Introduction

Discover the 3 best growth stocks to buy now amid easing tariffs: Nvidia, TSMC, and Alphabet. Discover how these tech giants are set to profit from the changing trade policies and global hunger for AI and semiconductor invention.

With the tensions of global trade starting to ease, investors are now focusing towards the high-potentials in the tech sector. The reversal of essential export prohibitions, especially those on artificial intelligence (AI) chips, will trigger a new wave of prosperity for prominent players in the semiconductor and technology industry.

Within these changing circumstances, now is the perfect opportunity to highlight the best stocks to buy for growth right now. Firms that are strongly integrated in AI, cloud computing, and digital infrastructure are projected to outperform, particularly those that would capitalize from relaxed trade barriers and growing worldwide demand.

In this article, three super growth stocks – Nvidia, TSMC and-Alphabet — are in the limelight as positioned to benefit from this emerging terrain.

Nvidia Corp. (NASDAQ: NVDA)

- Sector: Semiconductors / AI Hardware

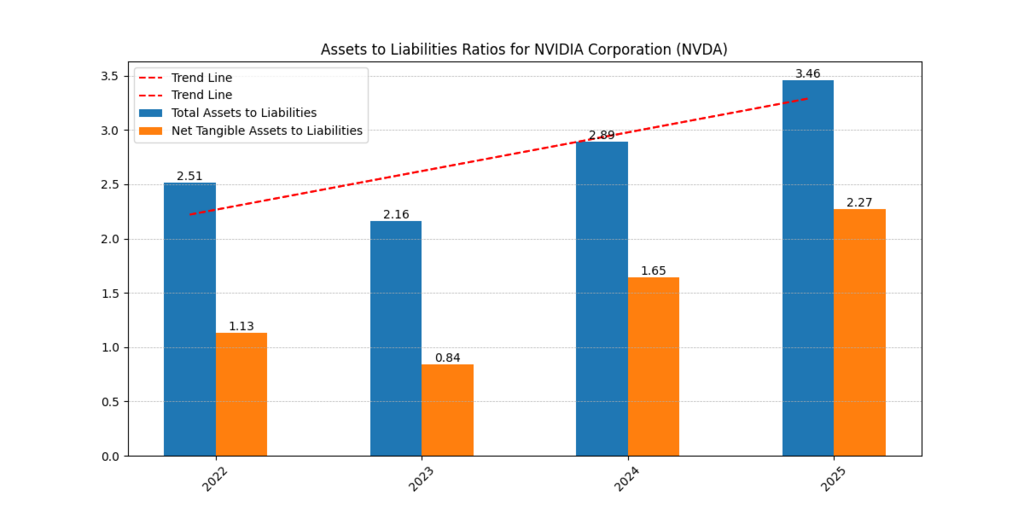

Nvidia has established itself as a milestone in the AI revolution. Having its graphics processing units (GPUs) anchor the process of AI model training and data center operations, the company has seen exponential demand for its high-performance chips.

Recently, Nvidia was about to encounter new barriers owing to a Biden-era order aimed at restricting the exportation of AI chips to a large number of nations. Nevertheless, the current U.S. administration is canceling this regulation, making it easier for Nvidia’s overseas sales. The revoked rule that was supposed to regulate the diffusion of AI chips was going to limit the capability of Nvidia to send hardware to over 100 middle-tier countries.

It was a positive response from the market to the news. Nvidia’s shares skyrocketed 3% in a day, indicating investor confidence. As the global AI infrastructure buildouts of the past three years are accelerating and the regulatory pressure is being faded, Nvidia is poised for the further growth. This makes it one of the best growth stocks to buy today for investors who want exposure to AI-powered innovation. Another guide here on The 5 Best AI Stocks to Buy Now in 2025: A Comparison.

Taiwan Semiconductor Manufacturing Company (NYSE: TSM)

- Sector: Semiconductors / Foundry

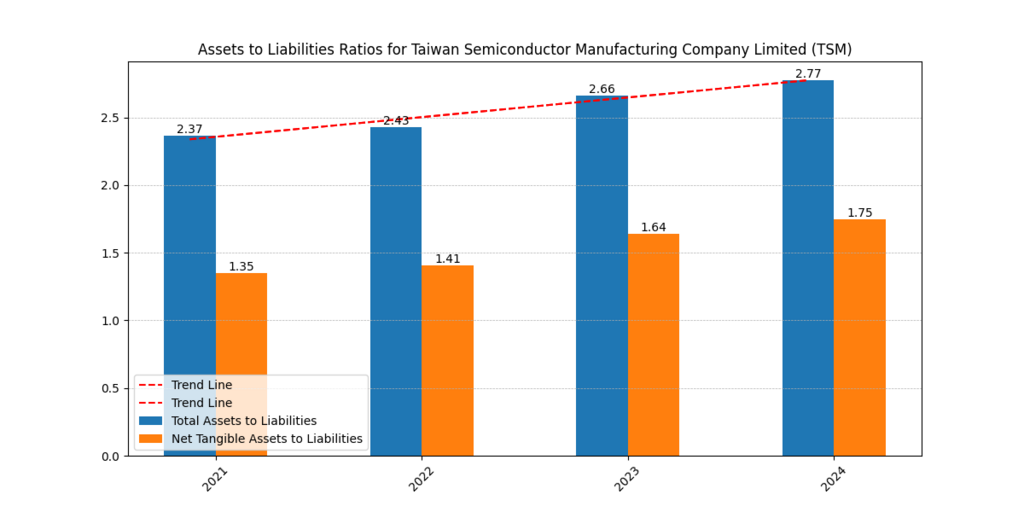

TSMC is the world’s largest, and most advanced, chip contract manufacturer. It is crucial for the global tech supply-chain as it makes chips for Apple, AMD, Nvidia, and even for automakers.

