Microsoft Stock for Long Term Portfolio: Find out why, in 2025, MSFT will still be the dominant IT company, redefining sustainable growth. Examine its robust cash flows, dividend consistency, and AI-driven growth, which make it an essential asset for patient investors. Microsoft Stock for Long Term Portfolio remains a pillar of disciplined investment in 2025. The company’s strong foundation, steady dividend growth, and leadership in artificial intelligence (AI) all influence its long-term performance. Microsoft’s financial performance 2025 is solidified by its strategic investments in cloud computing, generative AI, and digital productivity tools (Microsoft Annual Report (10K), 2025). MSFT offers a unique combination of growth, stability, and profitability for investors seeking a balance of innovation and consistent income.

Microsoft’s well-rounded business strategy makes it one of the best AI stocks to buy now, even in the face of economic uncertainty and rapid technological advancements. The company can maintain strong cash flows while expanding its AI footprint due to its integrated ecosystem, which includes Azure and Copilot, and generates sustained demand across various industries (Statista, 2025). This contrast between financial caution and innovation highlights Microsoft’s supremacy in the Microsoft stock forecast 2025.

Financial Strength and Performance Overview

Revenue and Profitability

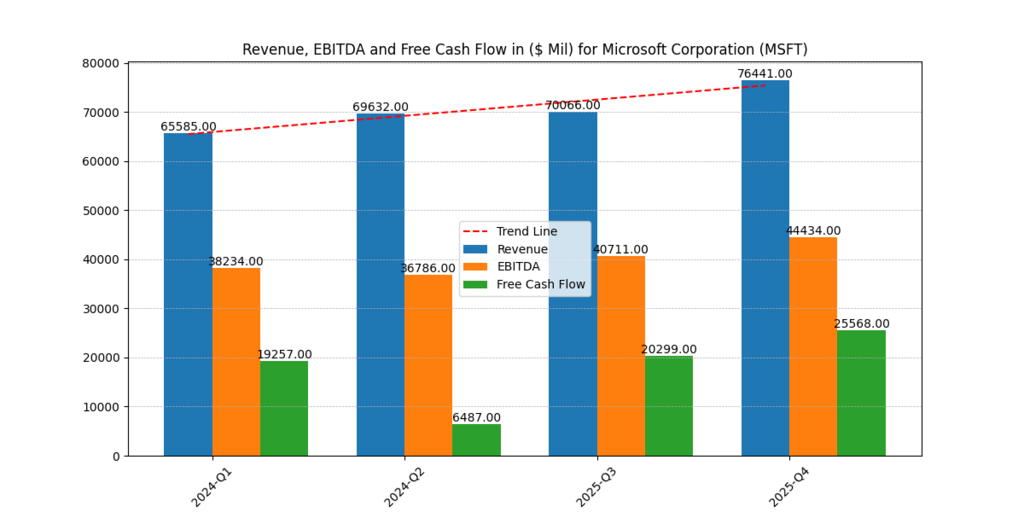

Strong cloud and enterprise performance underpin Microsoft’s consistent top-line growth, as indicated by revenue trends. Azure, LinkedIn, and Office 365 sectors are the main drivers of the steady double-digit increases shown in the attached revenue chart (Figure 1). The company’s remarkable capacity to sustain investor confidence and maintain growth potential is demonstrated by its total market equity, which has reached over $3.85 trillion, according to internal valuation statistics.

Figure 1. Microsoft Revenues (2020–2025)

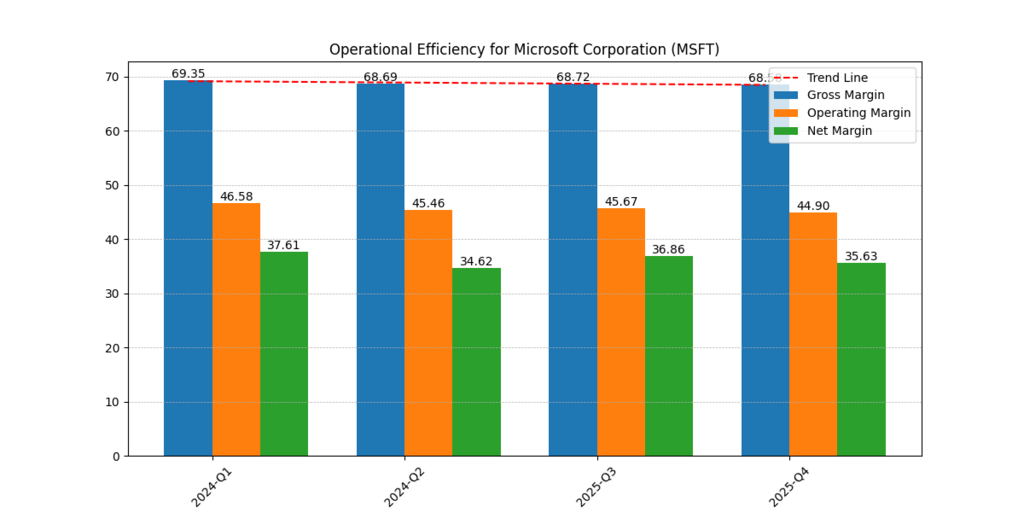

As shown in Figure 2, the company’s operating margins have remained strong and are typically among the highest in the technology industry. The scalable nature of cloud subscriptions, software licensing, and AI-powered enterprise solutions is reflected in high margins (Microsoft Annual Report (10K), 2025).

