In our article we discuss Taiwan Semiconductor Manufacturing Company Limited (TSMC) ,ticker symbol TSM stock price prediction that remains a dominant player in the international semiconductor field. Being the sole foundry partner of leading chip developers, such as Apple, Nvidia, and AMD, TSMC prefers to position itself as a chip powerhouse, which makes it the epicentre of the global tech supply chain (Reuters, 2024). TSMC has been years ahead of its competitors due to its industry-leading process technologies, including 5nm and 3nm, and the upcoming 2nm nodes, which can enable performance and efficiency that competitors cannot match or are slow in matching.

Although the mood of investors in the TSM stock price prediction is largely bullish, a balanced analysis based on fundamentals gives another picture of the story leading to 2025. There are solid financials, disciplined capital management and strategic positioning, which form part of the value portfolio of TSM beyond mere growth enthusiasm. But an increase in competition, growing tensions between the U.S. and China, and swings in cyclical demand in the chip market imply that the future performance of the company needs further examination, not sheer optimism. An evidence-driven strategy presents both advantages and the limits of sustainable growth, which makes the decision process more identifiable among all the noise present in the market.

Capital Structure Stability and Risk Cushion

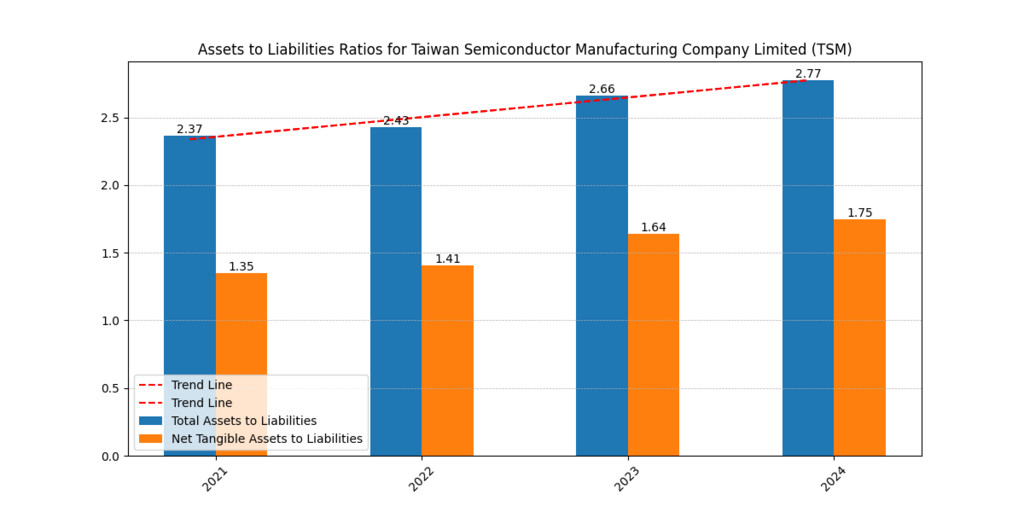

The assets-to-liabilities ratio is one of the core indicators of the financial health of a company. The Total Assets to Liabilities Ratio of TSM reached 2.37 in 2021 and 2.77 in 2024, whereas the Net Tangible Assets to Liabilities increased to 1.35 and 1.75 over the same period (TSMC, 2024). This linear trend depicts greater solvency and greater protection of equity against debt.

Trend Insight: The increase in the asset-to-liability ratio provides a buffer against global supply chain shocks and chip demand instabilities, which are key factors influencing TSM stock price predictions.

