Introduction

Discover the top 4 energy sector best stocks to buy and hold in 2025 which are OXY, CVX, XOM and NEE. Explore the reasons why the companies offer both stability and opportunities for growth in the long run. Visualize the results now with our easy to understand analysis.

The energy industry is crucial to the global economy and is undergoing transformations to promote cleaner energy use. Despite unstable markets, some businesses have shown resilience and expansion potential. They adapt to market changes and create innovative, environmentally beneficial solutions. Investigating the energy sector can increase capital value and yield consistent dividends. Therefore, it is essential to invest in this sector to prepare for future achievements.

Energy companies, whether in the oil and gas sector or in renewable energy, offer a variety of options. The best energy businesses to buy and hold are those with exceptional fundamentals, aggressive strategies, and a focus on long-term returns. These businesses are suitable for those seeking a solid and increasing portfolio.

Financial Analysis of the 4 Energy Sector Best Stocks to Buy and Hold

Chevron Corporation (CVX)

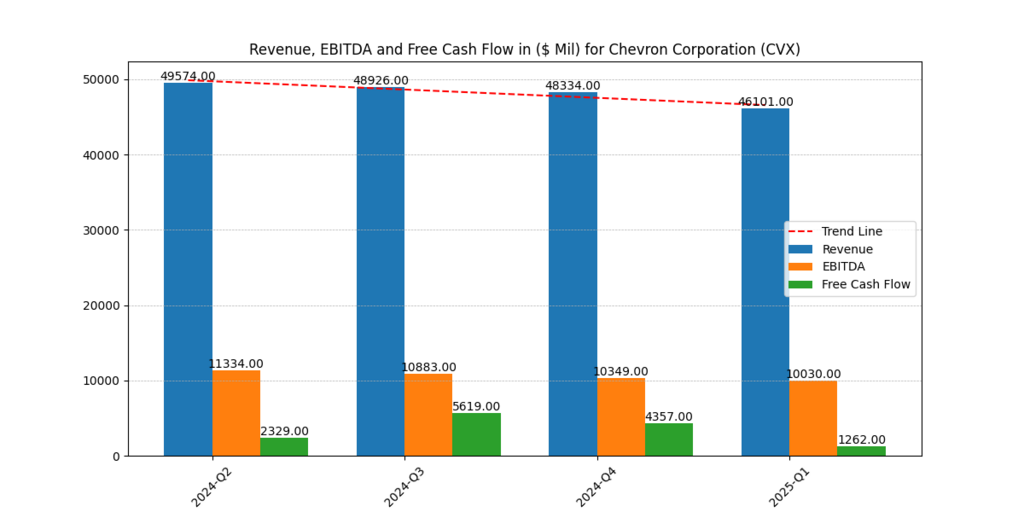

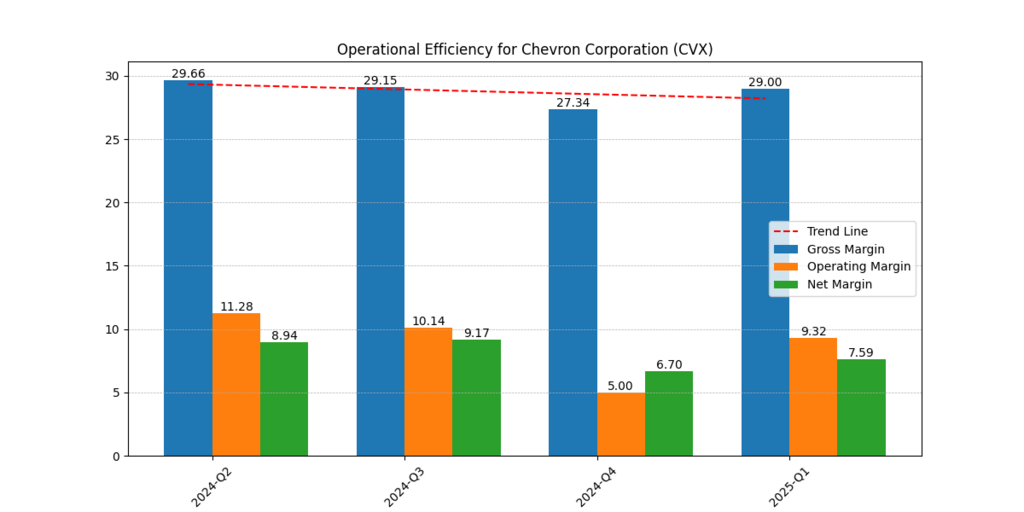

Chevron’s financial indicators have seen a slight decline, with total revenue dropping from $49.6 billion in Q2 2024 to $46.1 billion in Q1 2025. This decrease is attributed to decreased oil prices and global demand. EBITDA also dropped from $11.3 billion to $10 billion, indicating higher input expenses and lower refining profits. These changes are largely due to decreased oil prices and global demand.

Chevron’s free cash flow decreased from $5.6 billion in Q3 2024 to $1.26 billion in Q1 2025, possibly due to increased reinvestment in assets, dividends, and buybacks. Short-term cash flow may be impacted by low-emission projects and offshore LNG investments.

Despite decreased numbers, Chevron remains robust, maintaining control over spending and strong management, making it an attractive investment option. The company’s ability to manage expenses effectively contributes to its strength. [1]

Occidental Petroleum (OXY)

