Introduction

Five outstanding high dividend stocks options wait to boost your secondary earnings. Understand the main financial performance indicators of Realty Income alongside Chevron and Eversource Energy together with Kraft Heinz and Energy Transfer since these firms present strong dividends and reliable payments.

High dividend yield stocks offer consistent dividend payments, enhancing long-term financial planning and development. Investors seeking financial security should focus on dividend-paying companies like Realty Income, Chevron, Eversource Energy, KHC, and Energy Transfer LP. These companies establish themselves through dependable dividends, creating constant cash flow from dependable earnings throughout their operational existence. These stocks are beneficial for investors seeking to maximize income output and those seeking diversified portfolios to achieve financial objectives. The article highlights several high dividend stock possibilities, including O, CVX, ES, KHC, and ET, which provide a solid foundation for establishing themselves as legitimate businesses.

Realty Income Corporation (O)

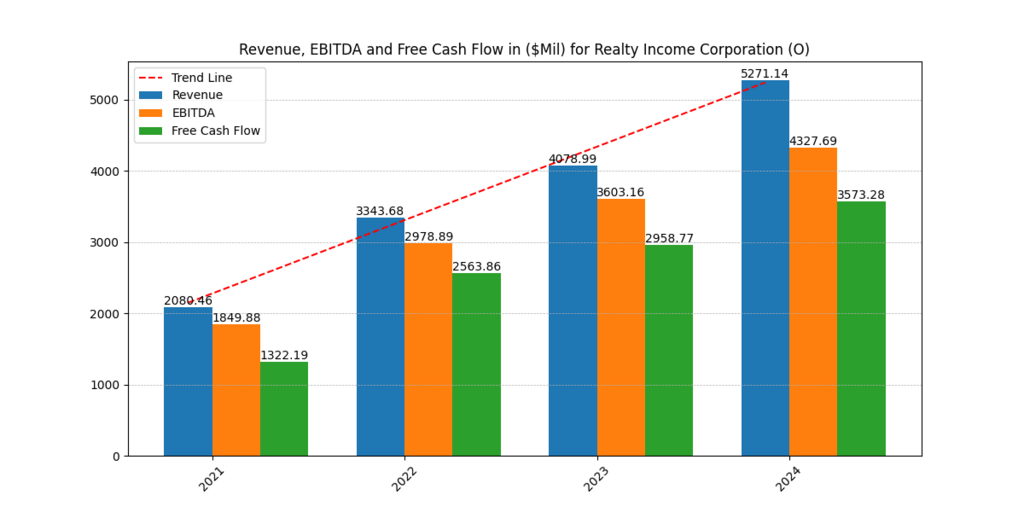

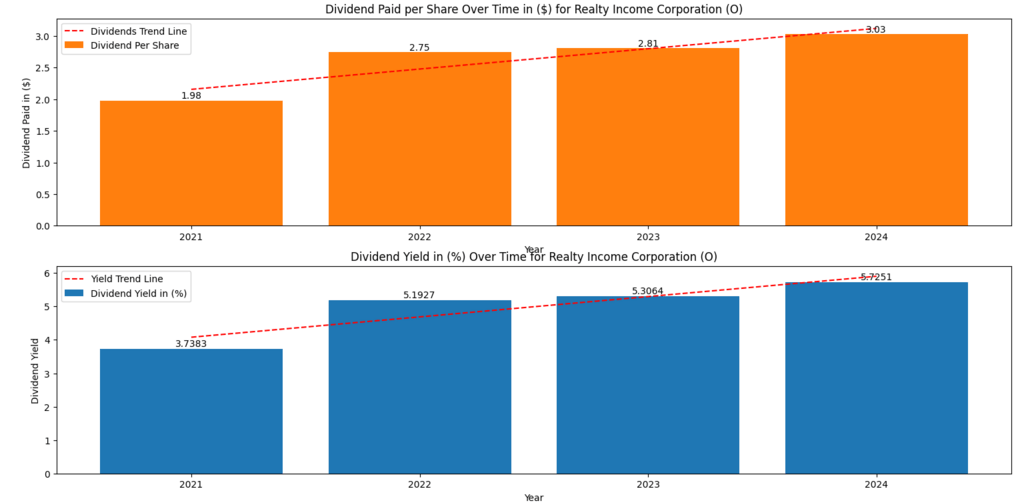

Realty Income operates as a real estate investment trust (REIT) that distributes investor dividends through monthly payments to shareholders. Realty Income experienced consistent revenue expansion from 2021 through 2024 resulting in $2.08 billion to $5.27 billion in annual income according to its demonstrated growth plan. During this period the company improved its profitability by creating an EBITDA increase from $1.85 billion to $4.33 billion. Realty Income generates $3.57 billion in positive free cash flow during 2024 demonstrating high financial capacity to sustain its dividend payments. The dividend yield of Realty Income has expanded from 3.73% in 2021 to 5.72% in 2024 which gives income investors an enticing opportunity.

Realty Income achieves revenue stability through its business model design of leasing generation properties to high-standards tenants over extended durations. The company’s financial strength is demonstrated through its steady upward trend in dividend per share amounts from $1.98 in 2021 ending at $3.03 by 2024. Realty Income maintains its position as an amazing opportunity for cash flow-oriented investors based on its strong cash generation capabilities and expansion potential.

Chevron Corporation (CVX)

