Introduction

Stocks can be categorized in different sectors as well as in different cap sizes. Growth stocks, penny stocks, value stocks, dividend stocks etc. When we talk about dividend stocks, it is not just about dividend yield rather the stability of the company to consistently pay those dividends without compromising the balance sheet quality. Today, the focus of this article will be on dividend stocks. What are dividend stocks and how different metrics can be used to find and understand healthy dividend stocks.

Focus Points

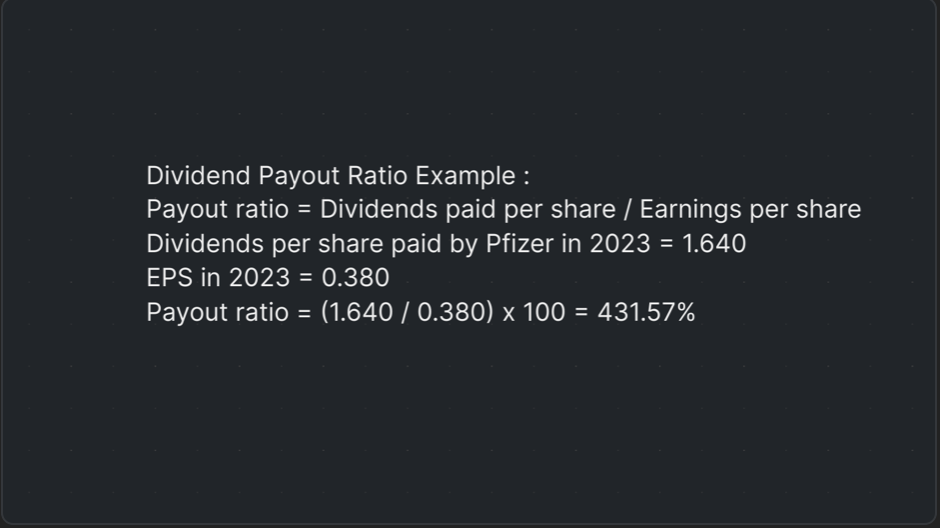

- Dividend Payout Ratio: This crucial metric evaluates dividend sustainability by comparing dividends paid to earnings. For instance, Pfizer’s 2023 payout ratio was an unsustainable 431.57%, highlighting the importance of assessing long-term averages.

- Dividend Consistency: Companies with a 20+ year track record of regular dividends, as advocated by Benjamin Graham, are preferred by defensive investors. This historical consistency indicates resilience through economic crises.

- Economic Moat: Warren Buffet’s concept emphasizes a company’s competitive advantage. Questions about product innovation and market dominance help identify firms capable of enduring economic fluctuations for the next decade.

- Cash Flow Health: Warren Buffet emphasizes Free Cash Flow (FCF) as an indicator of financial stability. Positive FCF after operational expenses suggests a company’s robustness, urging investors to review 5-8 years of median FCF for accuracy

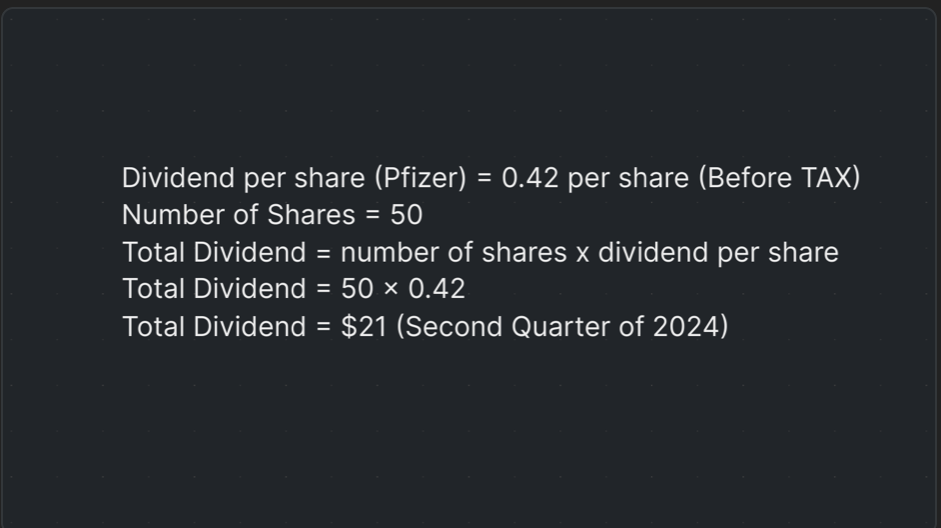

- Dividend Disbursements: Companies pay dividends to reward investors, often quarterly or yearly. For example, Pfizer’s $0.42 per share dividend demonstrates how investors can earn income proportional to their shareholding.

