Introduction

Is META stock a Strong Buy? Examine financial outcomes of Meta along with important profitability indicators and their AI investments and stock market performance. Research how Meta Platforms Inc. performs in comparison to its competition in the tech industry.

The world’s technology industry recognises Meta Platforms (NASDAQ: META) as one of its most powerful companies because of its social media dominance combined with its artificial intelligence (AI) and virtual reality (VR) capabilities. The four major platforms Facebook and Instagram combined with WhatsApp operate under a Meta’s umbrella as the company pushes advancements in digital advertising infrastructure and metaverse development.

Meta generated substantial revenue gains in addition to enhanced profits in 2024 while using its financial resources to develop AI-based products as well as immersive platforms. Reality Labs consumes over $100 billion of investment dollars from the company to spearhead development for future AR/VR capabilities. Meta generates substantial free cash flow from its profitable advertising segment which supports exceptional shareholder returns.

The analysis examines Meta’s 2025 financial results by assessing key ratios in the context of general technology sector performance. The analysis will evaluate Meta’s current value position in the market and future expansion potential and investigate if stock purchases in 2025 would be profitable. [3]

Key takeaways

1. The profitability of Meta (META) stands strong as its 37.91% return on sales exceeds main tech competitors in the industry.

2. Return on Assets stands at 22.59% which indicates capital efficiency on par with rival companies in the sector.

3. Shareholders receive a healthy return on equity of 34.14% although this figure stands below the 36.95% average of the MAG-7 companies.

4. The Enterprise Value/EBITDA ratio shows Meta to be moderately priced within the technology industry at 22x.

5. The financial stability of Meta reveals itself through its 78.58% equity ratio although it remains slightly under the MAG-7 average of 80.17%.

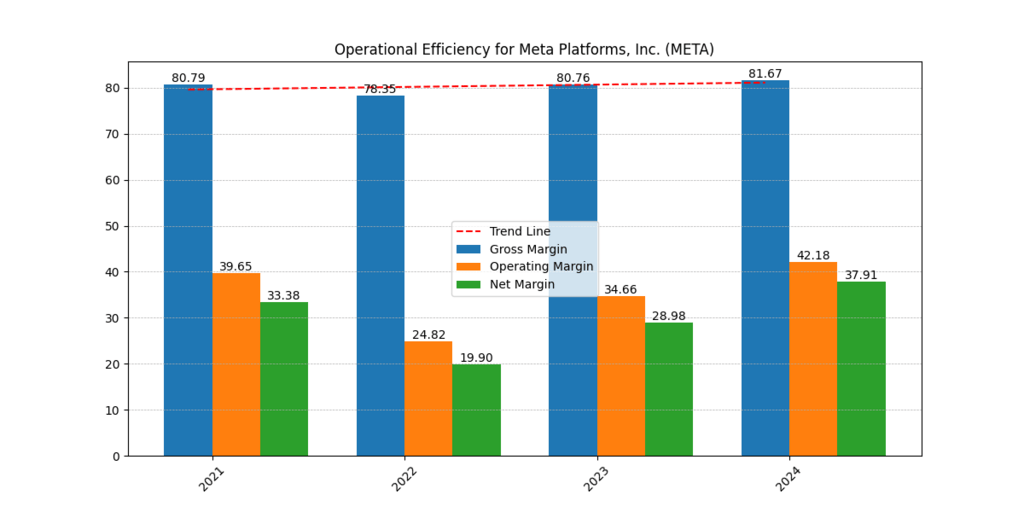

Profit Margins for Meta

The company achieved significant revenue expansion over the previous few years reaching $164.5 billion in 2024 while maintaining the previous year’s figure at $134.9 billion. The company demonstrates strong advertising revenue expansion through its 22% revenue increase which occurs even with macroeconomic uncertainties in place.

The operating margin for Meta reached 42.18% in 2024 because the company enhanced efficiency while managing costs more effectively. Meta Platforms achieved a remarkable financial milestone in 2024 by moving its net margin to 37.91% which exceeded 2022’s level of 19.90%. Improved profitability in the company is primarily driven by AI-based advertising methods and automatic cost reduction strategies. Meta continues to balance its future financial health through AI and metaverse investments while achieving both revenue expansion and profitability growth potential.

