Are AI stocks a good investment in 2026? AI stocks valuation analysis takes into market implied growth, the trends in the residual earnings, the key risks, as well as the realistic expectations of returns to the long-term investors.

Introduction

Are AI stocks a good investment in 2026? The consideration of valuation is more crucial than the excitement through which it was driven. AI is now widely applied to cloud computing, online advertising, business software, and data infrastructure, and has received the reaction of markets valuing AI-related companies as long-term growth champions. Therefore, the current stock price already shows that people have a lot of trust in AI-driven development.

This gives another direction to the investor. The question of whether AI is relevant is no longer important, but rather whether the future of the financial-performance is going to be in a position to support the high expectations that are already being reflected in valuations. High expectations imply that a good performance will deliver solid returns even when it fails to exceed the expectations that the market holds.

This growing clash between AI narratives and the evaluation discipline has been identified, which has identified that the returns of investors are increasingly being pegged on realistic performance rather than on visionary assurance (Financial Times, 2024a). On the same note, the AI trade is at a point where the markets demand to witness what has been delivered and not what is possible in the long run (Yahoo Finance, 2026).

What Growth the Market Is Already Pricing In?

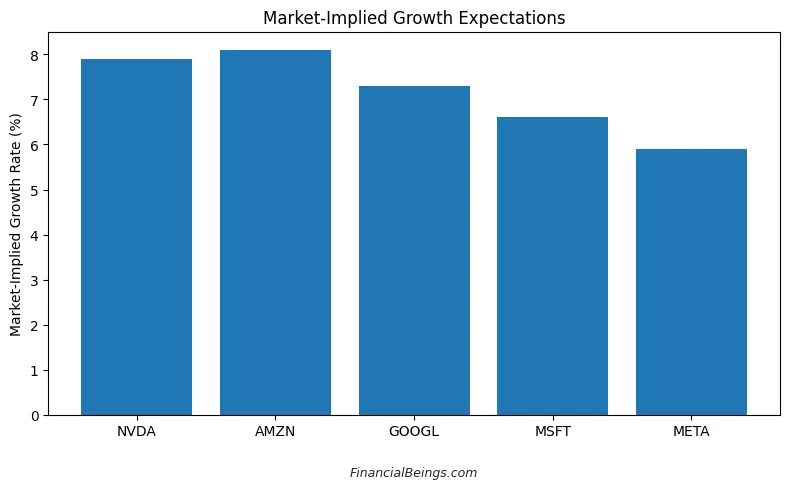

Table 1: Market-Implied Growth Expectations

| Company | Market-Implied Growth (%) |

| NVIDIA | ~7.9 |

| Amazon | ~8.1 |

| Alphabet (Google) | ~7.3 |

| Microsoft | ~6.6 |

| Meta Platforms | ~5.9 |

The market is rewarding the long-term growth that is constant and high on all major stocks of AI. This has a direct effect on the argument about market-implied growth AI stocks and the question of whether the AI stocks are overvalued in 2026.

