Tesla stock forecast 2030: How the growth of EVs, artificial intelligence-intelligent self-driving, and energy storage might influence the long-term development of TSLA. Is Tesla still a smart buy? Tesla, Inc. (NASDAQ: TSLA) has proven to be one of the most disruptive companies in the 21st century. Outside the carmaker, Tesla is creating a future based on electric vehicles (EVs), AI-autonomous solutions, and renewable energy. With such a wide range, the most crucial question investors will need to ask is: What is the Tesla stock prediction for 2030?

The fundamentals of Tesla have both strengths and weaknesses. Assets are solid, though there is a narrowing of margins due to competition. The revenues have not stopped fluctuating, whereas the returns on equity and capital efficiency have softened in the short term. However, the drivers of growth for the company, including EV adoption, artificial intelligence, and energy storage, may transform the company’s valuation by 2030.

Tesla’s Strategic Growth Drivers Toward 2030

Electric Vehicle Market Expansion

Even the EV revolution is gaining momentum. In 2023, Tesla significantly expanded its global presence by becoming the largest-selling car brand, surpassing the Toyota Corolla and reaffirming the leadership of the Tesla brand (Financial Times, 2024). With an estimated global car sales population of over 3 million vehicles, Tesla has a massive market that it can tap into by 2030, when EVs might constitute over fifty percent of all new automobile sales.

Artificial Intelligence and Full Self-Driving

The Full Self-Driving (FSD) program developed by Tesla is also an essential long-term catalyst. Although the heavy-duty legal authorization has been piecemeal, a positive monetization would generate recurrent subscription incomes and convert Tesla into a hybrid automobile-technological enterprise (Financial Times, 2025a).

Energy Generation and Storage

Another area of growth for Tesla is the Megapack and solar division. By 2030, Tesla will have the opportunity to compete with energy division revenues alongside its automotive revenues (Financial Times, 2025b).

Financial Review: Tesla’s Current Fundamentals

The short-term performance of Tesla provides an adequate background for its long-term valuation. Recent quarterly data reveal both strengths and weaknesses.

Balance Sheet Strength

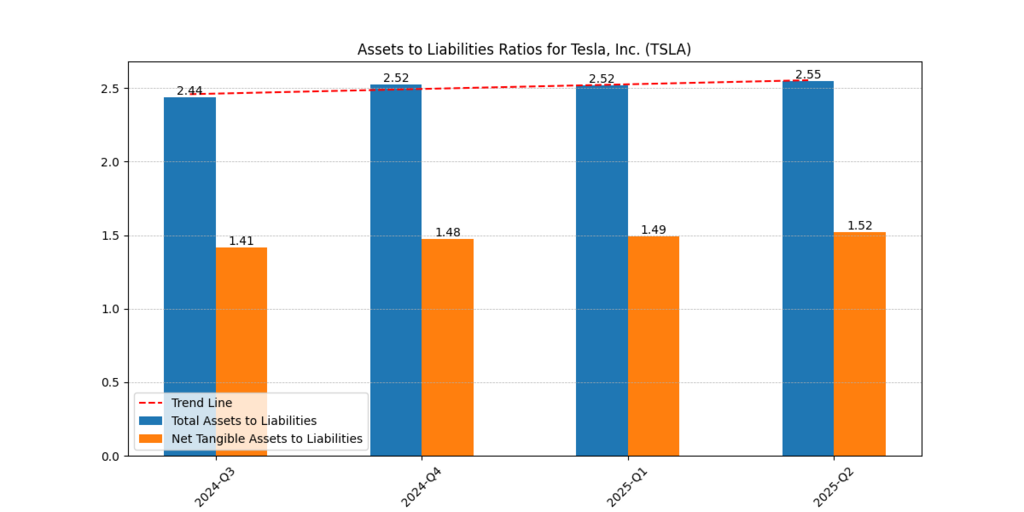

Tesla is highly covered in terms of assets; thus, it is financially stable.

Table 1: Tesla Balance Sheet Snapshot

| Metric | 2024-Q3 | 2025-Q2 | Trend |

| Assets / Liabilities | 2.44 | 2.55 | Improving coverage |

| Tangible Assets / Liab. | 1.41 | 1.52 | Improving cushion |

Tesla currently has a ratio of over 2.5 times assets over liabilities, and has a solid expansion cushion.