Figure 2. Microsoft Margins (Operating, Gross, Net)

Return on Equity and Capital Efficiency

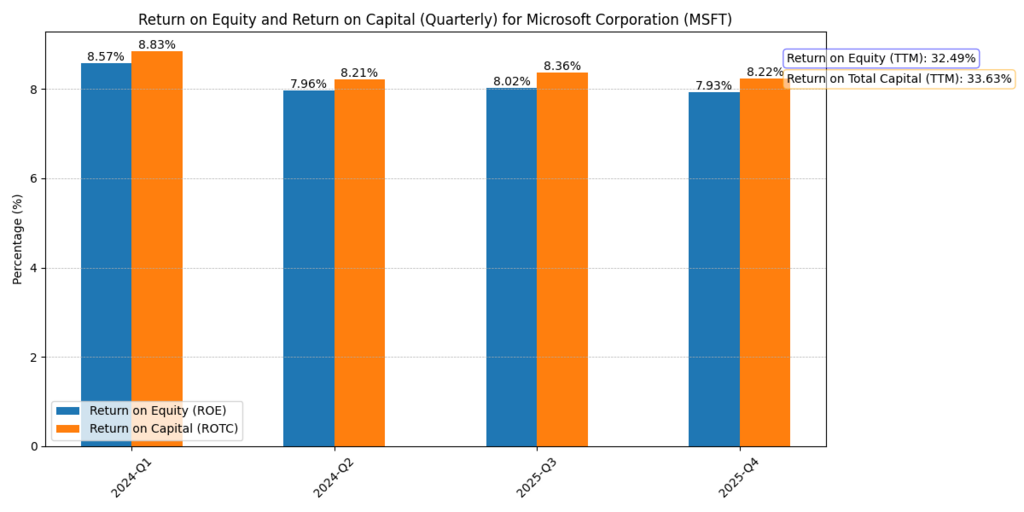

Microsoft continues to be incredibly efficient financially. The Return on Equity (ROE) and Return on Total Capital (ROTC) ratios exhibit steady annual growth, as seen in Figure 3. With a return on equity (ROE) of more than 30%, the business effectively turns shareholder capital into profit, promoting the long-term viability necessary for dividend stocks with consistent growth (MSFT Investor Relations, 2025).

Figure 3. Microsoft ROE and ROTC Ratios (2020–2025)

Free Cash Flow and Dividend Reliability

Cash Flow Trends

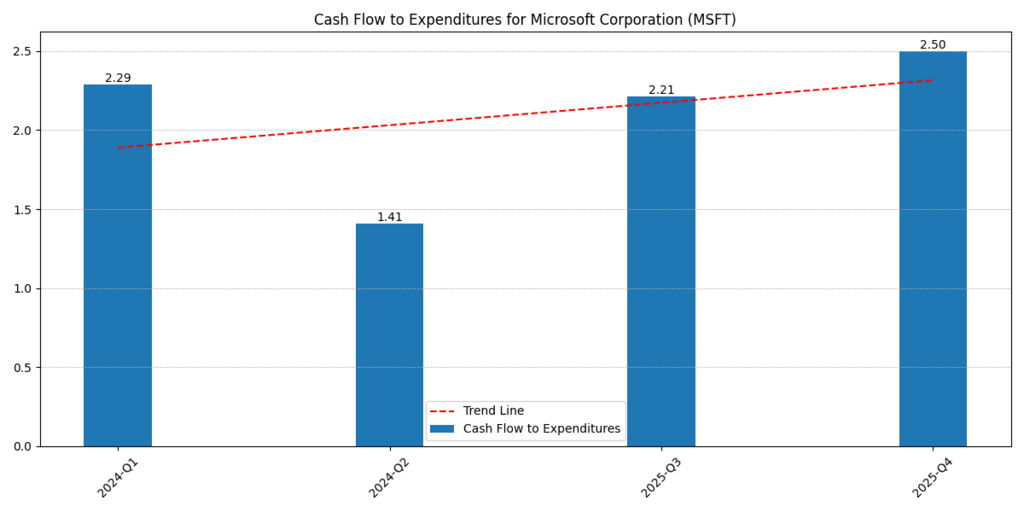

Microsoft’s free cash flow trends indicate strong liquidity and excellent operating performance. Figure 4’s operating cash flow to expenditure ratio suggests that the company generates sufficient funds to reinvest in AI infrastructure and research without placing undue strain on its capital structure.

