The AI Penny Stocks that are worth considering as Artificial Intelligence (AI) is no longer a future trend; it is a tool that drives the digital transformation of almost all industries worldwide. Whether it is healthcare, transportation, defense, logistics, or retail, AI technologies are becoming increasingly effective in terms of decision-making, automating processes, and unlocking new possibilities for efficiency. With this revolution taking shape, all investors are in search of prospects in artificial intelligence (AI) stocks. Most are already interested in big-cap tech leaders, but an increasingly large number of intelligent investors are paying attention to AI penny stocks instead: smaller, less expensive stocks of early-stage companies in the game-changing business of AI.

These AI penny stocks can be riskier because they have limited resources and they have shorter histories of work, but they have disproportionate upside potential. To investors who are open to increased volatility, they provide early exposure to companies that may become tomorrow’s market leaders. Three of these stocks have become interesting in 2025: SoundHound AI, Inc. (SOUN), which is a voice AI expert; BigBear.ai Holdings Inc. (BBAI), a company concentrated in defense and predictive analytics; and Guardforce AI Co., Limited (GFAI), a security business that is based on robotics and AI.

SoundHound AI, Inc. (SOUN)

SoundHound AI has already advanced its voice and conversational AI technology significantly, which makes it a potential player in the long term. On the one hand, the company is not profitable; on the other hand, the company has demonstrated impressive changes in revenue and assets, as compared to liabilities.

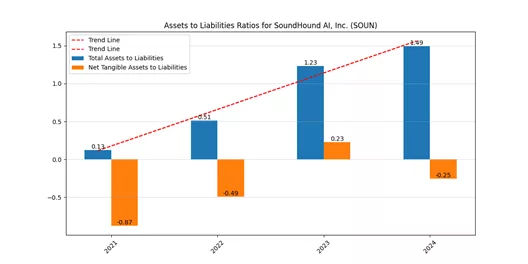

The chart below shows that the Assets to Liabilities ratio rose consistently between 2021 and 2024, elevating from 0.13 to 1.49, indicative of increased financial stability in SOUN.

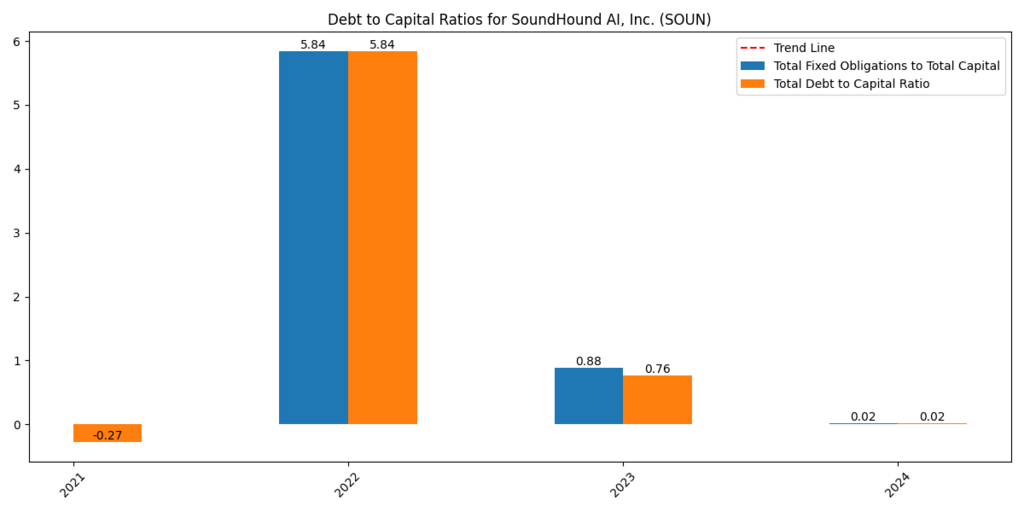

Nevertheless, the Debt-to-Capital ratio of SOUN has been extremely volatile. Having hit a dramatic surge to 5.84 in 2022, the company also sharpened its leverage, reducing it to 0.02 by 2024, which pointed to a strategic direction toward financial sustainability.

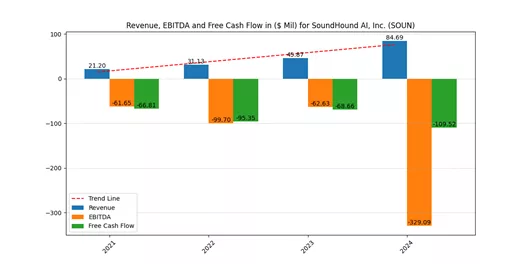

Regarding operations, the revenue increased to $84.69 million in 2024 compared to 2021, when that number was $21.2 million. Nevertheless, its EBITDA turned bad and reached a low of -$329.09 million in 2024, and Free Cash Flow was also very negative, casting doubts on the burn rate.

