Are you looking for Apple Stock Price Prediction 2030? Look no further! Apple Inc. (NASDAQ: AAPL) has been a rock in investment portfolios of both institutional and retail investors. Apple is an industry giant in the technology sector with high brand equity, unremitting innovation, and a close circle of loyal buyers. But in people looking to the future, they are wondering: What will be the Apple stock price prediction in 2030?

This article extracts recent financial performance, operations efficiency, capital returns, and the macro-economy of Apple and develops logical forecasts for the Apple stock price prediction 2030 without resorting to discounted cash flow (DCF) models. Instead, we are concerned with actual performance measures, valuation multiples, and competitive position supported by sound databases.

Apple’s Current Market Position

By Q3 2025, Apple maintains its position as the most valuable company in the world by market value, with its market capitalization worth close to three trillion dollars. Their product ecosystem (iPhone, iPad, Mac, Services (iCloud, Apple Music, etc.), and their new growth in wearables and AI) has been able to be a very resilient profit generator even as macroeconomic headwinds take their toll.

Also, the services business of Apple alone has been around $23 billion during the third quarter of 2025, and this is a larger slice of the pie (Financial Times, 2025a). This change to repeatable revenue contributes to an improved margin structure and long-term valuation support at Apple.

Financial Health Snapshot

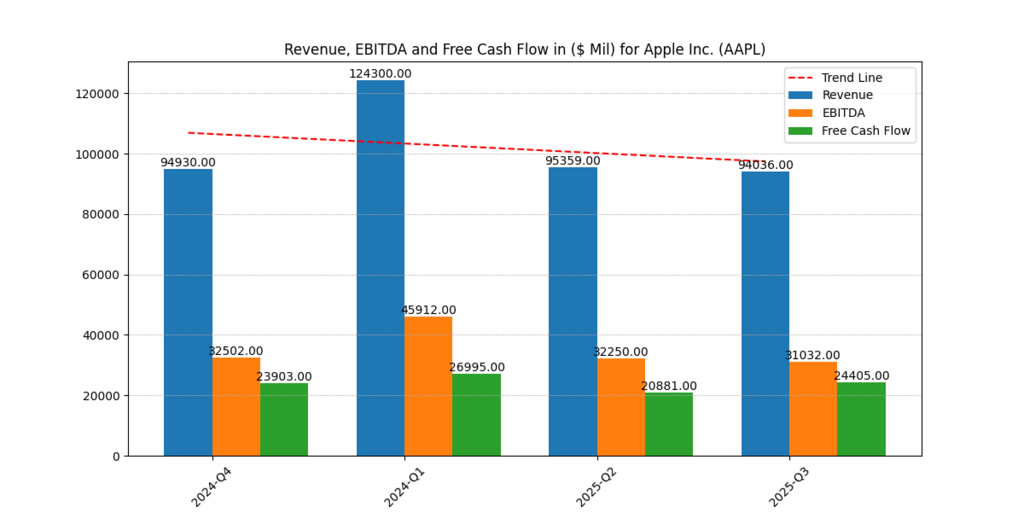

The following table gives a summary of the recent quarter-by-quarter performance of Apple:

| Quarter | Revenue ($ Mil) | EBITDA ($ Mil) | Free Cash Flow ($ Mil) | ROE (%) | ROTC (%) |

| 2024-Q4 | 94,930 | 32,502 | 23,903 | 25.88 | 18.09 |

| 2024-Q1 | 124,300 | 45,912 | 26,995 | 54.42 | 26.19 |

| 2025-Q2 | 95,359 | 32,250 | 20,881 | 37.10 | 17.93 |

| 2025-Q3 | 94,036 | 31,032 | 24,405 | 35.60 | 16.83 |

Source: Data source: Apple Earnings Releases, and Financial Times data (2025a, 2025b).