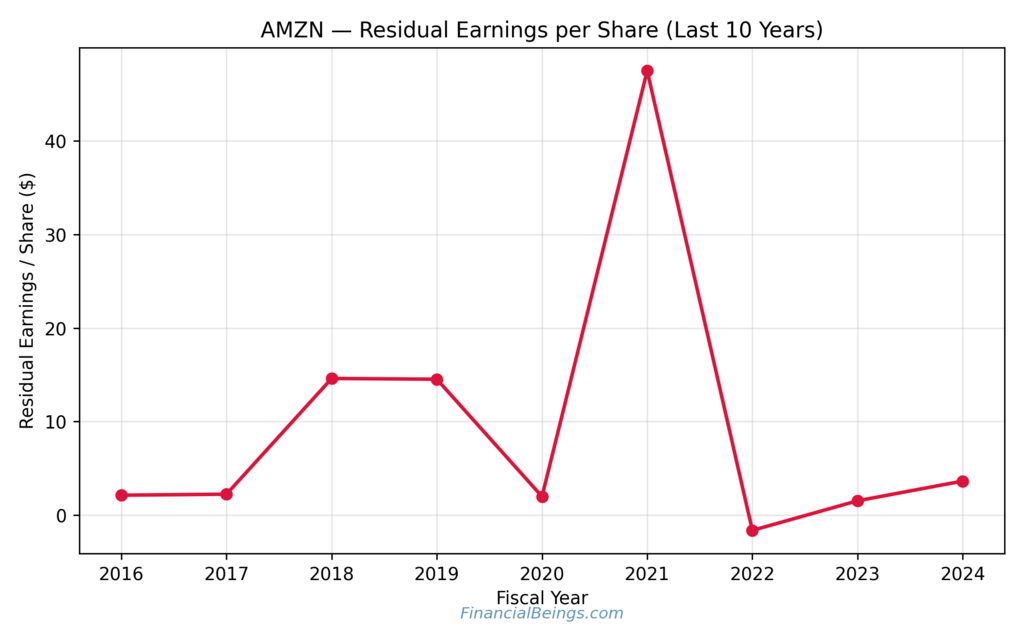

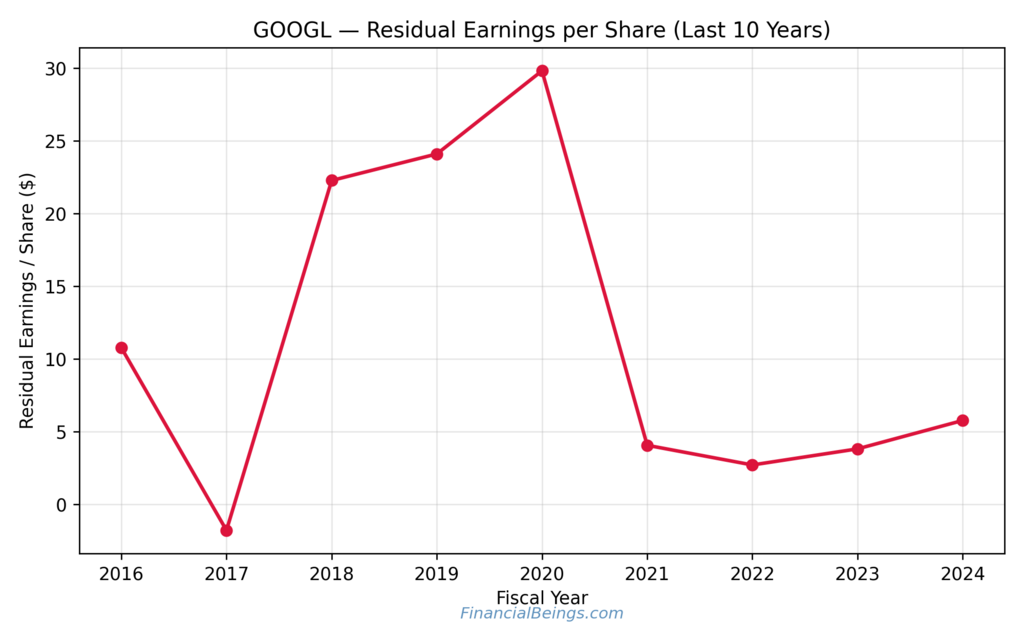

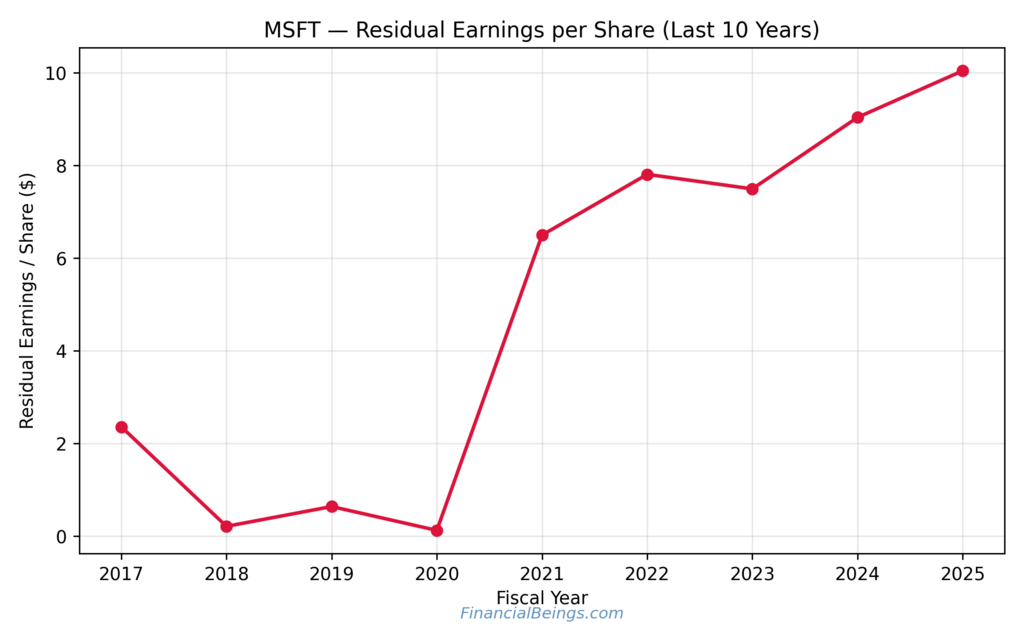

Table 2: Residual Earnings per Share

| Company | Latest Residual Earnings / Share | Pattern Observed |

| Amazon | ~3.6 (2024) | Extreme volatility; sharp spike, negative year, partial recovery |

| Alphabet | ~5.8 (2024) | Peak → reset → gradual recovery |

| Meta | ~18.0 (2024) | Strong upward momentum after the 2022 dip |

| Microsoft | ~10.0 (2025) | Most consistent improvement since 2021 |

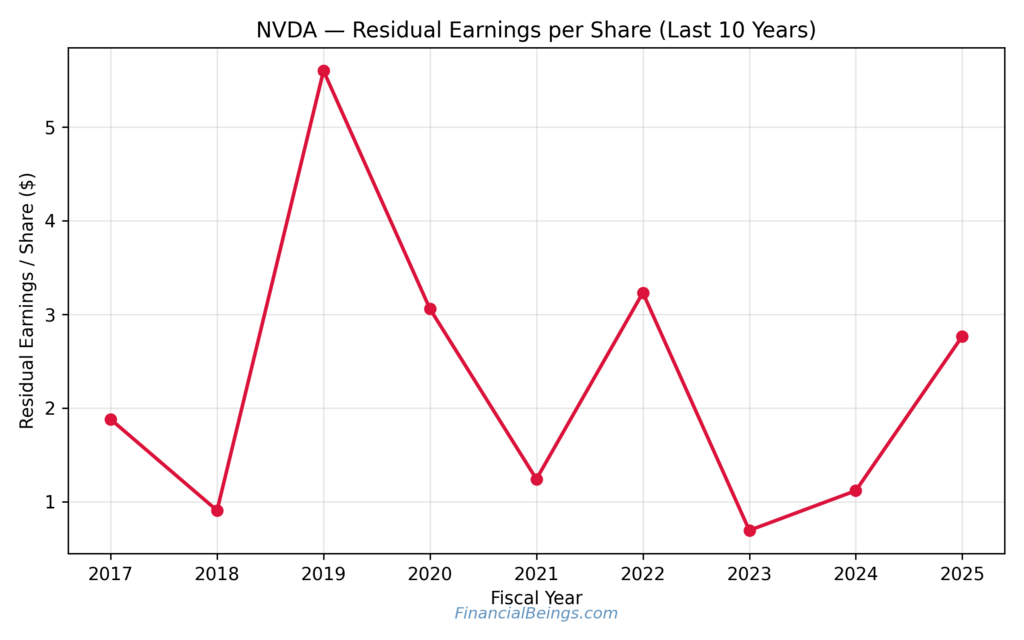

| NVIDIA | ~2.8 (2025) | Cyclical swings, not linear growth |

Valuation risk is caused by unstable residual earnings as well as the high implied growth. The less volatile residual earnings reduce the downside sensitivity. This is the primary difference that is necessary in the computation of AI stocks long-term returns.

Figure 2: Amazon (AMZN) – Residual Earnings per Share Trend, 2016–2024.

Figure 3: Alphabet (GOOGL) – Residual Earnings per Share Trend, 2016–2024.

Figure 4: Meta Platforms (META) – Residual Earnings per Share Trend, 2016–2024.

Figure 5: Microsoft (MSFT) – Residual Earnings per Share Trend, 2017–2025.

Figure 6: NVIDIA (NVDA) – Residual Earnings per Share Trend, 2017–2025.

Why AI Stocks Are at the Center of Investor Attention in 2026?

Investors will focus on the AI stocks in 2026 because the idea of artificial intelligence as an experimental technology will be a thing of the past, and it is already a foundation of contemporary business models. AI has turned into the heart of cloud computing, digital advertising, enterprise software, and data infrastructure, and the base of the work of big technology firms and their scaling, operation, and competition. Those companies that hold data, cloud systems, and systems of a worldwide network of users are therefore considered to be the biggest benefactors of AI implementation as time goes by.