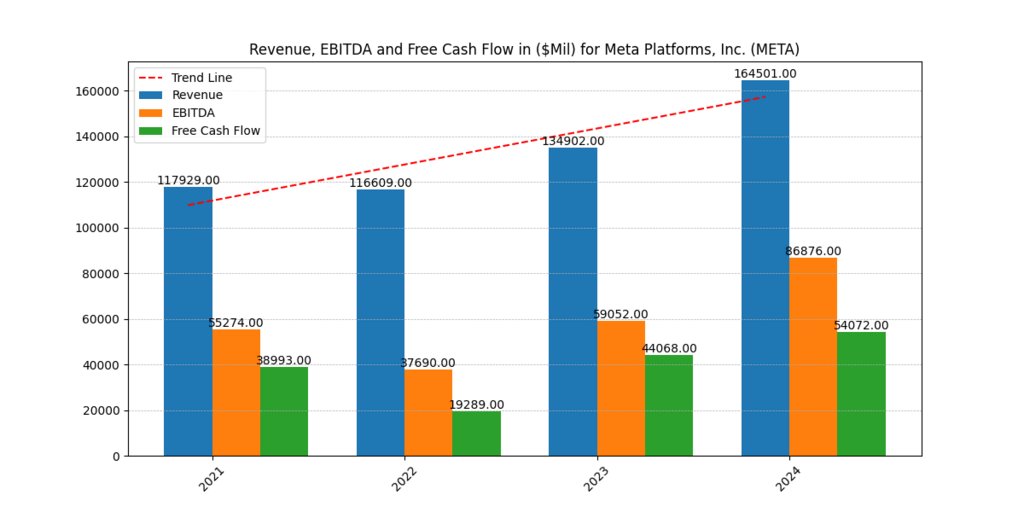

EBITDA and Free Cash Flow: Strong Liquidity Position

With an EBITDA of 86.87 billion dollars in 2024, Meta’s 2023 level of $59.05 billion was 47% higher from 2024. Improved advertising revenue streams, effective cost management systems, and AI-driven operational efficiencies are all evidenced by the quick rise. Between 2022 and 2024, free cash flow (FCF) increased significantly, rising from $19.28 billion to $54.07 billion for the former. Meta has enough cash to finance investments in AI technology, the metaverse, strategic acquisitions, and share buybacks due to the significant increase in liquidity.

The company displays exceptional financial health through cautious capital allocation and strong cash flow management, all the while remaining ready for future technological advancements and shareholder profitability. As the AI Boom is taking the Semicoductor stocks to new highs, do not forget to read Semiconductor Stocks in 2025: A Value Comparison.

