Explore the battle of Nvidia vs AMD AI dominance 2025. Discover market trends, GPU innovation, and investment opportunities shaping the future of AI chips. The development of artificial intelligence (AI) has transformed it from a research frontier to a mainstream driver of the economy within a remarkably short period. Graphics processing units (GPUs), the engines of deep learning, large language models, autonomous vehicles, and generative artificial intelligence applications, are at the center of this transformation. Attention is focused on the battle between Nvidia vs AMD AI dominance 2025, where not only semiconductor dominance is at stake, but also the entire AI revolution in tech stocks.

Financially, this competition determines how money is distributed, stock market prices, and institutional trust in AI-controlled development. Psychologically, it is a conflict between an established leader (Nvidia) and a challenger (AMD) that aims to bridge the performance and market gaps. The issue of which company emerges as the unchallenged leader in AI chip technology not only influences earnings but also the strategic positioning outlook of the semiconductor industry.

This paper compares Nvidia and AMD based on some metrics: financial health, operating margin, ROA, free cash flow, Bear-Moderate-Bull valuations, and investor psychology. It applies proprietary valuation models, along with financial visuals, to offer an evidence-based discussion of the future dominance of Nvidia vs. AMD.

Semiconductor Industry Outlook

The semiconductor business is experiencing one of the most transformative periods. The future is characterized by three converging factors as we head to 2025:

- Rapid AI demand: Hyper scalers like Microsoft, Amazon, and Google are increasing their capital spending on AI servers and GPU clusters. This translates into a previously unmet demand for high-end GPUs (McKinsey & Company, 2023).

- High-performance computing GPUs (HPC GPUs): GPUs were initially created to serve the gaming and visualization markets, but today they are the workhorse of AI training and inference (Huang, 2023).

- Capital-intensive growth: The AI boom presupposes not just innovation but also colossal investment in fabs, research and development, and cloud infrastructure (Deloitte, 2024).

To investors, the AI revolution in tech stocks makes the GPU leaders AI stocks to buy in 2025. However, a financial core is as much a driver of sentiment as faith in companies being in the position to take a lion’s share of AI-powered higher revenues (Bloomberg Intelligence, 2024).

Financial Position: AMD vs Nvidia Assets & Liabilities

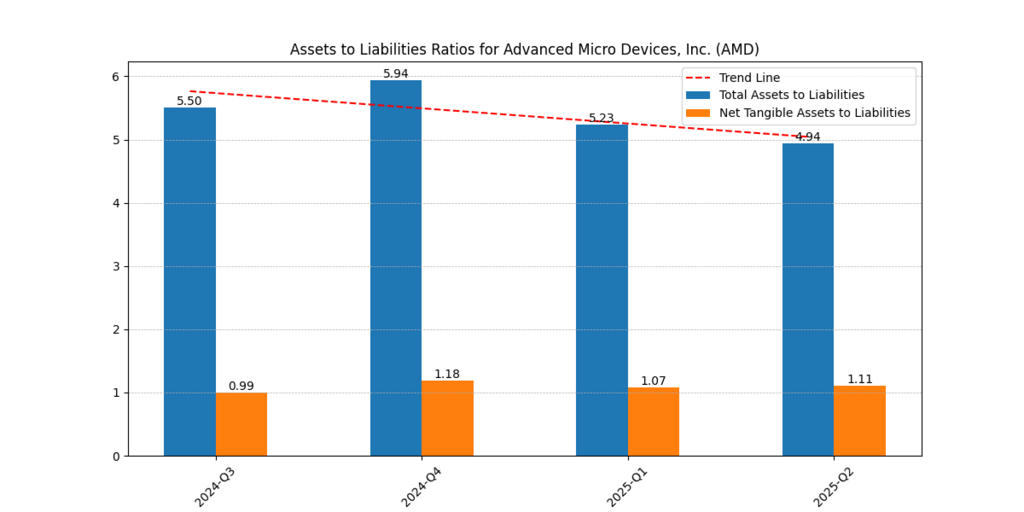

AMD Assets to Liabilities

Figure 1. AMD Total Assets vs Liabilities (Q3 2024 – Q2 2025)

