In the current turbulent oil market, it is essential to determine the fundamentally stable oil companies to come out with a healthy and growth-based investment portfolio. As the world faces growing energy demand, volatility of the supply chain, and the ongoing energy transition, investors are shifting to feature players in the oil sector, as they experience a need to protect themselves when the market turns sour, but experience an upside in case energy demand grows.

The three top stocks that never cease to come up when one is interested in good oil stocks to buy include: EOG Resources (EOG), Occidental Petroleum (OXY), and Exxon Mobil Corporation (XOM). Not only have these companies been able to earn substantial revenues and profits, but they have also been able to exhibit efficiency in their operations, management of debt, and generation of free cash flow (Financial Times, 2024a).

EOG Resources (EOG)

EOG has been a viable competitor in good oil stocks to buy as it has demonstrated robust sales and operational effectiveness even when faced with changes in the market.

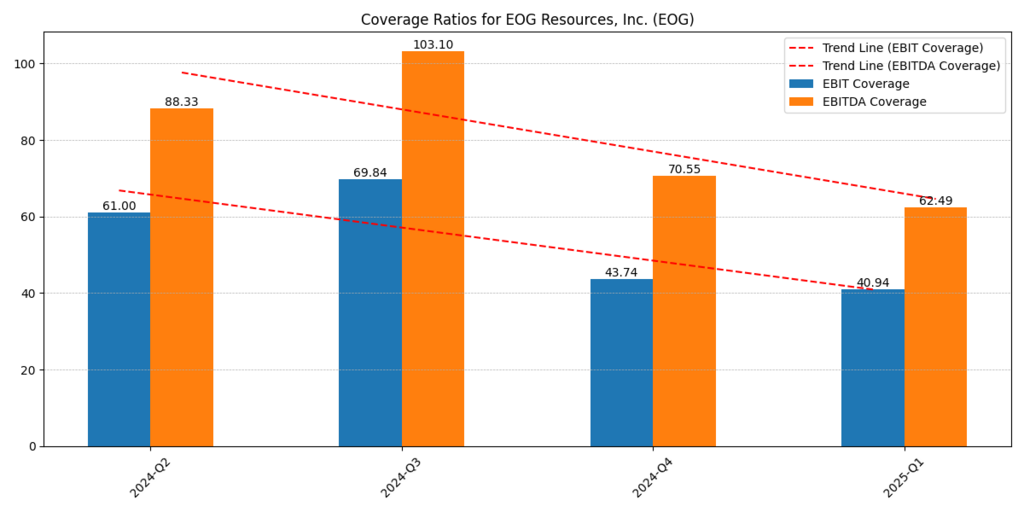

EOG Resources is a company that has become so well-known because of its operational excellence and cost-efficient approach to producing shale oil that it can be considered one of the best oil stocks to invest in. In Q3 2024, EOG has an EBITDA coverage ratio of 103.10, whereas the EBIT coverage ratio amounts to 69.84.

