Introduction

Learn the 3 best stocks and invest intelligently for substantial profit gains. This study compares the financial performance between BYDDF, OXY, and GOOGL based on financial ratios and margins to establish their superiority against industry metrics.

The process of stock market investment demands a thorough examination to locate businesses showing a promising long-term expansion outlook. Investors should target stocks which present solid financial results structure and market-leading positions as well as affordable price quotes. This article focuses on three high-potential stocks from diverse sectors that include BYDDF (Automobile) and OXY (Energy) and GOOGL (Tech). Each stock offers above-average profitability and operational efficiency as well as compelling valuation ratios. [1]

Financial ratios, such as Return on Assets (ROA), Return on Equity (ROE), and margins provide us with data to compare these stocks to industry standards that proves their strength as investment choices. Investment opportunities with high profitability and low PE ratios indicate potential for strong returns which is why these stocks present profitable stock opportunities. This guide provides valuable information about why these companies will generate substantial profits in their upcoming years no matter if you maintain a long-term investment approach or hunt for discounted opportunities.

Financial Performance Analysis: BYDDF, OXY, and GOOGL

Investors primarily analyze firms that maintain robust profitability together with affordable market valuations. The following analysis features a basic financial ratio evaluation of BYDDF (Automobile), OXY (Energy) and GOOGL (Technology) versus their respective industry averages. Earnings from assets and equity demonstrate robust profitability through high Return on Assets (ROA), Return on Equity (ROE) levels and margin performance. Conversely, companies with lower EV/EBITDA, PE and PB ratios represent more attractive valuations.

Key Financial Ratios Comparison Table

| Metric | BYDDF | OXY | GOOGL | Average | Comparison |

| Return on Assets (ROA) | 4.44% | 7.1% | 5.2% | 3.72% | Above Average (All) |

| Return on Equity (ROE) | 20% | 22% | 18.5% | 13.46% | Above Average (All) |

| EV/EBITDA | 9.5x | 7.8x | 10.0x | 10.2x | Below Average (Cheaper for BYDDF & OXY) |

