Will Tesla Stock Continue to drop? Tesla, Inc. (TSLA), which was a disruptive innovation golden boy, is currently at a crucial financial crossroads. The recent quarterly figures reveal an intensification of pressure, an increase in global competition, declining European sales, and subpar delivery levels. The article will provide an in-depth analysis of Tesla’s financial performance, stock price, and estimated returns to answer this question.

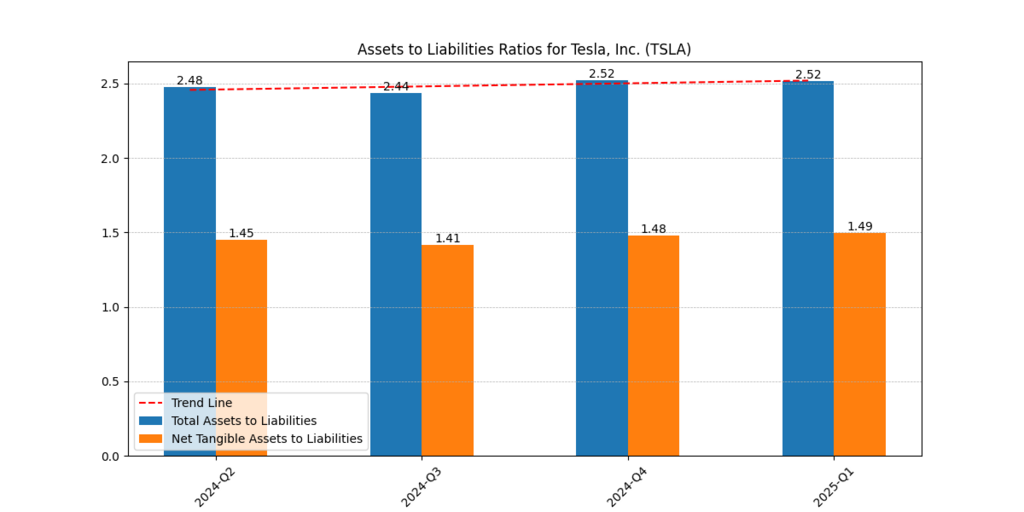

Stability or Cracks? Tesla’s Assets to Liabilities

Tesla has consistently maintained a favorable total asset-to-liability ratio, with an average of 2.5 over the past four quarters, indicating a highly capitalized balance sheet. However, closer inspection reveals stagnation: the net tangible assets to liabilities ratio, a more conservative measure, changed from Q2 2024 to Q1 2025 by just a few points, to 1.49 net tangible assets to liabilities.

This indicates that Tesla is not significantly strengthening its solvency or tangible footing, despite having decent liquidity, which is a red flag as the macroeconomic situation becomes more turbulent. Read our Best EV Stocks Comparison: BYD vs TESLA in 2025.