Figure 1: Tesla’s assets-to-liabilities ratio indicates that it has been improving steadily over the years, with the ratio standing at 2.44 in Q3 2024 and 2.55 in Q2 2025, which means that the company is financially well-positioned.

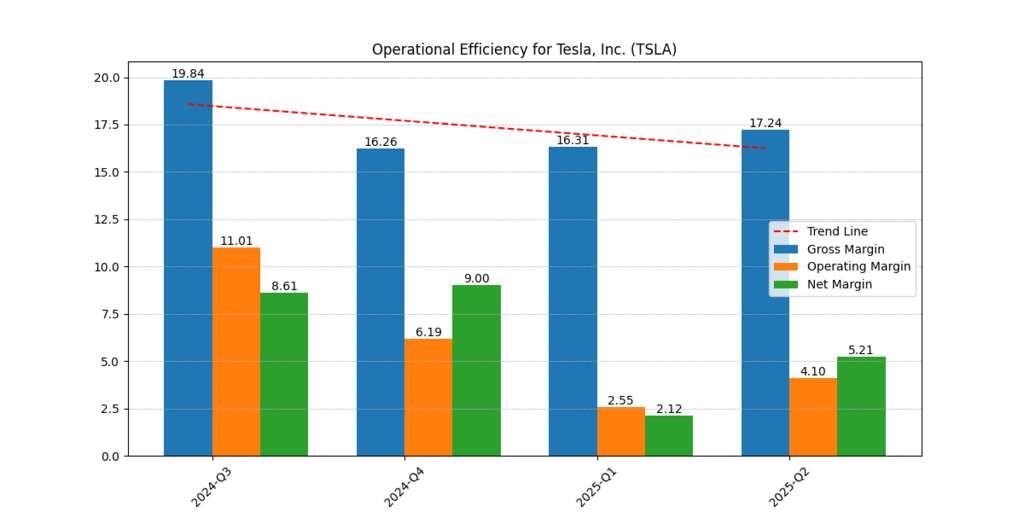

Margins and Operational Efficiency

Competitive prices on EVs and price changes at Tesla have put pressure on margins.

Table 2: Tesla Margins (Operational Efficiency)

| Margin Type | 2024-Q3 | 2025-Q2 | Trend |

| Gross Margin | 19.8% | 17.2% | Declining |

| Operating | 11.0% | 4.1% | Sharp decline |

| Net | 8.6% | 5.2% | Narrowing |

All these pressures notwithstanding, Tesla has healthier margins than its traditional automaker counterparts.

Figure 2: The gross, operating, and net margins of Tesla have decreased over the last few quarters, which demonstrates the pressure on prices and an increase in competition in the EV market.

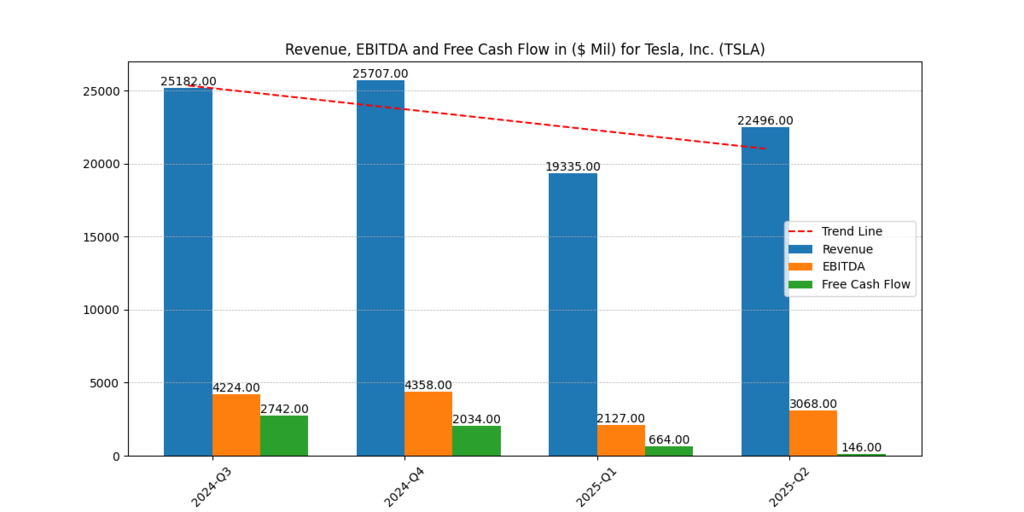

Revenue and Free Cash Flow

The revenues have varied significantly, whereas free cash flow has been negatively impacted.

