Introduction

Explore the 2024 performance summary of the Magnificent 7 stocks tech giants: Microsoft, Meta, Amazon, Apple, Alphabet, Tesla, Nvidia. Learn about their financial standing and growth rates, as well as the evaluation of the technology industry’s market potential.

Microsoft, Amazon, Apple, Alphabet, Tesla, Nvidia, and Meta Platforms constitute the Top 7 Magnificent MAG-7 companies of the contemporary technological advancements. These well-known businesses continue to raise the bar for success and competitiveness because of their dominance in productivity, growth, and company size. By the end of 2024, MAG-7 enterprises had successfully navigated and weathered the market shifts. By employing technology to differentiate their products, they were becoming market leaders in terms of revenue and profitability standards.

This article assesses MAG-7’s operating results, future development possibilities, and profitability based on an examination of the company’s financial performance for the fiscal year 2024, which includes information on revenues, EBITDA, and free cash flows. It highlights the upstream elements that produced details like markets and technology, as well as underlying challenges that businesses face, including regulation and competition. The blogpost for navigating industry leadership also covers innovation projects and ways to sustain progress. By describing how the advancements achieved by tech titans will impact the economy and technology in 2024, this research aims to inform readers about the recent developments.

Key Takeaways

1. Valuation Divergence: Tesla and Nvidia lead with high PB ratios, reflecting strong investor confidence in future growth.

2. Informed Investing: Understanding PE and PB ratios is essential for aligning investment strategies with market dynamics.

3. Balanced Performers: Microsoft, Alphabet, and Meta offer stable valuations, catering to risk-averse investors.

Magnificent 7 Stocks Performance Summary in 2024

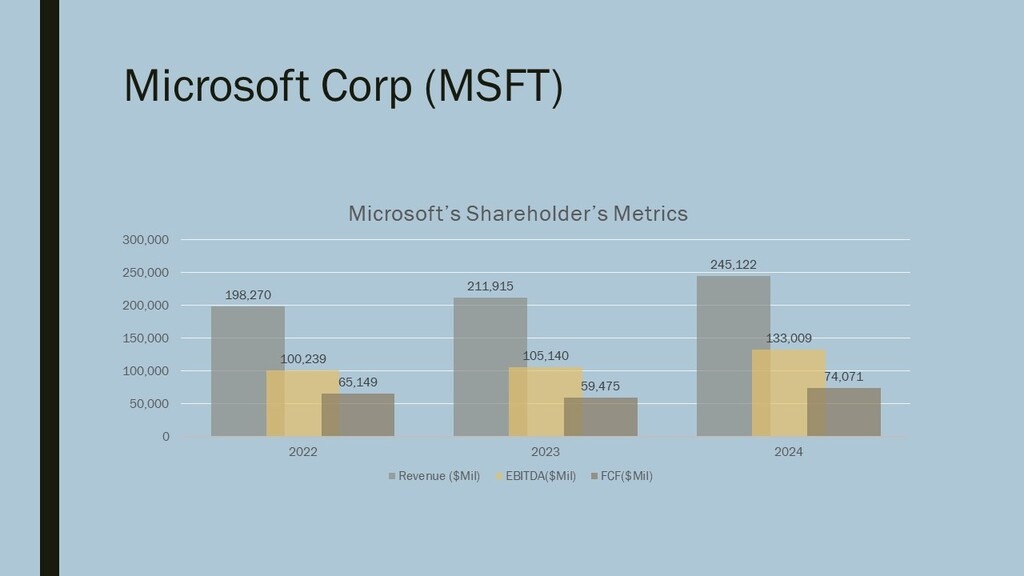

Microsoft Corporation (MSFT)

With $245.12 billion in revenue for 2024, Microsoft reported a 15.66% increase over 2023. EBITDA increased by 26.55% to $133.01 billion over the prior year, which was a result of improved operating efficiency. Additionally, free cash flow, or FCF, increased by 24.34% to $74.07 billion, demonstrating great operating profitability. The company’s Azure cloud computing division and artificial intelligence services accounted for the majority of this growth.

Microsoft keeps increasing its enterprise and AI efforts, which are starting to pay off and strengthen the company’s control over the cloud, which boosts profitability. This further illustrates cost control and robust cash head growth despite the ongoing volatility of the operating environment as a whole. Given its strategic focus on utilizing cutting-edge technology, particularly for enterprise digitization and artificial intelligence, Microsoft stands out as a strong performer. Their ability to sustain consistent growth across all metrics is evidence that the company works hard to adjust to a cutthroat market.

