Introduction

Learn more about Occidental Petroleum Corporation (OXY), including financial statement analysis, a fair value assessment for the company’s shares, price target estimates, and advice on whether to purchase OXY stock just now. Continue reading!

Occidental Petroleum, also known as OXY, has been in the petroleum industry for a number of years, and owing to its strong operational and fundamental advantages, investors have had a fantastic opportunity to purchase the company. [1]

Founded in 1920, OXY operates in important producing locations and regions, such as Latin America, the Middle East, and the United States. It also engages in chemical manufacturing through OxyChem, which greatly aids in enhancing the company’s capacity. Occidental has established a solid reputation for resource efficiency, advanced energy solutions, and ethical and sustainable operations. With a broad asset portfolio and exceptional operational skills, OXY has maintained its position as a major player in the global energy market.

Given the steady demand for natural gas and oil OXY, it is now essential for any potential investors to evaluate the company’s performance, fair value, and prospects for the future. In order to determine if this share is deserving of an investment right now, we look at OXY’s most important financial parameters, project how the Company’s fair value will change with different growth rates, and provide price projections. This article will examine all you need to know to determine whether OXY is an appropriate long-term investment or if it is undervalued.

Key Takeaways

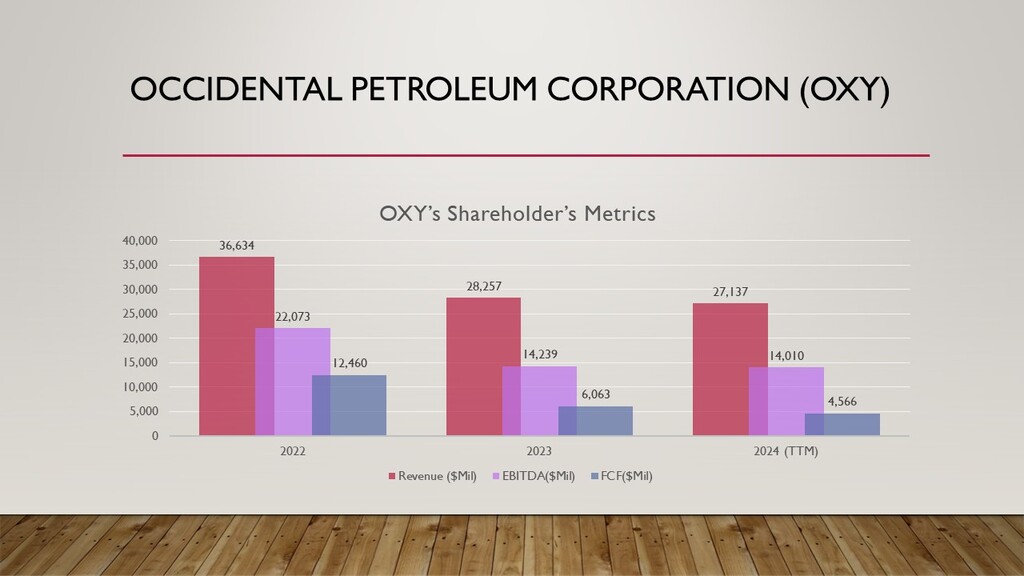

Strong Financials: OXY demonstrates good revenue growth, high EBITDA margins, and sustained FCF among the indicators examined.

Undervalued Stock: In all growth areas, OXY is underpriced when compared to our fair value targets.

Growth Prospects: According to analysts, the price will fluctuate between $62 and $74 over the course of the year, making it a long-term investment worth considering.

