GOOGL residual earnings per share from 2016 to 2024.

The graph shows:

- Around 10.8 in 2016

- A drop to negative values in 2017

- A steep rise to 22.3 in 2018

- Continued growth to 29.9 in 2020

- A sharp decline to 4.2 in 2021

- Stabilisation and recovery to an approximate of 5.8 in 2024

Alphabet is also among the secure long-term growth stocks as its earnings are regaining rapidly. The large changes suggest that there are high variations in the advertising cycles, but the long-term direction is positive.

Why GOOGL rank second

Digital search and cloud services’ level of demand are in line with Alphabet due to its size. Recent reports also imply that its operating expenses are declining and it has spent a significant amount of money on data centres (Alphabet Inc., 2024). These are part of the reasons why it is one of the stocks that have been highly recommended to be bought by 2025.

The investors also trust its ability to commercialise the AI-based resources, such as Gemini, and this is reported in the company disclosures. This predisposes Alphabet as one of the safest AI and non-tech growth stocks in the stock market.

ConocoPhillips (COP)

COP offers the energy industry stability to this list. The company is enjoying favourable free cash flows and suppressed spending. Its periodic report has underscored the fact that it has been enhancing its capital efficiency and operating margins (ConocoPhillips, 2024).

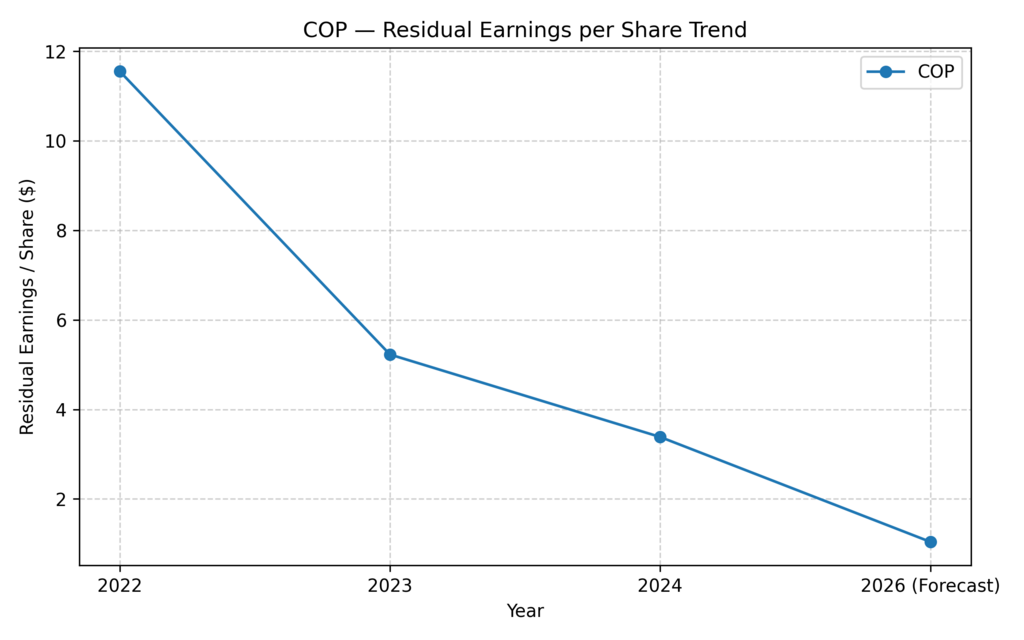

Figure 3. COP’s residual earnings per share from 2022 to 2026.

The graph shows:

- Around 11.6 in 2022

- A decrease to 5.2 in 2023

- A lower value of 3.4 in 2024

- A forecast dip to 1.1 in 2026

This shows a declining trend. This, however, can be normalised by a strong 2022 energy cycle, residual earnings.

