Introduction

Which top 5 AI stocks to buy now that are the best investments to make at this time? To maximize earnings during market turmoil, invest in AI firms that exhibit strong market positions, increasing revenue, and innovative improvements.

Given market risks, investors seek out market-shielding opportunities to provide sustainable long-term growth, particularly in the technology sector. Significant industrial developments are being driven by artificial intelligence’s (AI) disruptive power in global marketplaces. AI stock positions have been a popular market choice due to the extensive firm investment in AI for innovation and operational efficiency benefits.

This article emphasizes companies with significant market values, strong income growth, and successful AI directed strategies while analyzing the top five AI stock options for immediate investment. Anyone looking to make a significant profit from AI should consider investing in the companies on this list, as they have a strong chance of performing well during a market downturn.

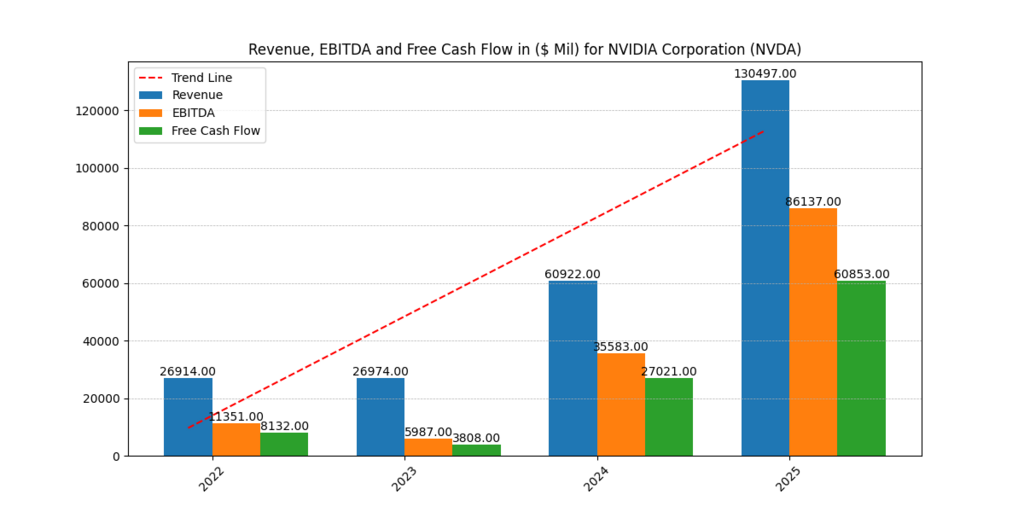

Nvidia (NVDA) Financial Metrics

With its innovative graphical processing units (GPUs) that support critical operations for both AI and machine learning, Nvidia is a dominant force in artificial intelligence (AI) sector. The gaming industry’s market dominance and data center expansion have contributed to the company’s strong financial progress, and its GPUs serve a variety of AI-related applications, from autonomous driving to cloud computing and robotics, so the company maintains powerful prospects for expansion. Nvidia’s strong financial strength is demonstrated by its successful revenue generation and improved free cash flow, which demonstrates its position as an industry leader.

The company’s commitment to AI is demonstrated by its AI Enterprise suite, which enables businesses to expedite their AI software deployments. The growing industrial adoption of AI places Nvidia in a favorable position to profit from growing computational demands, making it one of the top AI investment opportunities. [1]