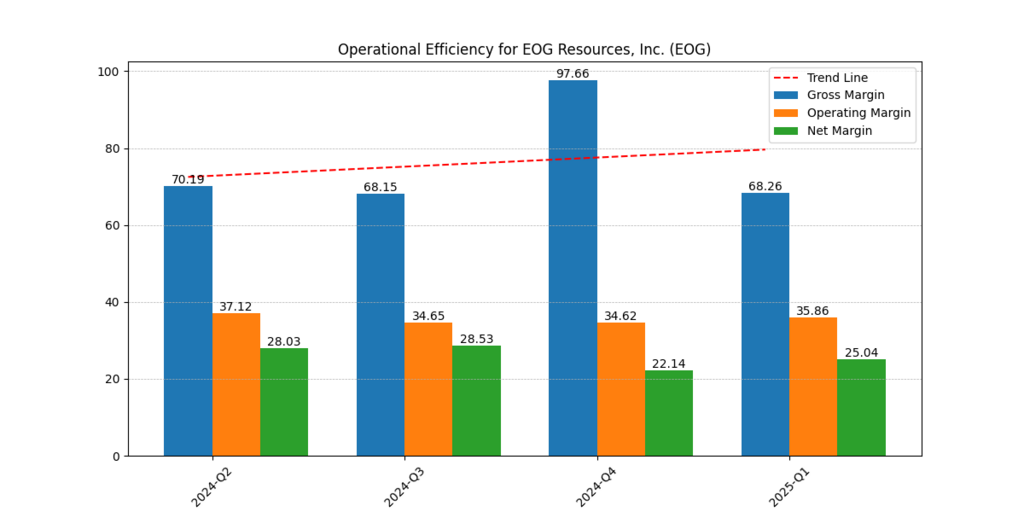

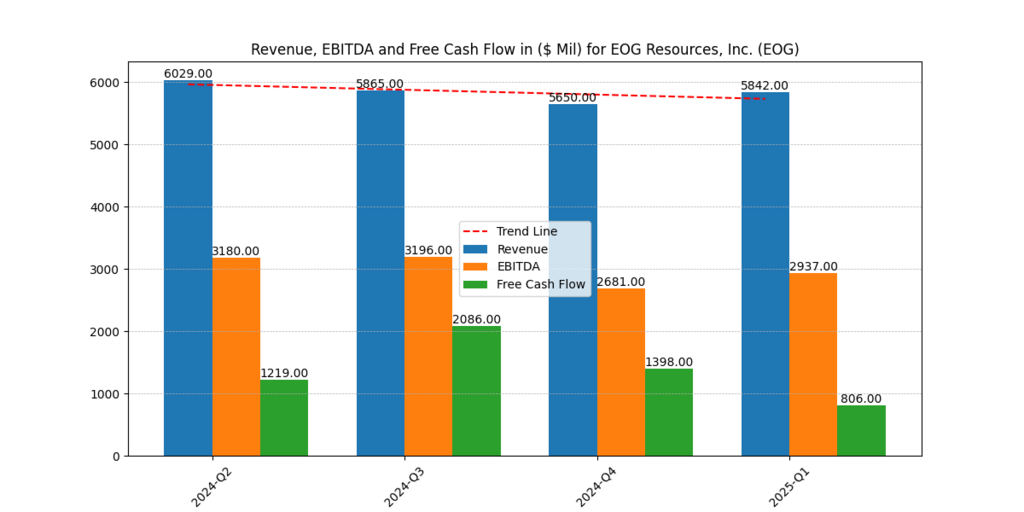

In Q1 2025, there was a slight increase in revenue to 5.84 billion in comparison with Q4 2024, which was 5.65 billion. Yet, the remarkable reduction in free cash flow to only 806 million dollars indicates a weaker cash flow, so reinvestment becomes larger or pressure exists on the costs (EOG Financials, 2025). Nonetheless, its gross margins were also strong with a key high of 97.66 in Q4 2024.

Figure 2: Operational Efficiency for EOG Resources, Inc.

Figure 3: Revenue, EBITDA and Free Cash Flow for EOG Resources, Inc.

Occidental Petroleum (OXY)

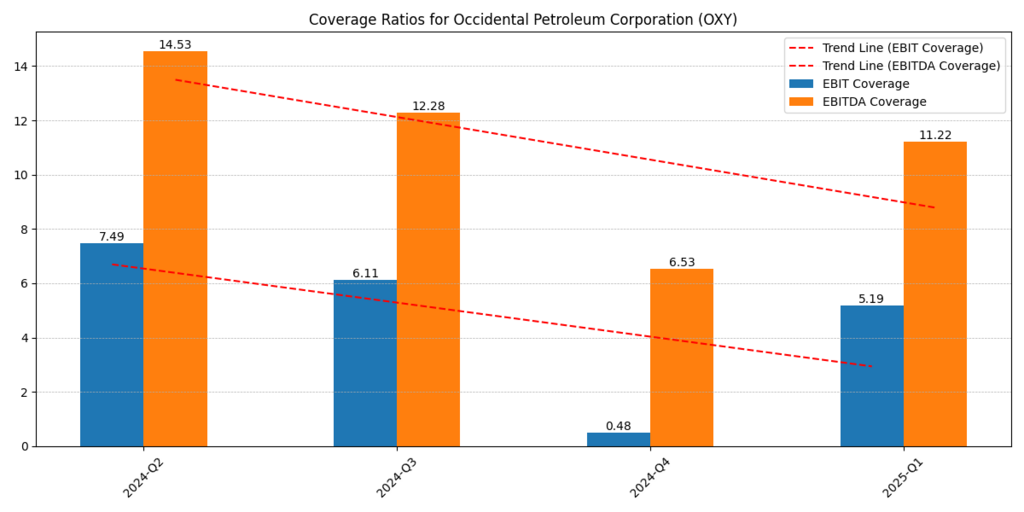

The Occidental Petroleum Corporation, in support of strategic steps and robust operational enhancements, can also be discussed as one of the fine oil stocks to purchase. EBITDA coverage by OXY bounced back to 11.22 in the first quarter of 2025 to reduce after a low of 6.53 in the previous quarter (Q4 2024). The EBIT coverage also improved to 5.19, demonstrating higher earnings and more available capability of debt services.

