The Chinese EV stocks to buy are gaining momentum as investors consider the future of mobility. Three names stand out: BYD, Xpeng, and NIO. Each has a different investment thesis – cost dominance, technological innovation, and premium positioning.

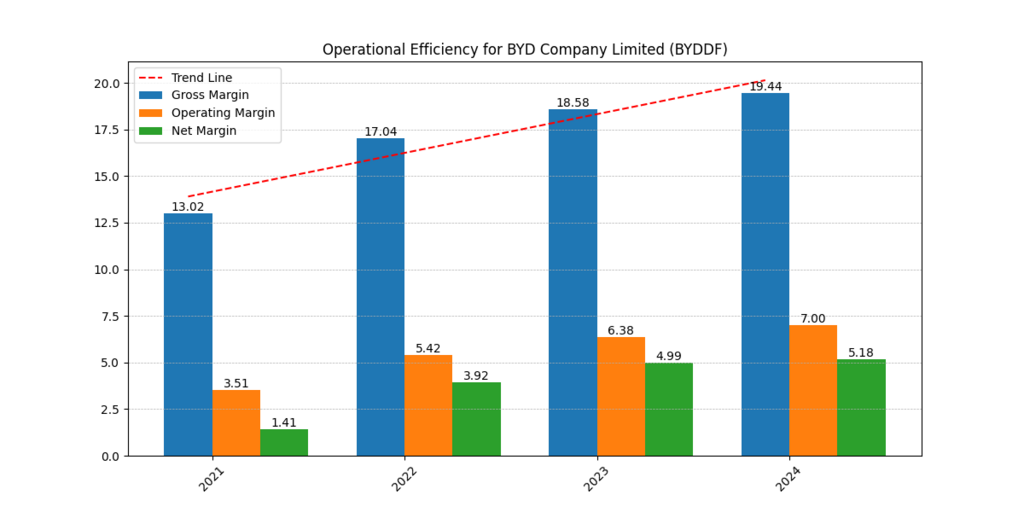

BYD – Championing the EV Price Wars in Europe

Overview: BYD is a worldwide EV giant. In 2024, it sold more than 4.2 million new energy vehicles (NEVs), and it is predicted to sell more than 5.5 million in 2025. It is vertically integrated and manufactures its proprietary Blade batteries and electric motors on its own (Levi, 2025).

The Catalysts: Low-cost Small Electric Vehicles in Europe:

BYD introduced the Dolphin Surf in the UK in June 2025 at a price of 18,650 (~$25,000), matching the Seagull hatchback that started at less than $7,800 in China. This represented an intentional entry into the small EV market in Europe, where BYD pricing has led to what the FT described as a “price-war panic” (Financial Times, 2025a).

This plan is already paying off: the market share of Chinese brands in the UK and the EU increased by 2.9 % to 4.8 % in early 2025. Moreover, in April 2025, BYD passed Tesla in European EV registration to sell 7,231 EVs compared to 7,165 by Tesla (Financial Times, 2025b).

Investor Implications:

Aggressive pricing, scale, and vertical integration of BYD make it one of the best Chinese EV stocks to purchase. By forcing legacy OEMs to embrace more efficient battery technology and reduce prices, its strategy is aiming at (Financial Times, 2025a). But there are still threats – the possibility of EU tariffs and margin squeeze as competition becomes fierce.

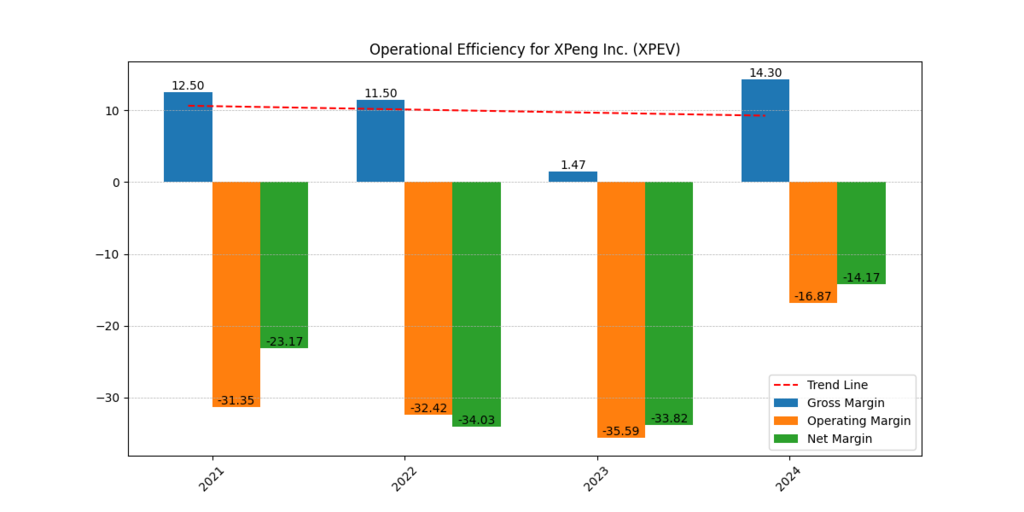

Xpeng – Pioneering AI Chips and EV Innovation

Overview: Founded in 2014, Xpeng sold 190,068 EVs in 2024 and reported net losses of CNY 5.79 billion, reflecting its significant investment in R&D.

