What is tesla stock 2030 price prediction? The pioneer of the electric vehicle (EV) and clean energy revolution, once again kept the market in its focus after the publication of its Q2 2025 earnings results.

When it comes to investors, they are keen to analyse the financials, but the larger significance is still squarely cantered on the long-term trend, namely, what is the future of Tesla stock in 2030? With Tesla having big plans based on high valuation multiples and a rapidly changing technological environment, it is now even more critical to project its 2030 share price. This article looks at the latest earnings outcomes, reads the valuation indicators, and matches feasible growth projections and scenarios to determine the price of Tesla stock in 2030.

Tesla’s Q2 2025 Earnings: A Strategic Snapshot

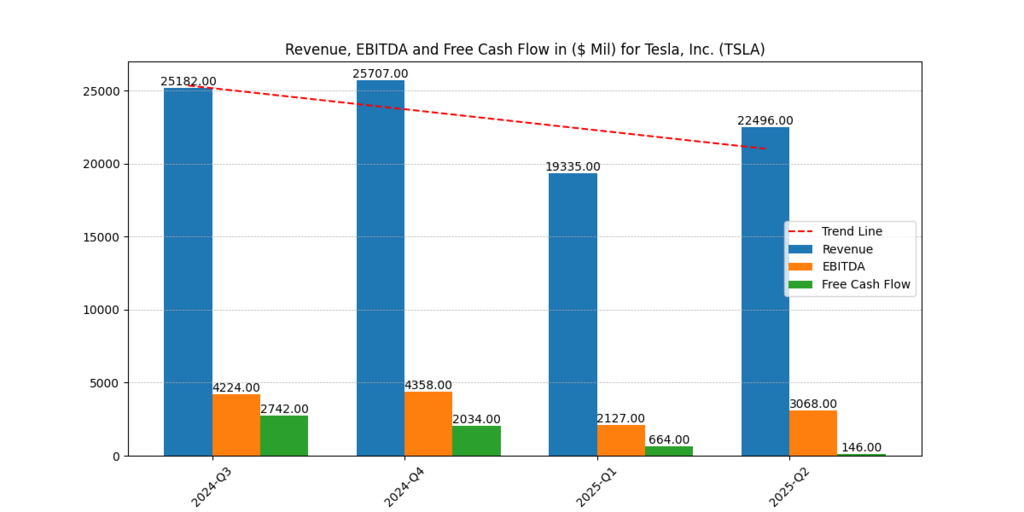

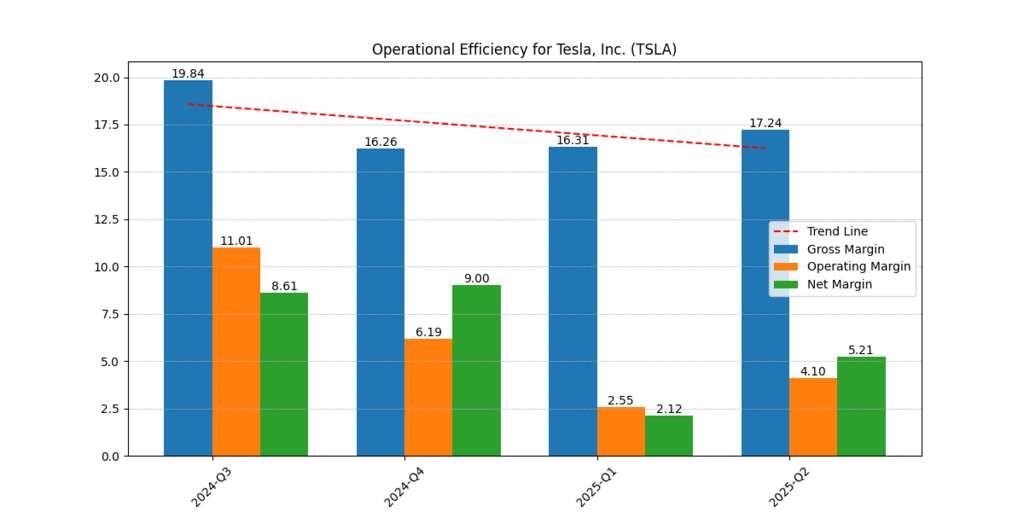

In Q2 2025, Tesla had an impressive revenue of 32.5 billion dollars, showing an increase of 12.4 per cent year over year, and its energy segment, as well as Full Self-Driving (FSD) subscription incomes, were key to this growth (Tesla, 2025). But its operating margins went down as well, now operating at 8.6%, compared to an operating margin of 10.1% a year ago, due to heavy investments in AI development, expansion of Optimus robots, and Gigafactory establishments in India and South America.

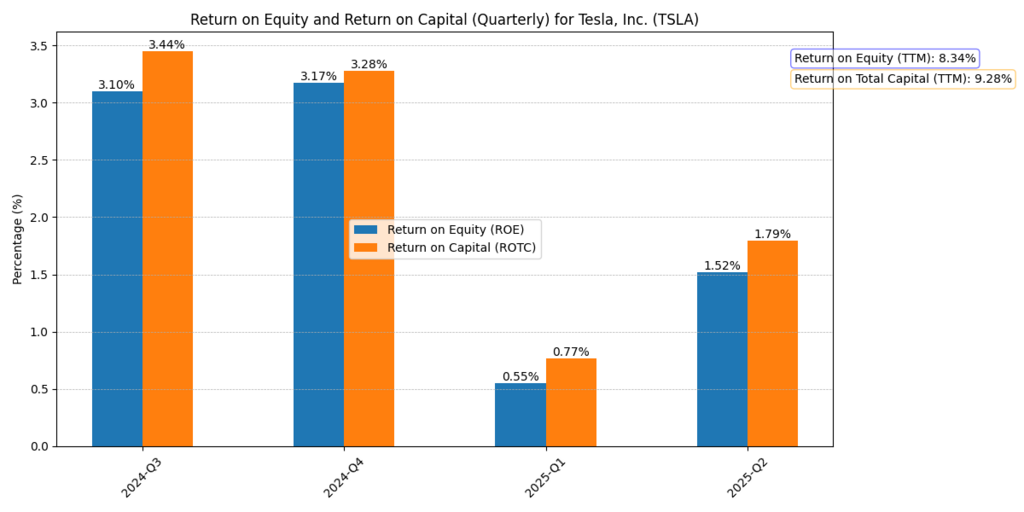

