Looking for the best AI stocks to buy? This analysis simplifies the top AI companies that will be part of the growing enterprise and cloud AI expenditure in 2026.

Introduction

Currently, AI is at the experimentation stage and can be implemented in large businesses. AI has now been a series of decisions related to capital allocation underlying cloud infrastructure, enterprise software, digital advertising, semiconductor manufacturing and others. This has seen the equity markets responding by re-rating some leading technology companies that are on the frontline of such a transformation, with the AI expenditure in the world increasing beyond 2026.

However, the rise in its adoption does not imply the presence of attractive investment opportunities. Some of the AI-exposed stocks already have the positive assumptions of long-term growth, profitability, and competitive advantage. These returns of the shareholders are not pegged to the increase in the shareholders’ isolated but rather to whether the increase is greater than what is already reflected in the stock, as it is continuously enforced by the theory of valuation.

The article provides the best AI stocks to buy now after examining the association between the intrinsic value of AI stocks and market expectations. The growth-sensitivity valuation and trends on the residual earnings analysis reveal the leaders in the AI industry that are assessed based on sustainable creation of value, and the ones that require an abnormally large execution level to warrant their valuation.

The analysis focuses on five companies with robust AI presence on different levels of the ecosystem, including Amazon, NVIDIA, Alphabet, Microsoft, and Meta Platforms.

What the Current Stock Prices Reveal?

| Company | Market-Price-Implied Long-Term Growth |

| Amazon | 8.61% |

| NVIDIA | 8.43% |

| Alphabet (Google) | 7.87% |

| Microsoft | 7.19% |

| Meta Platforms | 6.36% |

These growth rates are the long-term growth that must take form, whereby the existing market prices can be explained. A positive implied growth implies that there is already AI-driven success that is already reflected in the stock price. The implication is lower growth, which implies that there is more to gain in terms of increasing the valuation in the case of further improvement of AI monetization.

At the start, this ranking demonstrates a big difference between AI stocks vs market expectations. Amazon and NVIDIA can be valued as long-term growth expectations, and comparatively less aggressive assumptions should be made to value Meta and Microsoft.

Which Stocks Should Investors Buy Now and Why?

| Company | Intrinsic Value vs Market Price | Valuation Signal |

| Amazon | Below market price | Priced for aggressive AI success |

| NVIDIA | Approaches market price only at high growth | Highly growth-sensitive |

| Alphabet | Near market price | Balanced |

| Microsoft | Converges near implied growth | Reasonable |

| Meta Platforms | Exceeds market price | Valuation cushion |

Market-implied growth rates are so high, indicating that the price of a stock is not supported by the fundamentals rather than optimism itself. Even in these cases, although the increase in the use of AI can take longer than expected, the risk to the downside is low since the valuation is not pegged on radical assumptions. Conversely, those stocks whose growth rates are overly high to warrant the prevailing price create a risk of compression to the investor. When the execution, monetization or competitive positioning is lacking, the market quickly sets the expectations straight, which in most situations causes an excessive decline in prices. This makes the AI stocks whose valuation is structurally more resilient during the changing-sentiment periods.

