Introduction

What are the best AI stocks to buy now during the market uncertainty? The companies, GOOGL, MSFT, and Broadcom (AVGO), demonstrate exceptional performance in terms of revenue generation, EBITDA, and free cash flow. These companies have gained popularity as premier investments in AI technology.

Artificial intelligence (AI) has significantly boosted profits and revenues for successful businesses in the technology sector. However, the GPU leadership of Nvidia faces potential threats due to the emergence of Blackwell chips and intensifying competition. Alphabet, Microsoft, and Broadcom are attractive companies for investors to consider during dips in AI stocks. These companies have shown growth in revenue, EBITDA, and free cash flow numbers, making them excellent opportunities for long-term investments in AI.

Alphabet (GOOGL): The Best Value Play in AI

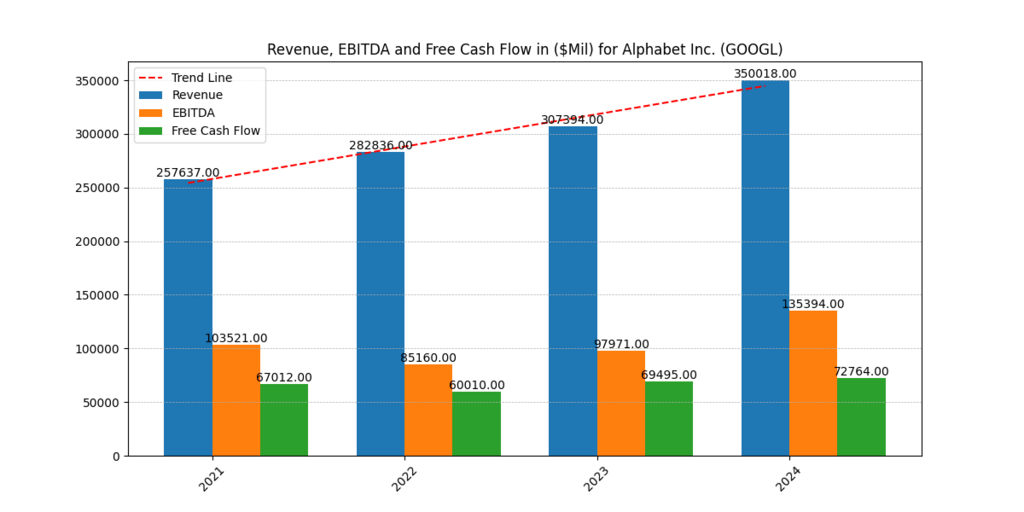

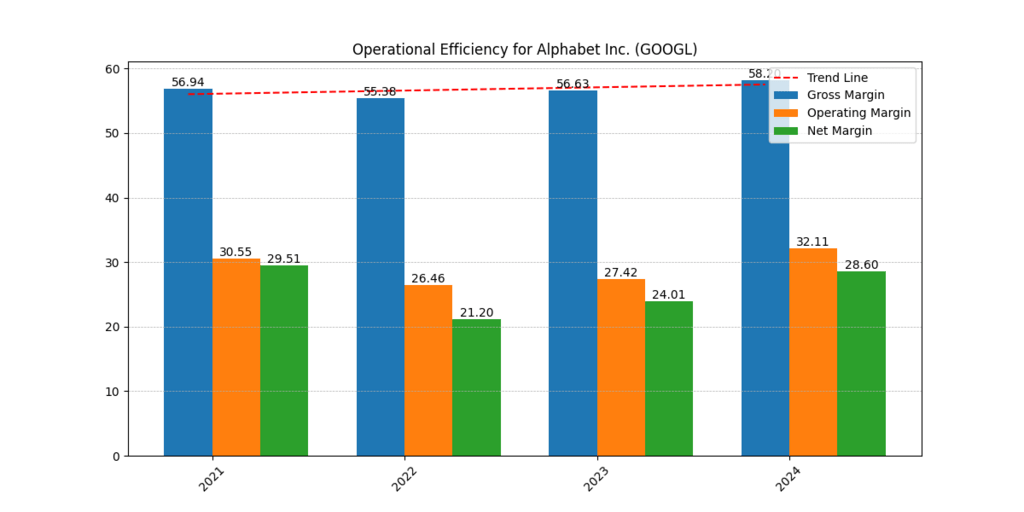

Alphabet (GOOGL) represents the top AI stock for purchase due to its outstanding performance in both artificial intelligence expansion and price-to-valuation ratio within the well-known Magnificent 7. Google utilizes AI throughout its business spectrum by improving Google Search capabilities while expanding cloud services under Google Cloud and Gemini platforms. Financial excellence defines GOOGL despite its substantial AI investments as it anticipates $350B in revenue growth from $257.6B in 2021 and projects $135.4B in EBITDA rebound.

The company maintains strong free cash flow at $72.7B to support its AI innovation program and its operating margins have increased to 32.1% in the most recent financial period. Investors who want AI exposure at an affordable price should analyze GOOGL due to its improved financial position as well as its competitively low market value relative to other companies. Do not miss out on these two best AI stocks with plenty of growth and profits on the line.

