Introduction

This analysis of Microsoft (MSFT) stock provides thorough information about MSFT’s 2025 market valuation along with value assessment. Understand how Microsoft performs financially from current metrics then study future growth potential through price targets created based on revenue developments.

The Microsoft Corporation is a global leader in many different types of technology domains, including software development, hardware and software production, and artificial intelligence research. The corporation was started in 1975 by Bill Gates and Paul Allen, and it has since evolved from its early days of creating personal computer software to become a global leader in technical innovation. Since their founding, Microsoft has contributed to the development of the contemporary tech environment with key products like Windows OS, Microsoft Office, and Azure cloud solutions.

Microsoft’s Azure cloud operations, AI-enabled solutions, Xbox games, and LinkedIn user services have all been fundamental to the company’s many business models. CEO Satya Nadella forced Microsoft to concentrate on cloud computing and artificial intelligence as part of its plan to increase its development potential during the ensuing years.

Investors looking at MSFT stock in 2025 will be interested in the company’s potential for growth as well as the risks associated with an unpredictable economy, competition, and regulation from all angles (both inside the technology sector and across the industry). Based on expected growth dynamics and revenue patterns related to performance factors that will define Microsoft’s next set of financial results, the analysis examines the dynamics of the company’s future worth. Second, this section assesses MSFT stock by determining its price value based on high, medium, and low growth scenarios. It also highlights key points for investors considering MSFT stock.

Key Takeaways

Microsoft (MSFT) stock

1. The company maintains stable revenue growth through customer adoption of Microsoft Azure cloud services together with AI benefits and enterprise software product selection.

2. The company produces powerful operating profits through efficient expense management along with its dominant market position until economic events impact profitability numbers.

3. Investors consider MSFT a long-term investment because it remains at the forefront of the technology sector and its profits demonstrate sustainable growth and steady dividend payment.

4. The company encounters multiple obstacles that stem from regulatory pressure and competition threats by artificial intelligence together with cloud computing and economic business cycle downturns affecting enterprise IT expenditure.

Recent AI Developments by Microsoft

| AI Development | Description | Impact |

| Copilot Integration | Microsoft has integrated AI-powered Copilot across Office 365, Windows, and Azure to enhance productivity. | Boosts enterprise efficiency and drives AI adoption in workplace applications. |

| Azure OpenAI Services | Expanding cloud-based AI services, enabling businesses to leverage GPT models for various applications. | Strengthens Azure’s competitive position and increases cloud revenue. |

| Partnership with OpenAI | Multi-billion dollar investment in OpenAI to enhance AI research and product integration. | Ensures Microsoft remains at the forefront of AI advancements. |

| AI-Powered Bing & Edge | AI-driven search and browsing enhancements using OpenAI’s GPT models. | Improves user engagement and challenges Google’s search dominance. |

| Custom AI Chips (Azure Maia & Cobalt) | Developing in-house AI chips to optimize AI workloads and reduce reliance on Nvidia. | Enhances cloud efficiency and cost savings for Microsoft’s AI operations. |

| AI in Gaming (Xbox & Activision) | AI integration in game development, personalized experiences, and automation. | Strengthens Microsoft’s gaming division and creates new revenue opportunities. |

| Healthcare AI Initiatives | AI solutions for medical diagnostics, imaging, and data analysis. | Expands Microsoft’s footprint in the lucrative healthcare tech sector. |