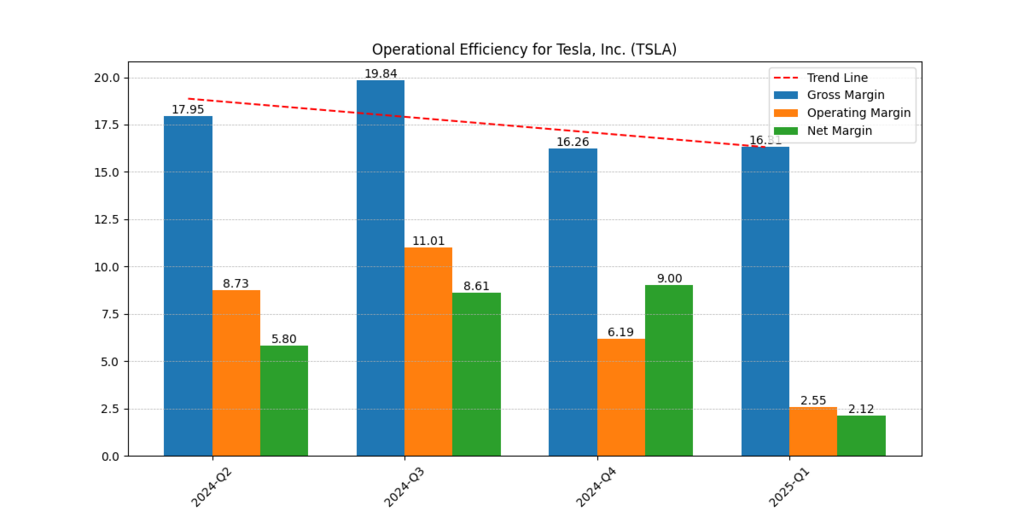

Margins Under Pressure: Declining Operational Efficiency

Here, a significant trend is observed. The gross margin declined to 16.31% in Q1 2025, compared to 19.84% in Q3 2024. What is even more concerning is the operating margin, which dropped by 11.01% over the same timeframe to 2.55%, a challenging position to be in, but one that should help them better face the challenges ahead. The net margin turned negative at -2.12%, a concerning indication for a company once touted as efficient.

Such a sharp decline in margins is indicative of weak cost control at best and of demand weakness at worst, or both. As the Financial Times reported, Tesla’s sales in Europe declined for the fifth consecutive month, providing competitors with an opportunity to accelerate their global expansion, according to rivals such as BYD (FT, 2025).

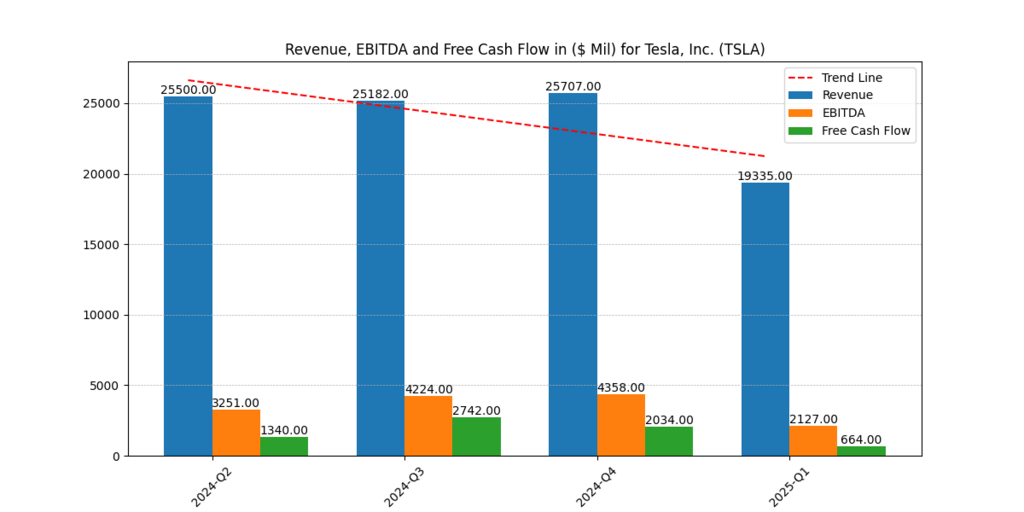

Revenue vs. Cash: Slowing Growth, Vanishing Free Cash Flow

Although Tesla showed mainly positive revenues in the fourth quarter of 2024 ($25.7B), there is a sharp decrease in the first quarter of 2025 to only $19.3B. Free cash flow has followed this decline strongly, from -$2.7B in Q3 2024 to $664M in Q1 2025.

The trend line has shown that, although revenue decline is expected in cyclical industries, Tesla is experiencing an abnormally quick slowdown. This loss of free cash flow raises questions about its ability to sustain growth plans or finance changes from its resources.