AI Stock Valuation Analysis: Intrinsic Value vs Market Expectations

Amazon (AMZN): Growth Sensitivity and Valuation Pressure

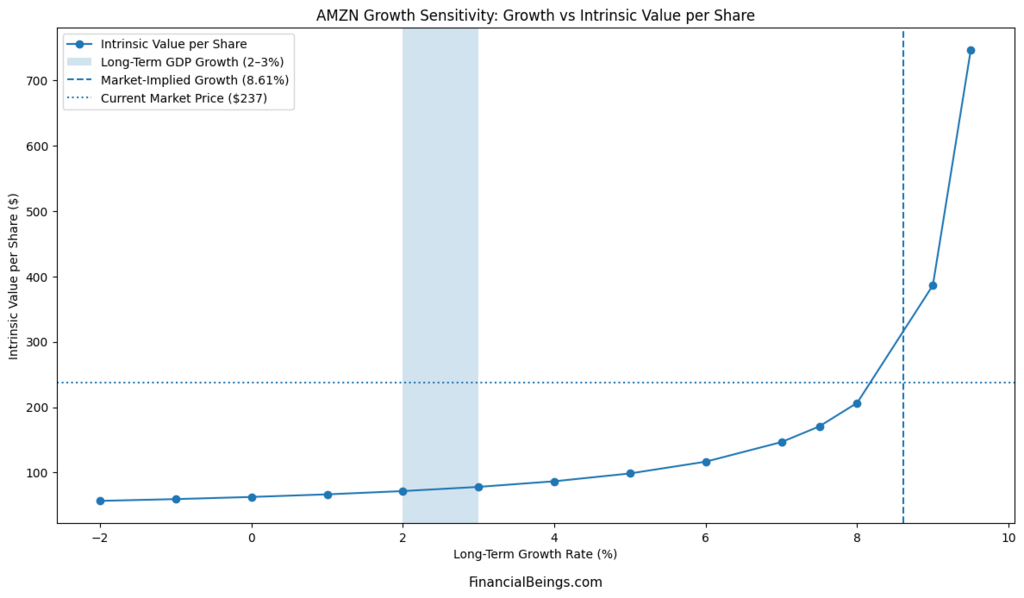

Figure 1: Comparative intrinsic value per share of Amazon between long-run growth assumptions, the current market price and market-implied growth.

The growth-sensitivity of Amazon suggests that the intrinsic value curve is quite a flattened curve at the lower growth rates, and only at very large long-term assumptions, there is a steep increase. The intrinsic value in the cases of the middle range growths is extremely low compared to the market value.

This tendency means the capital-intensive AI methodology at Amazon. The economic payoffs in the long term will not be instant on cloud infrastructure, automated logistics, and machine-learning platforms. Amazon will see a variation in short-term margins according to its disclosures, as the company will be concerned with long term capacity building (Amazon Investor Relations, n.d).

In terms of valuation, Amazon is, in fact, one of the AI stocks that are priced on growth. The market assumes that AI will not only result in the rise of revenues, but will eventually culminate in the structural rise in the returns on invested capital. Such an outcome is possible, though it is difficult not to be disappointed in it.

Amazon is a high-potential, low-valuation opportunity for investors of the best AI stocks to buy now.

NVIDIA (NVDA): Extreme Sensitivity to Growth Assumptions

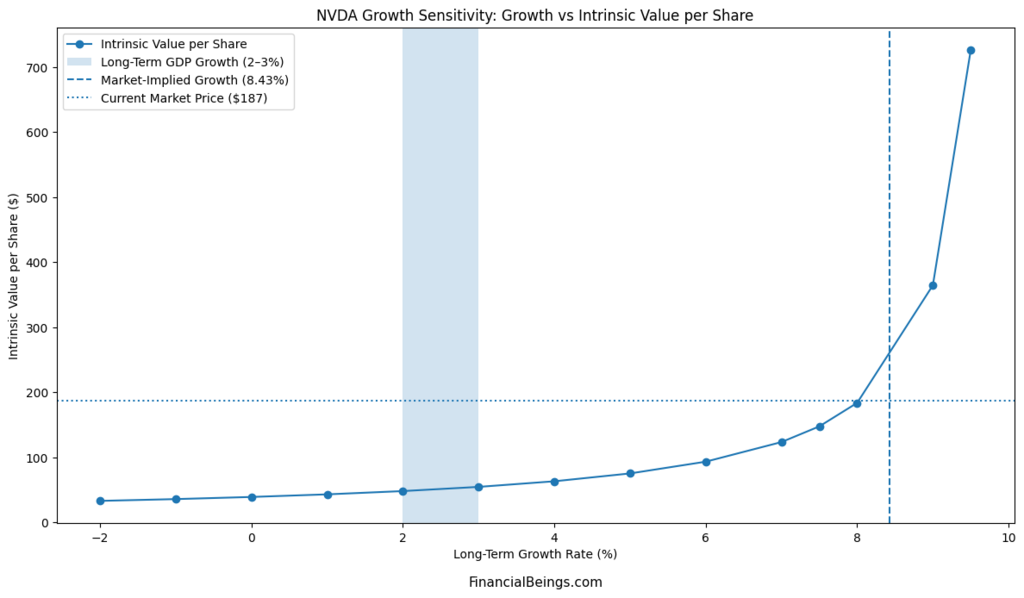

Figure 2: NVIDIA intrinsic value per share that is exceedingly sensitive to growth assumptions in the long term.