Table 3: Revenue and Free Cash Flow

| Quarter | Revenue ($B) | Free Cash Flow ($B) |

| 2024-Q4 | 25.7 | 2.7 |

| 2025-Q1 | 19.3 | 0.3 |

| 2025-Q2 | 22.5 | 0.1 |

This drastic reduction in free cash flow highlights the liquidity constraints of producing on a massive scale while maintaining low prices.

Figure 3: Tesla’s revenues are volatile, and they are expected to reach their highest point in 2024-Q4, but will then decline in early 2025, with an almost free cash flow by 2025-Q2.

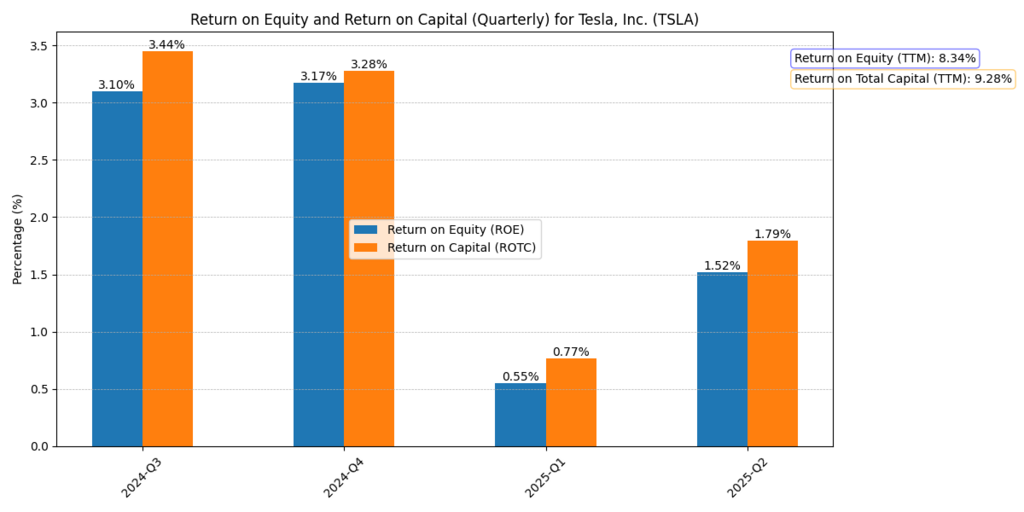

Returns on Equity and Capital

The short-term returns of Tesla are on the downside, but its long-term efficiency remains stable.

| Metric | 2025-Q2 | TTM |

| ROE | 1.5% | 8.3% |

| ROTC | 1.8% | 9.3% |

Table 4: ROE & ROTC

These figures suggest that Tesla is effectively managing the short-term strains while maintaining its competitiveness.

Figure 4: Short-term ROE and ROTC of Tesla declined significantly in 2025-Q2 but are still trailing twelve-month efficiency, indicating long-term strength.

Valuation Scenarios for 2030

With the help of internal valuation models, the opportunity to present the 2030 picture of Tesla in Bear, Moderate, and Bull scenarios can be achieved without referencing growth rates.

Table 5: Tesla Stock Forecast 2030 Scenarios

| Scenario | No Growth Price per Share ($) | Growth Price per Share ($) | Final Valuation Range ($) | Description |

| Bear | 24 | – | 24 | EV adoption slows, weak FSD monetization, and limited energy scaling. |

| Moderate | – | 65 – 121 | 65 – 121 | Steady EV growth, partial AI adoption, and the energy sector continue to expand steadily. |

| Bull | – | 311 | 311 | Aggressive EV adoption, FSD success, and energy division rival the automotive industry. |

The ranges denote the optionality of Tesla: the negative is a fact, but the positive is transformative in the context of realizing the vision.

Further Reading : The Road Ahead: A Deep Dive into Tesla Stock 2030 Price Prediction Post-Q2 2025 Earnings!