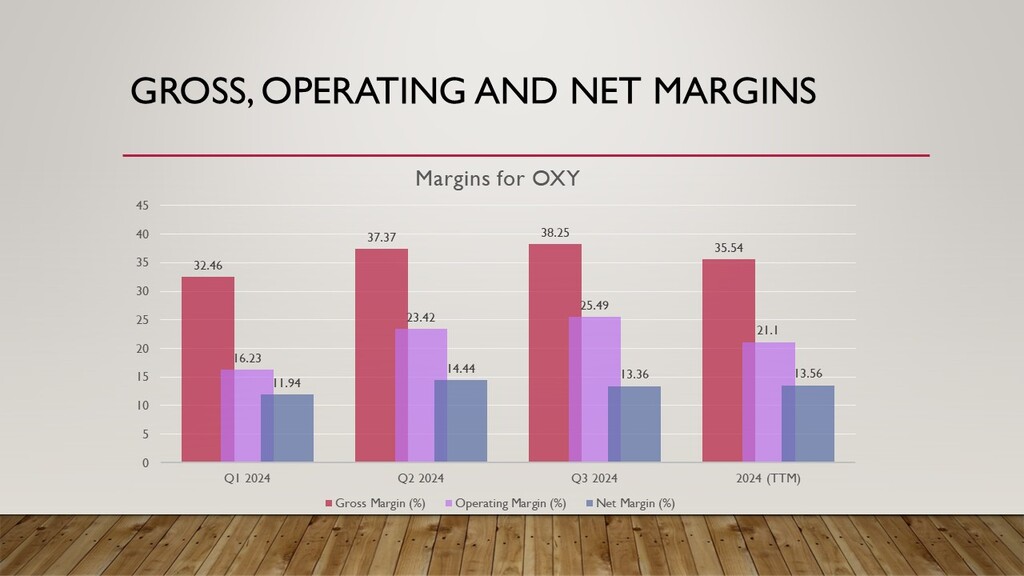

Quarterly Earnings Performance: Although there are some minor fluctuations, OXY’s profit margin is comparatively steady, which can be a sign of stability in a highly volatile environment.

OXY Financial Metrics Analysis

| Metric | Value |

| Revenue | $27,137 million |

| EBITDA | $14,010 million |

| Free Cash Flow (FCF) | $4,566 million |

| Firm Value (High Growth) | $69 billion |

| Firm Value (Medium Growth) | $63 billion |

| Firm Value (Low Growth) | $58 billion |

Driven mainly by revenue and cash flow decline financials, OXY is a financially sound company. Despite reporting $27,137 million in sales for the time, the company shows that it has control over and is in an advantageous position to take advantage of the oil and gas market. OXY’s $14,010 million EBITDA confirms its operational efficiency by showing a high degree of competitiveness in the industry and effective cost control. If you feel that individidual stock picking is a hectic task, read our ETF guide 5 Best Energy ETFs to buy in 2025.

The business also reported free cash flow (FCF) of $4,566 million, indicating both its capacity for expansion and its capacity to generate and allocate value to its shareholders. Growth rates for OXY have been considered to be high, medium, and low, which offers a useful assessment of the stock’s fair value. [1]

OXY Price Target

In spite of the rapid expansion, the company is worth $69 billion, and the price goal is $74 per share. Based on the company’s price objective of $67 per share, the firm value drops to $63 billion when growth is in the medium range. However, OXY maintains its $58 billion company valuation even in low-growth scenarios, with a price target of $62 per share.

They show that there are opportunities for shareholders to increase their profits because the current equity price does not match the fair value. Additionally, OXY’s stability and operational performance are implied by the Q1 2021 EPS data. Despite minor fluctuations, the company has been growing gradually to generate positive earnings per share (EPS). Their ability to control market price fluctuations and maintain profitability is exemplified by the consistent growth of their yearly sales. [2]

In general, the fair value and growth model makes Occidental Petroleum appear rather inexpensive. Given its financial strength, operational competence, and growth possibilities, OXY presents a great investment opportunity for investors seeking a long-term stake in the oil sector.