The valuation curve of NVIDIA is even steeper compared to any other companies that are reviewed. A relatively small modification in the alleged increase in the long run results in a relatively huge modification in intrinsic worth. This means that the expectations in terms of stability of AI demand are quite sensitive to the market price of NVIDIA.

Such a sensitivity shows where NVIDIA is in the hardware centre of the AI ecosystem. The demand for AI accelerators, data-centre GPUs, and the like platforms has grown at a high rate, hence making the role of NVIDIA an important supplier. The company reports are devoted to further dedication to AI computing architectures and software ecosystems (NVIDIA Investor Relations, n.d).

According to the theory of valuation, the greater the expectations of growth attained, the risk is the higher it will be. It can only be at a very high growth assumption that NVIDIA is on its way to its intrinsic value that is very near its market price, that it will firmly be in the AI stocks vs market expectations, where optimism is the major driving force.

NVIDIA is appealing to those investors who are growth-oriented. Investors who are valuation-conscious should take critical risk tolerance.

Alphabet (GOOGL): Balanced AI Valuation Profile

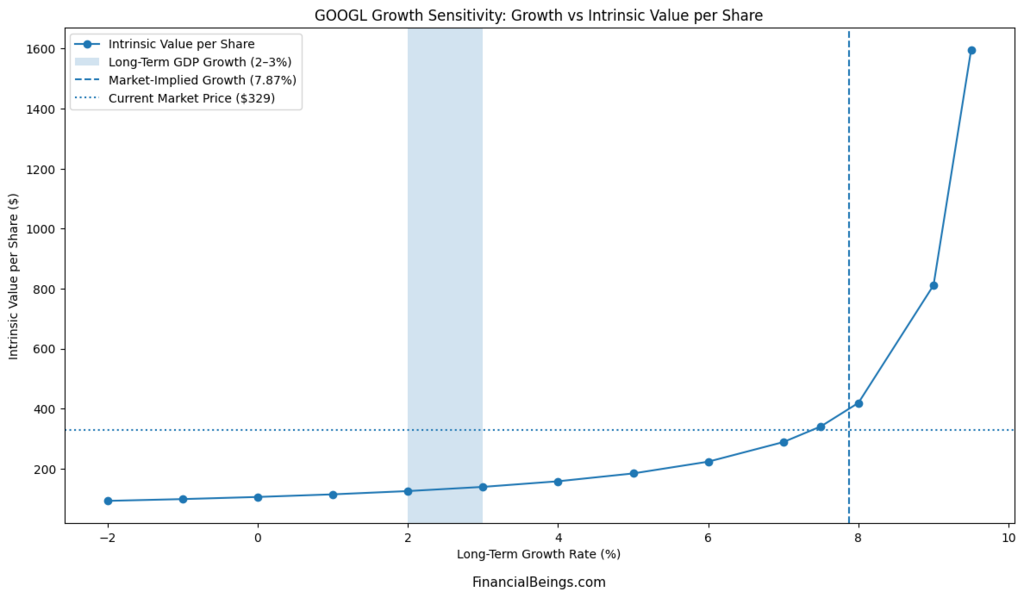

Figure 3: Value of the alphabet intrinsic to share on a growth basis to various growth scenarios, which meet at market-implied growth.

The growth-sensitivity of Alphabet demonstrates rather a slow and smooth growth in the intrinsic value with the growth of the long-term growth. The intrinsic value of the current share price is almost equal to the intrinsic value at the growth rate that the market suggests.

This balance is the exposure to Alphabet in the diversification of AI. AI is incorporated in search, advertisement optimisation, cloud computing and productivity. The disclosures of Alphabet claim that AI is not a one-product investment but rather an improvement of the existing revenue engines (Alphabet Investor Relations, n.d).

As a result, the valuation of Alphabet is not based on extreme assumptions. It is among the brightest examples of the intrinsic value of AI stocks according to the market expectations.

