Introduction

How emotions can fuel stock market crash is not an idiosyncratic event, rather it is repetitive and it has been happening in the stock markets for decades. People starting investing in the times of optimistic or bull markets can be the advocates of markets’ efficiency and they certainly enjoy investing. It is a great surprise for them when all the positive feelings and logic of media experts bring them losses in a form of a market crash. All the crashes in the stock market history, the wall street crash of 1929, black Monday (1987), the bursting of dot com bubble or the financial crises of 2007 all of the mentioned stock market crashes had one thing in common, the investors’ emotions. Investors’ optimism can be an amalgam of two basic phenomenon—Fundaments and Investor’s Psychology[1]. In today’s article, I will expand upon how the hitherto phenomenon can really shape the Market ups and downs and how Investor Psychology can have more effect on the market crashes than company’s fundamentals.

Focus Points

1. Emotionally Driven Market Volatility: It’s fascinating how human emotions, rather than just cold hard numbers, massively influence stock market swings. From the roaring 1929 Wall Street crash to the 2007 financial crisis, investors’ emotions have consistently played a pivotal role.

2. Bull Market Psychology: The combination of economic positivity, corporate earnings, and investor optimism creates the perfect storm for a bull market. It’s all about how investor psychology drives the relentless rise, even when reason suggests caution.

3. Bear Market Dynamics: The shift from euphoria to fear is what transitions a bull market into a bear market. It’s incredible how quickly investor sentiment can flip, causing a dramatic downturn as once greedy investors suddenly become fearful and risk-averse.

