Nvidia stock forecast 2030: Can NVIDIA be a $10-$20 trillion company? We break AI expansion suppositions, valuation boundaries, and the motivation behind the calculations. Extreme predictions are not the way to go.

Overview

The Nvidia stock forecast 2030 has also been gradually developing to determine whether it will go up further or not, and whether the valuation limits are still in force. The role of Nvidia in the artificial intelligence workload of data centres across the world has not only elevated Nvidia a notch higher to be not only a significant AI semiconductor market projections but also the harbinger of the AI era itself. Nvidia is commonly known as essential infrastructure among investors, analysts, and commentators in the market, which is an adjective that sparks hope of unprecedented capitalisation outcomes in the market.

Among the forecasts, one of them is the idea that Nvidia can reach the trillion-dollar market value, something that not only a few weeks ago was not the subject of any conversation, but is now being talked about everywhere.

Such a shift is noteworthy because the financial markets have a history of combining strategic importance with unlimited evaluation potential. This does not always seem to be true that being at the centre of a technological change would result in the never-ending excess returns to shareholders.

The final value is determined by how much a company can generate, from a comparatively long-lasting time span, the extent of capital that a company needs to plough back in order to develop it, and the length of time that such growth can be sustained before it starts to push towards more broadly based economic limits. These fundamentals have not been changed regardless of the technology that is behind railroads, electricity, the internet, and artificial intelligence.

This article critically examines the expectations of Nvidia’s market cap based on the operating data, as well as the operating valuation machinery of Nvidia. The analysis is not concerned with the size of the AI market in the future, but with a more consistent financial structure internally, which should be employed in supporting a valuation of $10 trillion. These doubts that extreme Nvidia stock price expectations 2030 are possible given realistic assumptions of the long-term by examining intrinsic value sensitivity, net operating assets increase, operating leverage, sustainability in returns and revenue concentration.

Intrinsic Value and the Terminal Growth Assumption

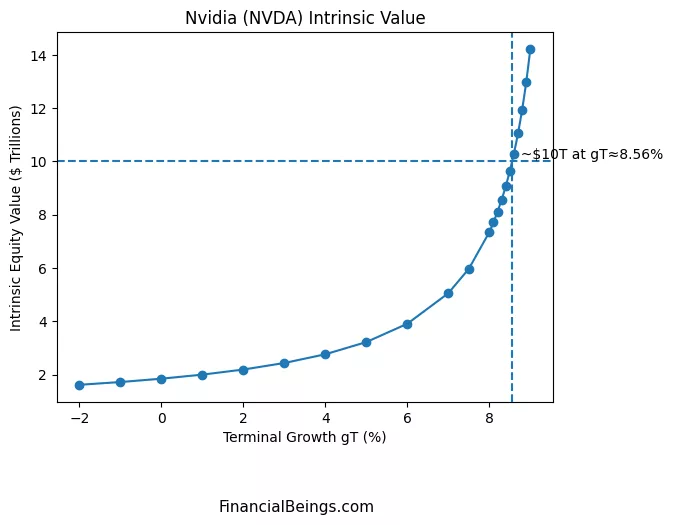

Figure 1: Nvidia Intrinsic Equity Value vs Terminal Growth Rate

The intrinsic equity value within Nvidia is somewhat contained at lower growth assumptions, which grows gradually at lower growth rates of less than one trillion at a one percent terminal growth rate up to less than four trillion at a six percent terminal growth rate. It is only on the occasion when terminal growth is about 8.6 percent, intrinsic value attains the mark of the $10 trillion threshold.

| Terminal Growth Rate (%) | Intrinsic Equity Value ($T) |

| -2.0 | 1.6 |

| 0.0 | 1.9 |

| 2.0 | 2.2 |

| 4.0 | 2.8 |

| 6.0 | 3.9 |

| 7.0 | 5.1 |

| 8.0 | 7.5 |

| 8.6 | 10.0 |

| 9.0 | 12.0 |

| 9.5 | 14.2 |

It is not the expansion of a terminal that would occur within the following five or ten years. It is the alleged unchanging growth rate of the cash flows beyond the explicit projection period. The standard valuation theory postulates that terminal growth must never exceed long-run nominal economic growth because in the long run a company with a growth rate exceeding the economic growth would have become the economy (Damodaran, 2023).