Financial Analysis For Microsoft (MSFT) Stock

Revenue Growth and Trends

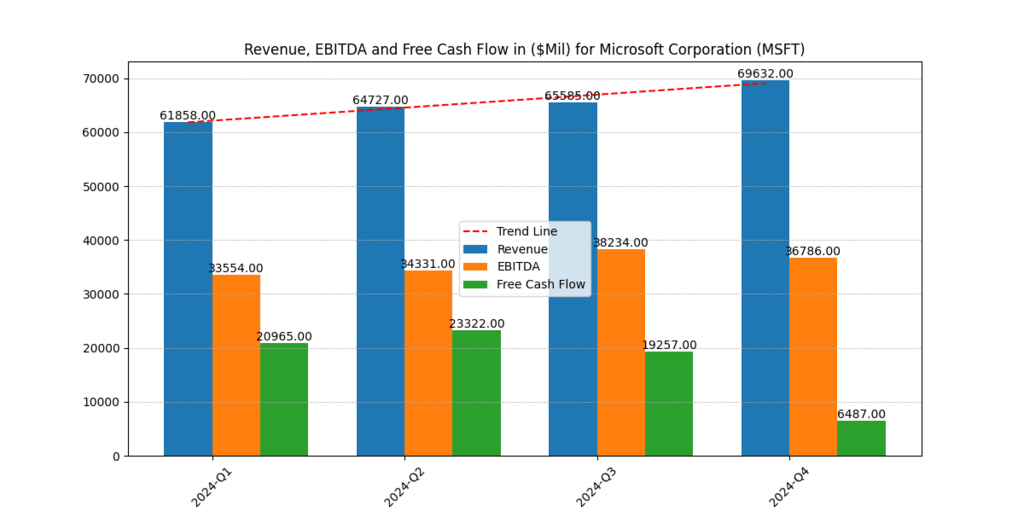

The expansion of Microsoft’s revenue growth stems from their Azure cloud computing platform together with their AI-based enterprise solutions. Microsoft achieved total revenue growth of 13% in its most recent earnings report which exceeded anticipated market results. The cloud segment delivers the highest level of revenue for the company as Azure revenue demonstrated 28% YoY expansion. Microsoft continues posting revenue growth through its AI strategy as well as strategic acquisitions and rising demand for enterprise software solutions. Macroeconomic conditions together with alterations in currency values and anticipated PC market slumps might challenge Microsoft’s coming revenue patterns. Investors need to observe both consistent cloud business expansion alongside AI integration in order to validate long-term business stability. [1]

Gross, Operating and Net Margins

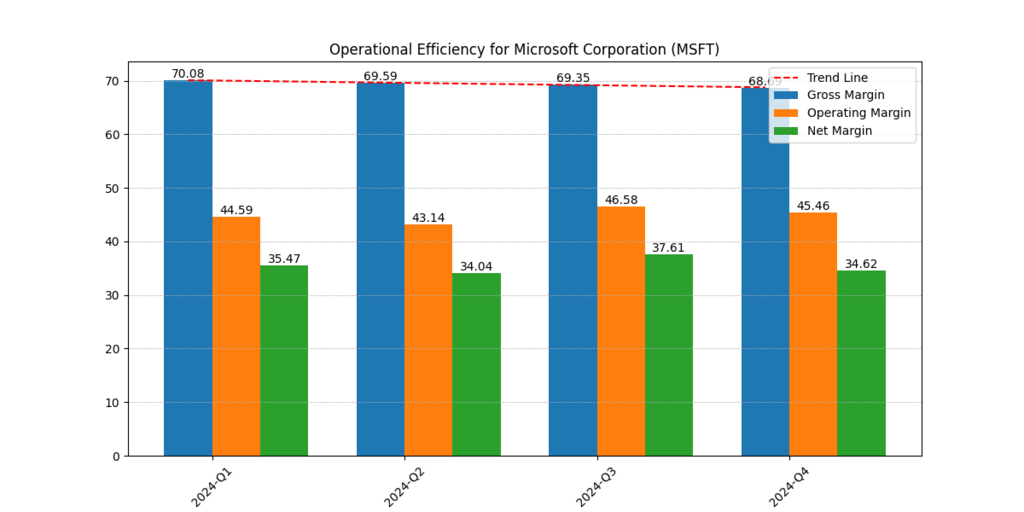

The operating margin of Microsoft currently holds the top position in the technology sector according to its most recent financial results at 42%. The company keeps high operating margins from its three major profit sources which consist of software licensing along with cloud services and AI-based enterprise solutions. Operational effectiveness and effective cost management enable Microsoft to maintain its stable profitability level. Margin performance at Microsoft could be negatively impacted by rising AI development costs along with regulatory demands. Microsoft can sustain or enhance its profit margins through successful capitalization of its Artificial Intelligence research investments. Microsoft’s financial health can be effectively evaluated in 2025 by studying changes to operating margin performance.