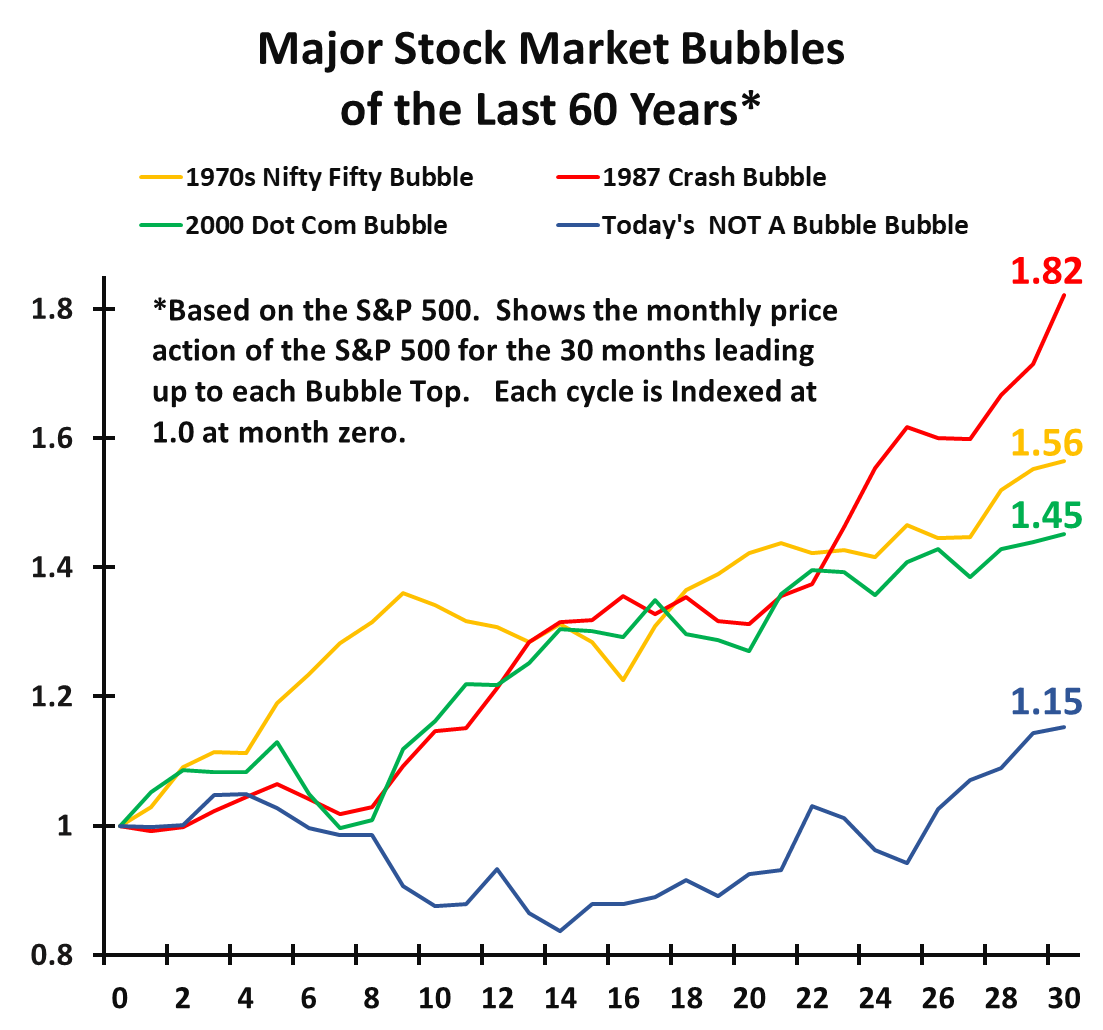

4. The Bubble Phenomenon: Stock market bubbles, like the dot com bubble or the 1960s’ “Nifty Fifty” craze, are prime examples of how irrational investor exuberance can inflate asset prices to unsustainable levels. The mantra “no price is too high” often signifies an impending burst.

5. Crash Catalysts: Market crashes occur when negative sentiment and weak economic conditions lead to a massive sell-off. It’s intriguing to note that during a crash, even high-quality assets can be undervalued—presenting rare opportunities for savvy investors to capitalize.

Exaggerated Emotions and Company Fundamentals

The two main components of Fundamentals of the company are usually the top line and the bottom line. The top line is the revenue of the company that is usually the business or incoming cash flow for that business. The bottom line is the net margin or the net profit that a company calculates by subtracting COGS, Expenses and Taxes from the revenues[2],

Gross Profit = Revenues – Cost of goods sold (COGS)

Net Profit = Gross profit – Expenses – Taxes

The question would be that if it is just mathematics and numbers then it should be fairly safe and the markets should be fair in the evaluation of any company but unfortunately it is not. The huge swings in the prices of stocks even after every quarter tells a different story. The reaction of investors mainly produces the swings or irrationality of the markets toward company fundamentals. A slight drop in the expected bottom line can cause a stock to drop 5% or even more. Hence, the amplified human reaction on the fundamentals and the negative news on the national media can bring havoc on the markets that in turn convert to market crashes.

How Bull Markets Arise

Human emotion is a powerful driver of human behaviour. The small part of humans’ brain ‘’Amygdala‘’ is a core component for processing human emotions[3]. The world view of any human being is evolved from the time of birth and during different environmental effects or situations they face during their lifetime. The two basic human instincts greed and fear are the most important emotions involved in the making of bear and bull markets.

When events in the economy turns positive the people are more willing to invest because of the positive outlook of the economy. The positive economic outlook means that the people are spending more that in turn improves corporate earnings. These positive events form a positive world view for the investors that feed their psychological needs.

In the all positive environment, little negative news or even word of caution does not change the investors mind. The positive psychologically consumed markets do not ask for higher risk protection and prospective returns. The rising economy, corporate earnings, the positive investor psychology and the demand for lower prospective returns all give birth to the investors greed and they demand more. The more they demand the more the markets rise because the investors are willing to pay any price for even less quality issues. These perfect ingredients contribute and constitute a bull market and it can take from several quarters to several years to form such a bull market.