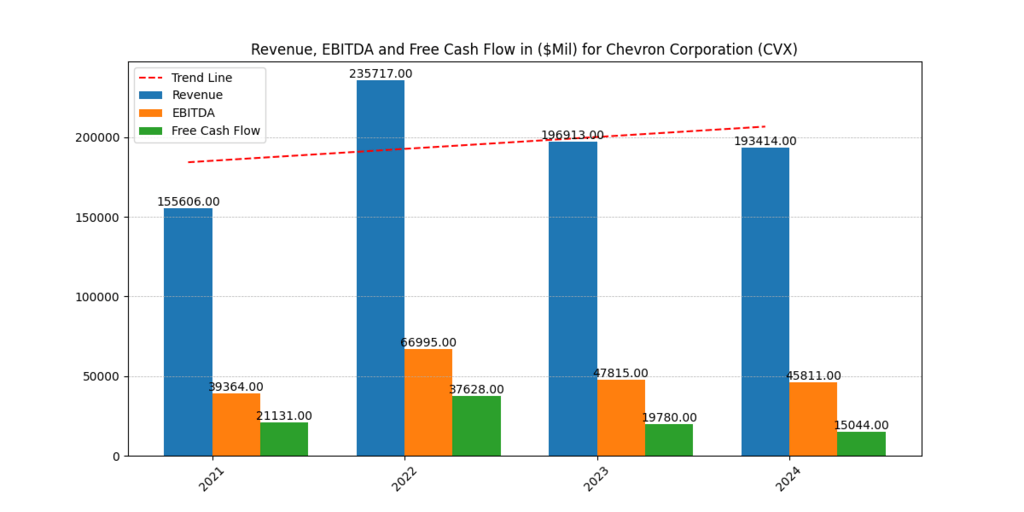

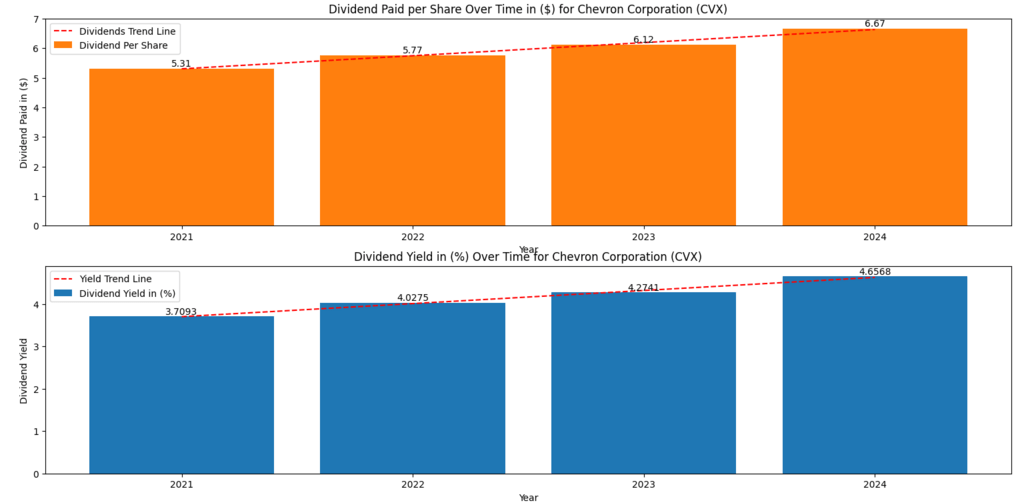

Chevron operates as a worldwide energy company, which maintains a substantial track record of increasing dividend payments. The company’s earnings levels show peaks of $235.72 billion in 2022 followed by a stable $193.41 billion in 2024 due to changes in oil market prices. EBITDA performance has been stable even though it experienced a slight decrease from $66.99 billion in 2022 to $45.81 billion in 2024. Despite FCF dropping from $37.63 billion in 2022 to $15.04 billion in 2024, the financial stability of the company remains strong. Read our list of Best Dividend Stocks Under $50 for 2025.

Chevron demonstrates consistent growth of its dividend payments as the company raised its per-share payment from $5.31 in 2021 to $6.67 in 2024. Throughout