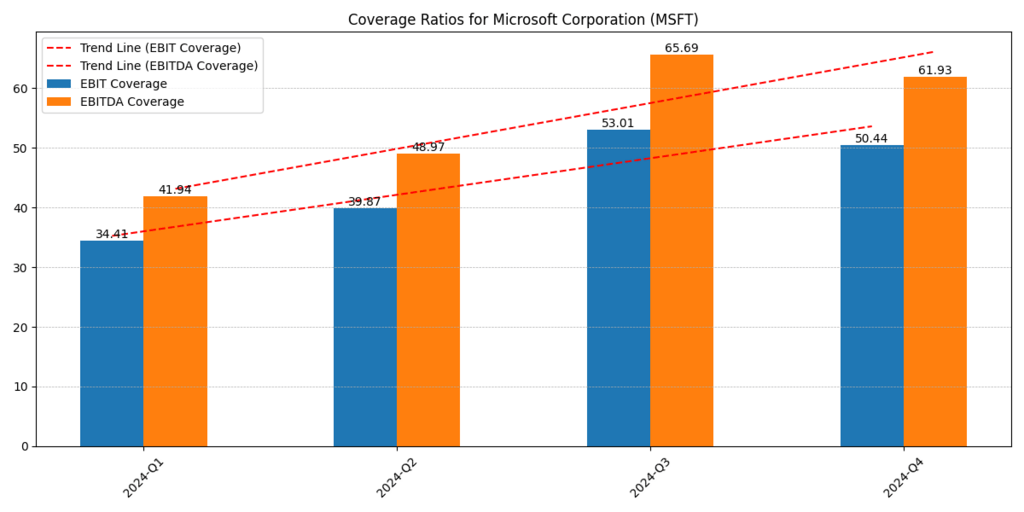

Cloud Computing, AI Expansion and EBITDA Coverage

Azure, Microsoft’s cloud division, reported YoY growth of 28% in the most recent quarter. Microsoft offers a wide range of products, including Azure AI and Microsoft 365, which incorporate OpenAI models. The growing popularity of generative AI services further boosts cloud use. However, businesses continue to face fierce competition from Google Cloud and Amazon Web Services (AWS). The cloud segment may continue to grow at double digit rates and add to the group’s long-term valuation, as Microsoft is expected to maintain its leadership in the delivery of AI-powered cloud solutions. Investors should focus on the adoption of AI as well as Azure’s market share.