Figure 1: Tesla Return on Equity (ROE) & Return on Total Shareholders’ Equity (ROTS) 2024- Q2 2025

Despite analysts predicting a long-term payout in these capital expenses, the short-term pressure on free cash flow has induced somewhat of a divided sentiment. Wall Street firms such as Goldman Sachs (2025) warn of negative consequences of Tesla using a growth-at-all-costs approach, whereas innovation-based firms like ARK Invest (2025) claim that these investments form the foundation behind Tesla becoming dominant in autonomy and robotics.

Modelling Tesla Stock 2030 Price Prediction

We used a model to determine a data-driven estimate of the projections of the Tesla stock in 2030. This model presumes further revenue growth, margin expansion and reinvesting in innovation at Tesla.

Figure2:Tesla Revenue Growth (2024–Q2 2025)

| Growth Rate (CAGR) | Projected Price per Share (2030) |

| 9.4% | $65 |

| 9.5% | $82 |

| 9.6% | $121 |

| 9.7% | $311 |

The model shows clearly that a slight change in growth assumptions generates a wide variation in the future value of the stock. A more conservative price target of $65 is achieved by a smaller growth of 9.4 per cent, but 0.3 per cent, or 9.7 per cent growth, sends the price soaring to $311. According to our vision of both Q2 performance and further expansion of R&D, as well as macroeconomic factors, we consider a 9.5% 9.6% range to be the most possible, which predicts the target range of Tesla stock in 2030 of $82-$121.