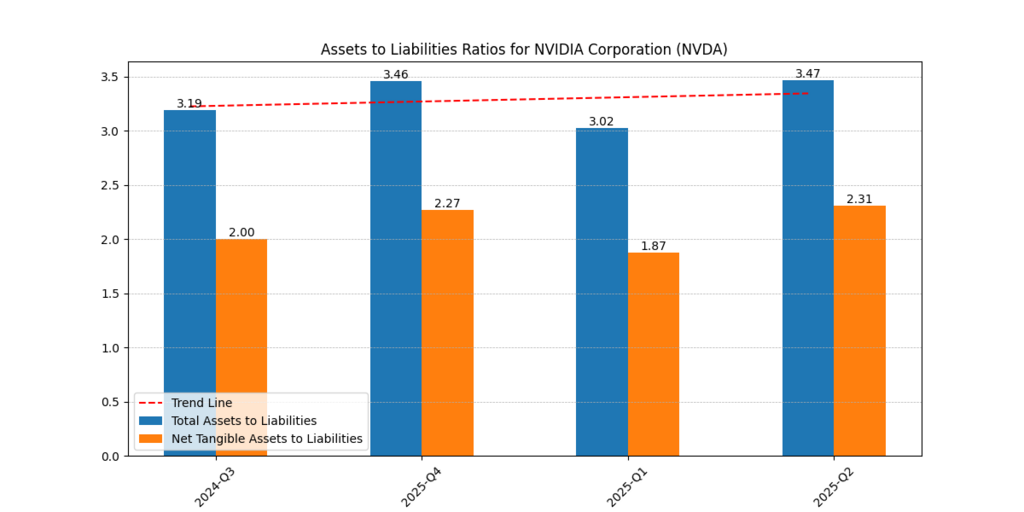

Figure 2. Nvidia Total Assets vs Liabilities (Q3 2024 – Q2 2025)

By examining the strength of its balance sheet, AMD has maintained a range of Total Assets to Liabilities ratios between 4.9 and 5.9 from Q3 2024 to Q2 2025. The corresponding ratio of Nvidia ranges between 3.0 and 3.5. Although AMD appears to have a leaner liability base compared to its assets, Nvidia has consistently recorded a higher net tangible asset to liabilities ratio, indicating better tangible equity coverage (Nvidia and AMD Analysis, 2025).

| Company | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Trend |

| AMD Assets/Liabilities | 5.5 | 5.9 | 5.2 | 4.9 | Gradual decline |

| NVDA Assets/Liabilities | 3.2 | 3.5 | 3.0 | 3.5 | Stable growth |

The balance sheet of AMD indicates that the company is both flexible and volatile, making it challenging for investors to assess the Nvidia vs AMD stock prediction. The consistent solid support of Nvidia conveys strength and enhances investor confidence in its ability to withstand the recession (AMD DCF, 2025).

Operational Efficiency: Margins Battle

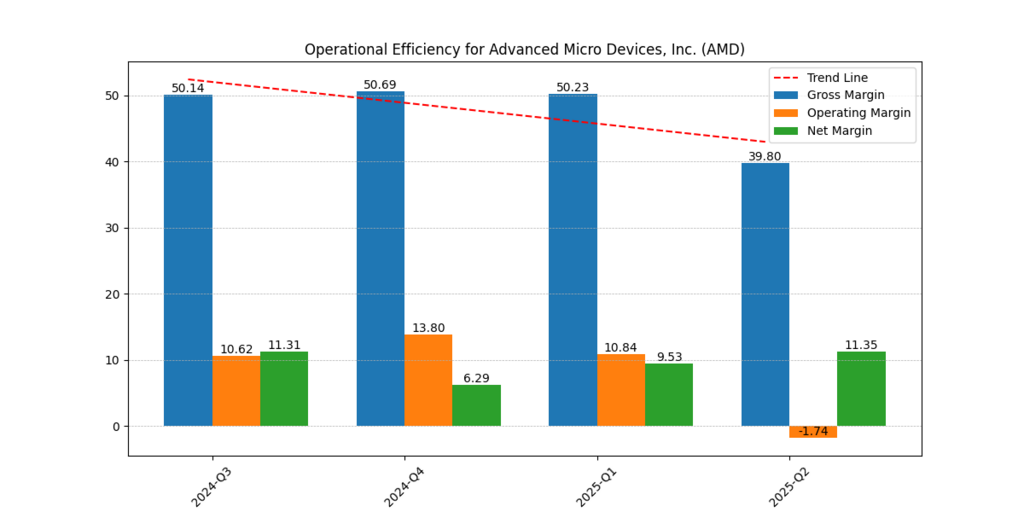

AMD Margins

Figure 3. AMD Profit Margins (Gross, Operating, Net) by Quarter (2024–2025)