Psychology of Investors and Market Sentiment.

Figures speak half the tale. Another factor, which in most instances equally impacts the share price as the financial indicators, is the investor psychology of Tesla.

Herding Behavior:

Tesla has become a market leader in the stock market in EV and clean technology. This is another herd effect that continues to value Tesla above its traditional automaker competitors, that have earnings starting to slow down.

FOMO (Fear of Missing Out):

The story of Tesla has to do with new-groundbreaking innovation: automated cars, robot cabs, and the supremacy of clean energy.

Long-term Patience:

It is not that there is no group of true believers of Tesla, as opposed to short-term traders who view the vision of Elon Musk as the only natural one. These investors will be able to withstand even the most volatile periods and weak short-term cash flows.

Narrative Anchoring:

Tesla has a good rapport with a green economy brand of innovation, disruption, and leadership. These kinds of stories usually ensure that the investors remain attached to them, as opposed to quarterly returns.

Social Influence and Media Attention:

Tesla is not just a stock, but a cultural phenomenon; media coverage, social media discussions, and the public persona of Elon Musk influence its affection.

Risks to the Tesla 2030 Outlook

The growth of Tesla cannot be ensured. Although the growth potential is enormous, multiple structural and operational threats may stop the company on its way to 2030:

Increasing Competition:

BYD, Nio, and XPeng, the Chinese leaders of the EV market, are rapidly expanding their production capacity and are fiercely price-cutting Tesla (Financial Times, 2025a).

Regulatory and Legal obstacles:

Full Self-Driving (FSD) of Tesla has been a pillar of the bull case. However, regulatory authorizations of autonomy differ in geographical areas.

Macroeconomic Headwinds:

Tesla cars are still luxury, despite the recent price reductions. This could limit the demand for EVs worldwide, as interest rates were high, inflation rates were high, and consumer purchasing power was decreasing.

Execution Risk:

Tesla is now simultaneously doing EV, AI-based software, energy storage, and robotics. The eventual completion of the supply chain, production, and technology combination results in control of these verticals.

Technological Disruption:

The technological innovation is unpredictable, and Tesla is an innovator. Any advancement in the technology of solid-state batteries, hydrogen fuel cells, or any other iteration of AI available on the market would put Tesla ahead of its rivals.

Geopolitical Risks:

The other factor that can expose Tesla to trade wars, tariffs, and political instabilities is that the company is very reliant on its supply chains of lithium, nickel, and rare earths across the globe.

Elon Musk dependency:

Tesla has numerous relations with Musk as a leader. His vision is attractive, but it also carries a key-man risk; Musk is preoccupied with other projects, such as SpaceX, Neuralink, and X (formerly Twitter).

Tesla Stock Forecast 2030: Final Outlook.

To conclude, the prospects of Tesla:

- Bear Case (~$24/share): EV low adoption and low rate of AI /energy monetization.

- Moderate Case ($65-121/share): EV sales are stable, Built-in FSD is built-in, and there is an additional energy business.

- Bull Case (~$311/share): Aggressive expansion of EV penetration, the FSD adoption of the whole world, and the energy rivalry with auto incomes.

These examples help illustrate the range of potential outcomes and demonstrate how the psychology of investors may push downside and upside fears to their extreme limits.

Conclusion: Is Tesla Still a Smart Buy?

Tesla has a 2030 outlook that incorporates financial, strategic, and behavioral growth forces. Balances’ balance sheet is also in a healthy state, yet margins and cash flows are already stressed in the short term. The existence of high downside and abnormal upside possibilities characterizes the valuation situations.

Tesla, as an investment, is a prospective bet on EVs, AI, and renewable energy, given its riskier nature. The bear case reminds conservative investors of the risk of execution. Regardless of the situation, Tesla will never leave any industry indifferent, even after the cars, and that is what makes this company one of the most followed companies of the decade.

Usama Ali

Usama Ali is the founder of Financial Beings and a self-taught investor who blends classic valuation study with insights from psychology. Inspired by works from Benjamin Graham, Aswath Damodaran, Stephen Penman, Daniel Kahneman, and Morgan Housel, he shares independent, data-driven research to help readers connect money, mind, and happiness.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.