Figure 1: Revenue, EBITDA, and Free Cash Flow of Apple (Fourth Quarter 2024 to the Third Quarter 2025)

Besides the volatility in quarterly revenues, Apple experiences stability in terms of EBITDA and free cash flow generation, indicating the efficiency of operations and the cash-generating business model of the company.

With the above data, it is apparent that although revenues have been stable, margins and returns on capital are beautiful, particularly in an economic environment that is tightening up. The Return on Equity (ROE) TTM of Apple is 152.99% which represents capital-efficient performance that is considered elite level (Financial Times, 2025b).

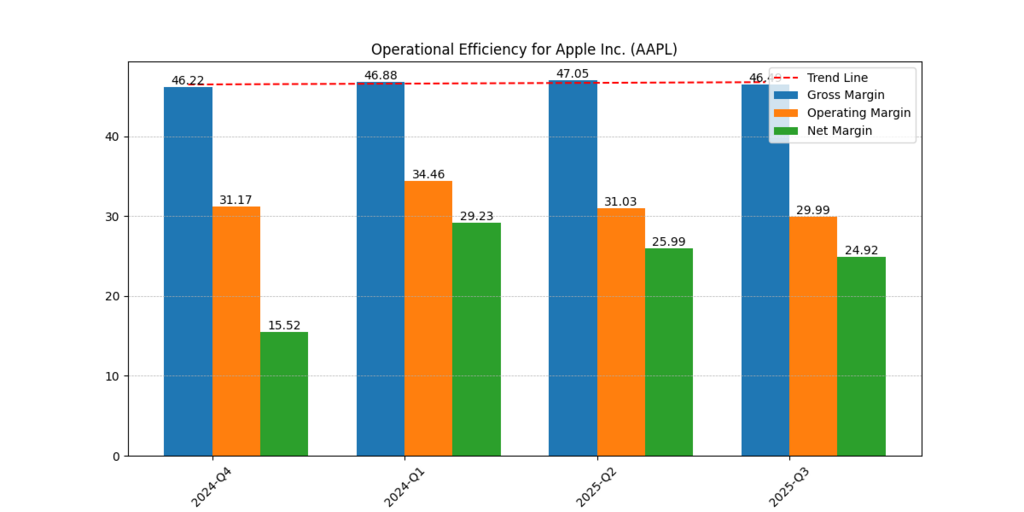

Operational Efficiency Metrics

A strength in the operating capacity can be proven by the fact that Apple has maintained high margins that are largely above most technological counterparts. Quarterly margin progression is illustrated in the figure below:

| Quarter | Gross Margin (%) | Operating Margin (%) | Net Margin (%) |

| 2024-Q4 | 46.22 | 31.17 | 15.52 |

| 2024-Q1 | 46.88 | 34.46 | 29.23 |

| 2025-Q2 | 47.05 | 31.03 | 25.99 |

| 2025-Q3 | 46.19 | 29.99 | 24.92 |

During modest tightening in operating margins, gross margins are sustained at 46-47% and this is reflective of the power to set prices and logistics capabilities of Apple (Financial Times, 2025a). This is good news for the long-term profitability.

Further Reading : Is Microsoft a Good Stock to Buy After FY26 Earnings? A Comprehensive Price Prediction Analysis

Figure 2: Apple Gross, Operating, and Net margins in 4 Quarters

Apple enjoys high gross margins of more than 46%, and operating and net margins indicate a healthy profitability resulting from powerful cost management and market power.