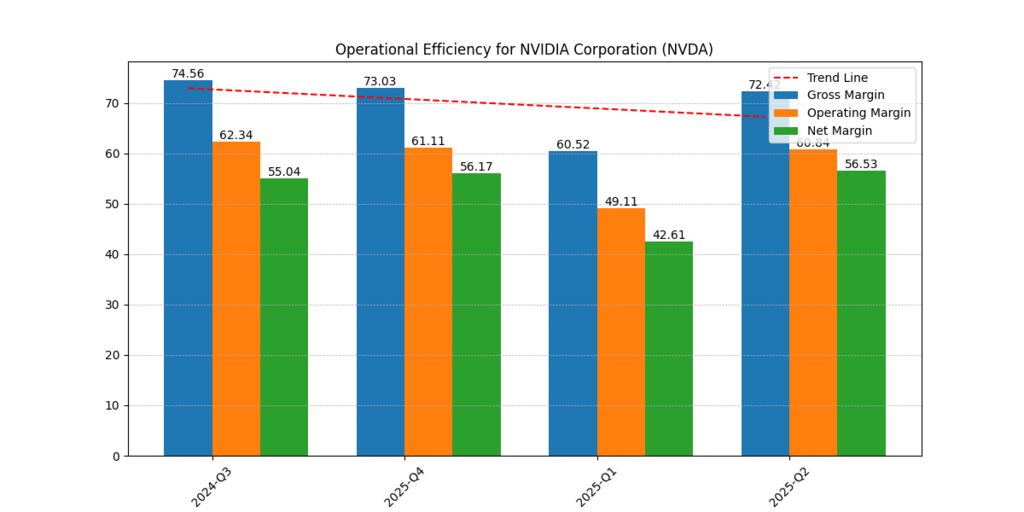

Figure 4. Nvidia Profit Margins (Gross, Operating, Net) by Quarter (2024–2025)

Margins provide a good indication of the operational strength. The gross margins of AMD have been around 40-50%, and the operating margins have declined to negative in Q2 2025 (-1.7%). AMD has experienced an 11.3% net margin recovery. In comparison, Nvidia has impressive performance, with gross margins above 70 percent in three out of the four quarters, operating margins exceeding 60 percent, and a net margin of 56.5 percent.

| Metric | AMD Q2 2025 | Nvidia Q2 2025 |

| Gross Margin | 39.8% | 72.4% |

| Operating Margin | –1.7% | 60.8% |

| Net Margin | 11.3% | 56.5% |

Investors derive signals of competitive advantage and pricing power out of margins. The uncommon profitability of Nvidia supports the assumption that it is the lowest risk AI stock to buy 2025 and not the highest, and the lower margins of AMD indicate its risk and upside (Statista, 2024).

Profitability: ROE and ROTC Insights

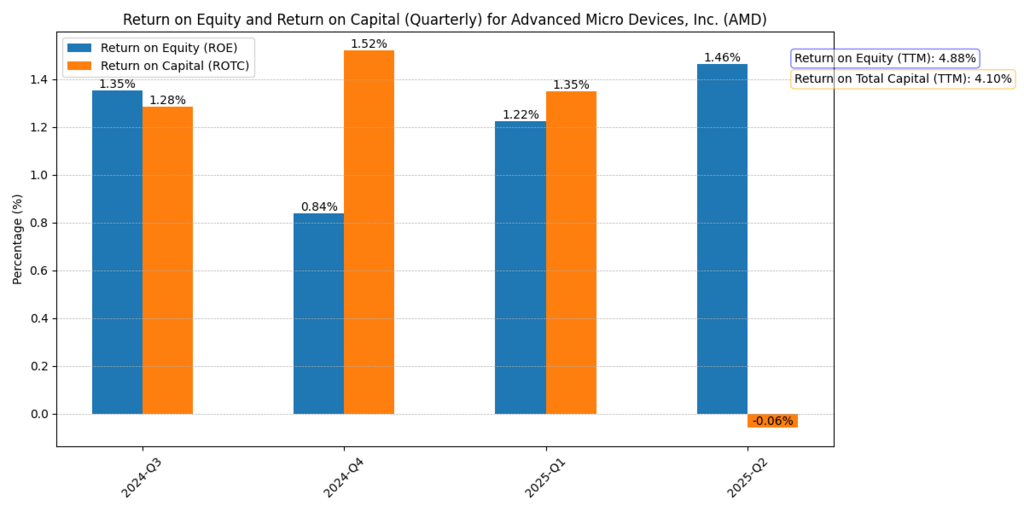

AMD ROE & ROTC

Figure 5. AMD Return on Equity (ROE) and Return on Total Capital (ROTC), 2024–2025

