Amazon (AMZN) and Alphabet (GOOGL) are two industry giants that should be taken into account in search of the best growth stocks to buy now. Both companies have shown to be financially resilient, displaying good income generation and a prudent positioning to exploit high-growth avenues such as cloud computing, artificial intelligence (AI), and digital advertisement.

Amazon (AMZN)

- Current Price: $226

- Baked‑in Growth Estimate: 8.1%

- Implied Fair Value: $271

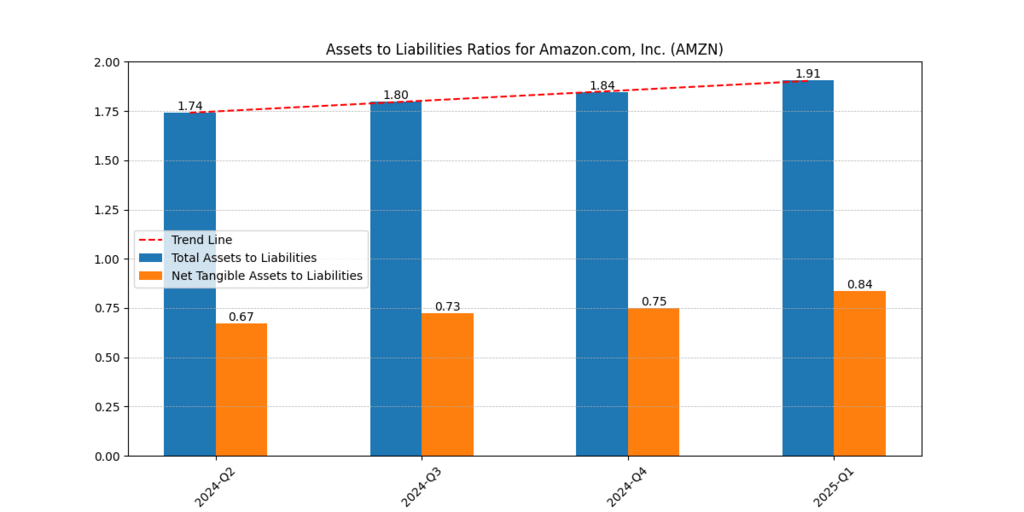

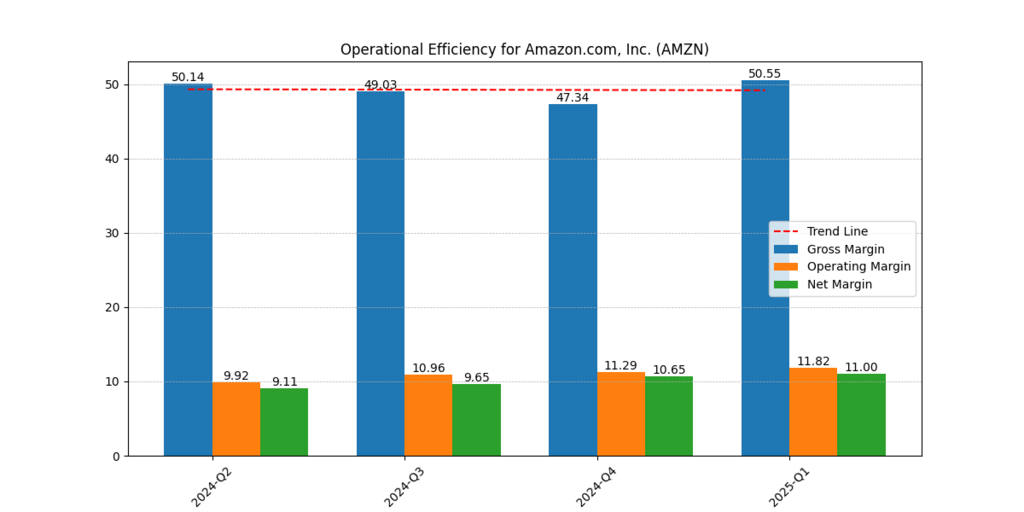

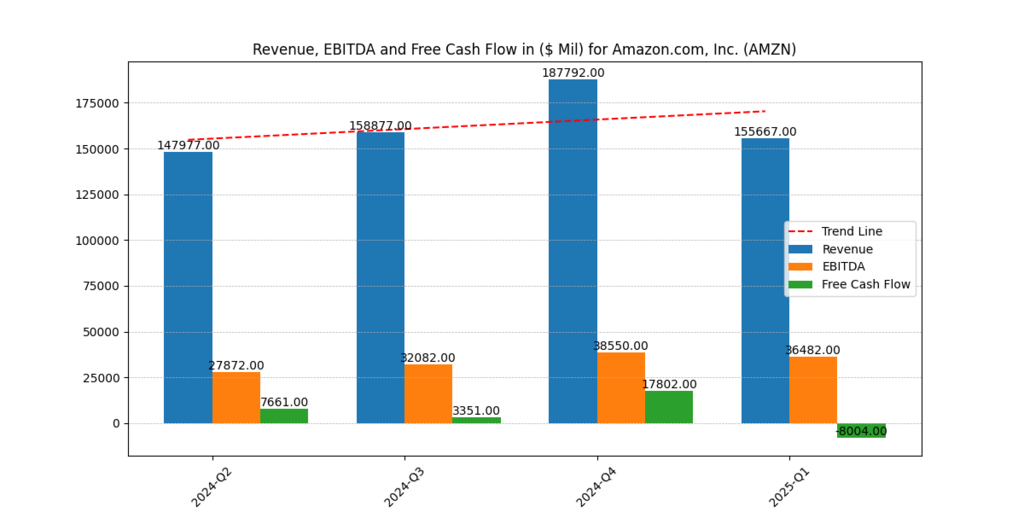

Amazon’s business model is based on e-commerce, AWS, advertising, and logistics. Compared to $36.8 billion in 2023, the free cash flow amounted to approximately $38.2 billion in a full year, 2024, with an operating cash flow going up by 36 per cent to $115.9 reported by Amazon.com in 2025 (Amazon.com, 2025; ZamWizard, 2025). Operating income rose almost 5.5 times to 68.6 billion in 2024 (Amazon.com, 2025; Captide, 2025). The Amazon image is also turning out to be financially strong, the asset-to-liabilities ratio improved to 1.91 and the profit margin (rising to ~11.8% up to ~ 9.9%).

Our valuation model also finds an opportunity in the stock, with a target price of 271 based on an 8.1 per cent growth rate, which comes to approximately 20 per cent upside, and thus it goes in the list of best growth stocks to buy now.

Figure 1: The total assets-liabilities ratio indicates that Amazon has a strong financial stability, which is progressively stable, with the ratio increasing by 0.17 between Q2 2024 and Q1 2025.

Alphabet (GOOGL)