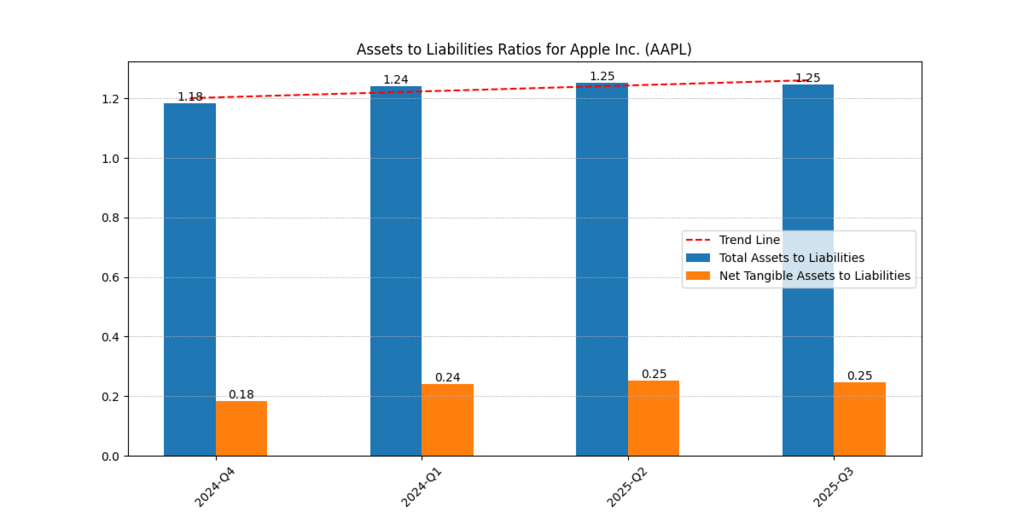

Balance Sheet Strength

Apple is in a good position of assets to liabilities. Quarterly ratio trend was captured in the chart below:

| Quarter | Total Assets / Liabilities | Net Tangible Assets / Liabilities |

| 2024-Q4 | 1.18 | 0.18 |

| 2024-Q1 | 1.24 | 0.24 |

| 2025-Q2 | 1.25 | 0.25 |

| 2025-Q3 | 1.25 | 0.25 |

Apple has conservative leverage, prominent liquidity positions, and its buyback policy supports the price of the stock during the decline. Such financial health is a critical element in predicting a bullish Apple stock price prediction for 2030

Figure 3: The ratio of Total and Net Tangible Assets to Liabilities of Apple (2024-Q4 to 2025-Q3). The figure described is an indication of the financial quality of Apple, as the total asset coverage ratio grows steadily over the liabilities, and the net tangible assets maintain a favorable position, which means that it is also a strong performer when looking at its balance sheet.

Innovation and Ecosystem Expansion

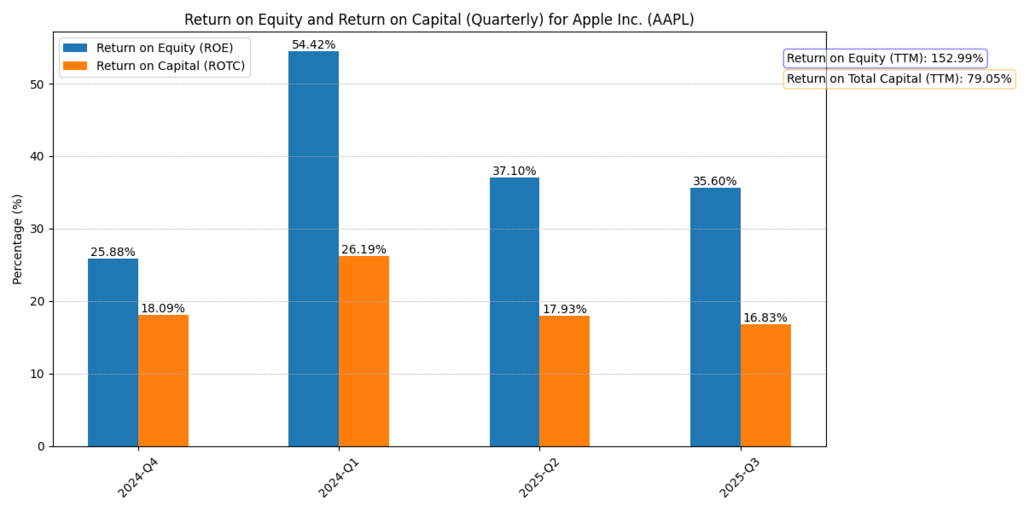

Figure 4: Return on equity and return on total capital (Quarterly and TTM) of Apple

High ROE and robust capital returns in the case of Apple prove their effective capital management and the strategy of creating shareholder value over the long term.