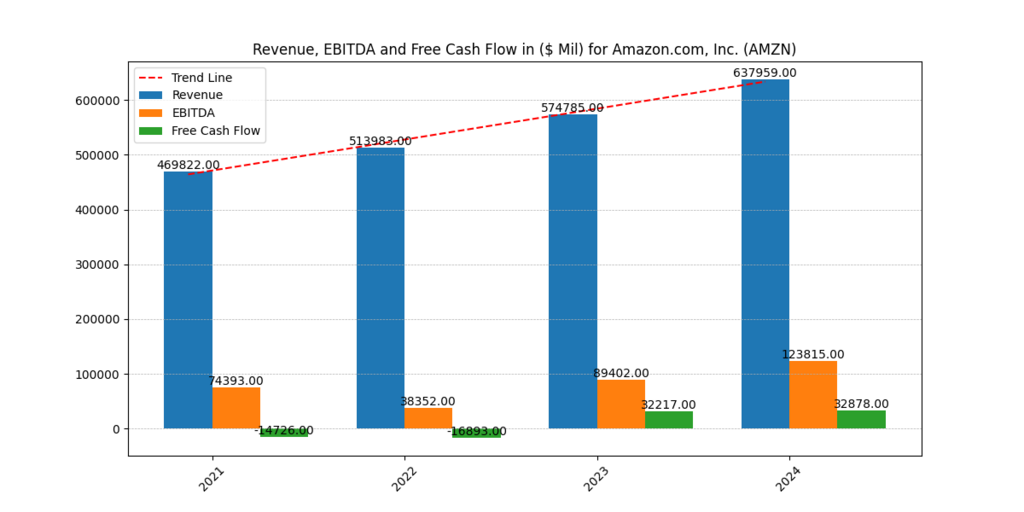

Amazon (AMZN) Financial Metrics

Since Amazon diversified its business beyond e-commerce to include cloud computing and artificial intelligence, the AI market has grown to be an important segment for the company. From predictive analytics to AI-implemented automation, the company’s AI and machine learning services, which are made possible by the Amazon Web Services (AWS) business unit, help a variety of businesses optimize their operations. Amazon leverages its cutting-edge artificial intelligence (AI) abilities to create consumer-focused products and cloud-based services, such as Alexa and the Nova Act AI agent for improved online shopping.

Since Amazon’s revenue is steadily increasing year, the company’s financial reports show strong upward momentum. Because Amazon uses AI to support its business model and promotes its cloud solutions, the company is still a great option for investors looking to gain exposure to AI growth. [1]

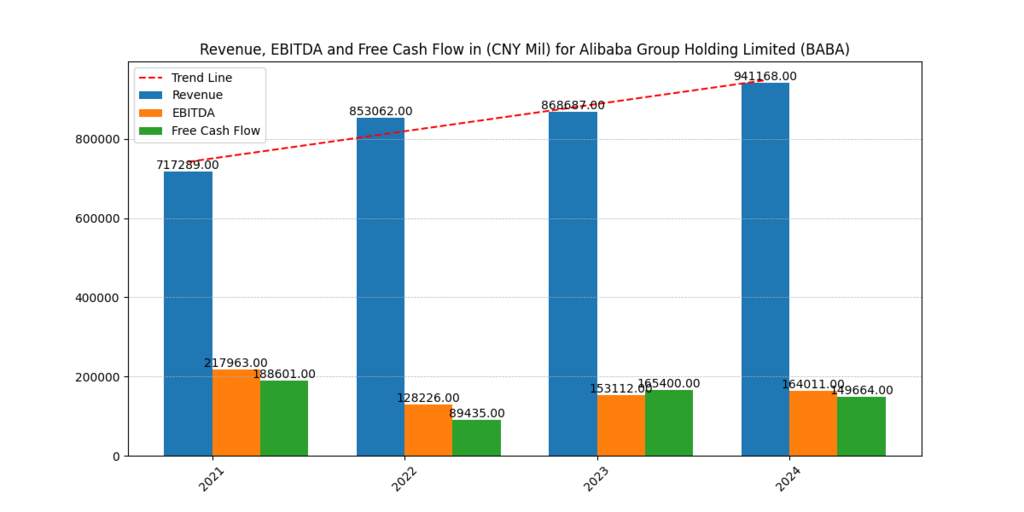

Alibaba (BABA) Financial Metrics

Alibaba leads its AI approach by improving its cloud computing, logistics, and e-commerce core business. The business makes significant investments in AI to improve the customer platform interfaces, streamline supply chain operations, and develop cloud service capabilities. Alibaba’s cloud division is a leader in artificial intelligence, providing AI-powered solutions for business operations in a variety of industries.

For the business to remain competitive in the e-commerce sector, it requires both autonomous logistics solutions and AI-driven recommendation systems. Despite geopolitical dangers, Alibaba’s economic strength and AI-driven technology breakthroughs make it an attractive option for investors looking to extend beyond U.S.-based AI investments. [2]

If you are interested in portfolio diversification due to US dollar decline as well as tariffs tumoil then check our article here!