Key Catalyst: Turing AI Chip and VW Partnership:

In June 2025, Xpeng announced its own Turing AI processor, with up to 2,200 TOPS—more than twice that of Nvidia Orin X (80-700 TOPS). The chip will be used to power future mid-range EVs of VW in China, a joint venture in which VW has bought a 4.95 \ percent stake, valuing it at approximately $700 million. Work is underway in Hefei and Guangzhou by hundreds of VW engineers.

In this regard, spending RMB 5 billion (~$700 million) annually on AI research and development, Xpeng estimates that it will turn profitable once it sells 1 million chips (Financial Times, 2025c).

Investor Implications:

This is the diversification that causes Xpeng to shine among Chinese EV stocks to buy since it has extended its operations beyond car sales into semiconductors. Its technological strength and outward momentum in revenue can compensate shareholders. There are, however, inherent risks because of chip market cyclicality as well as high R&D costs. A comparison between Tesla and BYD can be found here!

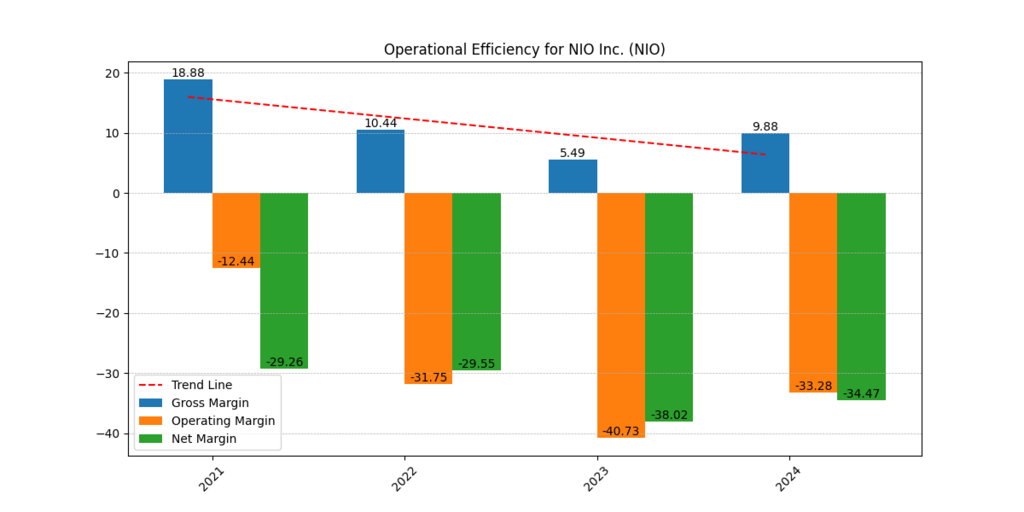

NIO – Premium EV Aspirations & Turnaround Potential

Overview: NIO holds a position in the premium EV market, distinguished by its battery-swapping technology and high-end design. It has introduced several models and it is selling in China and some foreign markets.

Key Catalyst – Growth and Technological Ambitions:

In April 2025, NIO introduced the Firefly subcompact hatchback in China, and it expects to distribute it to more than 16 markets by mid-2025, such as Europe and Latin America. It also launched the ET9, utilizing its proprietary Shenji NX9031 5nm chip, furthering its technology roadmap (Wikipedia, 2025).

Financial Position:

However, Q1 2025 results revealed growing losses, and the management hired capital markets executive Bagrin Angelov to strengthen the funding and speed up financial turnaround (NIO press releases, Jun 2025).

Investor Implications:

NIO is a top-conviction growth stock among the Chinese electric vehicle (EV) stocks to buy, and its upside is related to a successful global expansion, technology uptake, and profitability. Until structural cost reductions and top-line growth become a reality, however, it is a risky idea.

Comparative Summary

| Company | Core Strength | Investor Appeal | Primary Risk |

| BYD | Vertically integrated, low-cost leader | Reliable growth and powerful margins | Margin squeeze, geopolitical/tariff risks |

| Xpeng | Cutting-edge in-house AI chips | Dual revenue streams from EVs and chips | High development costs, chip cycle risk |

| NIO | Premium brand, battery swap innovation | Long-term tech and market upside | Funding dependence, execution uncertainty |

Investment Outlook & Strategy

- BYD provides growth and sustainability, exactly what an investor needs in a reliable Chinese EV stocks to buy. Its European aggressive expansion can result in great topline growth, but with regulatory watch and possible margin forces.

- Xpeng is a unique proposal of EV innovation and profitable semiconductor advantage. It provides diversification and access to premium chip development, which is rare in mass-market EVs.

- NIO is a speculative choice. Should its international expansion plans and technological investments work out, it might provide disproportionate returns. However, execution risks prefer a more modest, smaller allocation.

Final Thoughts

To give examples, investors seeking Chinese EV stocks to buy a well-diversified portfolio in BYD, Xpeng, and NIO may consider:

- Strong scale and cost leadership (BYD)

- Innovation and diversification driven by technology (Xpeng)

- Premium growth potential and execution upside (NIO)

Keep an eye on short-term snapshots:

- BYD’s share of the European market and regulatory actions,

- Xpeng’s chip deployment and integration with VW, and

- NIO’s worldwide product rollout and financial reorganization.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.