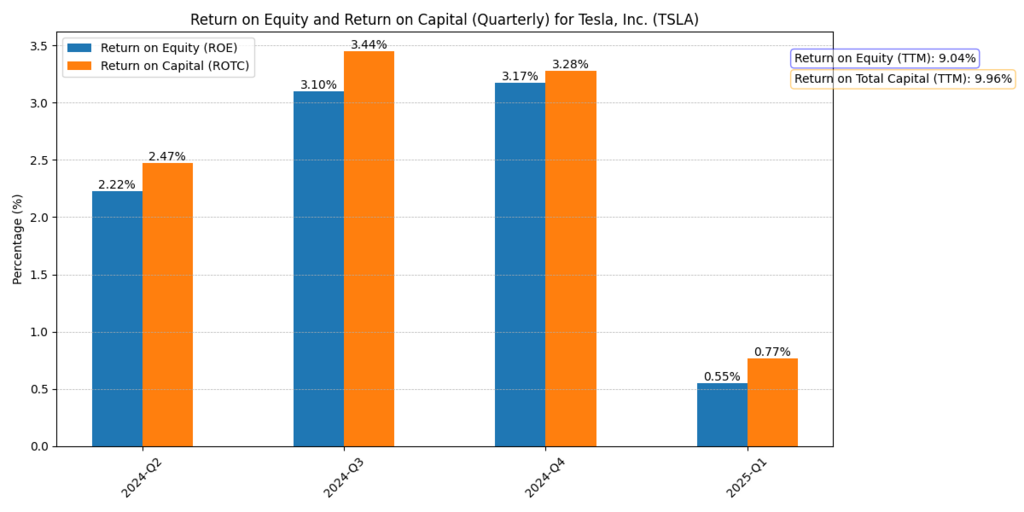

Return Metrics: Falling ROE Amid Valuation Concerns

The Return on Equity (ROE) of Tesla also decreased, dropping to 0.55% in Q1 2025, compared to 3.17% in Q4 2024. Nonetheless, analysts estimate the ROE recovery: 8.26% in 2025 and 15.99% in 2026, based on estimated EPS and the long-term average book value of admission.

However, the problem is that Tesla’s predicted earnings (after cost of capital) in 2025 are $ -1.45, and only $0.24 in 2026. This is perhaps a positive move, but the levels are not sufficient to support current valuations. Essentially, Tesla is not meeting its cost of capital, which is a sign of value destruction rather than value creation in 2025.

Unlevered Valuation and Growth Expectations: Signs of Overvaluation

The unlevered P/E ratio and P/B ratio of Tesla are also very high, even with fully diluted shares, which means that the company is being valued relatively highly based on optimistic growth forecasts – expectations that have not been borne out in recent history.

According to our internal growth model:

- Market Growth Rate expectation: 10%.

- Predicted Price per share for unlevered growth rate: $121

- Present price: $316

With a weak underlying picture, Tesla already trades above it’s predicted growth price at a 10% hurdle rate, which is a powerful indication that the stock is overvalued (unless it can one day significantly surpass contemporary expectations).

External Pressures Mounting: BYD and Delivery Drop

The recent FT report shows that BYD is not only beating Tesla in the innovative delivery race in China, but Tesla is also losing its delivery momentum. As the most recent million-claim SEC 8-K filing (Tesla, 2025) stated, a notable decline in deliveries was identified, which is why overall bearish sentiment prevailed.

These macro-forces may hasten margin contraction, restrict specific pricing capabilities, and ultimately erode Tesla’s competitive moat.

So, Will Tesla Stock Continue to Drop?

Given:

- Free cash flow and squeezed margins

- Small net incomes after deductions of capital costs

- Excessively high valuation multiples

- Decline in deliveries and confrontational competition

- ROE estimated by the analysts recovers marginally

The answer is yes, unless Tesla takes radical steps in terms of cost efficiency or introduces game-changing technology, further discussion is needed regarding whether Tesla stock will continue to drop.

Stocks are at valuations that ought to be regarded with skepticism, particularly in a market that is becoming increasingly influenced by value rather than hype. Unless there is a high margin or an innovation rebound, the risks outweigh the benefits.

Final Insight:

Tesla is a gamble. And unless the values realign with the fundamentals, the negative spell could continue or quicken.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.