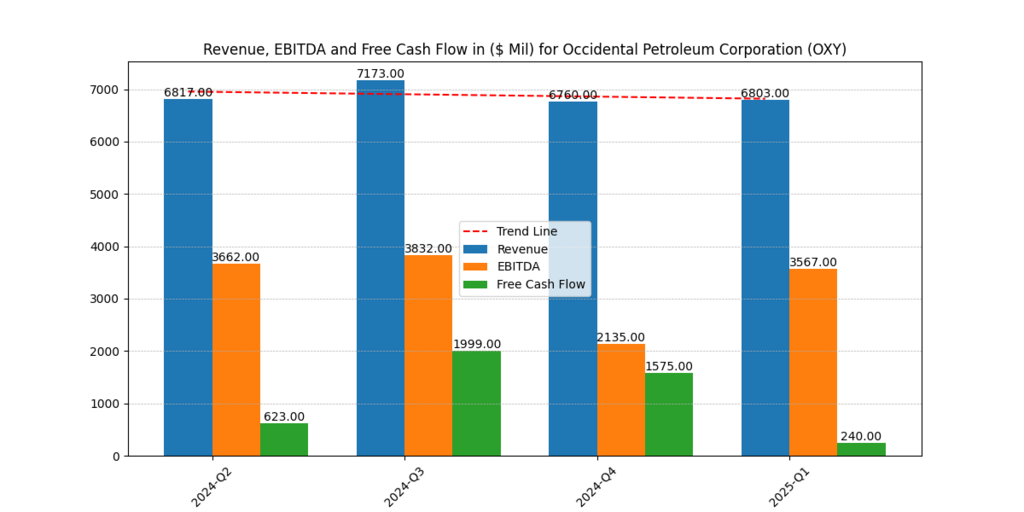

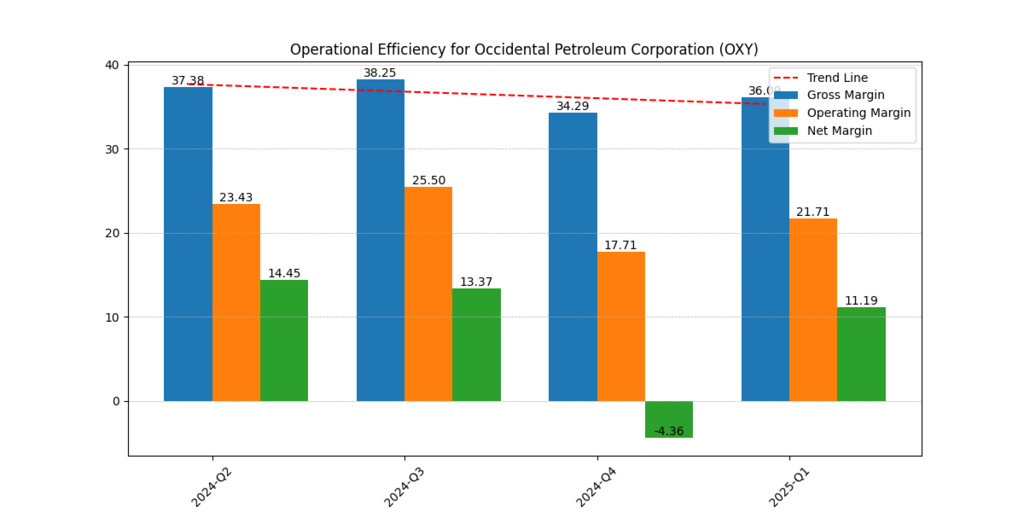

Occidental Petroleum has consistently seen a rise in earnings over the past few years, largely due to high oil prices and reduced costs. The company’s focus on the Permian Basin allows it to generate profits despite commodity price fluctuations. However, OXY’s significant investment in carbon capture and clean energy projects, such as their DAC projects, may have led to a decrease in free cash flow. The detailed analysis of OXY after Q1 2025 results.

OXY, despite generating profits from fossil fuels, plans to gradually transition to renewable energy sources. The company’s increased cash flow and debt reduction have positively impacted its balance sheet, boosting investor confidence.

Berkshire Hathaway’s involvement further boosts the optimistic outlook. OXY is a great investment for future-focused energy investors and those seeking value. The company’s earnings come from oil and creative projects, making it a suitable choice for investors. The company’s future-focused energy pick and value-added approach make it a promising investment.