Any scenario that predicts the value of Nvidia stock to be worth to investors up to 10 trillion in equity value, would imply on the part of the investors, an implicit assumption that Nvidia would grow at higher rates than the global GDP indefinitely, even to the point of reaching the size of megabytes. It is not an optimism supposition. It is contrary to mathematical limitation of discounted cash flow analysis. Though Nvidia can continue to grow at an impressive rate well into the 2020s, it cannot sustain it forever with an annual growth rate that is approximately nine percent that is not the economic equilibrium in the long term.

It does not mean that the business of Nvidia will not stand still. This means that there would be structurally unstable growth assumptions in the valuation results at some level. It is the main reason why Nvidia market cap expectation of $10 trillion can hardly pass any critical examination.

Net Operating Assets Show Why Scale Changes the Rules

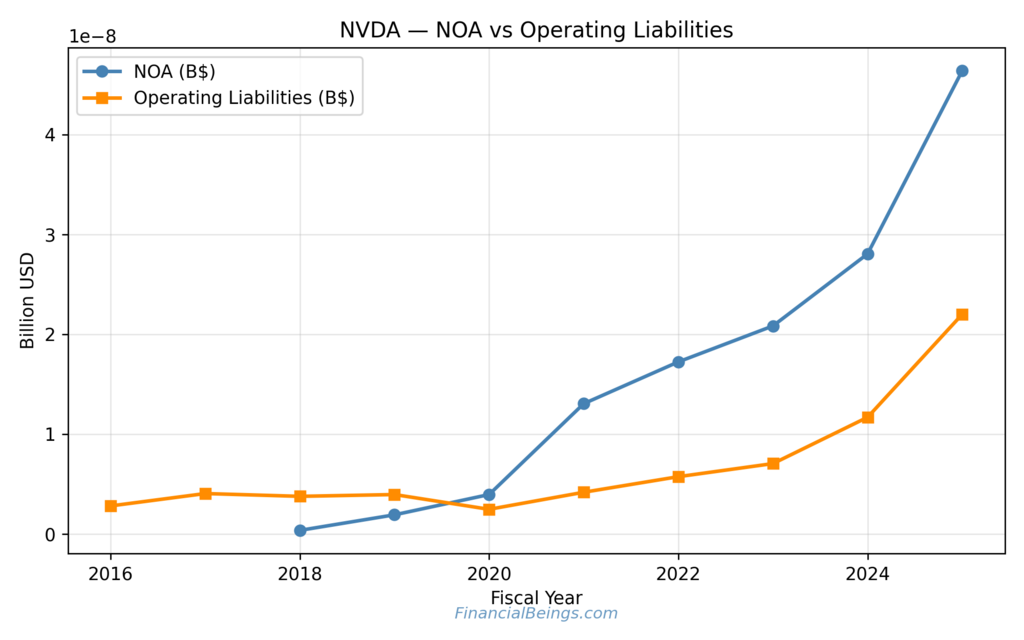

Even though the intrinsic value sensitivity exposes the growth issue, the net operating assets of Nvidia justify that it is harder to sustain extreme returns, which grow. Net operating assets are defined as capital invested in the company’s business core in terms of inventory, receivables and long-term operating assets that include all the operating liabilities. When Nvidia opened up to the Nvidia data centre revenue growth, its NOA soared to show the amount of money required to support the higher revenue.

| Fiscal Year | Net Operating Assets ($B) | Operating Liabilities ($B) |

| 2018 | 0.5 | 3.8 |

| 2019 | 2.0 | 4.0 |

| 2020 | 4.0 | 2.5 |

| 2021 | 13.0 | 4.2 |

| 2022 | 17.0 | 5.6 |

| 2023 | 21.0 | 7.0 |

| 2024 | 28.0 | 11.5 |

| 2025 | 46.0 | 22.0 |

The increase in operating assets has two major implications. To start with, Nvidia should now possess a much larger amount of operating profit to maintain the current profile of returns. Second, growth in terms of incremental growth is more capital-intensive over time. It is a trend in industries. The early growth may appear to be lean and scale introduces complexity, investment in working capital and infrastructure.