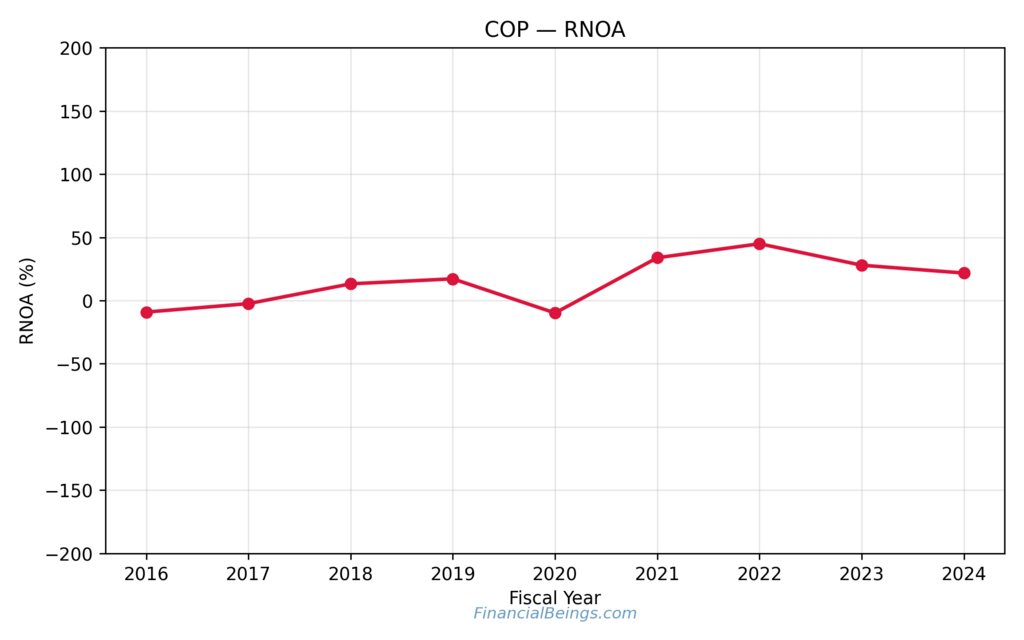

Figure 4. COP RNOA (Return on Net Operating Assets) from 2016 to 2024.

The graph shows:

- Negative values in 2016 and 2020

- A rise to around 14.4 in 2019

- A strong peak near 45 in 2022

- A gradual adjustment to 22.5 in 2024

These values imply that COP raises the efficiency of capital in the long term. The benefit of it is that it will control spending even when commodity cycles turn volatile.

Why COP ranks third

COP helps the investors to diversify the energy and industrials growth stocks. It is one of the best non-tech stocks for long-term growth in the long run since the compounding of its assets, cash flows, and management discipline is stable. According to its reports, COP is focused on shareholder returns and top long-term investment ideas in quality projects (ConocoPhillips, 2024).

UnitedHealth Group (UNH)

UnitedHealth offers long-term investors an easy narrative of compounding as the business model is not bound by the short market cycles. The company has a steady source of revenue that is in the form of millions of insured members, employer contracts, and government programs. Its second source of stability is its Optum arm, as the business provides pharmacy service, data analytics, clinics and care management.

The revenue of these operations is a constant, and it is growing even when the economy slows down. In the latest announcements, UnitedHealth notes that OptumCare is building its network of clinics, physicians, and digital solutions that can be used to help in preventative care and long-term care. The management mentions the new investments in virtual care and technology-enabled health services that would make the process of engaging patients in the entire US easier (UnitedHealth Group, 2024). This insurance size and provision of care structure make UnitedHealth one of the most successful growth stocks in the long run, as these two aspects of the business complement each other and enable the company to experience years of stable income.

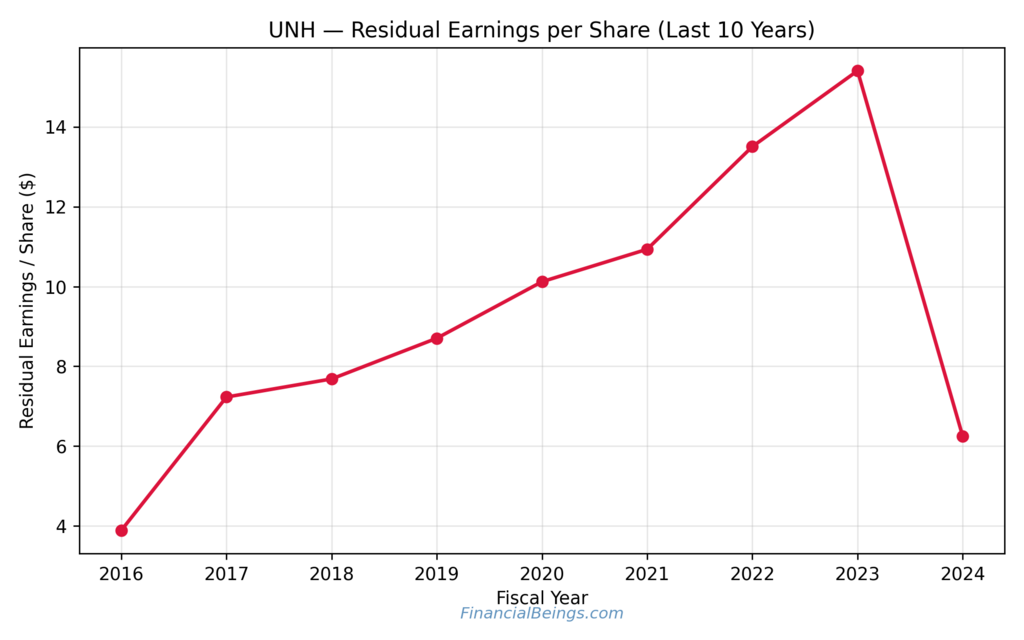

Figure 5. UNH residual earnings per share from 2016 to 2024.