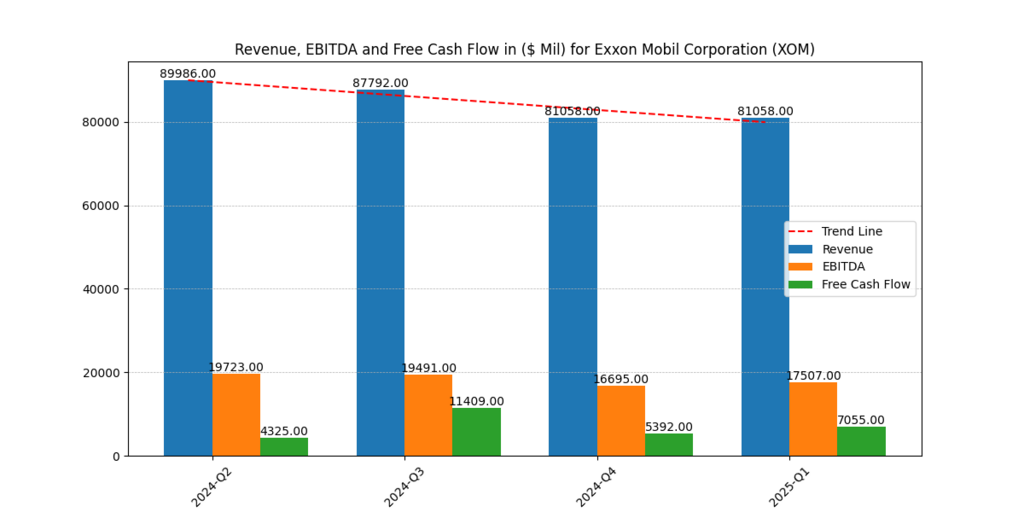

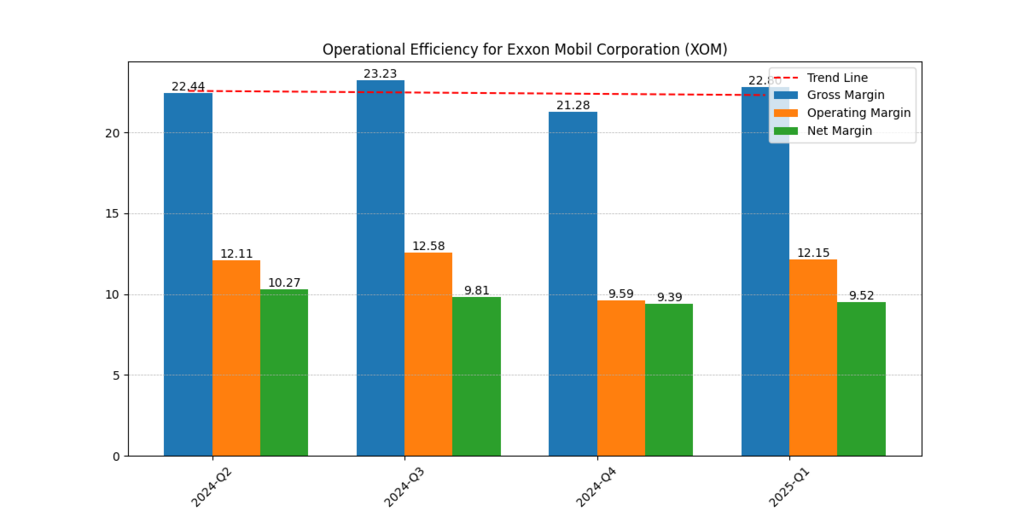

ExxonMobil (XOM)

ExxonMobil’s financial history is strong, despite not releasing quarterly figures. The company’s vertical integration allows it to offset challenges in its chemical and downstream sectors. Despite fluctuating oil prices, ExxonMobil maintains strong cash flow through efficient operations, commercial activities, and careful spending.

Recently, Exxon has increased its investment in carbon capture, hydrogen, and biofuels projects, demonstrating its ability to maintain strong cash flow despite fluctuations in oil prices.

Exxon, despite having significant capital, aims to ensure long-term sustainability and compliance with European and North American regulations. Profit generation has been made easier due to successful advances in Guyana and Permian, as well as cost-cutting measures during restructuring.

Shareholders prefer Exxon due to regular dividends and buybacks. NetZero, a top investment in the energy industry, is a good choice due to its outstanding performance and potential to support long-term growth.