The Nvidia Company has several NVDA long-term valuation stories that implicitly indicate that the company can hike revenue without a concomitant increase in the operating assets. The assumption cannot be supported by the data of NOA. Nvidia is doing well in terms of the conversion of capital to profits, but the denominator is growing at a high rate. The resultant effect is that the mathematical burden of generating proportional returns on its capital is increasing with the amount of invested money.

This pattern is justified by the official reports of NVIDIA Corporation because the company focuses on the growing working capital requirements and inventory management problems linked with the booming increase in demand (NVIDIA Corporation, 2024a). These are not forces that show weakness. They signal maturity.

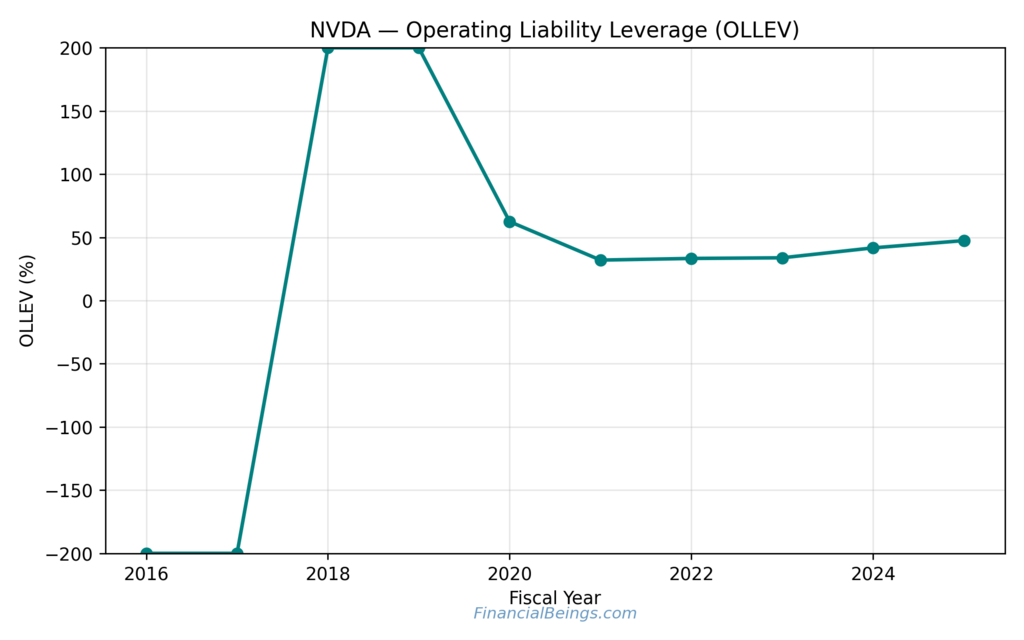

Operating Liability Leverage Has Already Done Its Job

The operating liability leverage is a measure of how well the assets of the company are financed by the operating liabilities. OLLEV assists in increasing the returns because in the optimistic scenario, companies can fund their operations without any investment in capital. This effect was positive to Nvidia when it came at earlier stages of its evolution, when returns were supported by the terms of suppliers and deferred revenues.

| Fiscal Year | OLLEV (%) |

| 2016 | -200.0 |

| 2017 | -200.0 |

| 2018 | 200.0 |

| 2019 | 200.0 |

| 2020 | 62.0 |

| 2021 | 32.0 |

| 2022 | 34.0 |

| 2023 | 35.0 |

| 2024 | 42.0 |

| 2025 | 48.0 |

The maturity of Nvidia has reached a level with that of OLLEV. The past years’ values are so high, which means that there is a moderate asset base rather than sustainable leverage. Over the past several years, the operating liability leverage has been in the moderate range, which is why the balance sheet structure is no longer a meaningful source of returns for Nvidia.

The Nvidia stock forecast 2030 analysis has found it significant because it gets rid of a latent factor of the previous performance. The returns would be forced to be made in the future, initially on operating margins and asset efficiency rather than the financial structure. This increases the sensitivity of competition, price pressure, and the decisions related to capital allocation. Extreme valuations typically ignore this transition, assuming implicitly that the benefits of leverage in the past will be the benefits of leverage permanently.