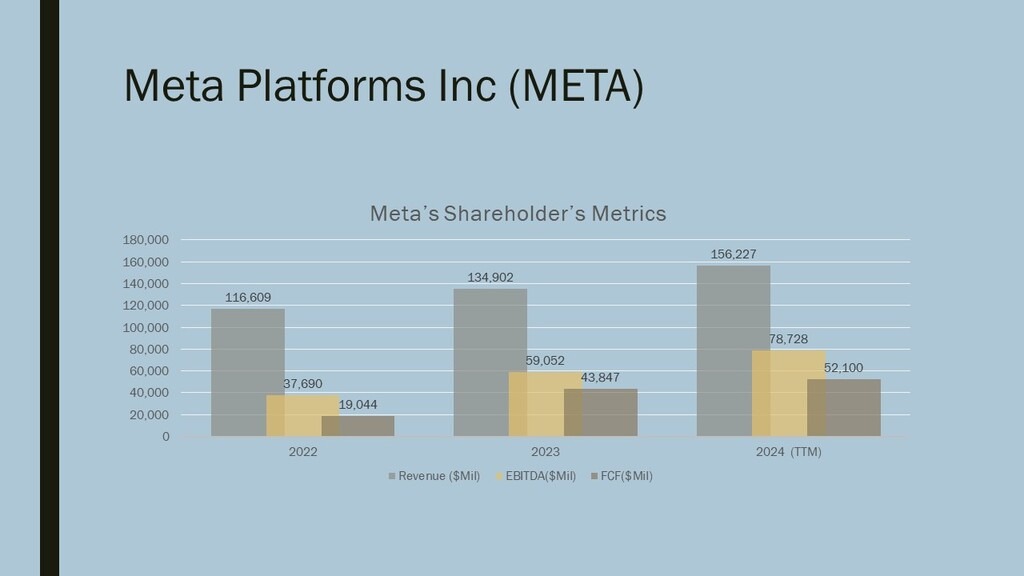

Meta Platforms Inc. (META)

With a 15.79% increase in sales from $134.95 billion in 2023 to $156.23 billion in 2024, Meta Platforms enjoyed an amazing year. The expansion of ad-based services and cost-cutting measures led to a 33.33% increase in EBITDA to $78.73 billion. This was combined with a rise in free cash flow from $43.88 billion to $52.10 billion, an 18.92% increase, demonstrating sound capital management and successful online revenue-generating tools.

The company has already started to benefit from the enforced emphasis on AI in advertising and the emergence of Metaverse initiatives. Meta has demonstrated a certain amount of flexibility, although regulations have been an emotive subject in the IT sector recently. Operating efficiency is demonstrated by Meta’s rise in profitability and successful revenue generation. It is a growth champion in the technology sector because of its focus on artificial intelligence and other potential areas for investment, like the Metaverse.

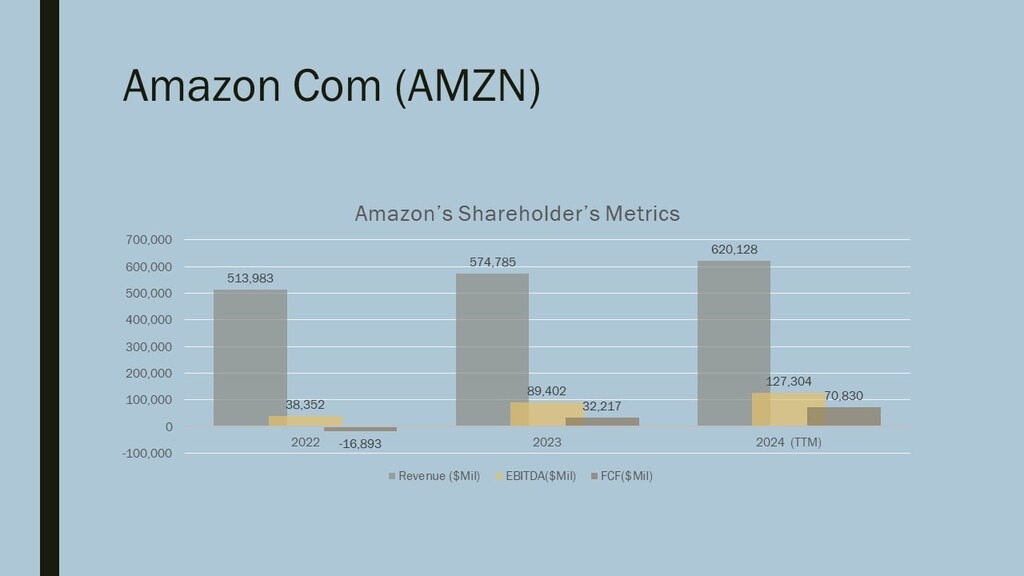

Amazon.com (AMZN)

The company’s earnings for 2024 increased significantly, with revenue of $620.13 billion, a 7% increase above 2023 earnings. EBITDA rose to $127.30 billion, a remarkable 42.42% growth, indicating that the business was expanding fast in its extremely valuable AWS (Amazon Web Service) division and was obviously managing expenses efficiently.