By 2030, Apple is likely to have further penetrated AI-powered devices, mixed reality (Vision Pro range), and car integration. Though sanctioned, the Apple Car project has been behind schedule, but it might experience some form of materialization before 2030.

Besides, to mitigate the geographic nearness to China, Apple has become more active in India and Southeast Asia, which, in turn, should increase the customer base of the company (Financial Times, 2025c). This offers several growth levers together with increased monetization of services such as Apple Pay, Fitness+, and iCloud.

Valuation Multiples vs. Peers

Apple is selling at a forward P/E ratio of about 29. In comparison:

| Company | Forward P/E | PEG Ratio (2025 Complete Year) |

| Apple (AAPL) | 29x | 3.24 |

| Microsoft (MSFT) | 33x | 2.23 |

| Alphabet (GOOGL) | 24x | 0.97 |

| Nvidia (NVDA) | 44x | 0.91 |

Even though it is mature, Apple continues to be highly rated, based on brand strength, loyalty, and high free cash flow generation. Apple has more consistency and balance sheet discipline in terms of margins as compared to Nvidia or Microsoft.

Apple Stock Price Prediction 2025

Considering the following of Apple:

- Even margin profile

- Capitalizing on the areas of service segmentation

- More powerful ROE and cash generation

- Hard-core share repurchases

- Innovation that kept valuation to a premium

We expect the following Apple stock price prediction for 2025 based on the current financials and calculating unlevered growth rate to come up with different stock prices (Subject to Change with Changing Financials) using different growth rates and a constant hurdle rate of 10%:

| Growth Outlook | Projected EPS Based on Value Added Earnings Growth rate (2025 Full Year) | P/E Multiple | Projected Stock Price |

| Base Growth rate (7.1%) | $7 | 27x | $192 |

| Moderate (7.5%) | $7 | 31x | $218 |

| Bullish (8%) | $7 | 38x | $270 |

Hence, Apple stock price prediction 2025 can be stated to be $192-$270, subject to execution, macroeconomic, and competitive environment. The midpoint guidance is around $230-250, stepping on the assumption of earnings growth and Apple retaining its historical valuation boundaries. For a shorter valuation forecast for Apple in 2026, read our latest AAPL buying guide for 2026 after AI advances, “Is Apple Stock Worth Buying in 2026 After AI and Services Growth—Or Is It a Trap?“

Apple Stock Price Prediction 2030

We expect the following Apple stock price prediction for 2030 based on the current financials and calculating unlevered growth rate to come up with different stock prices (Subject to Change with Changing Financials) using different growth rates and a constant hurdle rate of 10%. Instead of EPS growth we lean more towards the value added growth rate.

The PE might come down if the value added earnings increase substantially.

| Growth Outlook | Projected EPS Based on Value Added Earnings Growth rate (2030 Full Year) | P/E Multiple | Projected Stock Price |

| Base Growth rate (7.8%) | $10.22(@7.8%) | 24.26x | $248 |

| Moderate (8.3%) | $10.41(@8.3%) | 33.35x | $316 |

| Bullish (8.8%) | $10.60(@8.8%) | 41x | $436 |

Conclusion

Going by the available information, Apple is a fundamentally sound investment for the next decade. Although it might not provide the explosive growth that newer technology names are providing, it does:

- predictable Cash Flows

- Good returns on capital

- Brand moat, pricing power

- Struck a healthy balance between risk management and innovation

Therefore, the outlook of Apple stock is not dire to 2030, mainly concerning long-term investors who want a combination of a certain degree of protection and medium-term growth. Investors can be interested in taking advantage of any corrections in the market as a strategic route towards building positions in shares of this tech titan.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.