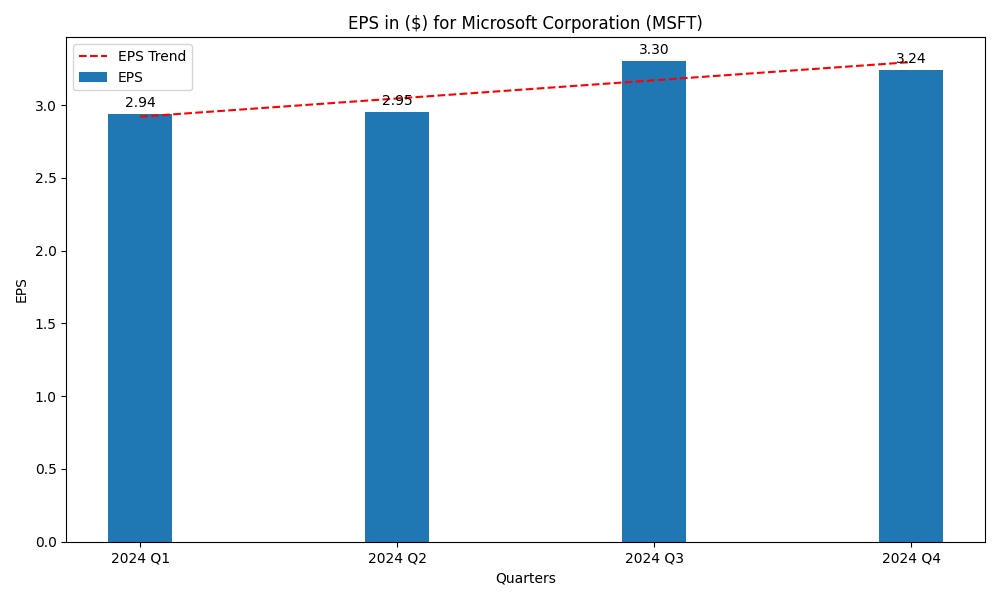

Dividend, Share Buybacks and EPS Growth

While the dividend yield is far from high for most income stocks, when combined with dividend growth and capital appreciation, Microsoft is an amazing long-term investment for both income and growth investors. The company, which has maintained a 0.8% dividend yield and has increased its dividend annually since 1990, recently increased its quarterly dividend by 10% and has good cash flow qualities. Additionally, Microsoft is continuously buying its own shares to reduce the number of outstanding shares and boost EPS growth. In 2024, the company allocated $10 billion for share buybacks, which is an impressive indication of forward strategies. [2]

