Introduction

In the fast-paced world of technology investment, identifying the best tech stocks to buy right now can pave the way for significant financial growth. Whether you’re an experienced investor or just starting, understanding which tech companies are poised for success is crucial. This article delves into three leading tech giants—ASML Holding NV, Nvidia Corp, and Alphabet Inc—that are not only key players in their respective domains but also present promising opportunities for investors. With impressive financial metrics and strategic initiatives, these companies stand out as some of the best tech stocks to consider for your investment portfolio.

ASML Holding NV (ASML)

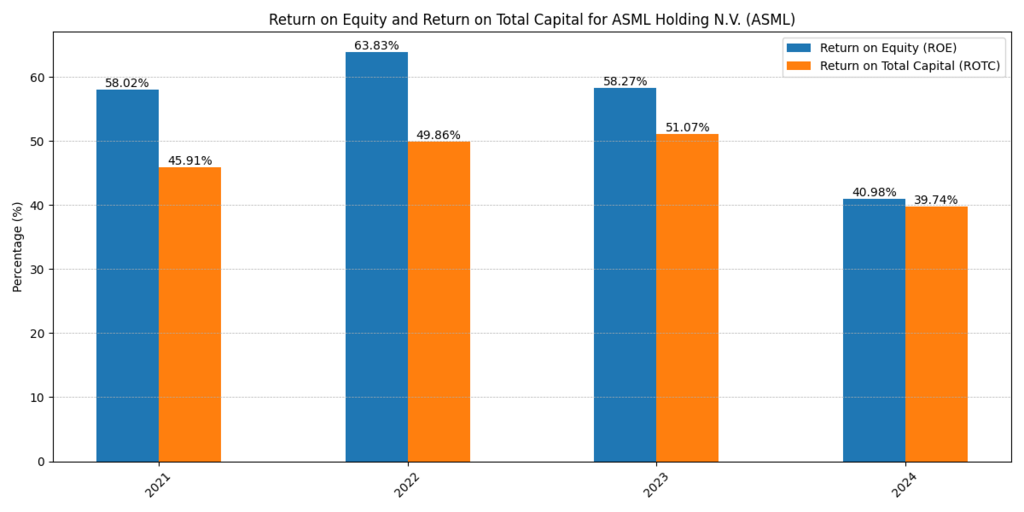

ASML (Advanced Semiconductor Materials Lithography) is a pivotal equipment maker for chip manufacturing companies worldwide. The company’s biggest customers include TSMC, Nvidia, Intel, and Samsung, all of whom rely on ASML to produce the most efficient and high-end chips. Recently, ASML reported a surge in orders that reached $7.1 billion, a significant $3.1 billion increase from analysts’ expectations. The company holds a strong footprint in lithographic equipment, boasting a return on equity of around 41% and a return on total capital of 40%.

The 12 analysts offering 12-month price targets for ASML Holding NV (ADR) have set a median target of 906.12, with a high estimate of 1,110.23 and a low estimate of 700.45, solidifying its position as one of the best tech stocks to buy right now.

Nvidia Corp (NVDA)