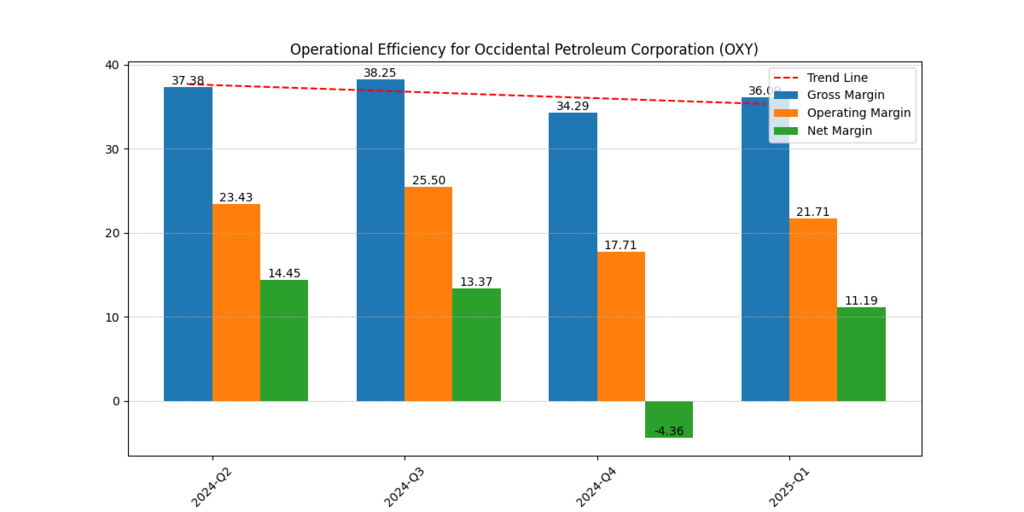

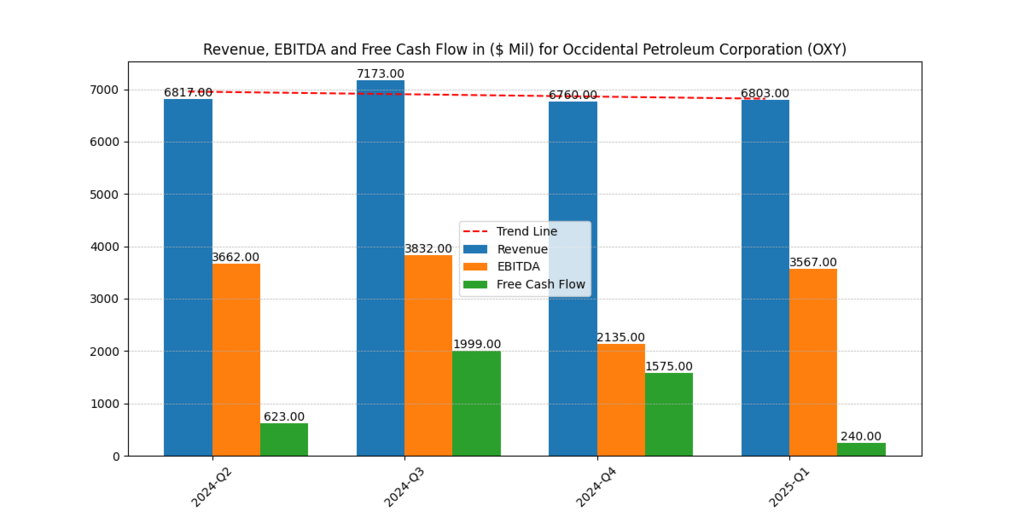

Its Q1 2025 revenue fell slightly to 6.8 billion, compared to 7.17 billion the quarter before, yet free cash flow held reasonably firm, climbing to 1.57 billion in Q4, compared to 240 million in Q3. Although the net margin had turned negative in Q4 2024 (-4.36), it only recovered to 11.19 in Q1 2025. This performance highlights the fact that OXY survived scheduled slumps without going bankrupt (Financial Times, 2024c).