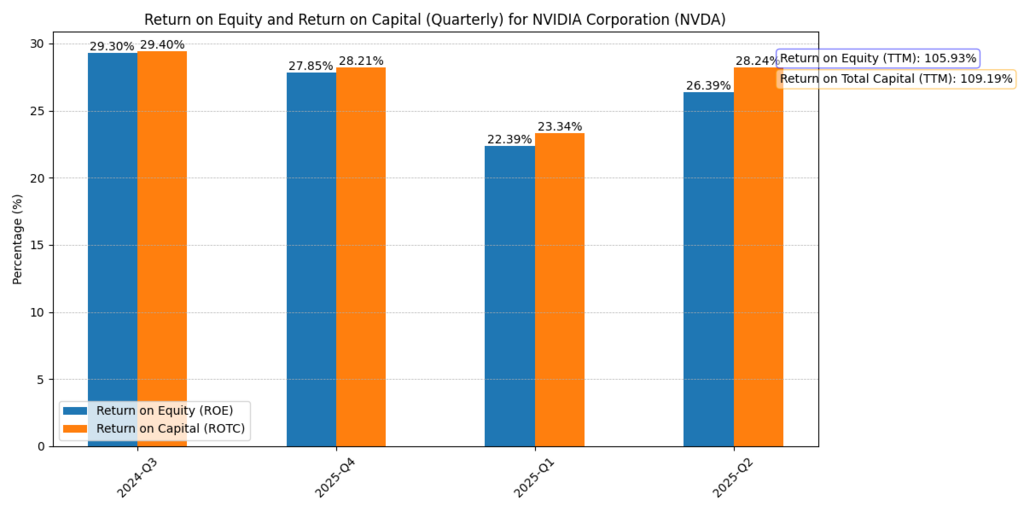

Nvidia ROE & ROTC

Figure 6. Nvidia Return on Equity (ROE) and Return on Total Capital (ROTC), 2024–2025

Profitability measures emphasize the gap between the two companies. AMD has an average ROE ranging between 0.8% and 1.5% per quarter, indicating low returns to shareholders. The ROE of Nvidia, on the contrary, shows high values in excess of 25 percent on a quarterly basis, with a TTM ROE of more than 100 percent (NVDA DCF, 2025). Similarly, the return on total capital (ROTC) indicates that Nvidia is more efficient in converting capital into profits.

This incident bolsters the Nvidia vs AMD future dominance story. Investors in Nvidia believe that it operates on a different plane and is also more capital-efficient (Accenture, 2024).