Quarterly EPS Trends

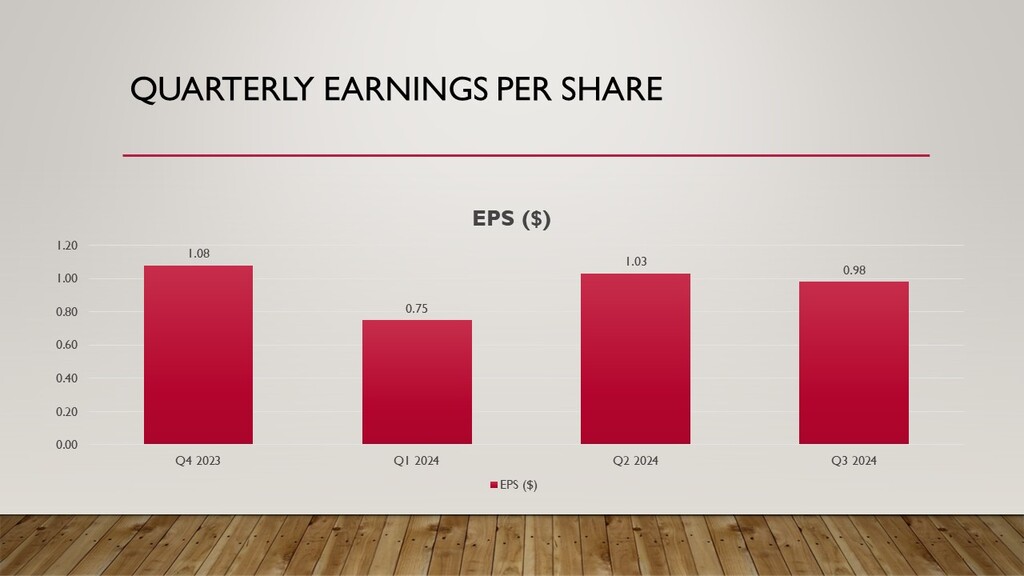

| Quarter | EPS |

| Q3 2024 | 0.98 |

| Q2 2024 | 1.03 |

| Q1 2024 | 0.75 |

| Q4 2023 | 1.08 |

Occidental Petroleum’s (OXY) quarterly earnings per share are reported as a sign of a comparatively steady and lucrative business in a volatile market. For the latest four quarters, which include Q3 2024 ($0.98), Q2 2024 ($1.03), Q1 2024 ($0.75), and Q4 2023 ($1.08), these reported EPS have been calculated. The average of these four figures is $0.94.

These figures demonstrate that OXY has produced steady profits in spite of these challenges, which affect the entire oil and gas industry both domestically and internationally as a result of shifts in commodity prices and energy demand. In Q4 2023, the adjusted EPS was $1.08, which is a respectable amount for the end of the year, compared to $3.40 for the entire FY 2023. Increased oil prices and improved cost management that increased margins were likely the causes of this strength. [2]

In the first quarter of FY2024, however, the EPS decreased limited to 0.75. In the energy industry, this was caused by a number of unusual characteristics, such as lower energy use in temperate climates or increased capital intensity. With an EPS of $1.03 during the recovery in Q2 2024, Occidental Petroleum demonstrated its flexibility and preparedness to react to market opportunities identified by this analysis. Given these circumstances, it is possible that this recovery was the result of wise financial and operational decisions. The Q3 2024 EPS of $0.98 is marginally lower than the Q2 2024 EPS, which could be explained by an up-and-down in the price of oil or perhaps a problem with their operations. [3]

Nevertheless, we believe it remains in a good profitability range. The ability of OXY to produce positive value for its shareholders each quarter is demonstrated by the overall quarter-over-quarter improvement in EPS. There have been minor variations in EPS, which are consistent with the seasonal variations in the oil and gas sector. More significantly, OXY’s present management has been able to find long-term growth opportunities and record profits, which has prevented them from being carried away by these cycles. The idea that OXY is an inexpensive stock for a long-term investment strategy is supported by this performance. [4]

Questions

1. Is OXY Stock a Good Buy Now?

Yes, Occidental Petroleum (OXY) is currently regarded as a wise investment. Given its consistent profitability, adequate cash flows, and high EBITDA, this company appears to be effectively managed. According to an analysis of its current business data, OXY is relatively inexpensive in all past and projected growth rates, suggesting that it is a prime option for long-term investors interested in the energy industry. Additionally, the stock is far more appealing for investing due to OXY’s proactive risk management and its will to maintain its position in erratic markets. OXY can therefore be viewed as an alluring addition to a diversified investment portfolio due to its strong experience in managing industry cycles.

2. Is OXY undervalued?

In comparison to its fair value assessments, it indicates that indeed Occidental Petroleum (OXY) is undervalued. In the low-growth scenario, this indicates that there is considerably more upside from the current stock price because it is much below the target of $62 per share. All growth rates — high, average, and low — show this undervaluation, with the firm’s value remaining higher than its present market capitalization. As a result, OXY presents an investment opportunity that could give access to a stable company with strong cash flow in the hope that the market will assign a greater multiple of its actual value.

Conclusion

Therefore, with steady financials and a great potential for investment appreciation, Occidental Petroleum (OXY) may be regarded as a jet and a smart investment. Stable revenues, a healthy EBITDA, and robust free cash flows all demonstrate the caliber of the business’s operations. It is also a promising option for long-only investors because it appears to be undervalued for all growth conditions. Even though the EPS fluctuates from quarter to quarter, it is evident that OXY maintains a consistent income statement and is consistently successful, which puts it in a strong position to withstand market dynamics. With its explosive long-term growth potential, the stock should appeal to value investors, making OXY a compelling purchase.

**Please be informed that the content is informational and by no means serve as a buy or sell signal. The company is not responsible for the loss of capital.