The company’s financial health is demonstrated by the fact that free cash flow increased from negative in 2022 to $70,830 billion in 2024. Opportunities include AWS expansion, operational enhancements, and robust and successful e-commerce outcomes. Amazon’s supply chain’s use of AI and automated technology has further advanced its profitability and efficiency goals. By converting every operational efficiency into a financial advantage, Amazon strengthens its position in the two commercial fields of cloud computing and e-commerce. By emphasizing innovation, these two main areas enhance its position as a technology hub.

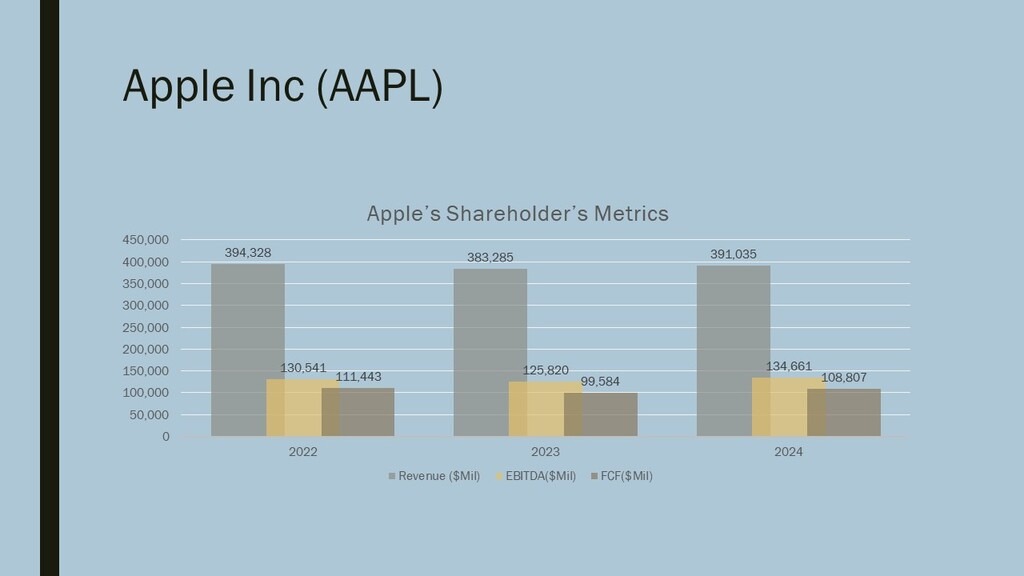

Apple Inc. (AAPL)

Apple’s 2024 revenue of $391.04 billion represented a mere 2.02% rise over 2023 revenue. Free cash flow increased by 9.23% to $108.81 billion, while EBITDA increased by 7.03% to $134.66 billion. Although crowded product divisions caused total revenue growth to drop, Apple managed to maintain profitability through new products and services, partly due to the rise in wearables sales, new services like iCloud and Apple TV+, and innovations in AR and VR. There is no question regarding Apple’s unparalleled ecosystem and consumer loyalty despite economic swings. Apple’s ability to seek value in an established sector demonstrates its strength and distinct focus on markets like wearables and services.