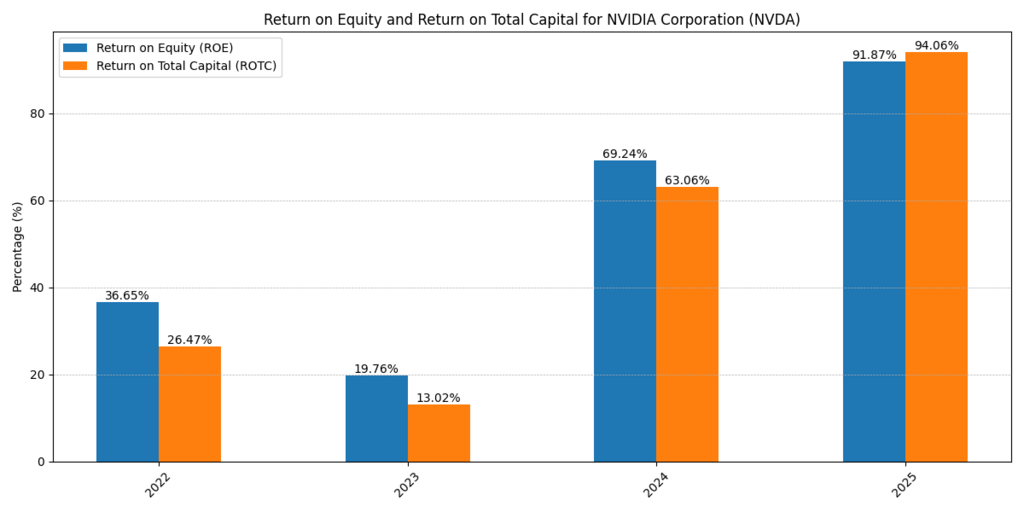

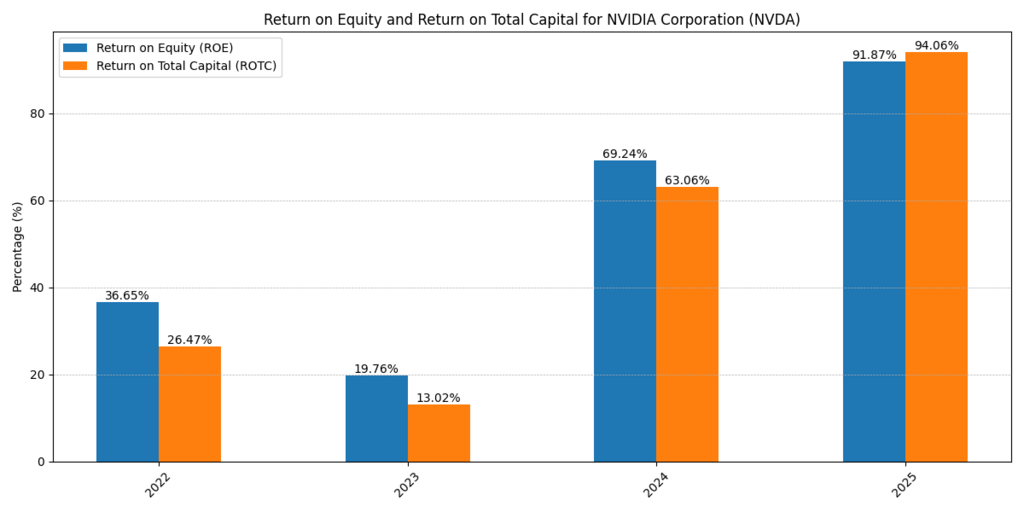

Nvidia is at the forefront of the AI revolution, capitalizing on high margins due to its market dominance in producing high-end GPUs for data centers globally. Nvidia’s new Vera Rubin AI chips can be clustered into millions of units to train larger AI models, serving a broader audience. The capital expenditures by major tech companies, including Meta, Alphabet, and Microsoft, will further boost Nvidia’s business, translating into higher revenues and margins.

The 52 analysts offering 12-month price targets for Nvidia Corp have a median target of 175.00, with a high estimate of 235.92 and a low estimate of 120.00. Nvidia’s innovative technology and strong financial metrics make it one of the best tech stocks to buy right now.

Alphabet Inc. (GOOGL)

As the parent company of Google, Alphabet is a conglomerate with a robust advertising business, along with ventures like YouTube, Waze, Fitbit, and the self-driving car project, Waymo. Alphabet boasts a gross margin of over 55% and a net margin exceeding 26%. The company posted an EPS of $8.05, with free cash flow increasing from $17.5 billion to $24.8 billion. Alphabet is financially sound with debt constituting around 9% of total capital. If you are interested in other Best Stocks to Buy during the AI Boom, find them Here!

With plans to spend $75 billion in 2025 on servers and data centers, a 50% increase from 2024, Alphabet’s financial strength and strategic AI endeavors mark it as one of the best tech stocks to buy right now. The 50 analysts offering 12-month price targets for Alphabet have set a median target of 218.81, with a high estimate of 240.00 and a low estimate of 167.00.

Conclusion

In conclusion, ASML Holding NV, Nvidia Corp, and Alphabet Inc. exemplify strength and growth potential in the tech sector, making them some of the best tech stocks to buy right now. ASML’s dominance in semiconductor lithography, Nvidia’s pioneering advances in AI technology, and Alphabet’s robust advertising capabilities and innovative ventures highlight their strategic market positions. By focusing on these industry leaders, investors can tap into the future of technology while potentially reaping substantial returns. With solid financial performance and visionary leadership, these companies are well-equipped to navigate and prosper in the ever-evolving technological landscape.

Disclaimer:

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.