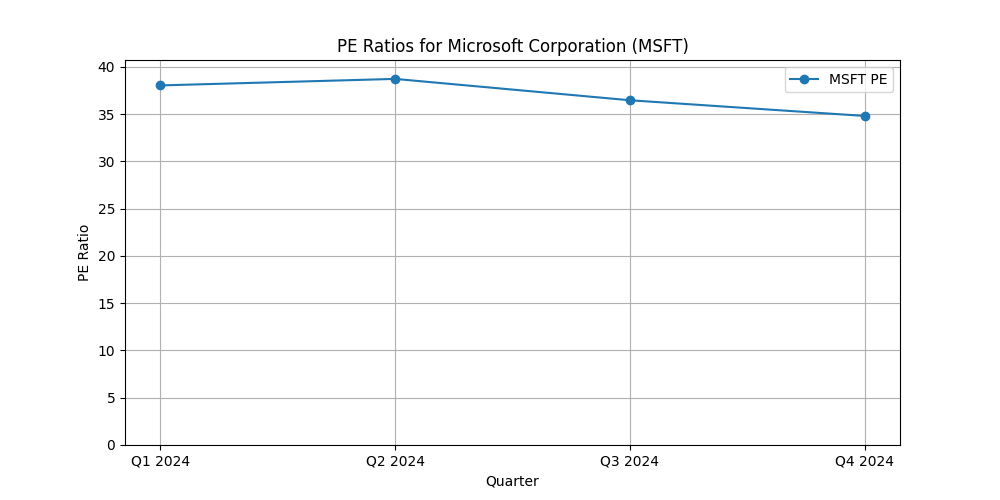

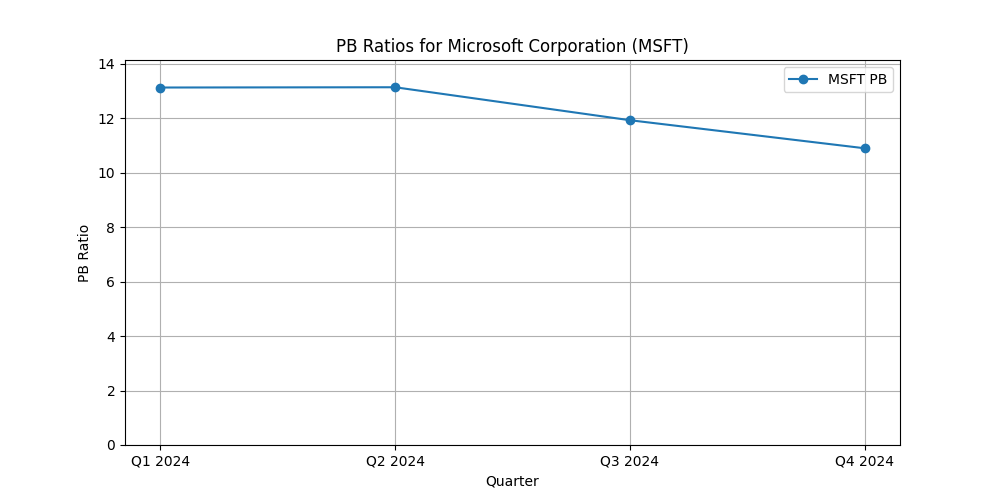

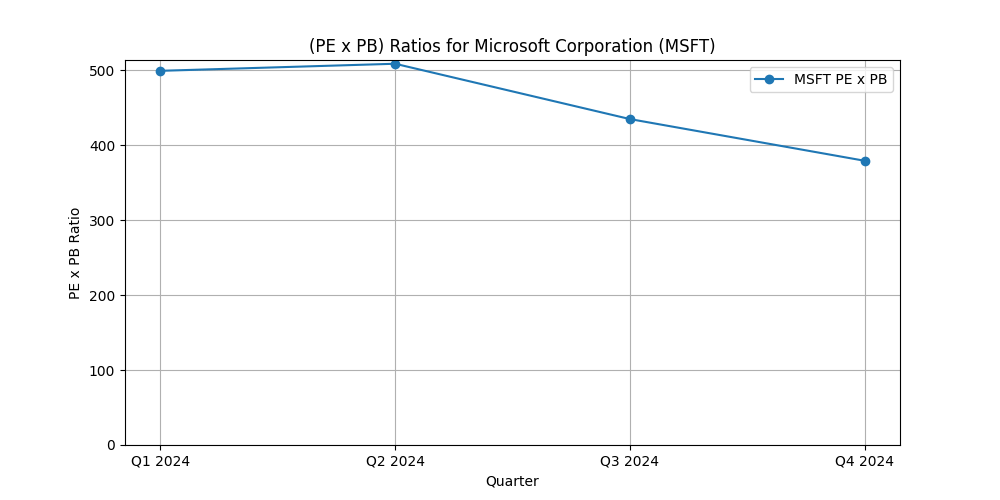

PE, PB and PExPB Multiple

Microsoft’s price-to-earnings (P/E) ratio is at 33 times, which is higher than the historical average of 25x. This suggests that investors anticipate robust growth in the future, partly due to the spread of AI and cloud computing. In addition to its clearly high valuation, Microsoft has demonstrated impressive earnings growth when compared to its competitors. The company’s software and notably large investments in intellectual property and AI indicate a price-to-book ratio of roughly 13x. Microsoft is not under any pressure to boost its revenue, profitability, or “parallel balance sheet” because of the higher price it pays relative to its industry counterparts. Investors should think about what this pricing suggests and whether it is justified if it shows growth. [3]

Microsoft (MSFT) Stock Fair Value Scenarios (2025)

| Scenario | Fair Value Estimate | Key Assumptions |

| High Growth | $470 per share | Continued double-digit revenue growth, strong demand for Azure, and expansion in AI services. Margins remain stable, and Microsoft maintains its competitive edge. |

| Medium Growth | $446 per share | Slight revenue slowdown due to economic factors but sustained profitability from cloud and AI innovations. |

| Low Growth | $346 per share | Declining revenue growth and operating margins, possibly due to increased competition or regulatory challenges. |

Conclusion

Microsoft (MSFT), one of the largest and most influential businesses in the technology industry, has one of the best foundations, as evidenced by steady sales and earnings growth as well as a strong presence in cloud computing and artificial intelligence.

Stable operating margins, robust cash flows, and a sound balance sheet have been the main drivers of the company’s financial performance in recent quarters. Based on several growth scenarios, we project the MSFT stock price in 2025 to range between $346 and $470 per share using the fair value approach. The medium growth scenario ($446) predicts a slowdown in sales growth but profitability, while the high growth scenario ($470) assumes double-digit revenue growth, especially for Azure and AI services. Potential hazards in this low growth scenario ($346) include increased competition that would lower margins or regulatory obstacles.

The company’s prospects are positively enhanced by Baidu’s ongoing investments in cloud computing, corporate software, and artificial intelligence. However, factors including the state of the economy, the level of regulatory scrutiny the industry will encounter, and competition in AI generally should all be closely monitored by investors. The company’s long-term stock performance will depend on its ability to maintain high margins and strong earnings.

In general, we would avoid MSFT for short-term gain unless you also have a business model that depends on cloud services and AI for the foreseeable future, even though that chart probably won’t turn out the way I have described it (reality is harsher). Although valuation estimations provide a range of potential stock values, Microsoft will continue to be a significant player in the IT industry due to its solid fundamentals and wise investments. One must consider their risk tolerance and desired growth rates before making any investing decisions.

**Please be informed that the content is informational and by no means serve as a buy or sell signal. The company is not responsible for the loss of capital.