Operational Efficiency: Margins Still Competitive

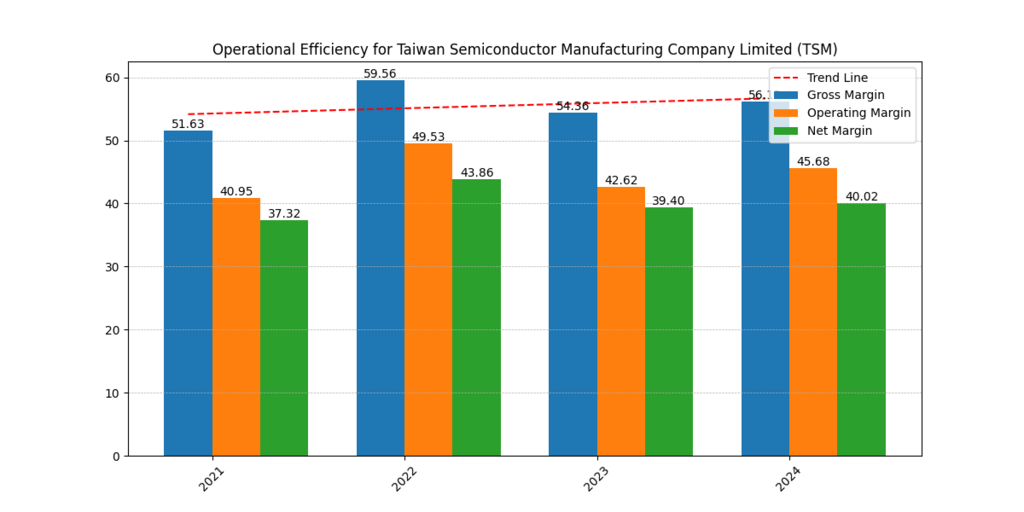

The margin profile of TSMC is among the best in the business. During the past four years, the company had a Gross Margin of more than 50%, which in the case of 2024 amounted to 56.10% of the sales. Their operating and net margins were also solid at 45.68 and 40.02 per cent, respectively (Yahoo Finance, 2024).

This strong efficiency talks about:

- Strong price momentum.

- The economy of scale.

- Technological moat through the novel node technology, such as 3nm (Statista, 2024).

Nonetheless, the 2023 margin pressure exposed TSM to cyclical declines, particularly the reduced demand for smartphones and PC (Bloomberg, 2024).

Revenue and Cash Flow Dynamics

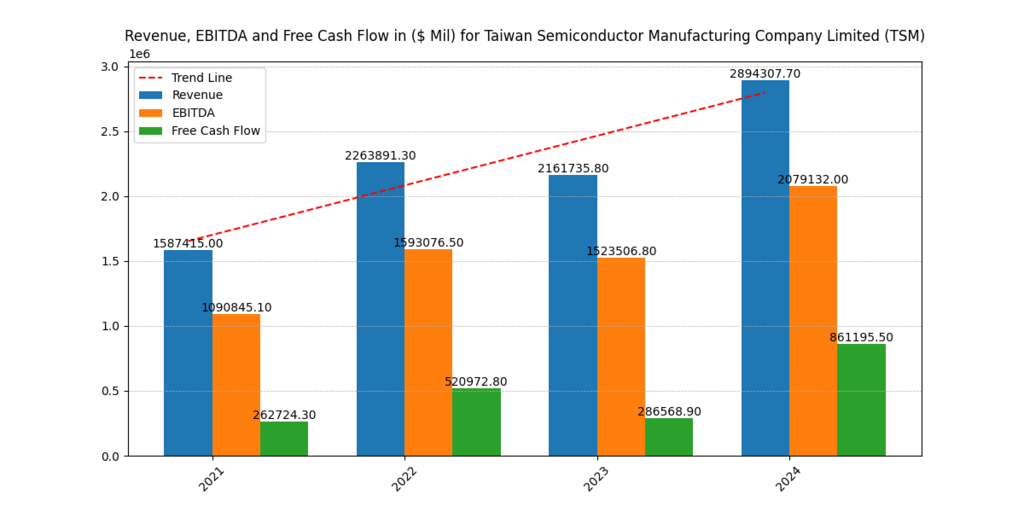

Although the revenues slightly fell in 2023, they bounced back in 2024 to 2.89 million (in $K), which means that there was strong demand and profitable capacity increase (TSMC, 2024).

| Metric | 2021 | 2024 | CAGR (2021–2024) |

| Revenue ($K) | 1,587,415 | 2,894,308 | ~22% |

| EBITDA ($K) | 1,090,845 | 2,079,132 | ~24% |

| Free Cash Flow ($K) | 262,724 | 861,195 | ~48% |

Strategic note: The trend in free cash flow indicates that TSM can invest in fab build-outs (e.g., Arizona and Japan), which would play an important role in the future value and stability that is vital in estimating the TSM stock price Prediction (Reuters, 2024).