RNOA Reveals the Fragility of Peak-Cycle Returns

The fact that the company has been efficient in converting operating capital into profit is one of the indicative indicators of valuation; this is because the return on net operating assets illustrates the efficiency of the company. The RNOA of Nvidia has outstanding peaks with a sharp compression followed by recovery.

| Fiscal Year | RNOA (%) |

| 2018 | -200.0 |

| 2019 | 200.0 |

| 2020 | 140.0 |

| 2021 | 112.0 |

| 2022 | 74.0 |

| 2023 | 5.0 |

| 2024 | 138.0 |

| 2025 | 205.0 |

The volatility itself is the most significant. The demand cycles, price power, and utilisation are very influential on the returns of Nvidia. Even though recent rebounds will indicate a tremendous demand in the field of AI, the sharp drop in 2023 demonstrates that returns can be flat in response to alterations in the conditions. This historical change is overlooked in long-run estimates of Nvidia’s market cap that hopes to remain constant, and high ROA.

The bigger the company, the greater the competition, the leverage assumed by the customers and the marginal pressure. Normalisation of returns can even be seen in the dominating firms over time. Extreme RNOA would require decades of non-response in competitors, which is not characteristic of competitive capital-intensive markets.

Revenue Concentration Exposes Nvidia’s Structural Risk

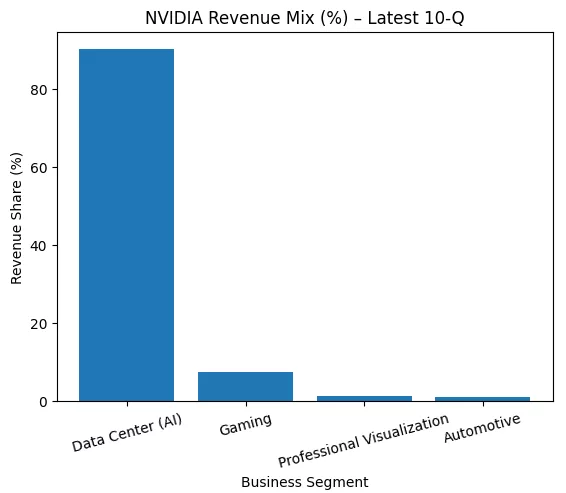

Figure 5: Nvidia Revenue by Business Segment (Latest 10-Q)

NVIDIA’s revenue model is highly concentrated in data centres, which currently makes the highest contribution to total revenue in the company.

| Segment | Revenue ($B) |

| Data Center (AI) | 51.0 |

| Gaming | 4.0 |

| Professional Visualization | 0.8 |

| Automotive | 0.6 |

This degree of concentration puts positive and negative factors into more focus as the revenue stream of Nvidia is more directly linked with a small number of large consumers rather than a mass of customers, which is fragmented. Hyperscalers, including cloud service providers, are highly restrictive of their internal return policy and capital efficiency. They are not merely driven by the necessity to buy it because of the technological necessity, but also by the cost discipline, the utilisation rates and future payback time.

This gives rise to the fact that data centre infrastructure spending is not always a linear form of advancement, but rather waves. The spurts of capacity development can then be followed by digestion spurts, where capital would be optimised on the current infrastructure before additional capital would be invested.

This cyclicality is also acknowledged by Nvidia itself, which declares that the changes in customer purchase trends, including when and the quantity of orders of large clients, can influence revenues and operating performance in a significant way (NVIDIA Corporation, 2024c). It is not a theoretical risk. It models the action of hyperscalers in the historical period when capital intensity rises and capital returns begin to become constant. The spending of the short- to medium-term could slow down in the situation when the requirement of computing power is long-term, yet customers will reconsider the usage, the model of prices, and the options inside.

The importance of such an imbalanced pattern of spending, in terms of valuation, is that long-term cash flow models are highly sensitive to the stability of growth assumptions. The outcomes of valuation become less predictable, and the terminal assumptions have a greater role to play when the growth of revenue is not consistent compared to smooth. Having a bigger and more focused revenue foundation, any minor changes in the continuous increase will be disproportionately influential on long-term valuation in a situation which assumes the presence of the market capitalisation of $10 trillion dollars and up.

Revenue Mix Confirms the Absence of Diversification

| Segment | Revenue Share (%) |

| Data Center (AI) | 90.0 |

| Gaming | 7.0 |

| Professional Visualization | 1.5 |

| Automotive | 1.5 |

This income analysis shows that the Nvidia valuation is a one segment bet because the majority of the financial performance of the company is excessively reliant on the market of data centers. The changes in a single market where the percentage that makes up the revenue is very high reflect positively and strongly on the cash flows in general. The diversification of the end market tends to provide natural shock absorber because one may be weak in one region, which is offset in part by strength or strength in other regions.