BigBear.ai Holdings, Inc. (BBAI)

BigBear.ai is a defense and logistics AI-driven decision intelligence provider. In spite of the fact that BBAI has been operating at a loss, it has had rather consistent revenues and has begun to demonstrate small improvements in its asset structure.

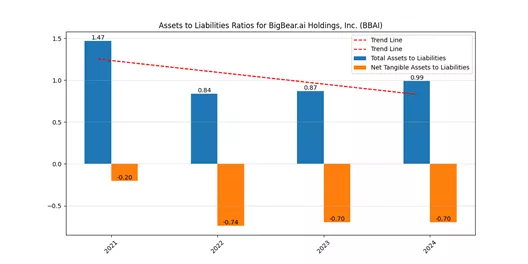

Based on the chart, the ratio of Assets to Liabilities decreased in the timeframe between 2021 (1.47) and 2024 (0.99). It signifies a growing financial risk.

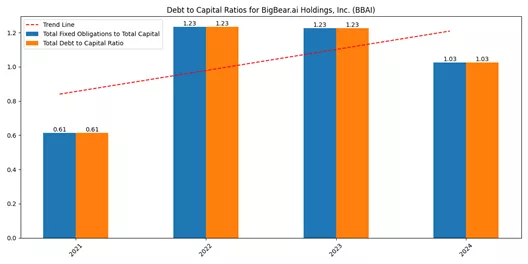

Meanwhile, Debt to Capital ratios increase to 1.23 in 2022-2023 and slightly decrease to 1.03 in 2024, which indicates high leverage.

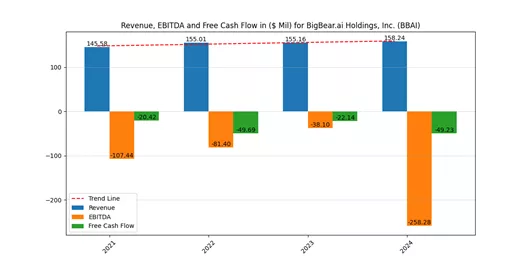

The revenue increased slightly by 18.46 percent in 2021 to 2024 of 145.58 million to 158.24 million. Nevertheless, EBITDA deficits jumped seriously to -258.28 million in 2024. Nevertheless, the stable inflow of revenue shows that customers are retained, at least with government contracts (MarketWatch, 2025).

As an investor, it is worth noting that although BBAI is speculative, the fact that it is strategically positioning itself in the defense industry, which is more likely to have AI requirements, will make it one of the less volatile AI penny stocks that will have possibilities of turning around. Check out our article on The 3 Best AI Stocks to Buy Right Now!

Guardforce AI Co., Limited (GFAI)

Guardforce AI is looking to benefit security and logistics businesses with robotics and AI capabilities, especially in Asian markets. Contrastingly, GFAI has recorded significant improvements in the balance sheet.

Between 2021 and 2024, Assets to Liabilities increased by more than triple to 3.52, portraying healthy asset coverage.

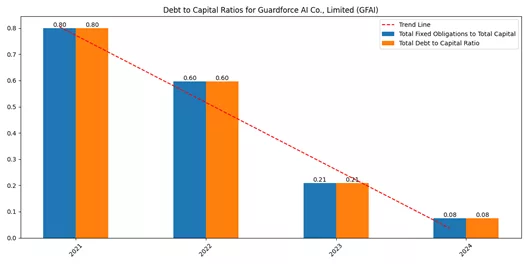

Its Debt to Capital ratio plunged to a net reduction ratio of 0.08 in 2024 compared to 0.80 in 2021, indicating a bankrupt basis in financial management and reliance on borrowed finances.

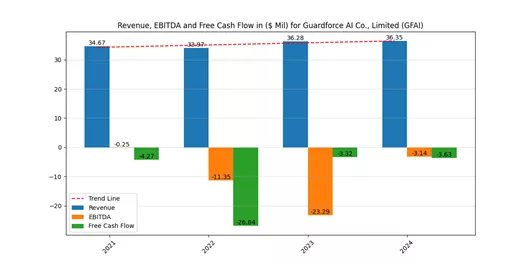

The revenue had been relatively constant at around $34 to $36 million a year, and the EBITDA losses had come down to $-3.14 million in 2024, compared with $-23.29 million in 2023. Free Cash Flow also rose significantly, indicating healthy activity in the operations.

Conclusion

Artificial intelligence is transforming the economic side of life, and the fascination with penny stocks in artificial intelligence is their opportunity to provide large-scale returns at minimal entry levels. Although highly speculative, these stocks provide market access to the AI boom without locking one into expensive blue-chip stocks.

After all, when seeking AI penny stocks in 2025, investors need to balance promise and risk. These firms have not yet managed to become profitable, yet each of them has its own path of growth and strengths within the sector. To individuals capable of accepting temporary dangers to gain long-term fortune, SOUN, BBAI, and GFAI present solid opportunities to enter the active AI market. Wise Research and timing, and an AI penny stock today can become an industry leader tomorrow.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.