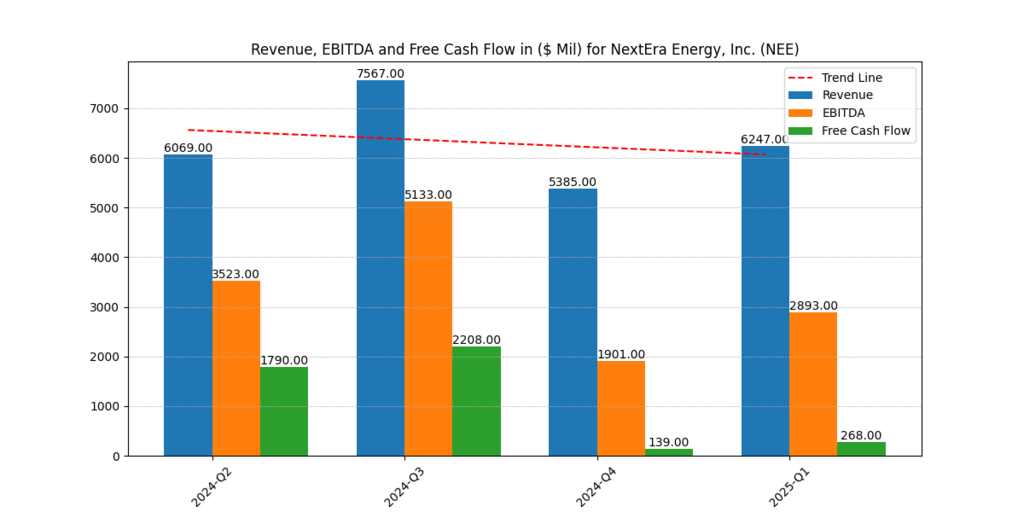

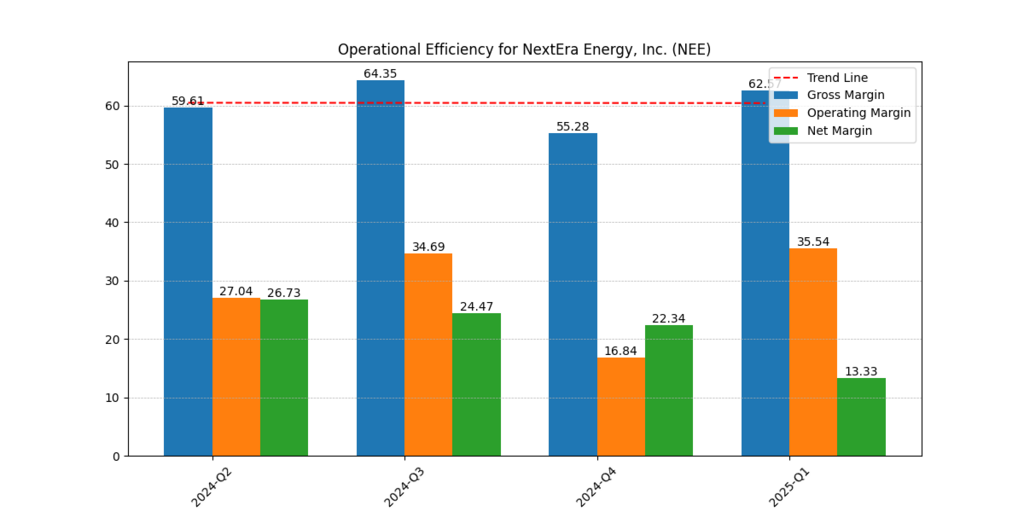

NextEra Energy (NEE)

NextEra Energy, a reliable utility business, has merged with renewable energy, resulting in increased earnings for Apple. This success can be attributed to factors such as regulatory changes and rising interest rates.

Apple’s success in recent years is attributed to increase solar and wind energy investments, while other companies like Apple have seen success due to PPAs and increased costs for renewable energy projects.

NEE is making rapid investments, anticipating growth due to government push and energy sector revolution. With a high credit rating, it can pay lower interest rates for its initiatives. NEE stands out for its consistent dividend increase and forward-thinking approach to the industry.

Among renewable energy stocks, NEE is distinctive and powerful, making it a top choice for portfolios. Its forward-thinking approach and consistent dividend increase make it a strong contender in the renewable energy sector. [2]

Recent AI-related Projects

| Company | Project Name / Initiative | Description | Year |

| Occidental Petroleum (OXY) | AI Center of Excellence & Seismic Data Integration | Established an AI Center of Excellence to align company-wide AI initiatives. Utilized AI for predictive maintenance, reservoir management, and environmental monitoring. Completed Algeria’s largest onshore seismic data acquisition to enhance AI-driven reservoir characterization. | 2024 |