OXY is also considered one of the good oil stocks to buy because it has a better margin profile and strong EBITDA coverage. The company has stable free cash flow despite variability in EBIT.

Figure 4: Coverage Ratios for Occidental Petroleum Corporation

Figure 6: Revenue, EBITDA and Free Cash Flow for Occidental Petroleum Corporation

Exxon Mobil Corporation (XOM)

XOM is considered one of the biggest integrated oil industries in the world, which makes it one of the best good oil stocks to buy. It is also very consistent in terms of revenue, strong free cash flow, and great EBITDA margin.

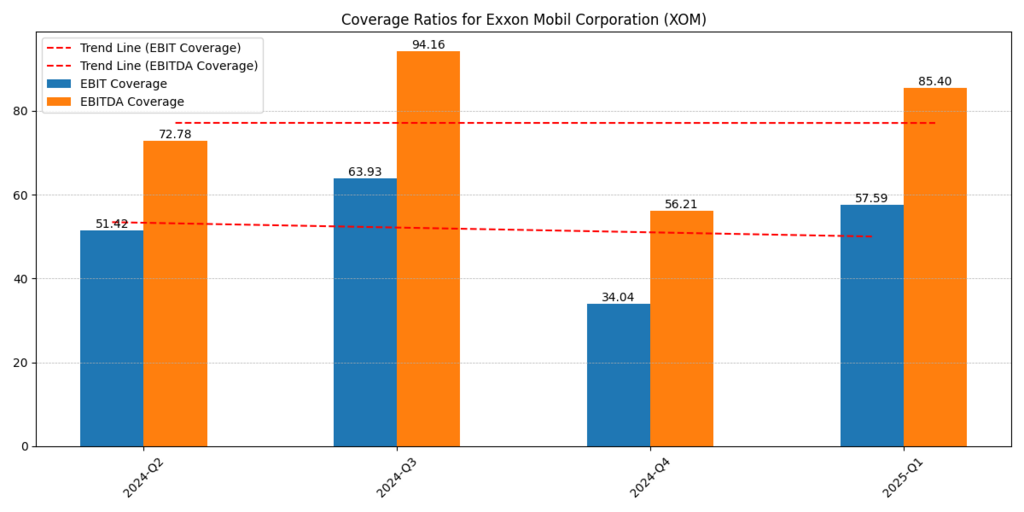

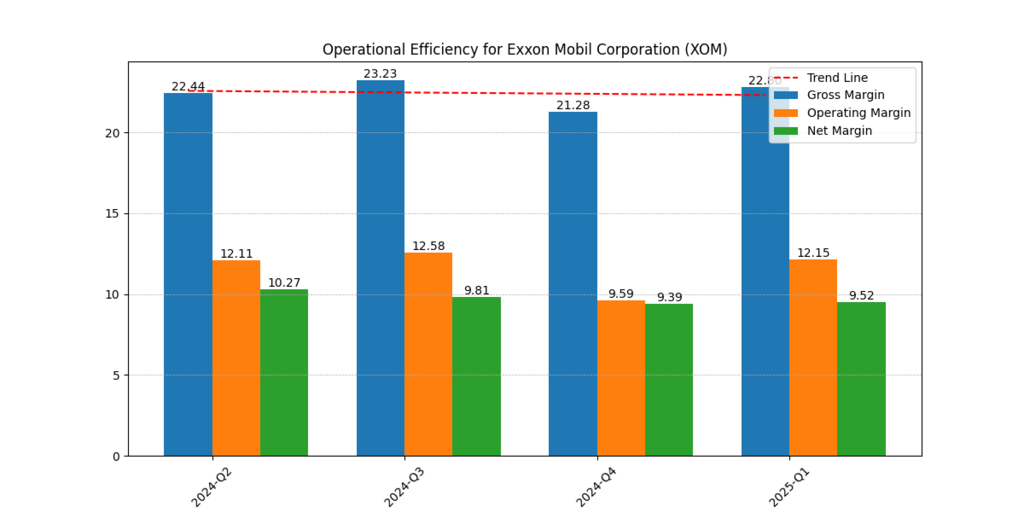

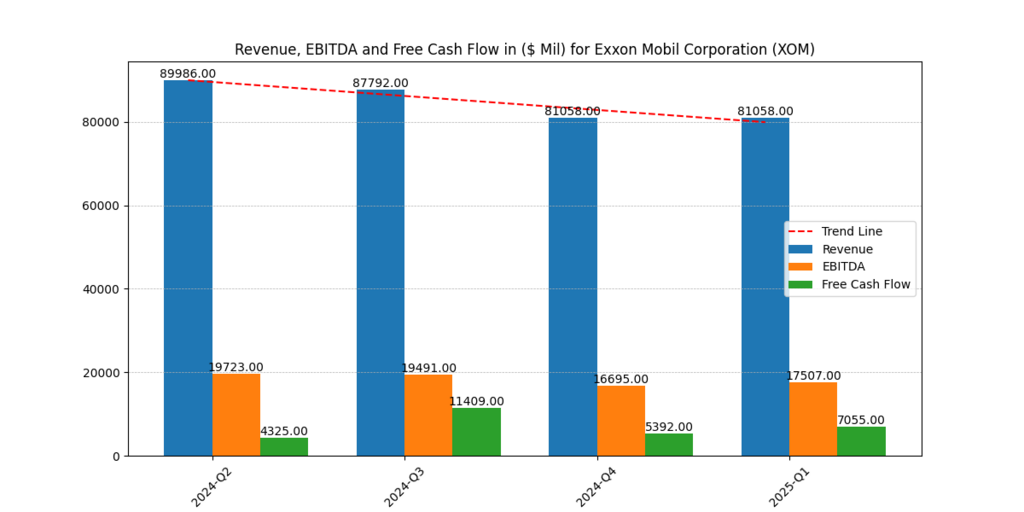

The largest of the three, the Exxon Mobil Corporation, still demonstrates impressive consistency. Being a diversified oil giant, XOM has enormous scale benefits and enduring strength. Its sales were on the positive side at 81.06 billion in Q1 2025 after a decline in Q2 2024 of 89.98 billion. Its EBITDA margin remained persistently higher than 17 billion dollars quarterly, and free cash flow improved tremendously to 7.05 billion dollars in Q1 2025 (Financial Times, 2024a).

Figure 7: Coverage Ratios for Exxon Mobil Corporation

Figure 8: Operational Efficiency for Exxon Mobil Corporation

Figure 9: Revenue, EBITDA, and Free Cash Flow for Exxon Mobil Corporation

Conclusion

To sum up, EOG Resources, Occidental Petroleum, and Exxon Mobil Corporation are the leading energy investments that an investor should consider when seeking to outperform in terms of purchasing good oil stocks in 2025. All of these businesses have a high capacity to produce sustainable cash flow, have good debt management, and good margins in all economic cycles. Don’t forget to read: The 4 Energy Sector Best Stocks to Buy and Hold in 2025.