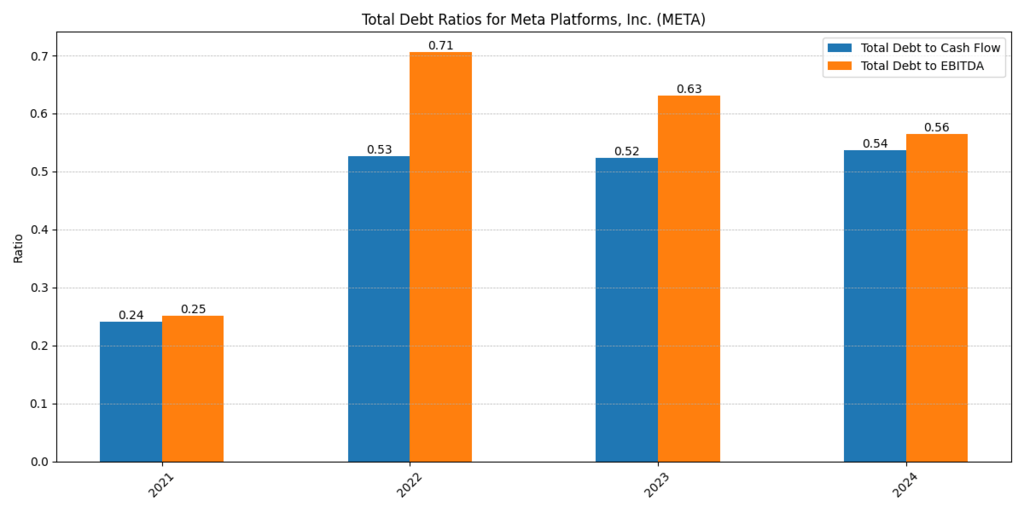

Total Debt to EBITDA Ratio: Low Financial Risk

The financial position of Meta in 2024 features a Total Debt to EBITDA ratio of 0.56 which has declined from 0.71 in 2022. The company demonstrates a low-risk financial structure because it can cover debt payoffs from EBITDA earnings that span less than seven months. The debt levels maintained by Meta remain lower than those of its tech peers and minimize potential risks due to interest rate fluctuations. The financial stability of the organization rises from its strong equity ratio measurement at 78.58%. Due to its robust cash generation and low debt levels Meta maintains the financial capacity to support AI and VR development as well as smart glasses research without damaging its financial health. [2]

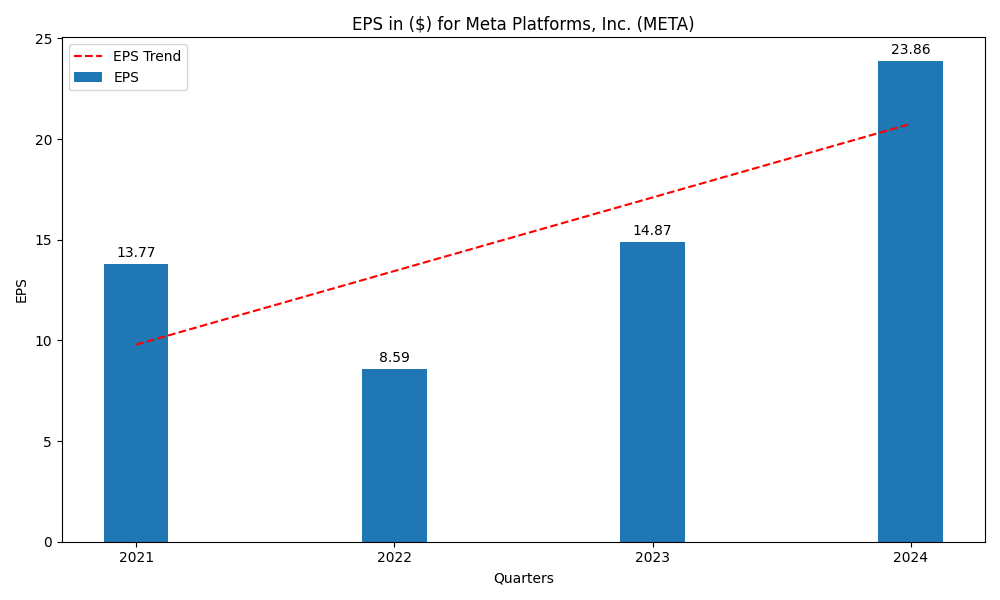

Earnings per Share (EPS): Robust Growth

Meta’s Earnings pser Share increased by 60% through 2024 to reach $23.86 while starting at $14.87 in 2023. The company drives its growth through enhanced profitability together with revenue expansion and strategic share buybacks. Meta consistently grows its earnings while other technology companies face economic volatility. The investment community finds the stock compelling because of its robust EPS performance. The constant investments in AI technology along with digital advertising monoetization will continue to drive Meta’s share earnings per share growth upwards permanently solidifying its position as an industry-leading technology enterprise.

Meta’s Strategic Investments in AI & VR

After increasing its investments in virtual reality (VR) and artificial intelligence (AI), Meta is now under the power of the digital ecosystem. The main goals of Meta’s artificial intelligence innovations are to automate processes on Facebook, Instagram, and WhatsApp and enhance ad targeting capabilities. AI-powered personalization tools have improved ad performance and user engagement, which has benefited the business financially.

Nearly $100 billion in investments have been made in Meta’s Reality Labs branch to create the Metaverse, smart eyewear, and immersive digital experiences. The company first invests a lot of funds in these long-term endeavors to create revenue streams that go beyond conventional marketing initiatives. The company’s investments in creating futuristic digital engagement through product development are exemplified by the Meta Quest series and Ray-Ban smart eyewear.