this period, the company elevated its dividend yield from 3.7% to 4.65%. Strong operational efficiency combined with global energy market demand allows the company to continue paying steady dividends. Investors who need dependable returns in the energy sector should consider Chevron as their high dividend stock choice.

Eversource Energy (ES)

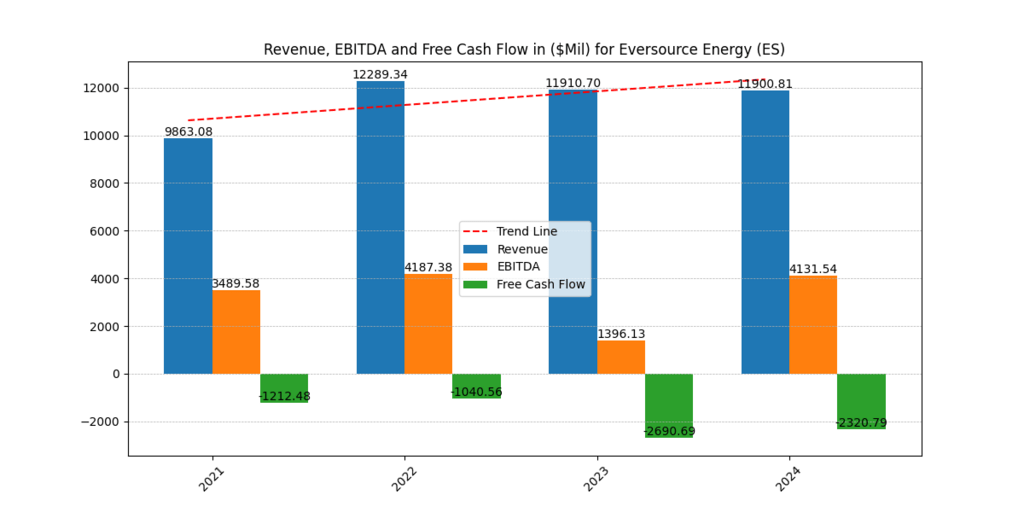

Eversource Energy operates as a regulated utility business that generates steady cash flows and maintains a long-standing track record of dividend payments. EBITDA reached $4.31 billion during 2024 while the firm’s revenue expanded from $9.86 billion in 2021 to $11.90 billion in 2024 indicating sustainable profitability. The company reports negative cash flow of -$2.32 billion in 2024 because of high infrastructure capital expenditures.