Alphabet is one of the most promising AI stocks to buy at this stage to benefit an investor who is interested in being exposed to AI, though at the cost of volatility.

Microsoft (MSFT): Valuation Discipline and AI Integration

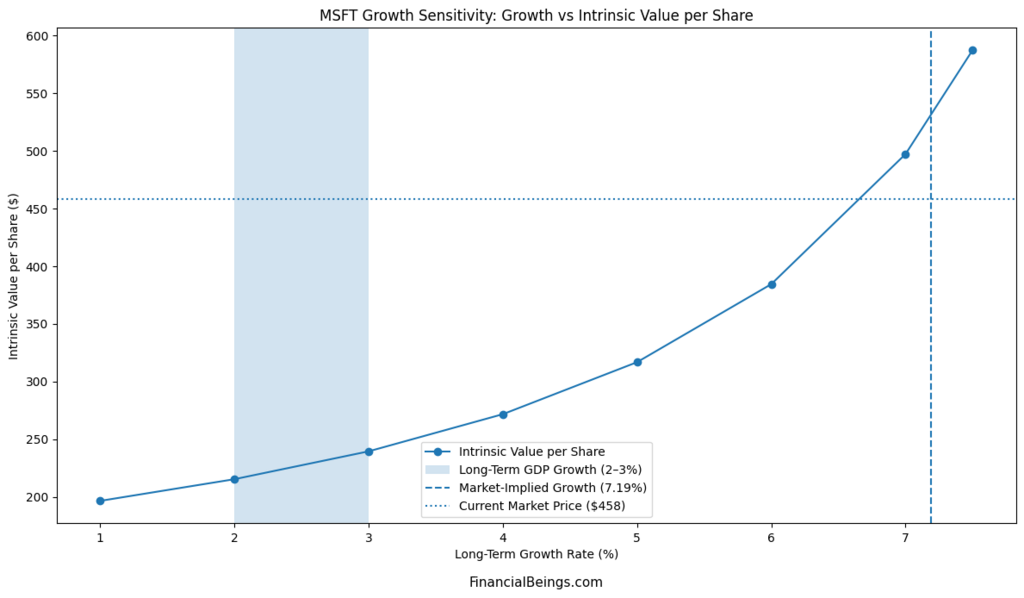

Figure 4: Intrinsic value/long-term growth assumptions: Microsoft, the valuation is observed to be held on the implied growth.

The intrinsic curve of Microsoft reaches the market price with a low growth rate as compared to Amazon or NVIDIA. This represents a signal of the fact that the company has created the ability to integrate AI into an already thriving enterprise ecosystem.

The Microsoft is interested in the application of AI as a productivity enhancer using cloud platform, enterprise software and developer tools (Microsoft Investor Relations, n.d). This integration assists in sustaining a constant cash flow and also gives a choice for expansion.

According to the valuation, Microsoft is not a perfect company to trade for short term. Instead, it assumes even more repressive action. Microsoft is one of the best AI stocks to buy at present, risk-adjusted, which allows the investor to gain both stability and AI potential in the long run.