Revenue, EBITDA, and Free Cash Flow Comparison

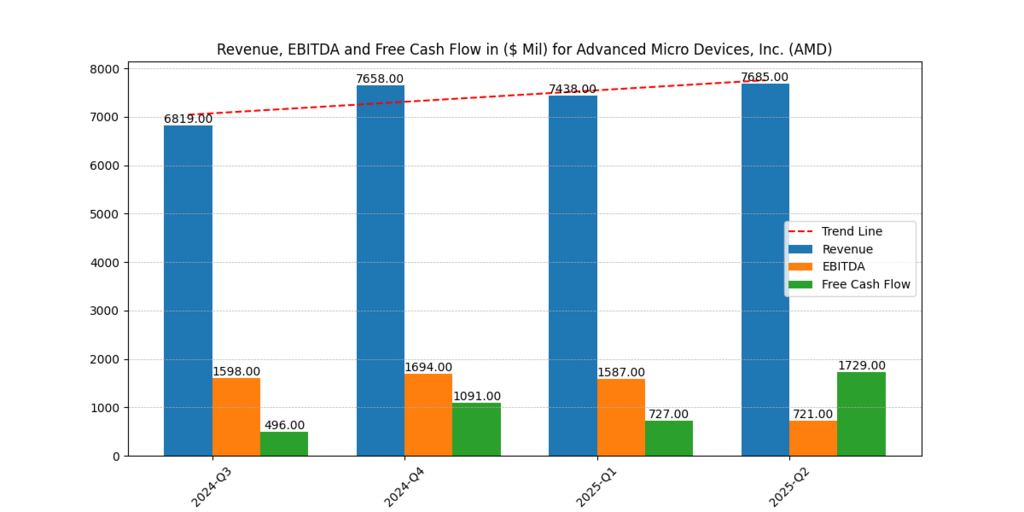

AMD Revenue & FCF

Figure 7. AMD Revenue and Free Cash Flow Trends (2024–2025)

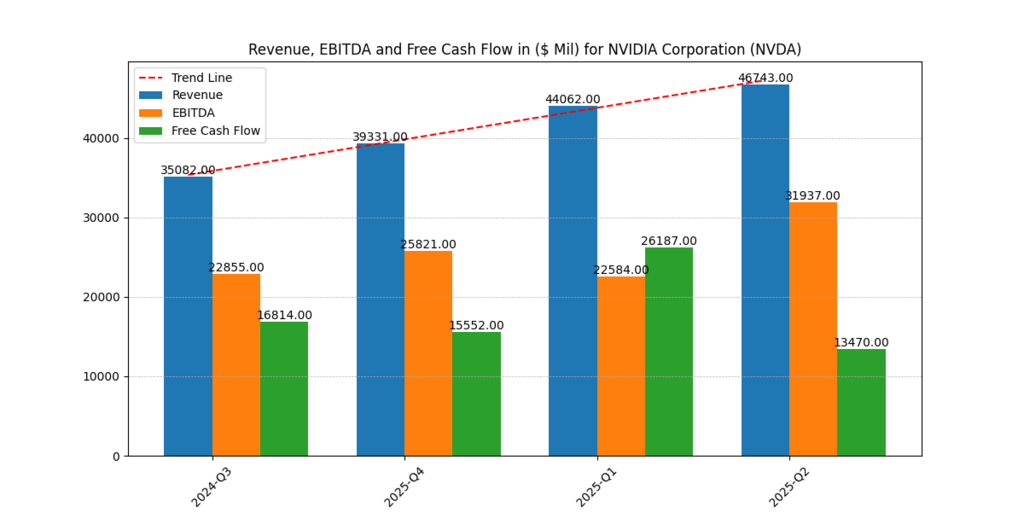

Figure 8. Nvidia Revenue, EBITDA, and Free Cash Flow (2024–2025)

| Company | Revenue Q2 2025 ($M) | EBITDA Q2 2025 ($M) | Free Cash Flow Q2 2025 ($M) |

| AMD | 7,685 | 721 | 1,729 |

| Nvidia | 46,743 | 31,937 | 13,470 |

The disparity is striking. Nvidia has about six times the revenue of AMD and has EBITDA margins that cannot be matched in the industry. Although AMD is stronger in terms of its free cash flow, generating $1.7 billion in Q2 2025, Nvidia has a substantial free cash flow of $13.5 billion, which compares to its competitor (Nvidia and AMD Analysis, 2025).

To investors, these figures serve as an incentive to recognize the scale advantage of Nvidia in AI-driven revenue growth. AMD is an underdog, however, with increasing financial credibility (PwC, 2023).

Valuation Scenarios (Bear, Moderate, Bull)

Here are the DCF valuation models from Bear, Moderate, and Bull scenarios.

| Scenario | AMD Valuation ($/share) | Nvidia Valuation ($/share) |

| Bear | 67 | 136 |

| Moderate | 84 | 163 |

| Bull | 136 | 210 |

Such assessments enter into market psychology. The Bear cases attract conservative investors, whereas the higher ranges attract the bullish traders, which magnify volatility. For long-term believers in the AI revolution in tech stocks, the increased multiples at Nvidia may be warranted, while contrarians view the underappreciated AMD (KPMG, 2024; Patel and Singh, 2022).