Microsoft (MSFT): The AI Powerhouse

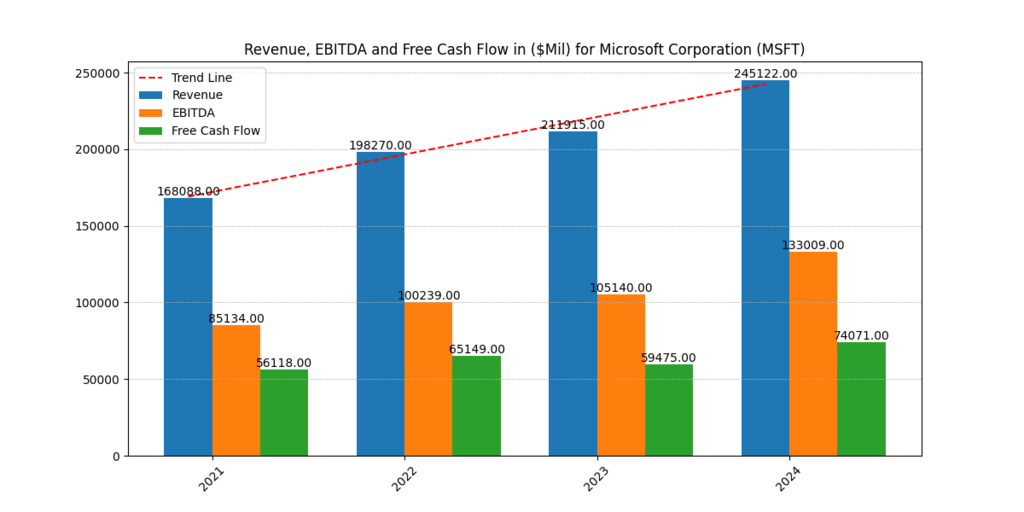

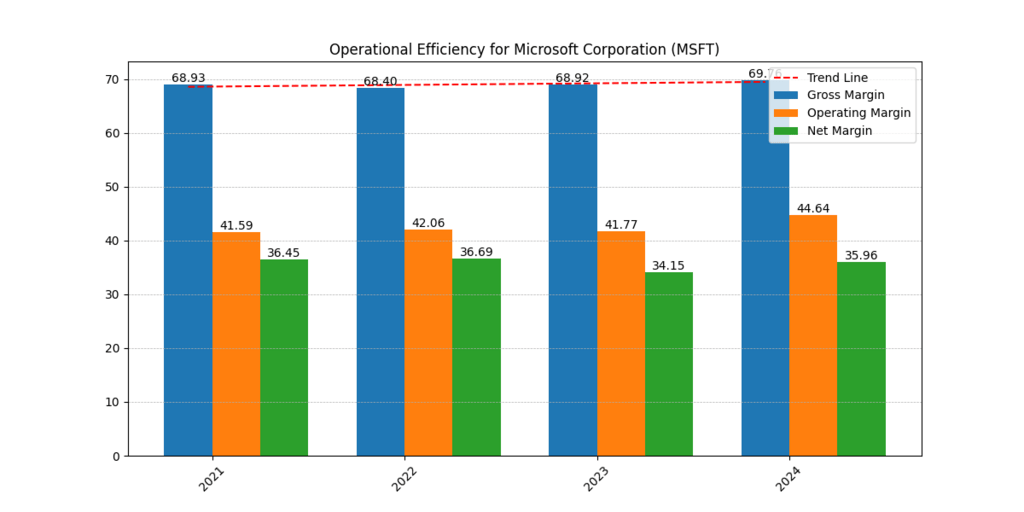

Microsoft (MSFT) represents the dominant force in AI stocks because its early investment in OpenAI has allowed it to embed AI throughout all its operations. Microsoft’s Azure computing power provides AI-based cloud services and Microsoft 365 integrates Copilot features to establish itself as a leader in AI innovation.

The company’s financial projections indicate rising revenue from $168 billion in 2021 to $245.1 billion in 2024 together with expected earnings before interest depreciation and taxes (EBITDA) reaching $133 billion demonstrating outstanding profitability. Microsoft uses its powerful free cash flow generation ability of $74B in 2024 to fund AI investments which solidify its position as a leading competitor. The dominant position in enterprise AI combined with unsurpassed financial strength makes MSFT a premier choice for AI investment since the company maintains high operating and net margins of 44.6% and 35.9% respectively.