- Current Price: $185

- Baked‑in Growth Estimate: 5.6%

- Implied Fair Value: $223

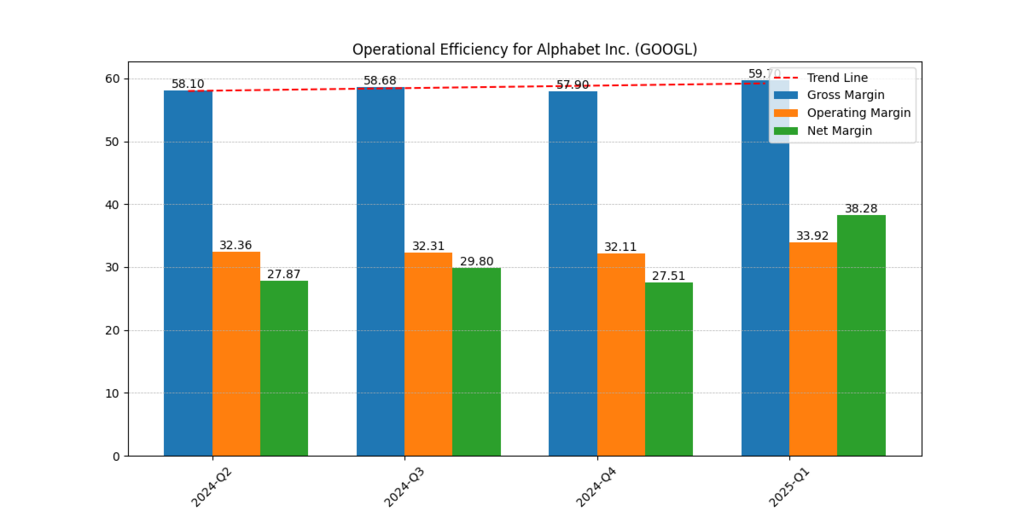

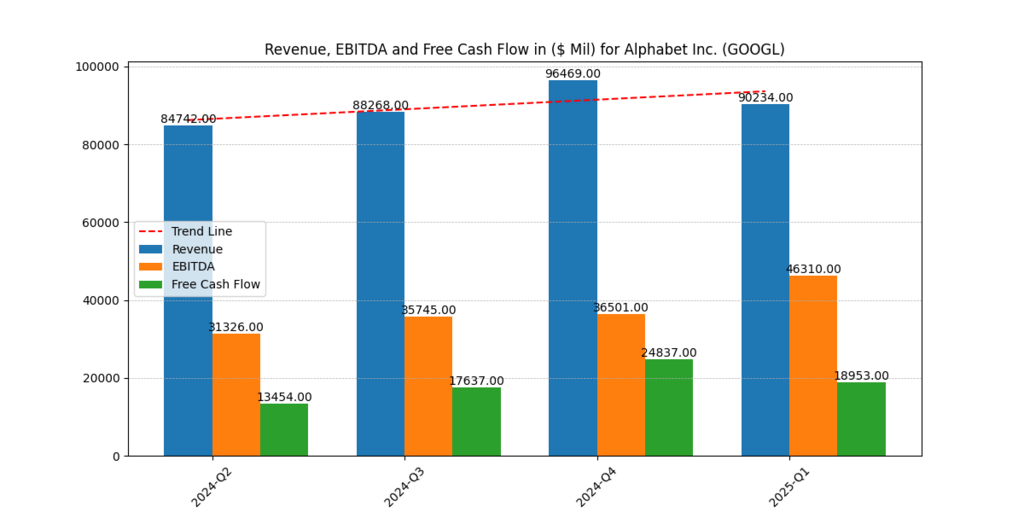

Alphabet does well in advertising, cloud and AI. In Q1 2025, sales increased by 12 per cent year-on-year to $90.23 billion; operating profit soared by 20 per cent, and adjusted margins jumped to 34 per cent; and net profit was up 46 per cent to $34.54 billion (Alphabet Inc., 2025a; 2025b). In Q1 2025, free cash flow was 18.95billion, and the trailing twelve-month free cash flow was approximately 74.9billion dollars (Alphabet Inc., 2025b; Investing.com, 2025). The profitability also increased as the gross revenue grew to ~59.6%, the operating margin ~33.9%, and the net margin reached ~38.3% (Alphabet Inc., 2025b; Investing.com, 2025).

Using the 5.6 per cent growth estimate, the intrinsic value of Alphabet is about $223 of share, which makes it a valued stock with close to a 20 per cent upside, making it one of the best growth stocks to buy now.

Figure 5: The gross margin of Alphabet has been higher than 57%, with the net margin reaching 38.28% in Q1 of 2025

Why They continue to be the Best Growth Stocks to Buy Now

Valuation Gap

- The AMZN stock is trading at ~ $226 compared to the modelled value of $271

- GOOGL trades for ~$185 vs. $223 modelled value

Massive Free Cash Flow Generation

- Amazon: $38billion p.a and Q4 2024 will show discipline in reinvestment (Amazon.com, 2025).

- Alphabet: $18.95bn Q1 2025 and ~ $74.9b TTM, driving even more innovation (Alphabet Inc., 2025b).

Strong Profitability Metrics