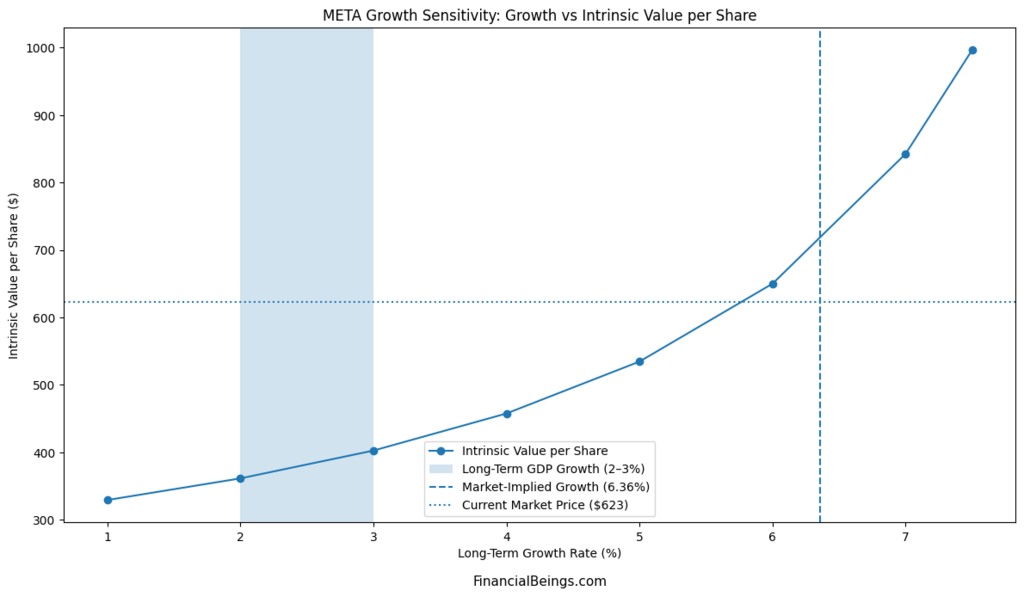

Meta Platforms (META): Valuation Cushion in AI Monetization

Figure. 5: Meta’s intrinsic value per share shows it has support in terms of valuation, even at a lesser growth implied by the market.

The intrinsic value of growth-sensitivity of Meta lies above the current price of the market, at such growth estimates that are extremely small. It implies that the market remains sceptical regarding the long-term AI monetization of Meta despite the favourable shift in the trends of profitability.

The official messages of Meta state that AI assists in ranking content, the effectiveness of adverts, and the optimization of content engagement (Meta Investor Relations, n.d). The quality of revenue and margins directly depends on such applications.

The valuation buffer of Meta is higher than that of the other companies considered. It is of particular interest in the environment of the universe of AI stocks priced for growth, as the expectations are somewhat domesticated.

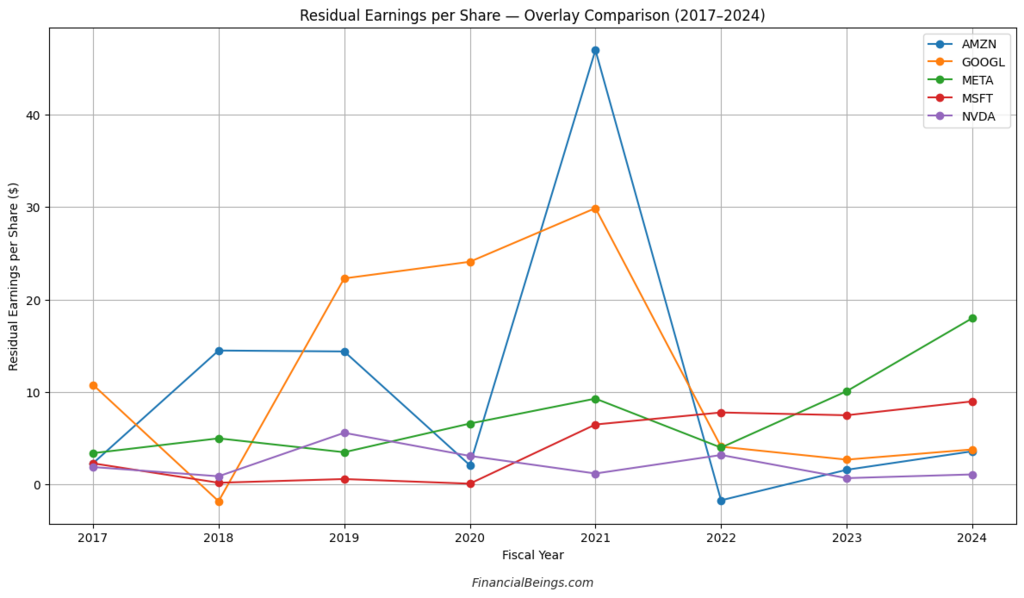

Residual Earnings Analysis: Value Creation For Investors

Figure 6: Comparative analysis of residual earnings per share of five leaders in AI with emphasis put on profitability, longevity and reinvestment effectiveness.

The leftover earnings are utilized in finding out whether a firm is generating returns that are above the cost of capital. The overlay duration of 2017-2024 shows that there are huge variations in value creation for investors.