With export controls loosening and AI demand exploding, firms such as Nvidia and AMD will most likely increase their business with TSMC. This is a good tailwind for the foundry giant. TSMC has also been diversifying the production footprint, wherein sites have been growing in the U.S. and Japan – a vital tactic to reduce geopolitical risk.

Although the company has historically been based on efficiency and manufacturing excellence, it is now the key enabler of AI, 5G, and high-performance computing. Its strength in sub-5nm process technology is what differentiates them from rivals, and one that keeps them commanding a lion’s share of the next generation chip production contracts.

Given that the AI boom is only in its early innings, TSMC is a long-term compounder and one of the best growth stocks to buy now, particularly for investors who want exposure to AI hardware value chain indirectly. [1]

Alphabet Inc. (NASDAQ: GOOGL)

- Sector: Technology / Digital Infrastructure / AI

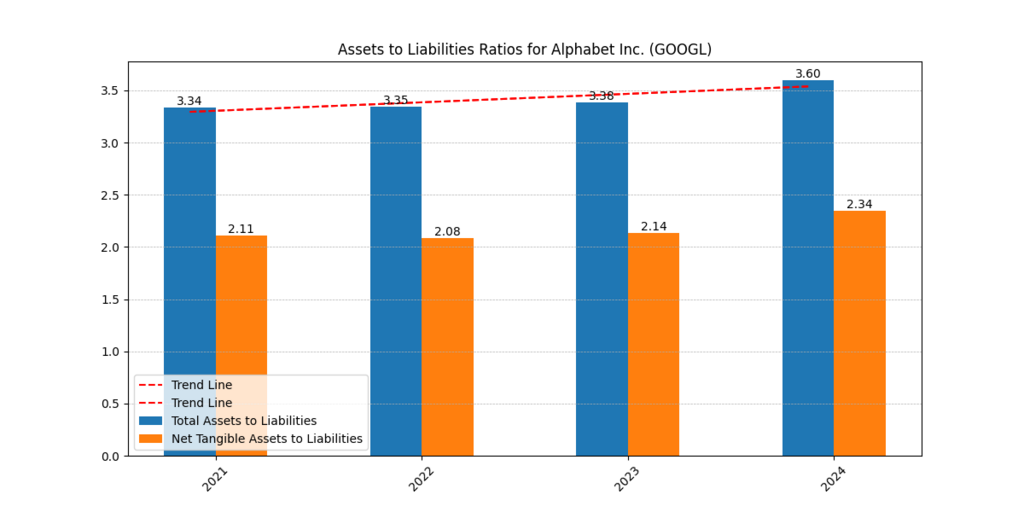

Alphabet, which is the parent company to Google, is still a pillar in the digital economy. Although its central business remains strong and performing well in cash flow (search, YouTube, and ads), the company is increasingly being aggressive with trying out things in artificial intelligence and cloud infrastructure.

A remarkable long-term measure of confidence on the part of Alphabet is its recent 40-year bond issuance – its first debt sale in five years. This involved sales of €6.75 billion euro bonds which shows the diversification of the company’s financial base and multi-decade investments in Artificial intelligence and cloud data centers.

Alphabet’s expansion of Euro denominated debt is in line with the company’s overseas operations particularly as rates in Europe are much lower than their U.S counterparts. The ‘reverse Yankee’ bond move not only marks maturity of staying power, but also provides money to fund Alphabet’s ongoing expansion into AI infrastructure, which is among the most capital-intensive, high-potential sectors in tech.

With a strong balance sheet, Alphabet is pouring resources to establish itself as the long-term dominant player for cloud AI services, autonomous driving (Waymo), and digital advertising, one of the so-called “Magnificent Seven”. It’s not just the tech giant – it’s a global digital utility. For investors who want to have both growth and financial strength, it is clear that Alphabet is one of the best growth stocks to buy now. [2]

Recent AI Projects

| Company | Most Successful AI Project | Description |

| Nvidia | Nvidia DGX Systems | Purpose-built supercomputers for AI research and enterprise use, DGX systems power cutting-edge innovations in generative AI, robotics, and autonomous systems. Widely adopted by OpenAI, Meta, and Microsoft. |

| TSMC | AI-Driven Smart Manufacturing | TSMC uses AI for predictive maintenance, yield optimization, and defect detection in semiconductor manufacturing, dramatically increasing efficiency and chip quality. |

| Alphabet | Google DeepMind (AlphaFold) | AlphaFold, developed by DeepMind, solved the 50-year-old protein folding problem. It’s considered a breakthrough in biology, with huge implications for drug discovery and healthcare. |

Conclusion

The relaxation of tariffs and restrictions on exports is diminishing the key limiting factors to the powerhouses of technology. Nvidia, TSMC, and Alphabet lead this rebound with increased use of AI, particularly enhanced demand for more sophisticated chips, and global infrastructures.

These companies all represent a different level of the digital ecosystems – from chip design and manufacturing up to AI-powered services and cloud platforms. With growth prospects being strengthened by positive policy changes, there will be no better time to consider these giants as part of a future-focused investment strategy.

These are the best growth stocks to buy for long-term value and innovation-led performance if you are constructing a tech-oriented growth portfolio.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.