Best Dividend Stocks: What are they?

Companies usually pay their investors a portion of their earnings back in order to make the investors feel valuable. The dividends are is a form of payment that can be paid monthly (not often), quarterly and yearly. After doing the business, usually stable companies take a portion of their profits and distribute it between all the investors of the company. Investors preferring income from the stocks buy dividend stocks and use those payments as per their needs. The amount of the dividend paid depends on the number of shares held by an investor. The annual dividend would be the sum of 4 quarters.

Dividend Calculation Example:

Dividend Payout Ratio: Health Metric of a Dividend Company

This is a very useful yet overlooked ratio for any dividend paying companies. Investors, especially young investors look for the highest dividend yield paying stocks to get the maximum out of their investment. The question here is : Are these high dividend yields sustainable or is it a trap? Dividend payout ratio gives a clear view for the valuation of the dividend strength of a company.

Dividend Payout Ratio Example:

It is not a good practice to look at a particular metric (e.g. Payout Ratio) only for a single year. Instead it’s prudent to look at the descriptive value (median) of the (Payout Ratio) or any metric when doing the valuation of any company.

Dividend Consistency

The other important factor that plays an important role is to look at the number of years the company has paid the dividends. According to the Author of the famous book The Intelligent Investor, Benjamin Graham states that the company with a continuous record of paying dividends for 20 years or more is an important plus factor for the quality rating for a defensive investor. Even starting from 2024, if we go back 20 years or more, you would be able to cover the 2007 crash as well as the Corona virus calamity and you can make a list of such strong dividend paying companies.

Company‘s Economic Moat

This term was coined by Warren Buffet of Berkshire Hathaway. The basic concept of economic moat is the strength of the company to survive the competitiveness as well as the economic conditions of the country or the world. We can not think of any company as a lone entity because that would make the market capitalization of that company to be 100% (no competition) and that is simply not possible. A better way is to answer some questions:

- How any given company dominates its competitors?

- Do they have enough innovative products that can put them above others for at least next 10 years?

- Would they be able to survive the economic headwinds?

Your answers would guide you towards stable companies.

Dividend Growth

In the book The Intelligent Investor, a sane advice can be heard from one of the investing greats of value investing, Benjamin Graham. Mr. Graham advised that the under normal market conditions an investor should look for a 3.5% to 4.5% dividend that should be increased steadily.

Mr. Graham further proposed that the dividend growth plus the share price appreciation can be 7.5% per year for a good company under normal market conditions. The accounting professors from Columbia, Dorron Nissim and Amir Ziv analysed that the companies that raise their dividends have not only better returns but also higher returns are a cause of company‘s better future prospects for next four years after the dividend change. More on BEST GROWTH STOCKS HERE!

Cash Flow

The health of the balance sheet of any company can be determined by one most important factor : The health of it‘s cash flows. Companies having a positive cash flows are stable companies likely to sustain the negative environmental impacts. Cash flow is the incoming and outgoing of the of the cash due to company‘s operations. A positive cash flow means the company keeps the money after paying it‘s liabilities while a negative cash flow means the company is not profitable. Warren Buffet looks for the Free Cash Flow (FCF) in company‘s balance sheets to understand the financial health of a company. Learn more about COMPANY’S FINANCIAL HEALTH HERE!

Free Cash Flow (FCF) Formula:

FCF = Operating Income – Capital Expenditures (Capex)

The formula shows that the income left to the company for shareholders after paying all the expenditures is the actual income the company or shareholders get to keep. It is usually a good practice to look at least 5-8 years median free cash flow to not fall for the accounting tricks.

Conclusion:

Dividend stocks present a compelling opportunity for investors seeking steady income and long-term financial stability. By focusing on key metrics such as the dividend payout ratio, dividend consistency, and company economic moat, investors can identify robust dividend-paying companies. The wisdom of investing legends like Benjamin Graham and Warren Buffet further underscores the importance of sound financial practices and the evaluation of free cash flow. Ultimately, the careful examination of these factors can guide investors toward making informed decisions, ensuring a balanced and prosperous investment portfolio. As we navigate the complexities of the stock market, understanding and leveraging the strengths of dividend stocks can provide a reliable pathway to sustained financial growth and security.