Debt & Cash Flow Management

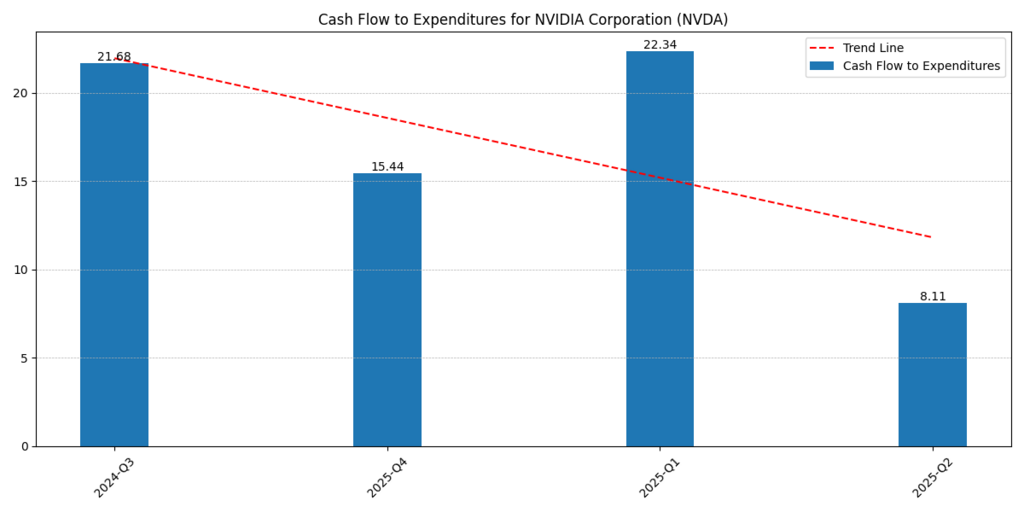

Nvidia Cash Flow to Expenditures

Figure 9. Nvidia Cash Flow to Expenditures Ratio (2024–2025)

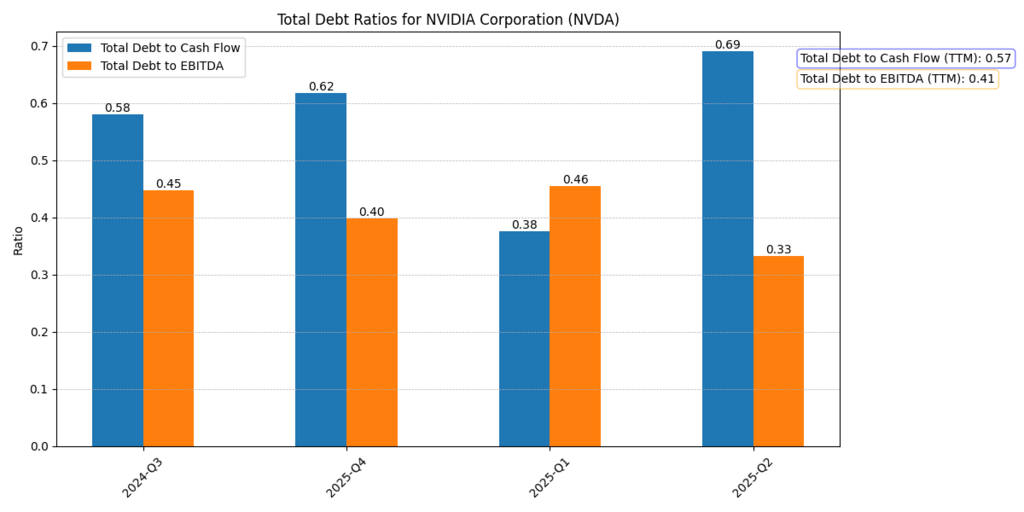

Nvidia Debt Ratios

Figure 10. Nvidia Debt Ratios (Debt/EBITDA and related metrics, 2024–2025)

Flexibility on capital is highlighted in debt management. The total debt-to-EBITDA ratio of Nvidia (0.41 TTM) implies that the leverage risk is very low. The amount of debt that AMD has, as a comparative measure, is low but limited by its lesser cash reserves. The cash-to-spend ratios of Nvidia indicate variability; however, the ratios remain high above crucial levels, which give it a strategic ability to grow (Bloomberg Intelligence, 2024).

Beyond Fundamentals: Investor Psychology in AI

The dynamics of Nvidia vs. AMD AI Dominance 2025 cannot be attributed solely to financial models. Behavioral finance reveals the impact of psychology on stock movements that are not driven by fundamentals.

- FOMO (Fear of Missing Out): Nvidia is a recent example of retail and institutional investors trying to become a part of the AI boom and likely overvaluing it (Patel and Singh, 2022).