Figure 4. Operational Cash Flow vs. Expenditures

Dividend Policy and Stability

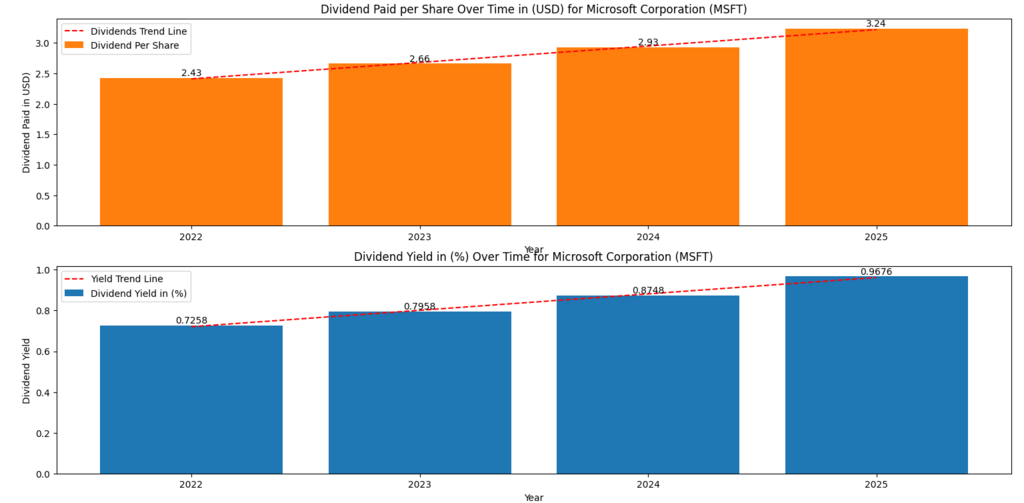

Long-term income investors are drawn to Microsoft because of its steady growth dividend stock reputation. The consistent growth in dividends per share in Figure 5 demonstrates management’s faith in long-term profitability and cash flow (Microsoft Annual Report (10K), 2025).

Figure 5. Microsoft Dividends per Share (2020–2025)

One of the main psychological elements affecting long-term portfolio decisions is investor trust, which is increased by dividends. Stable dividends give conservative investors a sense of financial security, while growth-oriented investors see them as a sign of strategic discipline that enhances the possibility of capital growth.

Valuation and Price Outlook

DCF-Derived Value Ranges

The primary reference point for the valuation range is Microsoft’s 2025 Market Equity Price per Share, which is $517.35 based on the value-added earnings model that was presented. Your internal DCF sheet is used to determine the Low, Mid, and High valuations, which represent conservative (Bear), moderate, and optimistic (Bull) situations.

| Valuation Case (2025) | Assumption Scenario | DCF-Derived Value (USD) | Interpretation |

| Low (Bear) | Conservative case – limited AI adoption | $403 | Reflects cautious investor sentiment and macro tightening. |

| Medium (Base) | Balanced case – steady AI and cloud expansion | $462 | Aligns with current intrinsic value and fair market pricing. |

| High (Bull) | Strong AI and cloud-driven growth momentum | $650 | Reflects strong investor optimism and innovation-led expansion. |

These estimates show how resilient Microsoft is by nature. One of the main reasons Microsoft Stock for Long Term Portfolio is still a safe compounder is that, even under conservative assumptions, its valuation is still close to parity with the current market price, suggesting no downside risk.

Further Reading : Why to Buy Microsoft Stock in 2025? Strong Earnings, AI Growth & Dividends!

Investor Psychology Insight Box

Why Long-Term Investors Trust Microsoft

When assessing large-cap tech companies, investors in behavioural finance sometimes waver between optimism and caution. Microsoft’s free cash flow trends uniquely appeal to both groups. While progressive investors see promise in its AI-driven stock growth, conservative investors like its consistent cash creation and stable dividend.

MSFT stock fundamentals are positioned as an aspirational stock during tech expansions and a comfort stock during instability because of this psychological duality & security combined with innovation (Kahneman, 2021).

AI-Driven Expansion and Strategic Growth

In 2025, Microsoft will have a competitive edge that goes well beyond software. An environment where productivity, automation, and enterprise analytics come together is fueled by the company’s expertise in generative AI (e.g., Copilot, Azure OpenAI Service). This change supports Microsoft’s AI-driven stock growth narrative by transforming the company from a software company to a full-fledged AI infrastructure supplier (IDC, 2024).

Long-term compounding is accelerated by its alliances with OpenAI and the widespread use of Azure by businesses. Due to its strategic diversification, MSFT can maintain its position as one of the top AI stocks to buy now, outperforming both cyclical and speculative peers in terms of growth and profitability.