Broadcom (AVGO): The AI Infrastructure Play

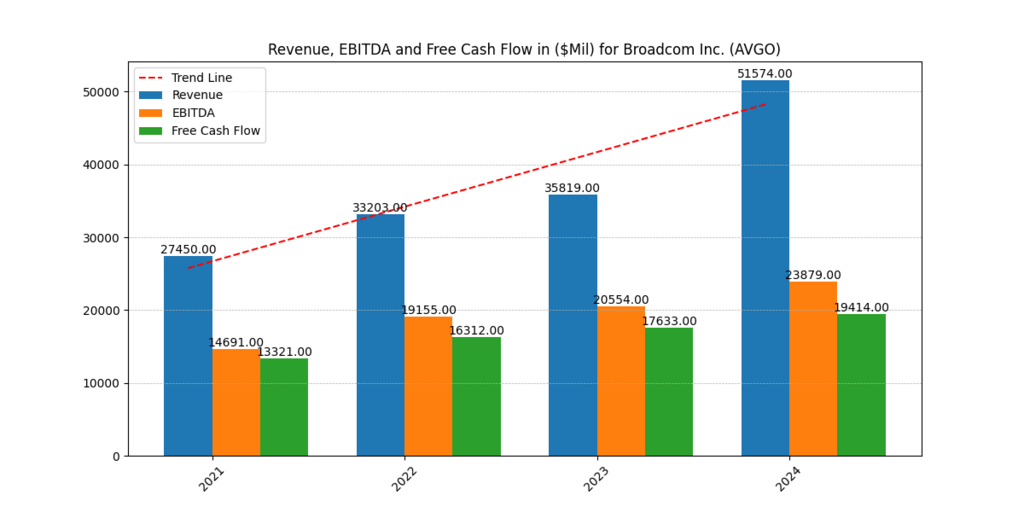

Despite its understated nature, Broadcom (AVGO) delivers a vital function to AI infrastructure through its extensive network capabilities. The recent acquisition of VMware has given Broadcom a stronger position in AI-driven networking and cloud computing to become a fundamental component that enables AI technologies. Financial reports indicate that Broadcom will experience significant expansion as it anticipates reaching $51.5 billion in revenue while EBITDA stands to reach $23.8 billion by 2024.

Through its capability to produce robust free cash flow which should reach $19.4 billion in 2024 the company will sustain funding for its leading semiconductor and networking solutions. The surge in market demand for AI infrastructure keeps Broadcom at the forefront of the AI revolution which provides investors a distinctive way to access the AI market through high-margin mission-critical technologies.