The graph shows:

- Around 3.9 in 2016

- Rising steadily to 7.2 in 2017

- A stronger rise to 10.1 in 2020

- A peak of 15.3 in 2023

- A sharp decline to 6.2 in 2024

It is a long-term trend that has a stable growth, but varied in 2024.

Why UNH ranks fourth

In every cycle in the market, there is no reduction in healthcare spending. UNH enjoys a stable demand based on policies. This is the reason why it is the safest undervalued long-term stocks, taking into consideration the tech in the long run. The investor sentiment is good because they have clear operating cash flows reported on official filings (UnitedHealth Group, 2024).

UNH is a necessity for all long-term stock selection and diversified long-term stock picks.

EOG Resources (EOG)

The low-cost operations are also important to EOG, and this can allow it to be profitable even in cases when the price of energy is changing. The company proposes in the annual report that it has a low cost of development, which is designed to identify quality drilling locations and internal technology to improve the performance of the well. The management also focuses on the balance sheet discipline. EOG does not presuppose high debt owed, and thus it is more lenient in the case of weak commodities. Its other advantage is that it is of a quality reserve. The company would take time to build an outstanding future drilling program that helps in the many years of production.

According to its reports of 2024, EOG has announced that the company is replenishing reserves at attractive prices and increasing the scope of resources using the exploration program (EOG Resources, 2024). It is this combination of good operations, financial health and quality reserves that would see several investors label EOG as a low-risk long-term growth stock in the energy industry.

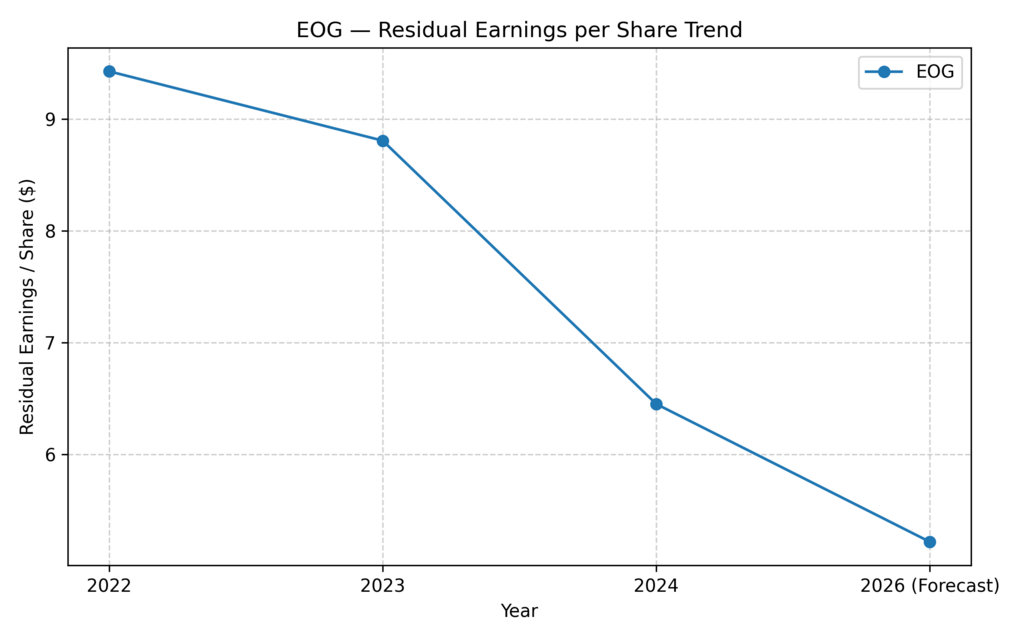

Figure 6. EOG residual earnings per share from 2022 to 2026.