Long-Term Investment Outlook

Defensive Strength

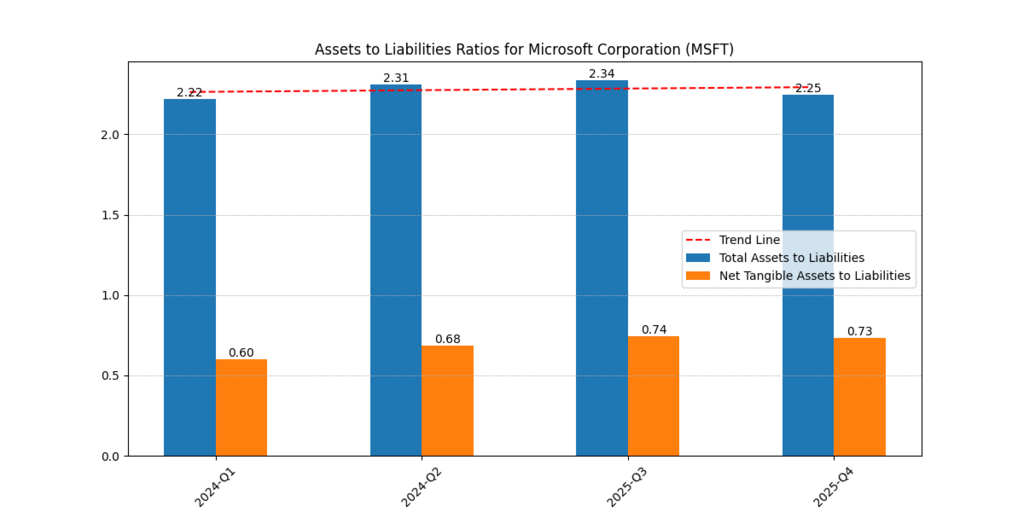

The assets and liabilities chart (Figure 6) illustrates Microsoft’s low debt ratio, which reinforces the company’s strong financial position. Flexibility during downturns is made possible by a disciplined financial structure, which permits ongoing innovation even when peers cut back on R&D expenditures.

Figure 6. Assets vs. Liabilities (2020–2025)

Investors building a long-term tech stocks 2025 strategy focused on stability and capital preservation may find this defensive positioning appealing. For endowments, pension funds, and long-term retail investors, MSFT serves as a pillar that strikes a balance between exposure to innovation and dividends.

Future-Proofing Through AI

Microsoft’s early investments in enterprise-level AI models reinforce its competitive moat as the world’s adoption of AI picks up speed. Long-term demand resilience is ensured by the company’s connection with cloud ecosystems and productivity (McKinsey, 2024). A steady revenue base with growing margins is the end result, generating long-term shareholder returns.

Conclusion

Microsoft Stock for Long Term Portfolio is a perfect example of the optimal balance between income and innovation. The company is a model for steady growth dividend stocks in 2025 because of its continuous dividend growth, robust cash flows, and leadership in AI. Limited downside risk is highlighted by its internal DCF valuation, and investor loyalty is strengthened by behavioural characteristics, including familiarity, trust, and perceived safety.

Microsoft’s capacity to translate innovation into quantifiable financial performance guarantees its continued appeal in a time when technological cycles change quickly. MSFT is more than just a company; it is a pillar of the contemporary long-term portfolio for investors who want both confidence and poise.

Frequently Asked Questions (FAQ)

Is Microsoft stock a good choice for a long-term portfolio?

Indeed. Microsoft is one of the most reliable long-term investments due to its diverse revenue streams, which include enterprise software, artificial intelligence, and cloud computing (Azure). Stability and growth prospects are reinforced by its steady earnings and growing AI ecosystem.

How does Microsoft generate long-term growth for investors?

Microsoft maintains growth through cloud leadership, recurring revenue models, and continuous innovation in productivity software, artificial intelligence, and cybersecurity. Compounding returns and strong free cash flow production are supported by these pillars.

Does Microsoft pay dividends, and are they reliable?

Indeed. With steadily increasing distributions supported by growing revenues and cash reserves, Microsoft has a solid dividend track record. Long-term investors can still rely on its payout ratio.

What risks should long-term investors consider with Microsoft stock?

Risks include regulatory challenges, slowing global IT expenditure, and competition in the cloud and AI businesses, despite Microsoft’s underlying strength. Over time, though, its financial stability helps to mitigate these difficulties.

Usama Ali

Usama Ali is the founder of Financial Beings and a self-taught investor who blends classic valuation study with insights from psychology. Inspired by works from Benjamin Graham, Aswath Damodaran, Stephen Penman, Daniel Kahneman, and Morgan Housel, he shares independent, data-driven research to help readers connect money, mind, and happiness.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.