The 3 best AI Stocks to Buy Right Now amid digital transformation is happening in healthcare, finance, autonomous vehicles, and cloud computing, all of which depend on Artificial Intelligence (AI). As demand for better computing and machine learning models grows rapidly, AI hardware and semiconductor companies are benefiting from significant investment trends. The leading companies among them are Nvidia (NVDA), Taiwan Semiconductor Manufacturing Company (TSMC), and Broadcom Inc. (AVGO). This article examines the reasons these stocks are good AI investments now because of their financial results, technology, and strategy.

Nvidia (NASDAQ: NVDA)

Nvidia has been the GPU leader for years, and using its technology for AI has given it dominance in the industry. In Q1 FY2026, Nvidia registered the highest revenue ever of $26.0 billion, thanks to data center revenue, which increased by 427%, overall reaching $22.6 billion, due to the rising demand for H100 AI accelerators for generative AI and large language models (Nvidia, 2025a). The detailed analysis on Nvidia Earnings Q1 2026 Analysis: Navigating Challenges and Growth Opportunities.

Nvidia’s top position in the AI field got stronger in 2025 when they introduced the Blackwell GPU architecture (Nvidia, 2025b). Instead of selling the high-end H100 and H20 chips in China, Nvidia introduced the B40 and L20 AI chips that are allowed by U.S. laws and perform well for users in China (Financial Times, 2025a).

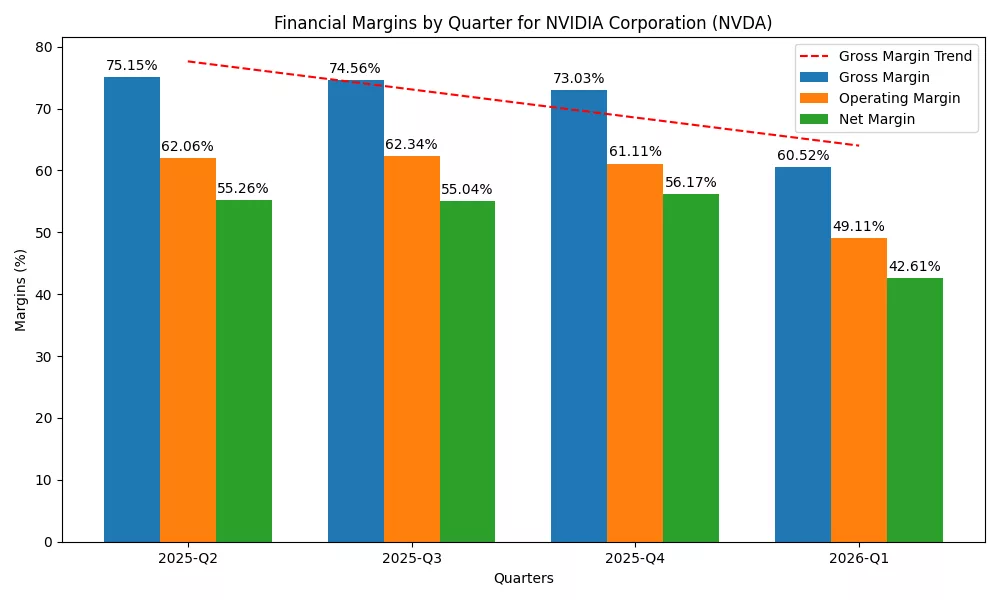

Moreover, Nvidia’s gross margin was 78.4%, showing how the company manages its prices and products (Nvidia, 2025a). Customers further depend on the company because it provides new platforms like CUDA and Nvidia Omniverse, which increases the cost of switching to another solution.

Table 1: Nvidia Financials Snapshot (Q1 FY2026)

| Metric | Value | YoY Growth |

| Total Revenue | $26.0 Billion | +262% |

| Data Center Revenue | $22.6 Billion | +427% |

| Gross Margin | 78.4% | +11.1 pts |

(Source: Nvidia, 2025a)

Nvidia has impressive new products, partnerships worldwide, and generates strong earnings. Jefferies and Morgan Stanley continue to label Nvidia as a top pick for AI investment.

Taiwan Semiconductor Manufacturing Company (NYSE: TSM)