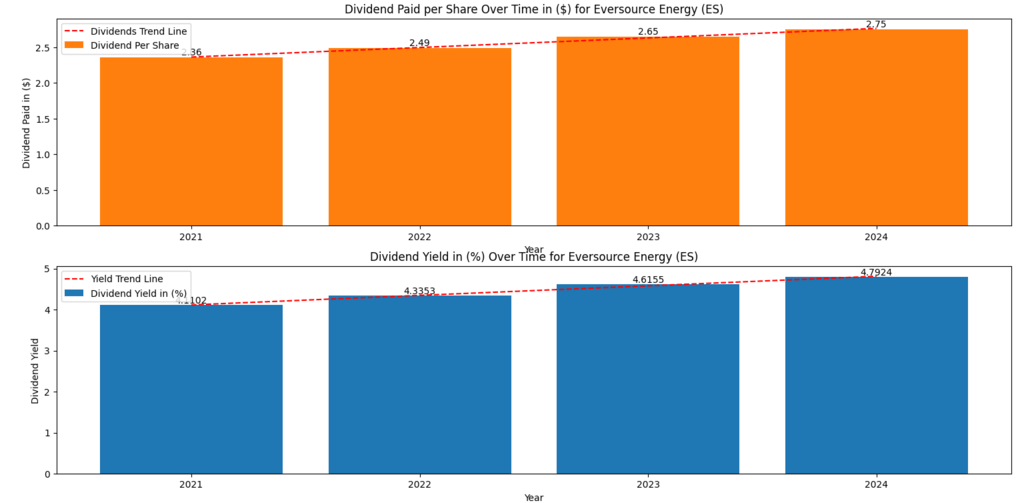

Eversource has demonstrated consistent dividend growth since 2021 when it paid $2.36 per share up to the projected amount of $2.75 per share for 2024. Investors targeting dividend income will find this stock attractive because its yield has risen from 4.1% to 4.79%. The regulated revenue model, which the company operates provides ongoing stability through economic fluctuations. Although negative free cash flow creates uncertainties Eversource continues generating dependable earnings that sustain its dividend payments. Investors who want defensive stocks with stable income should consider Eversource due to its strengths.

The Kraft Heinz Company (KHC)

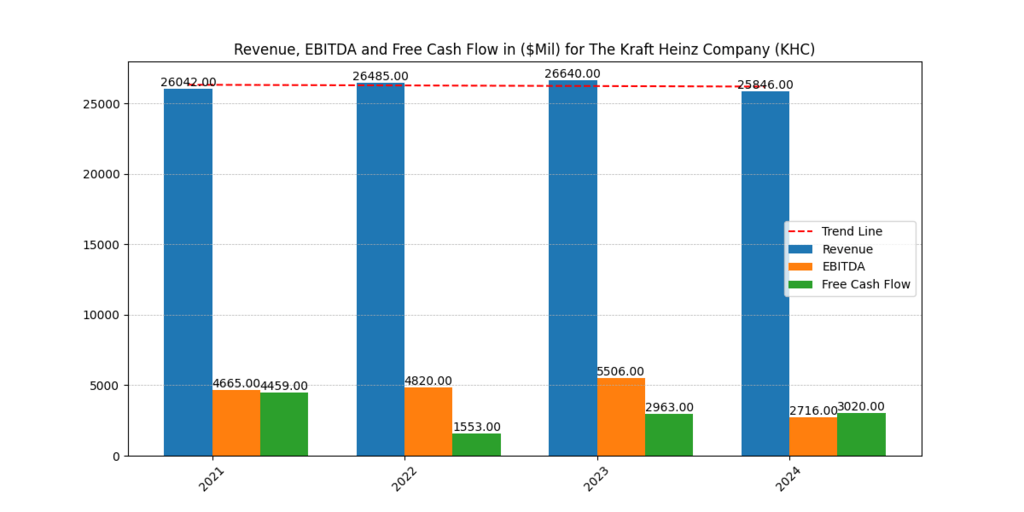

The consumer staples company Kraft Heinz maintains dependable dividends for its shareholders. Over the years Kraft Heinz has maintained consistent revenue levels that average at $26 billion per year. EBITDA experienced a significant decrease between 2023 and 2024 as margins released pressure leading to a fall from $5.5 billion to $2.7 billion. Free cash flow shows a minor increase to $3.02 billion during 2024 which provides adequate funds for dividend payments.