EOG can be preferred due to operational flexibility and world-class margins. The ability of OXY to resurface has been supported through solid cash flow and debt discipline. XOM is diversified in its sources of revenue and international presence, which also provides stability and scalability.

Comparison Table: Key Financial Metrics

The table below gives an overview of the most important financial indicators of the three good oil stocks to buy: EOG Resources (EOG), Occidental Petroleum (OXY), and Exxon Mobil (XOM). The indicators give their levels of efficiency, profitability, and financial health as of the last returned data.

| Metric | EOG | OXY | XOM |

| Asset Turnover | 0.50 | 0.32 | 0.75 |

| Return on Sales (%) | 25.99 | 11.27 | 9.76 |

| ROA (%) | 12.93 | 3.65 | 7.34 |

| Financial Leverage | 1.59 | 3.22 | 1.72 |

| ROE (%) | 20.59 | 11.75 | 12.63 |

| ROTC (%) | 22.98 | 9.17 | 15.97 |

| ROC (%) | 11.50 | 2.64 | 5.19 |

| P/E Ratio | 11.45 | 18.36 | 15.01 |

| Enterprise Value ($M) | 72,619.52 | 70,617.43 | 525,359.17 |

| EBITDA ($M) | 11,994.00 | 13,196.00 | 73,416.00 |

| EV/EBITDA | 6.05 | 5.35 | 7.16 |

| Equity Ratio (%) | 85.36 | 57.46 | 87.78 |

| FCFE ($M) | 18,501 | 23,303 | 78,355 |

| FCFF ($M) | 16,510 | 19,382 | 93,043 |

| Gross Margin (%) | 75.84 | 36.53 | 22.45 |

| Operating Margin (%) | 35.58 | 22.14 | 11.64 |

| Net Margin (%) | 25.99 | 11.27 | 9.76 |

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.