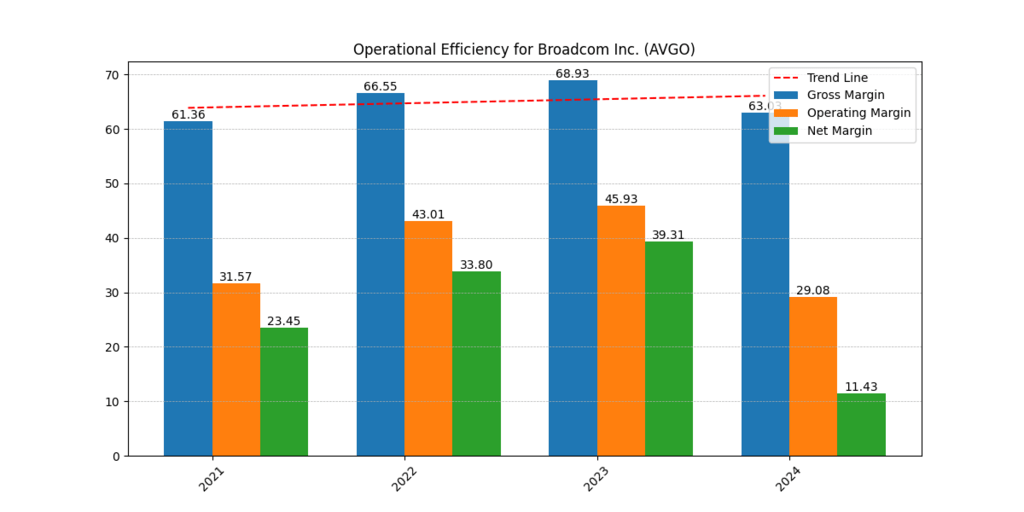

The Blackwell Chips Effect

The deployment of Nvidia’s Blackwell chips creates a substantial profit opportunity for Broadcom because its advanced networking infrastructure serves as the backbone for AI data centers. The increasing complexity of AI workloads drives a strong market demand for ultra-fast networking with low latency where Broadcom’s infrastructure solutions become vital for fulfillment purposes. The recent acquisitions have created margin fluctuations that reduced the net margin to 11.4% in 2024 from the initial 39.3% in 2023 but the business maintains a positive long-term perspective. Broadcom stands to benefit from the accelerated AI-driven data center expansion because it positions the company for leading advantages from upcoming market growth. Therefore Broadcom represents a powerful yet underrated investment choice in AI technology.

Recent AI projects from Alphabet (GOOGL), Microsoft (MSFT), and Broadcom (AVGO)

| Company | Recent AI Project | Description | Impact |

| Alphabet (GOOGL) | Gemini AI Expansion | Google’s multimodal AI model, Gemini, is being integrated across Google Search, YouTube, and Google Cloud. | Enhances search accuracy, AI-generated content, and enterprise AI solutions. |

| Alphabet (GOOGL) | AI in Google Ads | AI-powered ad targeting and performance optimization tools. | Boosts ad revenue and advertiser efficiency. |

| Microsoft (MSFT) | Copilot for Microsoft 365 | AI-powered assistant integrated into Word, Excel, Outlook, and Teams. | Increases productivity and automation for businesses. |

| Microsoft (MSFT) | Azure AI Model Catalog | Offers enterprises pre-trained AI models for integration into their workflows. | Expands cloud-based AI adoption and Azure’s competitive edge. |

| Broadcom (AVGO) | AI-Optimized Networking | Developing next-gen networking chips to handle AI-driven data center workloads. | Supports high-speed AI computing for cloud providers and enterprises. |

| Broadcom (AVGO) | VMware AI Cloud Integration | AI-powered automation for cloud and enterprise networking solutions. | Improves efficiency and scalability in AI-driven infrastructure. |

Conclusion

With strong financials and cutting-edge AI advancements, GOOGL, MSFT, and AVGO are the best AI stocks to buy now, offering investors high-growth opportunities in the AI revolution.

**Please be informed that the content is informational and by no means serve as a buy or sell signal. The company is not responsible for the loss of capital.