There has been a growing caution in proportion to the growing interest among the investors. The popular application of AI is not always linked with the commensurate shareholder returns, which warns that in situations where the organization has to spend large amounts of money on infrastructure, data centres, and research before the profits flow through (Financial Times, 2024a). This creates an imbalance between the technological possibilities and financial outcomes.

It is because of the intensity that the AI stocks investment outlook 2026 is aggressive. The investors remain optimistic about the future opportunities of AI to drive future growth, but they are more concerned about the cost, implementation, and the time of making the returns. (Yahoo Finance, 2026).

This implies that AI stocks are at an intersection between the opportunities and valuation risks. This makes the question are AI stocks a good investment end up being a valuation question and not a technological one.

Are AI Stocks a Good Investment – or Already Priced for Perfection?

Whether AI stocks a good investment in 2026 will highly depend on the assumptions already realized in the prices of the shares. The market-implied growth rates, as in Figure 1, suggest that investors anticipate the long-term growth and above-average growth in all five of the largest AI-exposed stocks. It implies that artificial intelligence is not perceived by the market as a promising opportunity, but people are sure that the development and emergence of this phenomenon will only be observed in several years.

Having expectations that are elevated will make the returns on investment less responsive to the growth in this form and highly responsive to whether the companies will be able to be better than currently assumed by the market. It has been noted that even the stocks that were priced towards near perfection cannot withstand comparatively small disappointments, as the valuation does not leave much room to go wrong (Financial Times, 2024b).

This risk can also be informed by the trend in the residual earnings. Amazon and NVIDIA are highly volatile, and this implies that the value creation has not been a smooth and predictable process. Alphabet is extremely vulnerable to fluctuating economic and competitive environments with a massive reset following a strong historical peak. Comparatively, Microsoft and Meta are doing better over the last few years, which reflects the establishment of more stable implementation and value creation.

This divergence points out the relevance of selectively treating artificial intelligence stocks valuation instead of treating them theme-based. The risk profile of any AI stocks is not comparable, even though they can share a technological narrative.

How to Evaluate AI Stocks as an Investment (Valuation Framework)

The natural starting point is the implied growth of the market

High expectation and sensitivity are indicated by an increment of the implied growth. The highest growth rates in terms of market implication are demonstrated by Amazon and NVIDIA, and indicate that they will be experiencing higher-than-average growth rates. In comparison, Microsoft and Meta can a bit more easily overcome entry barriers to growth, which relieved the pressure on future results. The difference is necessary because an assessment is conducted on whether there is a chance of positive surprises when prices are as they are.

Residual earnings are proof of the quality of value creation

The amount of residual earnings per share will help us determine whether the firm is generating returns that are greater than the necessary returns on capital required. Microsoft does show a similar trend of increase in residual earnings in the last few years, as compared to a new surge in growth in Microsoft, which was stagnant. These trends imply that the quality of earnings has been on the rise compared to that of their counterparts, whose earnings prove to be fluctuating.

There must also be time stability

Another aspect highlighted is that repeating and long-term value creation can be more significant to long-term investor performance than short-term high performance (Financial Times, 2024a). Unpredictability in AI stocks’ long-term returns is increased by volatile residual earnings that are observed in some AI stocks.

The structure is full of a margin of safety.

The high growth expectations are coupled with the presence of vicious cycles in earnings, thus a high level of downside risk is present. It is the logic framework on which the question will be evaluated whether the investor should investors buy AI stocks in 2026.

The Real Risks of Investing in AI Stocks in 2026

The risks of the AI stocks investment have been highlighted further as the valuation rose and the demands of the investors grew. As much as artificial intelligence is a powerful theme in the long-run, the market environment of 2026 poses investors with several risks that are interrelated and have a direct impact on returns.

The valuation risk is the most short-term. High market-implied growth rates imply that, at the moment, the prices are reflective of high and escalated growth. With a high expectations level, even simple mistakes in terms of performance can lead to a huge price movement. (Financial Times, 2024b).

There is a risk of volatility in earnings, which also complicates the situation. The pattern of the residual earnings suggests that not all the AI leaders generate value in a predictable and easy manner. The unpredictability is enhanced by the changing residual earnings that reduce the investor confidence in the reliability of value creation, which dilutes the AI stocks long term returns.

It also has the capital intensity risk. The creation of AI requires spending money on data centers, hardware, and research. Such investments can financially fall behind the expenditure, leading to pressure on profitability regardless of the high percentage of revenue increase (Financial Times, 2024a). This mismatch between investment and returns could strain valuation at this time.