| Chevron (CVX) | AI-Equipped Drones & Data Center Power Solutions | Deployed AI-powered drones for facility inspections in Texas and Colorado, enhancing maintenance efficiency. Partnered with GE Vernova and Engine No. 1 to build natural gas power plants aimed at supplying energy to AI data centers, addressing the growing electricity demand from AI technologies. | 2024 |

| ExxonMobil (XOM) | AI Technology Roadmaps & ReviewAI Collaboration | Developed AI-driven technology roadmaps to optimize oil and gas data analysis. Collaborated with CoLab Software on “ReviewAI,” an AI tool enhancing engineering design reviews, reducing cycle times, and improving decision-making processes on offshore platforms. | 2024 |

| NextEra Energy (NEE) | AI Education Initiatives | Hosted AI workshops for high school students in partnership with the Mark Cuban Foundation, aiming to foster interest and education in AI technologies among the younger generation. | 2023 |

Bottom Line

The energy industry is crucial for global economies, making investments in this sector beneficial for portfolio growth. Occidental Petroleum, Chevron, ExxonMobil, and NextEra Energy are considered the best stocks to purchase and hold for a long time.

Successful strategies for the future can be inferred from Chevron and ExxonMobil’s financial stability, Occidental’s progress in seismic data and carbon capture, and NextEra’s success in clean energy. These companies have demonstrated success in various sectors.

Investors should consider investing in companies that offer consistent gains due to the significant changes in the energy market. These innovative businesses, despite not being risk-free, are well-positioned for future expansion. Strengthening your investment portfolio can be achieved by investing in multiple energy companies.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.