Further Reading: Will Tesla Stock Continue to Drop in 2025? A Riveting Review

What the Market Is Pricing In?

In July 2025, the Price-to-Earnings (P/E) ratio of Tesla is 74x, and the Price-to-Book (P/B) ratio is almost 15x (Yahoo Finance, 2025). These multiples are far above those in the industry, and this shows that the market has already speculated on high future growth, aggressive growth, probably around a 9.9% CAGR in the next five years. This suggested growth is a reason why Tesla trades at a premium, but it also makes it a tough bar to meet.

Figure 3: Tesla Gross Margin vs Operating Margin, 2024–2025

Financial Stability: Assets vs Liabilities

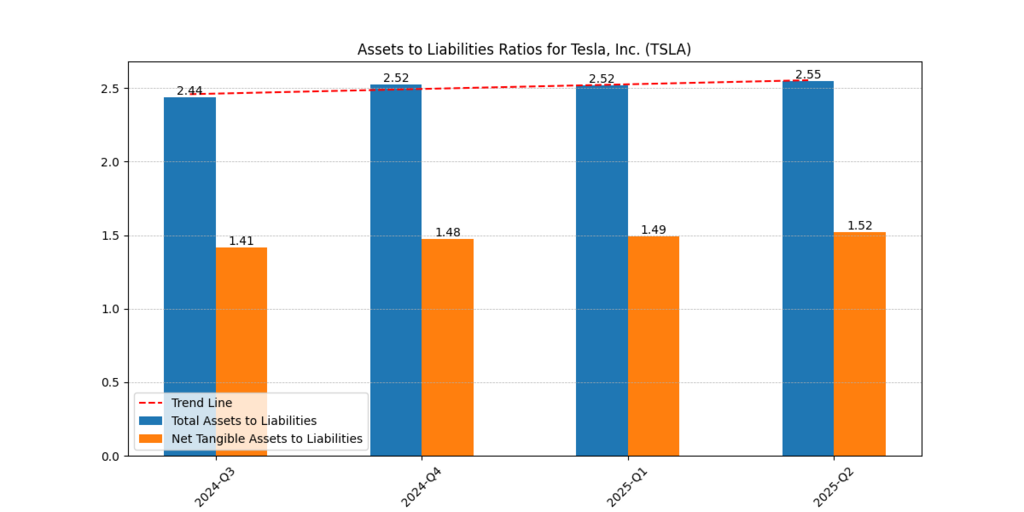

In mid-2025, the total assets of Tesla were 145 billion dollars, and total liabilities were 59 billion dollars, providing a debt-to-equity ratio of 0.48, which is very good in the case of a tech-industrial hybrid corporation (Tesla, 2025). Its cash reserves of more than 24 billion dollars enable it to maintain R&D and factory growth even in macro slowdowns.

Figure 4: Tesla Assets vs Liabilities (2024–Q2 2025)

Risks and Considerations

Investors need to look at both risks that may affect valuation in 2030:

- Execution Risk: the risks of delays in the Robotaxi program or manufacturing delays at new Gigafactories.

- Geopolitical Tensions: China, one of the largest markets for EVs, makes it a complicated regulatory environment.

- Competition: The fast pace of innovation by BYD, Lucid Motors, and legacy automakers.

- Interest rates and discounting factors: The high-interest-rate environment may negatively affect the present value of future cash flows, causing a less valuable stock.

Conclusion: The Likely Range for Tesla Stock 2030

Moving towards 2030 is expected to be a turbulent process. Yet, Tesla, with its innovative vision and strong market presence, sets itself as one of the most significant competitors in the EV market and AI-powered car automation. The Q2 2025 earnings estimate and growth modelling allow us to project a range of Tesla stock 2030 prices between $82 and $121 at a growth rate of 9.5 per cent and 9.6 per cent, respectively.

Nevertheless, this optimism should be counteracted by the concern about macroeconomic and regulatory movements—the ability to diversify and be disciplined when investing will help, as ever.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.