- Contrarian Optimism: AMD will appeal to investors who like the underdogs, in the bet that it will have asymmetric upside in the case it closes the gap with Nvidia.

- Herding Effect: Analyst upgrades with the media support the dominance of Nvidia, and this enhances the behavior of the herd and consequent inflows (Nvidia and AMD Analysis, 2025).

Finally, momentum, contrarian bets, and herd behavior are key factors in Nvidia vs. AMD stock prediction, rather than discounted cash flows; hence, sentiment is a significant influence on volatility.

Nvidia vs AMD AI Dominance 2025 – AI Revolution

Strategically, Nvidia’s leadership is based not only on hardware but also on controlling the ecosystem. Its CUDA platform is now regarded as the standard for AI development in the industry, making it challenging for companies and researchers to switch (Huang, 2023). Nvidia has an excellent moat in this software-hardware combination, as developers trained with CUDA are less likely to defect. Data center GPUs are also a key area of innovation at the company, positioning it as a leader in high-performance computing GPUs and giving it a first-mover advantage in the growing AI market.

Further Reading : Nvidia Stock Prediction 2030 after Q2 2026 Earnings: Should You Buy the Stock?

AMD is currently developing a challenger approach that combines low prices and performance enhancements with its MI300 line of accelerators (Accenture, 2024). Although AMD cannot match the depth of Nvidia’s software ecosystem, it positions itself as an affordable alternative for enterprises that wish to diversify their GPU suppliers and reduce their dependence on Nvidia. Although AMD is still lagging in terms of integrating into the ecosystem, its competitive prices and innovative pipeline can enable it to slowly gain market share, especially in organizations that have balanced performance requirements with limited budgets. Such duality of roles, with Nvidia being the luxury leader and AMD the practical challenger, characterizes the present-day trends in the industry regarding Nvidia vs AMD future dominance.

Conclusion

The relative comparison of assets, margins, returns, revenues, valuations, and debt establishes Nvidia’s superiority compared to its 2025 performance. Its productivity and impressive profitability are the reasons why it is the leader in the AI revolution in tech stocks. However, AMD presents another unique psychological selling point: the excitement of supporting the underdog with the possibility of a payoff.

In the future, the market is likely to become more competitive as each company expands its AI product offerings and seeks to integrate further with the cloud and enterprise clients. Nvidia is leading as its strong position in software ecosystems and profitability keeps it on the top; however, the leadership of the company is challenged by the strategic pricing and pipeline of innovations of AMD, which makes it a strong competitor, to the investors, that translates into the fact that the debate on who will dominate the market in the future between Nvidia and AMD is here to stay, with every earnings season serving as a trigger towards sentiment changes.

In the wider AI revolution in tech stocks, the two companies will be the most scrutinized and thus the tapes of diversified portfolios aiming to acquire AI stocks to buy 2025.

Overall, Nvidia stands a better chance of Nvidia vs AMD future dominance, yet AMD is a crucial component of the AI investment ecosystem, especially among investors interested in undervalued exposure to AI stocks to buy in 2025.

Frequently Asked Questions (FAQ)

Can AMD compete with Nvidia for AI?

Yes, AMD is competing with its MI300 accelerators and low prices. Although Nvidia is ahead in terms of the strength of its ecosystem, AMD is improving (Nvidia and AMD Analysis, 2025).

Is Nvidia expected to grow in 2025?

Indeed, Nvidia is likely to increase its revenues in the AI field, particularly in data centers and software licensing, especially in scenarios of Moderate and Bull (NVDA DCF, 2025).

Is AMD outperforming Nvidia?

AMD is not doing better financially than Nvidia. Nevertheless, it has been performing better compared to downward stock upside in particular quarters, which is a sign of contrarian investor interest (AMD DCF, 2025).

Who is AMD’s biggest competitor?

Nvidia remains the most significant competitor to AMD in the GPU market. Intel is an indirect player, yet Nvidia controls AI workloads (Statista, 2024).

Usama Ali

Usama Ali is the founder of Financial Beings and a self-taught investor who blends classic valuation study with insights from psychology. Inspired by works from Benjamin Graham, Aswath Damodaran, Stephen Penman, Daniel Kahneman, and Morgan Housel, he shares independent, data-driven research to help readers connect money, mind, and happiness.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.