The gaming market, automotive and professional visualization market segments in the case of Nvidia are not significant enough to make any actual difference in terms of offsetting data center demand. Therefore, the income statement of Nvidia is more susceptible to investment preferences of a limited number of clients as opposed to diversified technology companies (NVIDIA Corporation, 2024a).

This is even more problematic where expectations of valuation are on the rise because more market capitalisations make assumptions of stability and even growth. The markets are moderate and are able to absorb fluctuations in revenue. Even short shocks will lead to disproportionate repricing at extreme valuations as investors reconsider long-term assumptions. The one-segment revenue structure limits Nvidia in its capabilities in insulating revenue from fluctuations in economic cycles, and therefore the outcomes of the valuation process are more susceptible to fluctuations in the expenditure pattern, price pressure or even intensity within the data centre market.

The lack of any material diversification poses a structural risk to the Nvidia stock price expectations for 2030 in the form of a continued unbroken growth, which is often miscalculated in the setting of a positive valuation narrative (NVIDIA Corporation, 2024b).

Why AI Market Growth Does Not Guarantee Shareholder Returns

The presence of the market of AI development and its increase does not presuppose the corresponding shareholder returns as other mechanisms determine the growth and value creation in the market. The market size is the general value of the total spending at an industry where as the shareholder value is the value of the total expenditure converted into sustainable economic profit of individual firms. Based on the valuation theory, a growth can only create value when a business can deliver returns on invested capital which is greater than its cost of capital during the time (Damodaran, 2023).

The value retained by shareholders through incremental value might decrease with any further growth that would require a high level of reinvestment or the growth can be increased by competition despite the revenue being at an incremental level. As Tesla is pivoting towards AI and investors have suddenly started considering it as an AI stock, should you buy this story and how TSLA and NVDA compares, can be found here.

The expansion of the artificial intelligence infrastructure, as is the case in Nvidia, has led to rapid expansion in net operating assets to meet higher rates of volume, more complex supply chains, and reduced delivery times. According to the financial reports of Nvidia, the operating assets are growing at a large scale as the company is growing in terms of production and inventory to meet the demand of data centres (NVIDIA Corporation, 2024a). This growing degree of reinvestment is a sign that each additional dollar of revenue is increasingly dependent on a greater capital base.

The more the reinvestment, the lower the portion of operating cash to the equity holders and this imposes inherent limits to valuation multiples. Increased capital intensity, even in cases when the revenue growth is strong, reduces excess returns, resulting in multiple expansions.

This will be critical, particularly during the evaluation of the Nvidia AI growth outlook narratives that are deeply rooted in the total addressable market projections. High markets are known to attract competition, customer bargaining power, and accelerate the rate of price pressure, and all this makes the difference between returns and cost of capital to be minimal.

The value-generation that Nvidia is already in the process of doing over the long term, therefore, depends on the scale of the AI market, and its ability to retain the pricing power and the effectiveness of its assets as the market matures. In the event the underlying demand is good, inflating expectations of long-term returns to shareholders can be achieved by disregarding the necessity to make reinvestment and competitive responses to particular behavioural incentives.

Nvidia profit margins sustainability at Trillion-Dollar Scale

The second significant assumption which is entailed in the aggressive NVDA valuation analysis is that operating margins are sustainable. The good competitive environment, pricing power and the shortage of supply have been part of the good margins of Nvidia. The margin durability, however, increases with an increase in scale, to the hardness.

In particular, the filings of NVIDIA indicate that the pricing pressure, competition and customer negotiations can have a substantial effect on the gross margin in the long run (NVIDIA Corporation, 2024c). Having a valuation of $10 trillion, even a small squeeze in the operating margin will lead to hundreds of billions of loss in intrinsic value. This sensitivity is usually compromised on positive assumptions about the capital market of NVIDIA.

Economic theory and history show that margins, as a rule, will tend to level off to normal levels as an industry matures. Increased competition, the bargaining power of customers, and regulation are slowly eating up the peak profitability. Even though this process can be delayed in Nvidia by the technological leadership, it is not prohibited. NVDA long-term growth assumptions must go beyond the growth of revenue to consider ever more the possibility that, beyond exceeding growth, the company might be capable of putting back into the revenue growth to industry-standard margins.