- The presence of the operating margin (~10.8%) with the net income of more than $59 billion on Amazon is caused by structural efficiency (Amazon.com, 2025).

- The 34% Alphabet margins show great cost control (Alphabet Inc., 2025a).

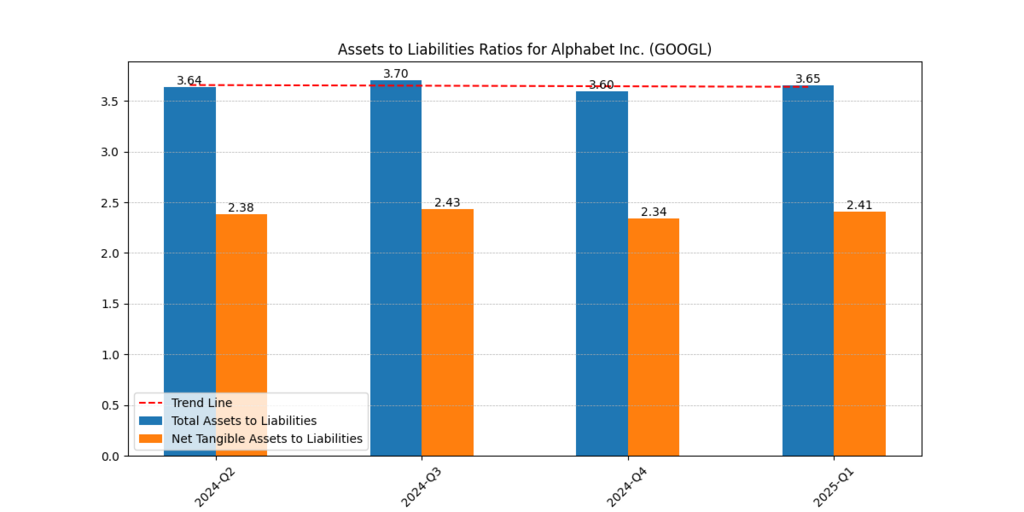

Rock-solid Balance Sheets

- The improving assets-to-liabilities ratios at Amazon and the constant ratios (~3.65) at Alphabet give these REITs enough wiggle room in terms of operations, which is a good determinant of REIT-level health.

| Ticker | Price | Impl. Value | Upside | Growth Baked-in |

| AMZN | 226 | 271 | +20% | 8.1% |

| GOOGL | 185 | 223 | +20% | 5.6% |

Such numbers reflect considerable “upside potential” to take these companies up to the list of the best growth stocks to buy now, which investors intend to use (and pass through) before and after 2025.

Furher reading : The 3 Best Growth Stocks for the Next 5 Years

Risks to take into account

- The volatility in macroeconomics can also depress advertising (GOOGL) or discretionary purchases (AMZN).

- Regulatory and machine learning disturbances continue to be wild cards.

- Execution risk: The further growth of the margin is provided by the discipline of management and strategic investments.

Final Take

Amazon and Alphabet are Big Tech juggernauts that seem to be underpriced by close to 20% based on a modest growth valuation framework. They are now two of the best growth stocks to buy as their cash flow, growing profitability, and sound financials are very healthy.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.