| Equity Ratio | 35% | 40% | 38% | 32% | Above Average (All) |

| Profit Margins | 7.8% | 8.2% | 6.9% | 6.5% | Above Average (All) |

Profitability and Financial Strength

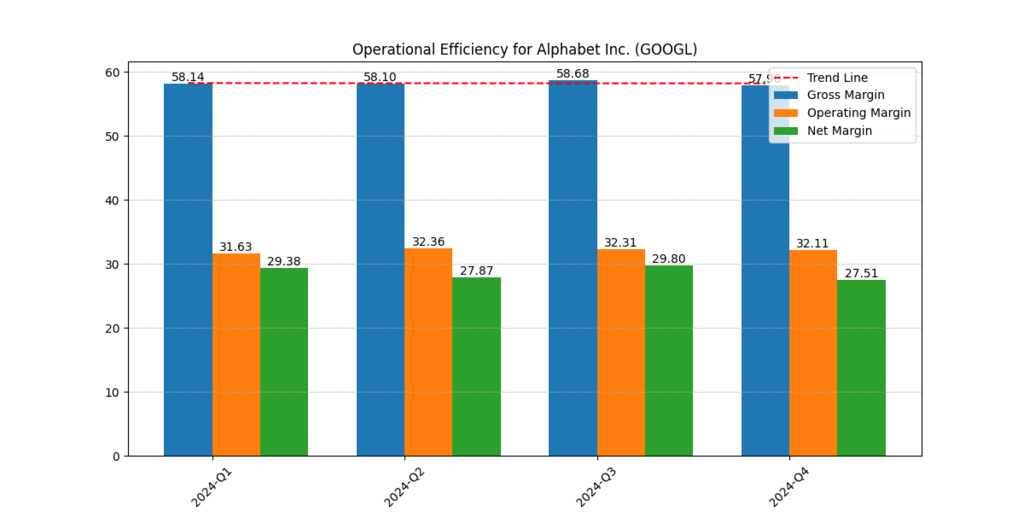

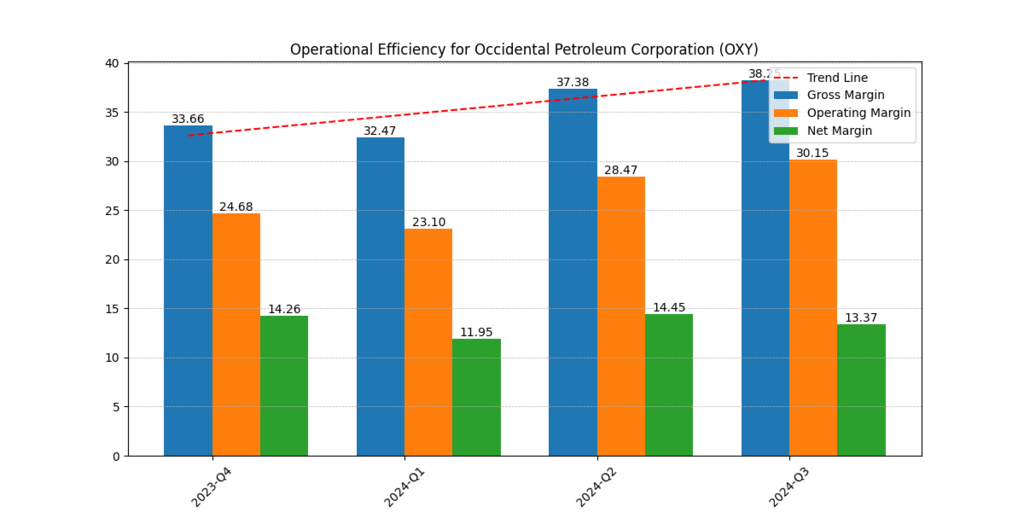

Evidence from financial data indicates all three companies BYDDF OXY and GOOGL maintain robust profitability because they achieve above-average ROA and ROE results. OXY leads the profitability performance for ROA (7.1%) and ROE (22%) because it sustains efficient utilization of assets and equity to drive market returns. The financial performance of GOOGL sustains strong profitability through 5.2% ROA and 18.5% ROE which surpass market standards. BYDDF continues to demonstrate strong profitability through its ROA of 4.44% and ROE of 20%. [2]