The fact that their residual earnings per share (REPS) have always been increasing and growing means that such companies have always been generating returns in excess of the cost of capital, thereby generating economic value to shareholders. At the current market prices, all companies, except META, are aggressively priced to exhibit high growth expectations because of the high cycle of investment in AI. Although such an environment of valuation impedes the short-term margin of safety, the businesses may remain appealing to the long-term growth-oriented investors. The trade-off is self-evident: the further implementation and reinvestment efficiency makes the realization of the future value more and more conditional, which assumes the increased volatility since the expectations remain high.

Amazon has unstable residual earnings, and this is an attribute of high reinvesting cycles. The remaining profits of NVIDIA are favourable, and they are not smooth as well, consistent with the cyclical demand trends. The residual earnings of Alphabet and Microsoft are less volatile, which reflects on sustainable profitability. The fact that the previous years have been recovered indicates that Meta is becoming more capital efficient.

This proves one of the most important points: AI spending does not always guarantee shareholder value. The best AI stocks to buy now are those that transform innovation into long-lasting residual returns.

Which Are the Best AI Stocks to Buy Now?

By Valuation Discipline

| Investor Type | Best AI Stocks to Buy Now | Rationale |

| Conservative | Microsoft, Meta | Valuation support and stable residual earnings |

| Balanced | Alphabet, Microsoft | Reasonable expectations and diversification |

| Growth-oriented | NVIDIA, Amazon | High upside with high valuation risk |

This framework will be supportive of AI exposure to investor risk tolerance rather than narrative momentum.

Conclusion

The rate of AI spending is so high in the overall economy of the world, that financial markets already describe much of this optimism in the existing stock prices. Thus, the best AI stocks to buy now are not the ones which have the most engaging narratives, but the ones where intrinsic value and market expectations are close to matching. Good shareholder returns when expectations are high may not be achieved by even high performance in its operations.

It is shown in this discussion that valuation-supported opportunities and expectation-driven investments are different. Microsoft and Meta Platforms offer the most suitable support for valuation. The current and future prices under market value, as per their intrinsic value curves, do not presuppose excessive long-term growth as long as investors have a certain degree of safety in case AI monetization is not a marathon but a process of gradual increase. The benefit of diversified business models is also extended to such companies where AI can be used to improve the already existing sources of revenue, as opposed to relying on a single end product.

The price of Alphabet is high, and the intrinsic value is quite similar to the expectations in the market at a very high growth rate. This means that it has long-term sustainability and moderate exposure to AI, but limits the valuation gains in the short run due tocurrently being expensive .

On the other hand, only Amazon and NVIDIA will be upside down because the expansion of AI in the long term is more ambitious than it is currently presumed. They are highly sensitive to valuation as compared to the execution risk, competition and capital intensity.

The most certain competitive advantage of the investor in the market with popular AI is its valuation discipline.

All calculations and valuation estimates are FinancialBeings’ own, based on data sourced from SEC filings NVDA (10K and 10Q), AMZN (10K and 10Q), GOOGL (10K and 10Q), META (10K and 10Q) and MSFT (10K and 10Q), use or reproduction before prior approval is prohibited.

Frequently Asked Questions (FAQs)

What are the best AI stocks to buy today?

The above-stock of AI is rated and categorized in accordance with the different risk appetites of the investors.

The best AI stocks to buy today are those whose information about AI growth is backed by fundamentals and not by hype. Meta Platforms and Microsoft have the best validation support, as their intrinsic value is in line with market expectations. Alphabet is overvalued but has sustainable profitability, whereas NVIDIA and Amazon have only upside in case the long-term development of AI growth ambitious forecasts materialise.

Which AI stock is going to skyrocket?

None of the AI stocks are guaranteed to skyrocket. The possible upside is grounded on implementation of AI and its revenue generation capacity, valuation discipline and risk tolerance.

Usama Ali

Usama Ali is the founder of Financial Beings and a self-taught investor who blends classic valuation study with insights from psychology. Inspired by works from Benjamin Graham, Aswath Damodaran, Stephen Penman, Daniel Kahneman, and Morgan Housel, he shares independent, data-driven research to help readers connect money, mind, and happiness.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.