The graph shows:

- Around 9.4 in 2022

- Declining to 8.8 in 2023

- Down to 6.4 in 2024

- Forecast at 5.3 in 2026

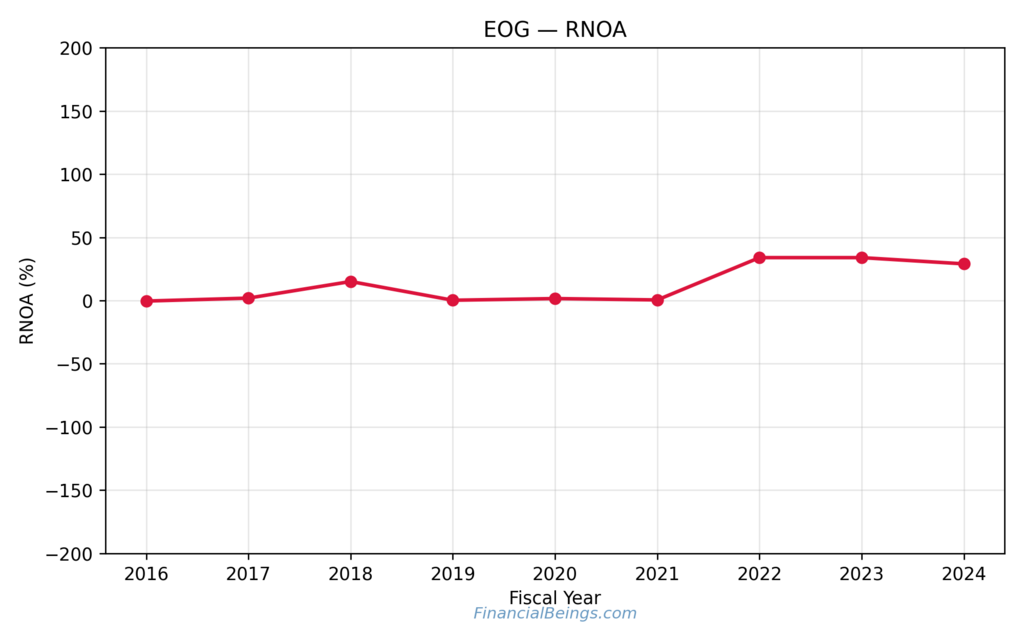

Figure 7. EOG RNOA from 2016 to 2024.

The graph shows:

- Stable near 0 in 2016, 2019, 2020

- Rising to 34 in 2022

- Remaining near 33–35 in 2023

- Slight decline to 30.1 in 2024

This confirms steady operating efficiency.

Why EOG ranks fifth

EOG is among the stocks to hold through the next decade, as it keeps the risk at a low level. Investors who desire predictable energy exposure can use its low leverage and control over its operations. This makes EOG suitable for multi-sector growth investment.

Further Reading : Best Tech Stocks to Buy Now: The AI-Driven Leaders Set to Shape 2025 to 2030!

Further Reading : What Is the Intrinsic Value of UNH Stock? Updated Fair-Value Outlook for 2025 and Beyond!

Further Reading : Meta Stock Forecast 2025: Breaking Down META’s True Value Beyond the Market Hype!

Further Reading : GOOGL Stock AI Driven Growth Explained – Why Alphabet’s AI Ecosystem Could Redefine Long-Term Returns!

Further Reading : ConocoPhillips Stock Forecast 2025: Can COP Outperform as Oil Prices Cool?

Conclusion

The top five names are the best stocks to buy in long-term growth through to the year 2025 because they have a connection with several other major economic drivers of the world today. Meta and Alphabet are the obvious leaders in terms of earnings recovery, growing margins, and demand for digital platforms in the long term. Their stability is made up of global advertising, monetisation of cloud services, AI and all these are expected to expand in the next few years, according to the investors. UnitedHealth introduces the aspect of healthcare sustainability.

It enjoys the benefit of not being subject to market cycles either in regard to demand or in terms of the size of its operations, both in respect of insurance as well as its clinical services, and this offers predictable cash flows. COP and EOG provide an exposure to global energy, which assists in defining portfolios whenever inflation and shortages of supply occur.

As a result of merging these two companies into one basket, investors who aim to find the best stock to buy before 2025 will experience the merger advantages of the two stocks. The portfolio consists of AI-based companies with high growth rates and protectionist healthcare and cash-generating energy companies. This will result in the entire profile being less vulnerable to changes in the market.

It also fosters the growth of investing in the multi-sector, where the different industries will be engaged in the long-term compounding. This approach has been preferred by most long-term investors because it reduces the emotional aspect of decision-making and prevents one not excessively focusing on a single sector. The combination of such companies will assist in creating a portfolio of diversified long-term stock picks that might produce high returns, and it may be a more pleasant experience for whoever may hold such over the coming decade.

All calculations and valuation estimates are FinancialBeings’ own, based on data sourced from SEC filings (10K and 10Q), use or reproduction before prior approval is prohibited.

Usama Ali

Usama Ali is the founder of Financial Beings and a self-taught investor who blends classic valuation study with insights from psychology. Inspired by works from Benjamin Graham, Aswath Damodaran, Stephen Penman, Daniel Kahneman, and Morgan Housel, he shares independent, data-driven research to help readers connect money, mind, and happiness.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.