Why Total Addressable Market Does Not Equal Shareholder Value

The overall trend that is visible in optimistic Nvidia AI development prognostications is the expansion of the total addressable AI computing market. Despite the significant role of market size, the shareholder returns are determined by the degree of such value returning to the equity holders following the competition, capital investments and the operating cost.

Aswath Damodaran holds that giant markets are likely to experience competition that later shifts the value to other places than the already existing firms, despite the rising demand (Damodaran, 2023). This is because the moment Nvidia dominates the industry today does not mean that the company will be in the position of gaining the same ratio of profit for decades. The difference is vital in estimating Nvidia’s market cap expectations, which implicitly assumes zero or increasing economic rents.

Besides, the arguments founded on TAM are more likely to neglect the necessity of capital reinvestments. The net operating assets of Nvidia are on the rise, which implies that the company requires high rates of sustained investment in order to keep growing. The growth does not assure the creation of shareholder value, but rather the difference between returns on the invested capital and the cost of capital. The less extensive the expansion, the less the multiples of valuation, no matter the increment in revenues.

Further Reading : NVIDIA Implied Growth Rate Surges – Is NVDA a Buy After Q3 2026 Earnings?

Further Reading : Nvidia Valuation and Implied Growth Rate: Is NVDA Still Worth Its Sky-High Premium in 2025?

Further Reading : Nvidia vs Google Stock: Which Tech Titan Is the Better Buy for 2026?

Investor Psychology and the Pattern of Extrapolation

Financial market history has a long history of extrapolation of peak conditions on a long-term basis. During the times of technological hype, investors are likely to mistake permanence with importance. The significance of Nvidia to the AI infrastructure is admittedly high; however, significance does not mean that there is no valuation opportunity.

It is the history of market cycles that points to the fact that the compressing of the valuation of the companies that lead the transformative trends is most often observed when the growth expectations turn out to be more stable. This is not required to collapse operationally. The natural market reaction to more realistic long-run assumptions is simply this. The Nvidia stock prediction 2030 arguments that rely on the high capitalisation of the market subject themselves to the repetitive nature of the same situation by assuming that the same problem is happening in the market today and projecting it into any given date.

To a professional investor, confidence in $10 trillion appraisals is not an issue. It is an acknowledgement that even the fantastic business undertakings have boundaries within which they operate in the economy. The most important thing is that these limits are to maintain the long-term capital.

Conclusion

Through its technology and wide integration with data centres and good relationships with its customers, Nvidia can remain at the centre of the AI infrastructure in the next several years. The above strengths can be used to justify the forecast regarding the additional increase in revenues and premium valuation relative to other conventional semiconductor players. However, an unremittingly high growth rate, perpetually high returns on capital, and absence of competitive pressure is not required to give Nvidia the strategic value that it has. Although companies have become large even those at the forefront of the transformative technologies, there are natural limits to the company in terms of capital requirement, customer power of bargaining and normalization of returns.

The strict Nvidia stock forecast 2030 realizes the fact that the creation of long-term shareholder value can be possible without Nvidia turning into a $10 trillion dollar company in the market. History teaches us that the highly successful companies that have been highly successful have also delivered huge returns to investors, even though the multiples of valuation have been normalised with time. Regarding Nvidia, the availability of continuous cash flow, a decent amount of capital investments, and the ability to adapt the AI infrastructure market to maturity are more likely to reflect on sustained success.

Beautiful regard for the success which Nvidia has achieved without breaking the valuation thresholds is not a pessimistic or cynical approach towards artificial intelligence. It is realism grounded on the financial history and principles of valuation, which at the end may present a more viable model to the long-term investors.

All calculations and valuation estimates are FinancialBeings’ own, based on data sourced from SEC filings NVDA (10K and 10Q), use or reproduction before prior approval is prohibited.

Usama Ali

Usama Ali is the founder of Financial Beings and a self-taught investor who blends classic valuation study with insights from psychology. Inspired by works from Benjamin Graham, Aswath Damodaran, Stephen Penman, Daniel Kahneman, and Morgan Housel, he shares independent, data-driven research to help readers connect money, mind, and happiness.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.