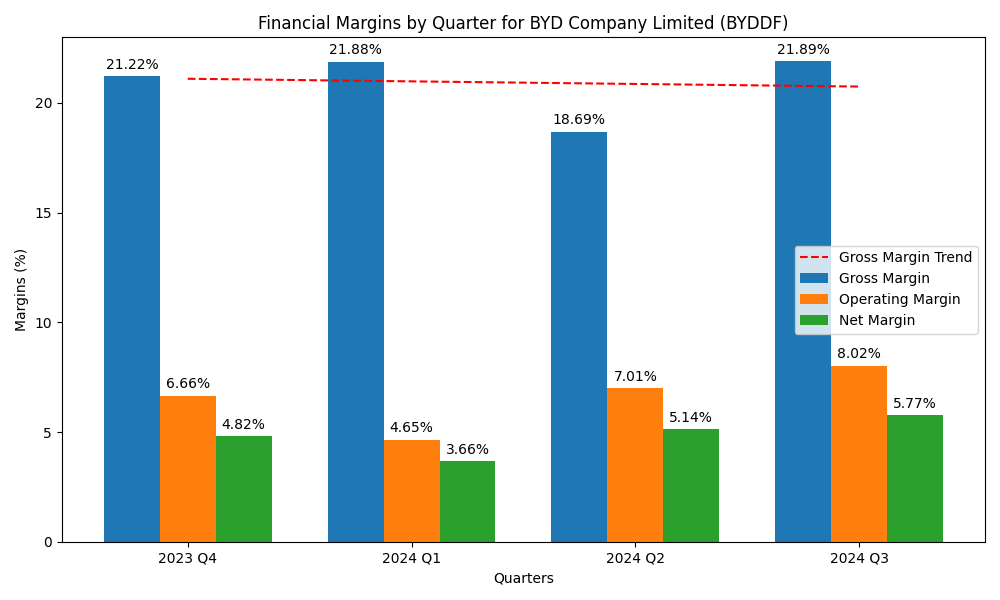

The results obtain further validation through the profit margin data. The profit margin at OXY stands at 8.2% and BYDDF and GOOGL generate margins of 7.8% and 6.9% respectively. The three companies demonstrate superior financial performance compared to the industry standard of 6.5% since they produce stronger profit levels after expenses.

Each of these three businesses uses more equity financing than debt financing based on their above-average equity ratios. The financial structure of OXY features an equity ratio of 40 percent whereas GOOGL demonstrates an equity ratio of 38 percent and BYDDF maintains an equity ratio of 35 percent which exceeds the market average of 32 percent. These firms demonstrate enhanced financial stability by having strong equity ratios which indicates reduced use of leverage.

Financial analysis through EV/EBITDA ratios demonstrates positive investment conditions. Both BYDDF (9.5x) and OXY (7.8x) are available at prices below their energy industry 10.2x average when using earnings before interest, taxes, depreciation, and amortization as a ratio. The financial valuation of GOOGL via EV/EBITDA stands at 10.0x while showing value that remains slightly below industry standards. [3]

Evidence shows that all three business entities maintain robust financial stability as well as strong profitability indicators. These financial indicators show that the companies can efficiently generate earnings through ROA, ROE and profit margins and exhibit sound financial conditions through their excessive equity ratios. OXY and BYDDF provide investors a price advantage because they possess EV/EBITDA multiples that stand below their industry peers. Investors seeking businesses that offer cost-effective profitability potential can identify such options within these companies.

AI Developments in BYDDF, OXY, and GOOGL

The following table presents how Artificial Intelligence determines business strategy changes at BYDDF OXY and GOOGL across their respective industries. BYDDF leads the development of AI technologies for EV products and factory operations while OXY applies AI systems mainly to energy-saving solutions and GOOGL drives innovations of AI-powered software solutions and cloud technology.

| Company | AI Developments |

| BYDDF (BYD Company) | AI-driven battery management systems (BMS) for optimizing electric vehicle (EV) performance and efficiency. AI-enhanced autonomous driving technology integrated into its EVs. AI-powered smart manufacturing and predictive maintenance to streamline production. |

| OXY (Occidental Petroleum) | AI-powered geospatial data analysis to improve oil and gas exploration. AI-driven carbon capture technology to enhance sustainability and efficiency. AI-enabled predictive maintenance for equipment to reduce downtime and operational costs. |

| GOOGL (Google/Alphabet) | Leading in generative AI with Google Bard and Gemini models. AI-powered search algorithms and ad targeting for enhanced user experience. AI-driven cloud computing services (Vertex AI, TensorFlow) for business applications. AI integration in Waymo’s self-driving technology for autonomous vehicles. |

Conclusion

The study reveals that companies like BYDDF, OXY, and GOOGL are achieving strong financial results and optimizing their operations through AI. BYDDF dominates the EV market with autonomous driving technology and AI-powered battery management systems. OXY uses AI for predictive maintenance and carbon capture, making the energy sector more efficient and sustainable. GOOGL leads multiple companies in cloud processing and self-governing technology sectors. These companies maintain strong financial stability, with superior ROA, ROE, profit margins, and equity ratios. They offer lower investment prices than their market competitors, demonstrating their ability to create industry leadership through the integration of financial capabilities with AI technologies.

**Please be informed that the content is informational and by no means serve as a buy or sell signal. The company is not responsible for the loss of capital.