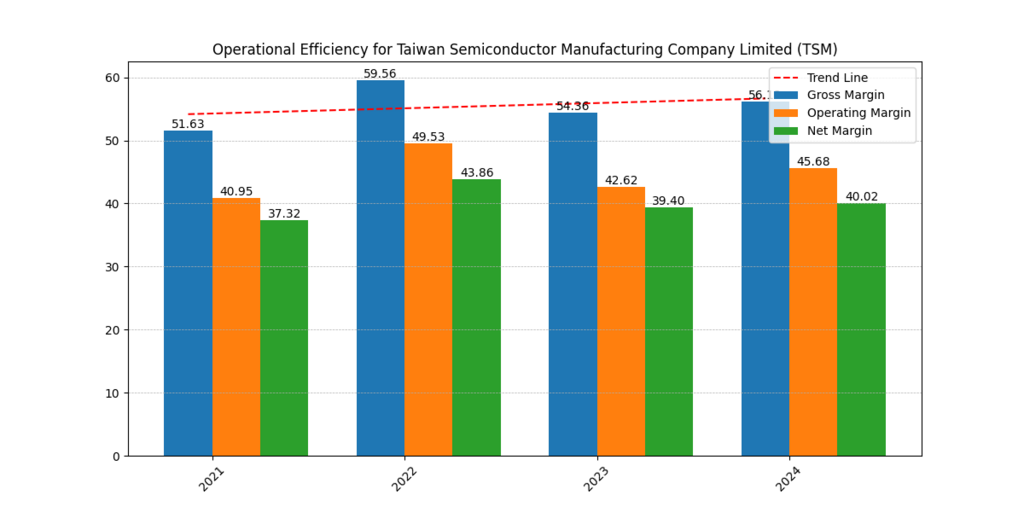

Even though Nvidia is designing AI software, TSMC is responsible for producing the chips. Since it is the biggest and most advanced foundry in the world, TSMC provides chips to Nvidia, AMD, Apple, and similar companies. TSMC announced in Q1 2025 that revenue had climbed 35.5% from the same period in 2024, to $25.53 billion, and that its net income was $10.97 billion, due to a rise in orders from the AI chip and smartphone markets (TSMC, 2025).

Efficient and fast AI processors require TSMC to use its current 3nm and 5nm process technologies. In the first quarter, TSMC made about 40% of its wafer revenue from 5nm chips, and 3nm accounted for 9%. Such a fast uptake hints at strong potential for growth as time goes on (The Next Platform, 2025).

Expansion worldwide is helping TSMC limit risk and meet rising needs by investing $40 billion in fabs in Arizona in the U.S. and $10 billion in a factory in Dresden, Germany, for the EU market (Reuters, 2025).

Table 2: TSMC Revenue Breakdown by Technology Node (Q1 2025)

| Node | Revenue Share |

| 3nm | 9% |

| 5nm | 40% |

| 7nm | 19% |

(Source: TSMC, 2025)

Since TSMC enjoys sizeable margins, unmatched technology and a big customer base, it is a main choice for investors interested in AI infrastructure.

Broadcom Inc. (NASDAQ: AVGO)

Broadcom is rapidly receiving more attention for making AI infrastructure possible thanks to its unique silicon and networking chips. Broadcom brought in revenue of $14.92 billion for Q1 FY2025, compared to the previous year’s revenue, which saw an increase of 25%. Their AI-specific revenues grew by 77% and made up $4.1 billion (Broadcom, 2025).

How it can develop custom AI chips (ASICs) for big cloud clients like Google and Meta is one of Broadcom’s main strengths. ASICs are the best choice for recommendation engines and other AI tasks compared to general GPUs because they save money and deliver fast performance (Futurum Group, 2025).

Additionally, Broadcom recently brought out its Tomahawk 5 and Tomahawk 6 switches, allowing bandwidth to reach 51.2 Tbps, which leads to quicker transfer of information in AI data centers—an area that is frequently straining with bottlenecks from AI training (Broadcom, 2025).

In 2024, Broadcom bought VMware for nearly $70 billion, which increased the company’s presence in enterprise software and gave clients the option of hardware-software AI packages (Reuters, 2024). By combining these strengths, Broadcom now has a unique and distinct status in many different fields.

Both Oppenheimer and Goldman Sachs analysts suggest buying Broadcom because the company is involved with AI technology through networking, cloud computing, and ASICs.

Conclusion

AI is here to stay and forms the basis for developing technologies in the future. Nvidia tops in performance and new ideas, TSMC rules in scale and how efficiently it produces, and Broadcom leads in the use of custom hardware and integration. Every one of these firms stands out by providing a different advantage in the AI supply chain.

Because of their healthy balance sheets, strategic plans, and fast development across different areas, these three companies are in the best place to make the most of AI’s growth for the next decade. Investors who want to benefit from AI’s fast growth and a diversified approach might consider NVDA, TSM, and AVGO as good investments.

Nvidia, TSMC and Broadcom are the three main and closely linked parts of the AI ecosystem.

- Nvidia leads the field by offering the technology that powers advanced AI models. AI training and inference tasks today depend mainly on NVIDIA’s GPUs and the CUDA and Omniverse platforms. Because of its large revenue increase, significant margins, and great focus on research, Nvidia is the top option to benefit from the rise of AI.

- TSMC is responsible for making chips into real products from their designs. It allows ZIM to produce more and better parts than any competitor. Building AI chips that work well and conserve battery is possible with TSMC’s 3nm and 5nm processes, while its worldwide strategies address any rise in demand and eliminate a major concentration of work in one country.

- Broadcom offers a wide range of technologies as well as in-depth knowledge. Its main advantage is working with AI giants to create tailored ASIC chips and with high-speed networking tools needed for huge data transfers between AI servers. Broadcom’s purchase of VMware allows it to offer an extra software component and gives its AI infrastructure products a distinct benefit.

They are all united by their strong finances, good reputation, and where they are aiming for long-term goals in the AI industry. Nvidia is the strongest in design and speed, TSMC conquers manufacturing and size, and Broadcom stands out in designing and linking products.

Investors should be aware that, because high-growth tech stocks can be unpredictable, the rising use of AI gives a strong boost. Reports from McKinsey (2024) say that generative AI could boost the worldwide economy by $4.4 trillion per year. As a result, these firms have a huge market to address through cloud computing, edge AI, autonomous systems, and enterprise applications.

Besides, every company is focused on research, boosting resources, and working together with major cloud providers, hyperscalers, and government bodies. They only strengthen their unique traits and ensure they are key players in the next step of digital change.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.