* The Revenue, EBITDA and FCF are in TWD K values.

Return Metrics: Sustainable but Volatile

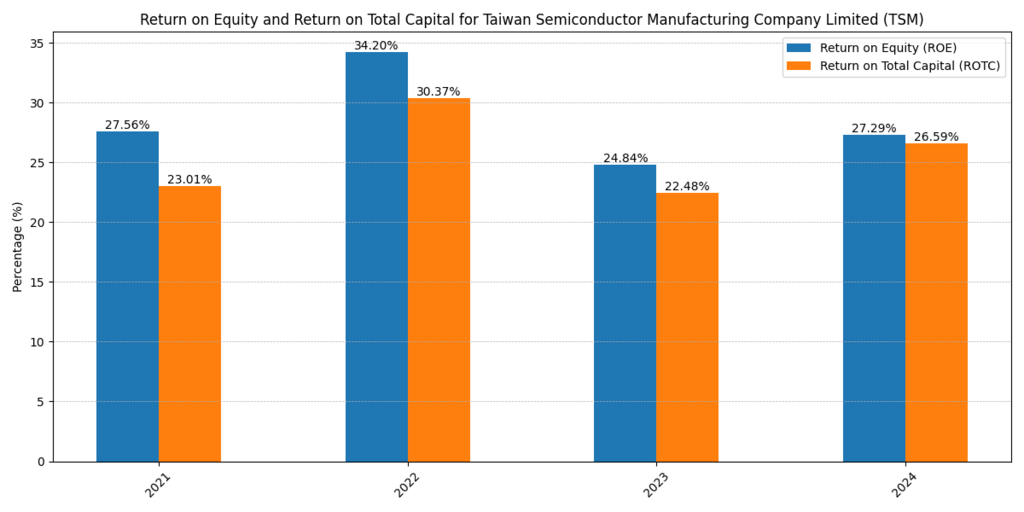

The Return on Equity (ROE) and Return on Total Capital (ROTC) of TSMC show a short-term decline, with recovery projected for 2024.

- ROE 2025 (Estimated): 28.2%

- ROE 2026 (Estimated): 30.6%

This growth indicates better shareholder value creation in the uptick in demand of AI and high usage of 3nm/2nm (Bloomberg, 2024).

Price Valuation: Predicted Target

With a hurdle rate of 7.6% and a rate of corporate growth of 5%:

Forecasted TSM Stock Price 2025 = $289/share

Although this is an upside on present prices, it might not be a highly profitable stock to all investors due to the small difference in the returns of the stock when its return is above the hurdle rate. The global chip cycle, in general, and the huge CapEx investments by TSM, in particular, give some leeway to be cautious (Statista, 2024).

Strategic Projects and Global Expansion

Key Future Projects:

| Project | Region | Completion | Focus |

| Arizona Fab (Fab 21) | USA | 2025 | 4nm and 3nm Production |

| Kumamoto Fab (Sony JV) | Japan | 2024 | Automotive and IoT chips |

| 2nm Node Technology | Taiwan | 2025–2026 | Leading-edge innovation |

Such projects are capital-intensive, yet actively working, each of them would add more to the TSM long-term profitability, lower the geopolitical risks, and bring diversity to customers base of the corporation that directly has an impact on TSM stock price Prediction (Reuters, 2024; TSMC, 2024).

Conclusion: Not a Must-Buy, But a Data-Supported Hold

TSMC has an impressive narrative: a leading market share, streamlined operations, and internationalization expansion strategy. The argument, however, is tamped down by macro risk, CapEx intensity and cyclical fluctuations of demand. Here our 3 Best AI Stocks.

TSM has strong fundamentals of the stock price of $289 in 2025 which is not a blind buy. Investors are to compare the valuation with risk-adjusted returns and diversification of the portfolio requirements.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.