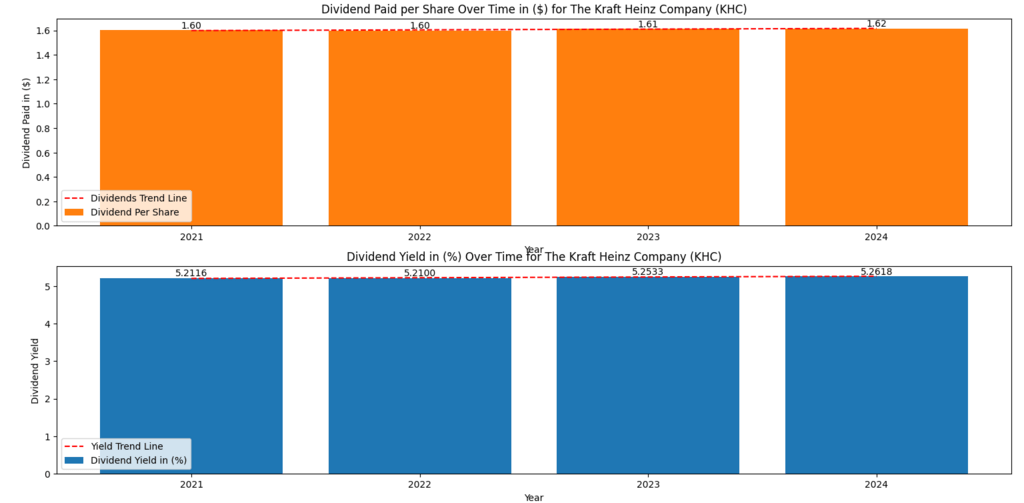

Kraft Heinz preserves its consistent dividend policy which experienced a minimal incremental increase from $1.60 per share in 2021 till $1.62 per share in 2024. The dividend yield of this stock maintains a consistent level of 5.2% which positions it among the highest yielding stocks within its consumer sector. Kraft Heinz offers stable demands for its products while maintaining a powerful brand collection which strengthens its dividend ability. EBITDA reduction prompts the company to explore cost management strategies for sustainable future profitability. Kraft Heinz functions as a valuable dividend stock in the consumer space that provides dependable high returns to investors.

Energy Transfer LP (ET)

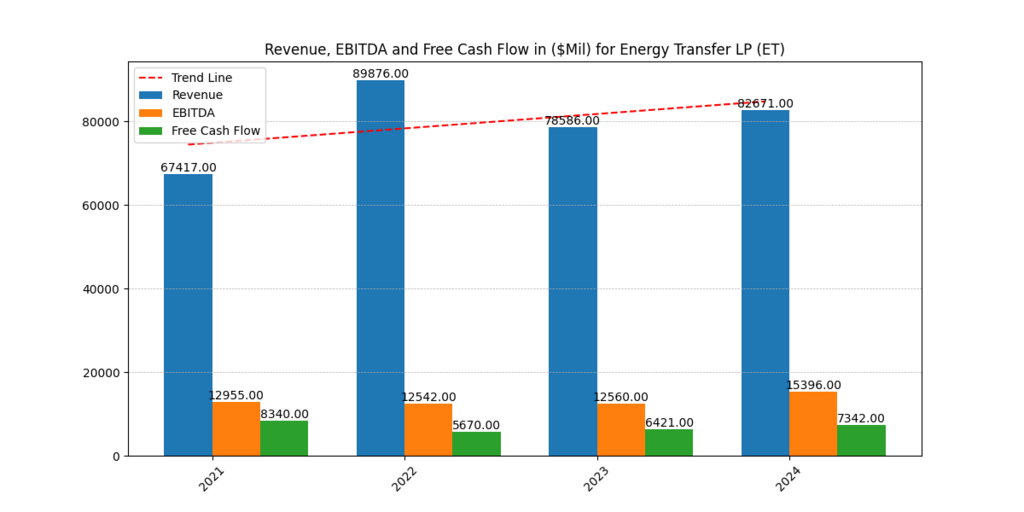

The midstream energy company Energy Transfer LP has maintained a firm track record of dividend payments throughout its history. The company achieved its highest revenue of $89.88 billion in 2022 before its revenue decreased to $62.67 billion in 2024 because of changing energy prices. However, EBITDA grew to $15.39 billion in 2024 as the company achieved operational benefits. Free cash flow increased significantly to $7.34 billion which guarantees that the company will continue paying dividends.