Due to his belief that these technologies will influence future social interactions and business endeavors, CEO Mark Zuckerberg continues to place his trust in VR and AI. In addition to its automated ad delivery system and generative AI content creation capabilities, Meta also makes significant profits from its AI-powered chatbots.

Meta will continue to dominate the development of the changing digital world while also securing the company’s business strategy for the future. In order to become the dominating force in the advertising and Metaverse economies, where they will create enduring shareholder value and uphold their position as the market leader in technology, Meta keeps up its creative work on AI-driven advertising income, virtual workspace development, and immersive gaming.

Meta’s Stock Valuation and Market Outlook

Below is a summary of Meta’s key valuation metrics compared to the average of the MAG-7 tech giants, highlighting its market positioning:

| Metric | Meta (META) | MAG-7 Average | Variance (Above/Below Avg) |

| Return on Sales (%) | 37.91% | 29.04% | Above Average 📈 |

| ROA (%) | 22.59% | 23.87% | Below Average 📉 |

| ROE (%) | 34.14% | 36.95% | Below Average 📉 |

| EV/EBITDA | 22.06x | 34.35x | Below Average 📉 |

| Equity Ratio (%) | 78.59% | 80.17% | Below Average 📉 |

Market Outlook

The market values Meta’s company highly and positions the stock at an undervalued point compared to technological competitors. The company demonstrates significant profitability through its strong Return on Sales number and trades at prices lower than other tech titans based on its EV/EBITDA ratio.

Meta maintains its solid market position by intensively investing in artificial intelligence and virtual reality together with advertising capabilities. Meta shows signs of potential capital risks and profitability efficiency risks since its return on assets and return on equity fell beneath sector norms. Investors need to observe how funding directed toward Reality Labs initiatives and AI-generated monetization practices affect upcoming financial results for Meta. [1]

Meta’s Recent AI Projects

Meta has been investing heavily in Artificial Intelligence (AI) to enhance user experiences, ad monetization, and automation. Below is a table summarizing its latest AI-driven projects:

| AI Project | Description | Impact |

| Llama 3 (Upcoming) | Next-gen large language model for AI chatbots and automation. | Expected to rival OpenAI’s GPT-4 in NLP and chatbot applications. |

| Meta AI | AI-powered assistant integrated across Facebook, Instagram, and WhatsApp. | Enhances user engagement and enables smart search and content recommendations. |

| AI-Powered Ad Targeting | Machine learning-driven system to optimize ad placement and audience targeting. | Increases advertiser ROI and boosts Meta’s ad revenue. |

| AI-Generated Content Tools | Enables automated content creation for businesses and influencers. | Reduces content production costs and enhances creator monetization. |

| Image and Video AI | AI-powered video and image enhancement tools for Reels and Stories. | Improves content quality and user experience. |

| AI-Powered Smart Glasses | Integrating AI for real-time voice assistance and translation in Ray-Ban smart glasses. | Advances Meta’s AR and wearable technology ambitions. |

| AI for Safety & Moderation | AI models detecting harmful content and misinformation in real-time. | Improves platform security and regulatory compliance. |

The AI strategy of Meta centers on improving advertising effectiveness together with content creation algorithms and augmented reality programs to maintain its status as an industry-leading company in AI technology.

Conclusion

The tech industry considers Meta a central participant because the company delivers robust financial results while strengthening investments in artificial intelligence and virtual reality and maintaining its leadership position in social media platforms. While some valuation metrics show detached performance from its competitors Meta demonstrates solid expansion opportunities with its aggressive AI initiatives and high Return on Sales figure. Meta’s sustained growth depends on its investments in AI-powered advertisement analytics combined with automated content generation and AR technologies which enhance both profit and product development. Meta presents an attractive investment opportunity for technology investors because its AI integration capabilities and metaverse expansion strategy reinforce its ability to dominate the market and maintain profitability including strong competition.

**Please be informed that the content is informational and by no means serve as a buy or sell signal. The company is not responsible for the loss of capital.