How Bear Markets Arise

The economic outlook and the positive investors’ psychology has fueled a bull market and the investors are reaping benefits in terms of stock price appreciation or capital appreciation. Eventually, the reversal starts. The first sign of reversal is the weakening of economy that can be due to many internal or external factors. The corporate earnings fail to live up to expectations. The failure of expectations, perhaps the markets were at unrealistically high levels and the stock prices were irrational signal the downturn of the unrealistic markets.

The investor psychological behaviour become gloomy because of the events and the news on the media. The positive psychology converts to negative psychology. The greed of profits and lack of capital protection (less risk demand and less return requirements) in the markets change to fear in the markets. The negative psychology and the market pundits conclude that the market prices are unsustainable at the present levels and thus the meltdown starts.

Stock Market bubbles

The market at the peak of it’s activity with all the positive news and positive investor attitude towards safe or unsafe assets form a bubble. The reasons for a bubble to form can be different because millions of people contributing to the market with their emotions as well as external events have a causal relationship.

Over a period of time during a bull market, if we draw a graph between time on the x-axis and market return on the y-axis, it can never be a linear line. Instead, it is always an irregular line comprising of dips and rises all along the way. In a rising market, it is impossible to predict the dips and rises at a certain level but overall the further rise can be concluded by looking at different factors (Economic, Political, Psychological).

The mania ‘’ Nifty fifty’’ stocks [4] from the 1960’s best describe the unsafe or if I may say the market bubble situation as far as the term asset is concerned , ‘’ There’s no such thing as a price to high’’. In other words, no matter what price you are paying for any asset (safe or unsafe), you are going to make money on that investment. The dot com bubble is an example, when no price was high for the internet and ecommerce companies.

Stock Market Crashes

The investor behaviour in the presence of all the negative market news, negative sentiment and weak economic outlook constitutes a market crash. A typical symptom of a market crash is, when people are not willing to pay any price for even the best assets that are bound to bounce back and give substantial profits. Due to the unpredictability of many factors, the domino effect can start from the weak economic condition or from the negative investor sentiment. The causality is so complex that it can not be clearly said which factor will start the downward trend.

When the demand for the stocks fall well below the supply and when the investors are not willing to pay any price for the assets, whose prices have fallen below the intrinsic value, when the investors are just risk averse and demand nothing but cut-off from the markets, when the news is gloomy, the economy is weak, the majority sell-off has taken place then this is a typical example that we are in a market crash. This is a the time to buy strong assets below their intrinsic value and reap way above average benefits. What you should know about Stock Market Investing, FIND OUT HERE!

Conclusion

In the grand theatre of the stock market, emotions take center stage. As we’ve explored, the euphoric highs of bull markets and the gut-wrenching lows of crashes both stem from the same source: human psychology. It’s a tale as old as the Wall Street crash of 1929, playing out again and again, each time with a cast of hopeful investors and the same script of greed and fear.

While company fundamentals provide the script, it’s the investors’ emotions that direct the performance. In moments of collective optimism, even the slightest good news can send stock prices soaring, creating a bubble that defies logic. Conversely, when the tide of sentiment turns, even the most robust earnings reports can’t prevent the slide into bearish despair.

Understanding this dance between fundamentals and emotions is crucial for any investor aiming to navigate the market’s tumultuous waves. It’s a lesson in recognizing that the same psychological forces that inflate bubbles can also deflate them, often with startling speed. The real challenge lies in maintaining a balanced perspective amid the frenzy, avoiding the pitfalls of irrational exuberance during bull markets and the paralyzing fear during bear markets.

In the end, those who can manage their emotions, stick to their principles, and recognize value amidst chaos will not only survive but thrive. They understand that market crashes, despite their immediate pain, are fertile ground for future growth. They know that when the dust settles, those who kept their heads will emerge stronger, having transformed a crisis into an opportunity. So, next time the market takes a wild swing, remember: it’s not just numbers on a screen. It’s a reflection of the human psyche in all its complexity—an ever-volatile, always fascinating dance of fear and greed.