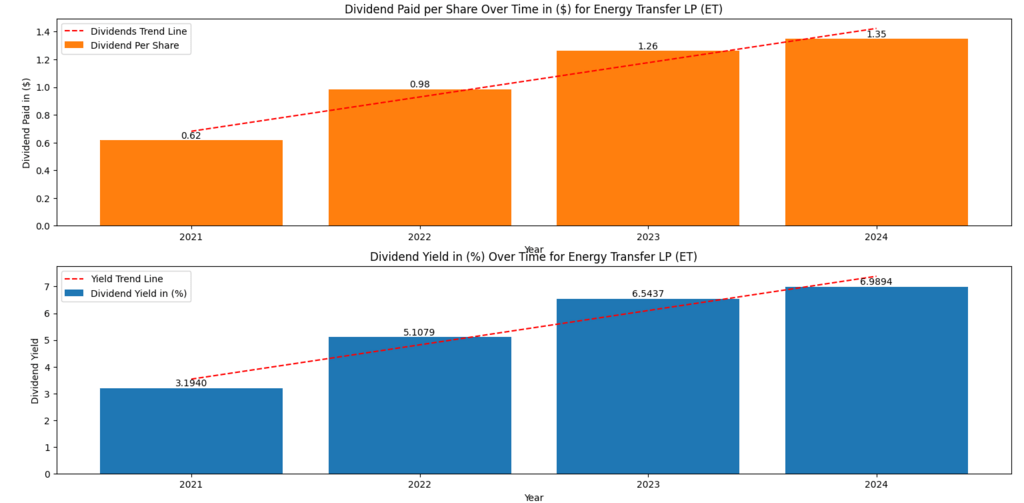

Energy Transfer witnessed a substantial increase of its dividend per share from $0.62 in 2021 to $1.35 in 2024 while its dividend yield rose from 3.19% to 6.9%. The energy segment generates this stock one of its highest dividend yields available today. Stable cash-flows and extended contracts at Energy Transfer minimize the business risks stemming from market fluctuations. Energy Transfer presents a superior investment choice to dividend-focused investors because of its robust finances coupled with elevated dividend yield.

Recent Projects of the Top 5 Stocks

| Company | Recent Project | Additional Details | Impact on Finances |

| Realty Income (O) | Acquisition of Spirit Realty Capital | Expanded portfolio by acquiring 2,000+ retail properties. | Increased rental income and portfolio diversification. |

| Chevron (CVX) | Gorgon Gas Expansion Project | Invested in LNG production to meet growing energy demand. | Boosted long-term revenue from LNG sales. |

| Eversource (ES) | Offshore Wind Partnership with Ørsted | Developing a 1,200 MW offshore wind farm for clean energy. | Higher capital expenditures but long-term stable cash flow. |

| Kraft Heinz (KHC) | Plant-Based Product Expansion | Launched plant-based cheese and mayo to meet demand. | Revenue diversification and potential market growth. |

| Energy Transfer (ET) | Lake Charles LNG Export Terminal | Expanding LNG infrastructure to boost global exports. | Increased cash flow from higher LNG export capacity. |

Conclusion

High dividend stocks such as Realty Income, Chevron, Eversource, Kraft Heinz, and Energy Transfer empower investors to receive regular income revenue along with fiscal security in the long run. Every strategic project undertaken by a company leads to revenue increases while improving cash performance and creating diverse business portfolios. Investors can enhance their side income stream while their stocks appreciate in value through investing in dividend-paying stocks with robust financial records.

**Please be informed that the content is informational and by no means serve as a buy or sell signal. The company is not responsible for the loss of capital.