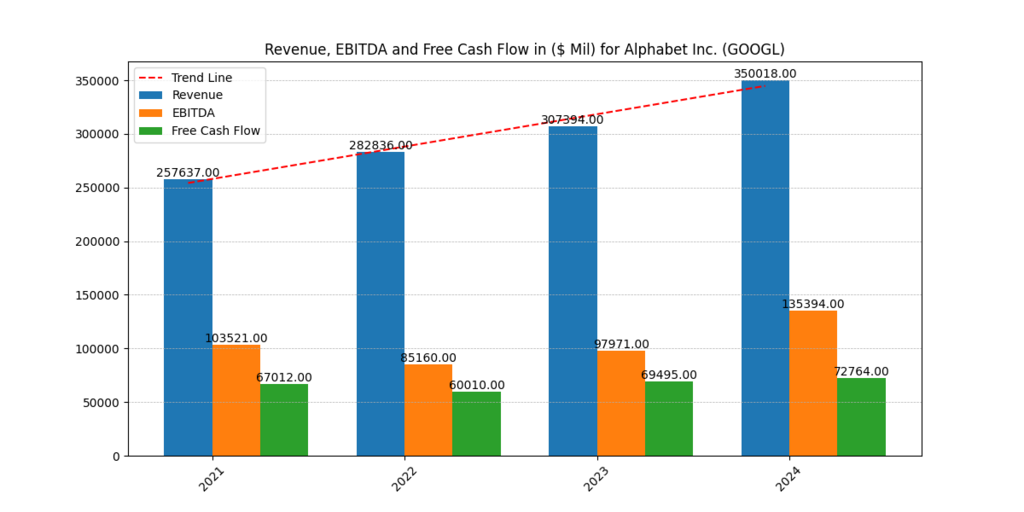

Alphabet Inc. (GOOGL) Financial Metrics

Alphabet Inc., the parent company of Google, is a dominant force in the market owing to its AI research and development efforts. Google’s AI capabilities are present throughout its whole ecosystem, including search engines, advertising models, and Waymo, its AI-powered startup. Because Google Cloud offers business-ready AI solutions globally, Alphabet’s AI advancements help the company keep its leading position in cloud computing. Alphabet’s consistent revenue growth, stellar financial results, and market penetration in AI-based businesses demonstrate its commitment to AI development. Alphabet is an appealing investment option because of its potent AI products and research funding, which allow it to take advantage of expanding AI market potential. [3]

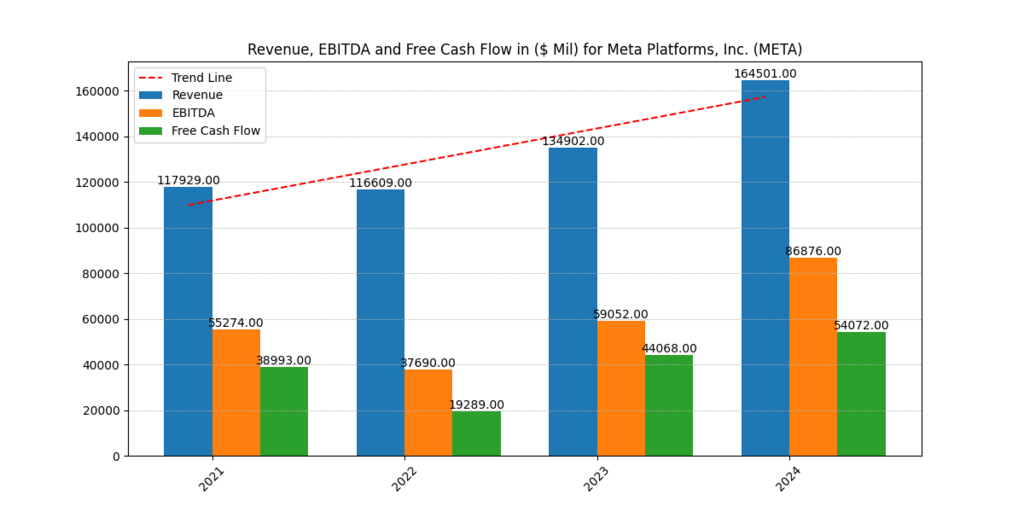

Meta Platforms (META) Financial Metrics

Meta Platforms, formerly Facebook, is a technology company that has invested heavily in AI technologies to support its business objectives and market positioning in the rapidly changing tech sector. Across its social media platforms, Meta Platforms runs three primary AI projects to enhance user personalization, provide more targeted advertising, and improve content recommendations. The focus on developing AI-powered virtual reality and augmented reality platforms is one way that Meta employs AI to advance its long-term metaverse goals.

Meta’s AI-based solutions surpass industry barriers such as heightened competition and regulatory scrutiny, establishing them as significant market contributors. Meta is able to efficiently expand in the AI industry thanks to its strong financial standing, laser-like concentration on AI, and profitable advertising operations. Investors hoping to profit from AI in social media and metaverse technologies have begun to speculate about Meta as a long-term, potential investment opportunity. [4]

AI Initiatives of Each Company

| Company | AI Initiatives |

| Nvidia | Develops AI-focused GPUs and platforms, including the CUDA parallel computing platform and the NVIDIA AI Enterprise suite, enabling AI applications across various industries. |

| Amazon | Introduced Nova Act, an AI agent designed to assist with online shopping and integrated into the upgraded Alexa Plus assistant, enhancing user interaction and convenience. |

| Alibaba | Invests in AI research and development, focusing on applications in e-commerce, cloud computing, and logistics to enhance customer experience and operational efficiency. |

| Alphabet | Engages in extensive AI research through its Google AI division, developing machine learning algorithms and AI applications across its product portfolio, including search, advertising, and autonomous driving technologies. |

| Meta | Invests heavily in AI to improve content recommendation algorithms, develop virtual reality experiences, and advance natural language processing capabilities, enhancing user engagement across its platforms. |

Conclusion

Financial investments in leading AI companies create opportunities to access successful firms strong in their market areas with solid revenue growth and intelligent AI development. AI innovation adoption positions these companies favorably to capture new technology sector possibilities which make them attractive investment choices for market participants during the present dip.

Disclaimer:

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.