Finally, we have the performance on the portfolio level, which is caused by the so-called crowding and rotation risk. The investors will exit the same trendy names once the AI stocks are owned by all, and this will impact the AI stocks vs market returns (Yahoo Finance, 2026).

The mixture of these dynamics defines the current AI sector investment risks in 2026.

Which Types of Investors Should (and Should Not) Invest in AI Stocks

The AI stocks are an investment that may be appropriate for some types of investors, but they should not be the appropriate investment for all kinds of investors. Nevertheless, the greatest factor is the correlation between the time horizon and riskiness of an investor and the value of the AI industry.

Long-term investors who are high-risk takers can tolerate AI stocks. These investors will prefer to stay in positions during the period of volatility and a temporary downward turn. Prices can be short-run intense because of the high valuation of AI stocks. Best AI stocks long-term investors are those that take into consideration the fundamentals of a business, and rather than look at the daily market fluctuations, are more likely to benefit from the potential additions of value as time goes by.

Alternatively, AI shares may not be suitable for income-oriented investors. The majority of AI-based enterprises have spent a significant amount of money on their growth compared to dividends, which makes them less profitable to investors who seek to have a constant flow of earnings.

The short-term traders will also fall victim since AI share prices will start reacting more to mood swings rather than predictable short-term events. Finally, the industry might be a burden to investors who are not fond of declines (Financial Times, 2024b).

Are AI Stocks Overvalued in 2026? A Realistic Return Outlook

Are AI stocks overvalued in 2026? The figures suggest that some of them are strictly priced and others possess restricted flexibility in valuation.

Companies with lower implied growth and improvement of residual earnings appear to enjoy higher chances of being able to deliver good long-term returns. The stocks with high implied growth and unpredictable incomes should be traded to perfection to warrant current prices.

AI future returns will be more about operational discipline than news about innovation (Financial Times, 2024a).

AI Stocks vs the Broader Market: Risk-Adjusted Perspective

The AI stocks are more vulnerable to the valuation and the expectation risk than the broader market. Even though it still possesses upside potential, there is also a rise in downside risks. AI leadership can hardly be homogeneous and stable, contributing to the dispersion of outcomes (Yahoo Finance, 2026).

Therefore, AI stock vs market returns should be risk-adjusted rather than headline growth potential.

So, Are AI Stocks a Good Investment in 2026?

This is why AI stocks are a worthwhile investment in 2026. Yes, but in a selective way and with valuation awareness.

The statistics show that markets already have a high growth anticipation. Bars of variances of residual earnings indicate that there are companies that are performing more frequently than others. The AI stocks may be suitable in long-term portfolios when the investors are sensitive to valuation and focused on earnings quality. Those who back the AI story and do not care about the price are at a higher risk.

The discussion of AI investing will no longer be a hopeful topic in the future, but a question of how much it will cost to pay.

All calculations and valuation estimates are FinancialBeings’ own, based on data sourced from SEC filings NVDA (10K and 10Q), AMZN (10K and 10Q), GOOGL (10K and 10Q), META (10K and 10Q) and MSFT (10K and 10Q), use or reproduction before prior approval is prohibited.

Freaquently Asked Questions (FAQs)

What is the most overvalued AI stock?

The overall AI stock has become overvalued seen in the very high market implied growth, because the market overvalues it according to how much its future development is already being reflected in the price of the stock thus high sensitivity, compared to the steadiness of its revenues. All in all, the stocks of AI companies, which have the greatest growth implication suggested by the market and unstable residual earnings, are the most susceptible to the risk of overvaluation since even the slightest slip up in the specified stocks can trigger a fall in price.

Should investors buy AI stocks in 2026?

In 2026, the AI stocks will be an issue of consideration, but only after gaining clear insight into valuation and risk. Most AI stocks are already valued at a substantial pace of innovativeness and, thus, returns will not vanish under the condition that businesses can surpass excessive expectations but it is difficult. It is more appropriate that a selective, long-term, and valuation-based approach be used rather than general or speculative buying.

Usama Ali

Usama Ali is the founder of Financial Beings and a self-taught investor who blends classic valuation study with insights from psychology. Inspired by works from Benjamin Graham, Aswath Damodaran, Stephen Penman, Daniel Kahneman, and Morgan Housel, he shares independent, data-driven research to help readers connect money, mind, and happiness.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.