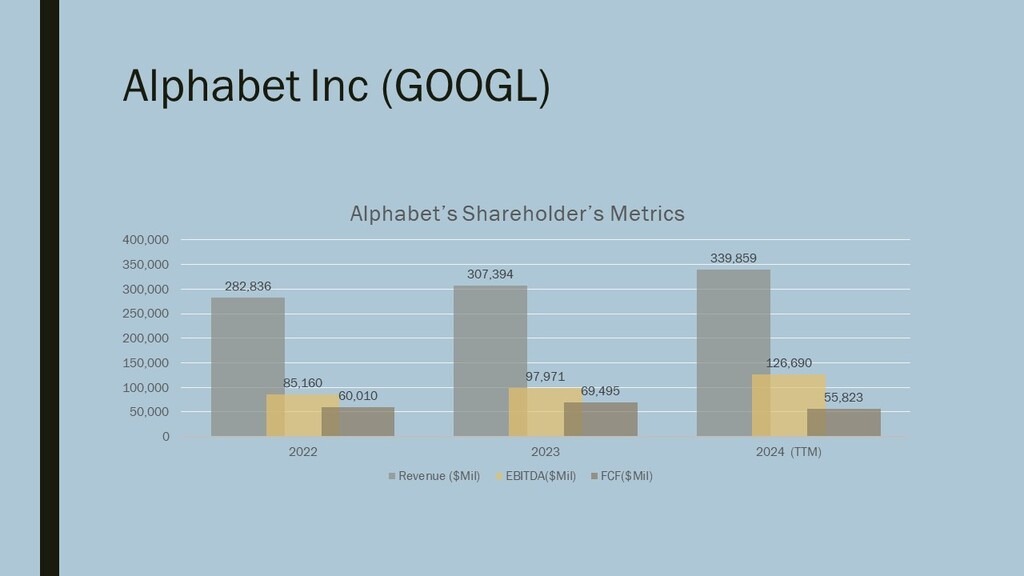

Alphabet Inc. (GOOGL)

In 2024, Alphabet Inc. generated $339.86 billion in revenue, a 10.58% increase from 2023. EBITDA rose to $126.69 billion, a 29.31% year-over-year growth rate. However, attributable free cash flow (FCF) decreased to $55.82 billion, a 19.32% decrease from the previous year, mainly due to increased capital expenditures on cloud and artificial intelligence technologies. Google Cloud emerged as the primary growth engine, with Google’s advertising division maintaining excellent performance. Alphabet’s cash flow declined in the short term due to increased R&D and infrastructure expenditures and fiercer competition in the cloud market. Despite the decrease in FCF, Alphabet’s investments in cloud computing and AI should provide a competitive edge and steady income.

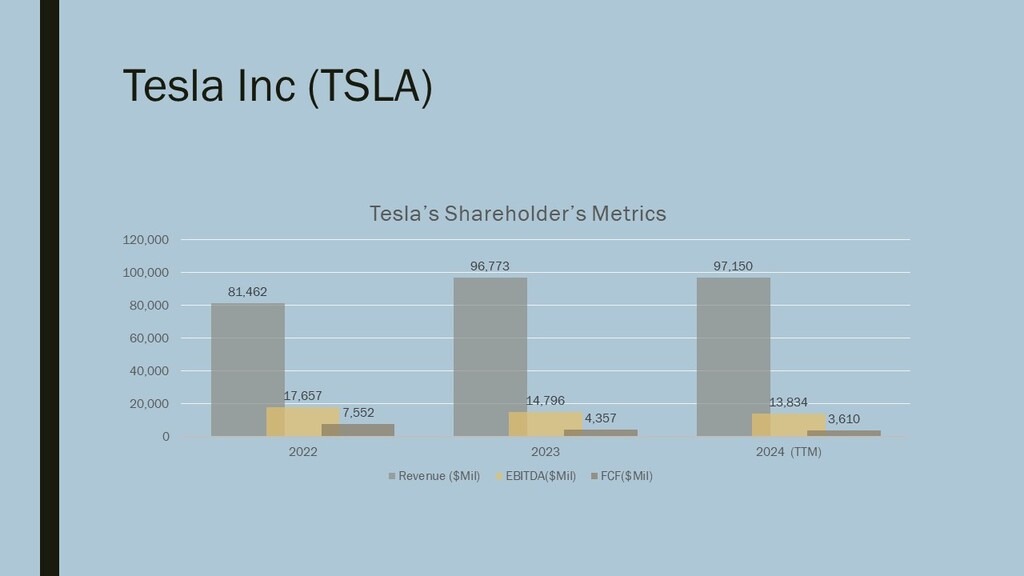

Tesla Inc. (TSLA)

Tesla’s fiscal year 2024 saw a 0.39% increase in revenue compared to 2023, with EBITDA dropping to $13.83 billion and free cash flow dropping to $3.61 billion. This decline is attributed to price reductions for market share preservation and increasing competition in the EV industry. Despite these challenges, Tesla continued to innovate and create new products, expanding its coverage of energy solutions like batteries and solar goods. The company also introduced new electric car models to enhance its global brand reputation. Despite a plateauing in revenues and deteriorating profitability, Tesla’s focus on energy solutions positions it well for long-term business model innovation due to its focus on energy solutions.

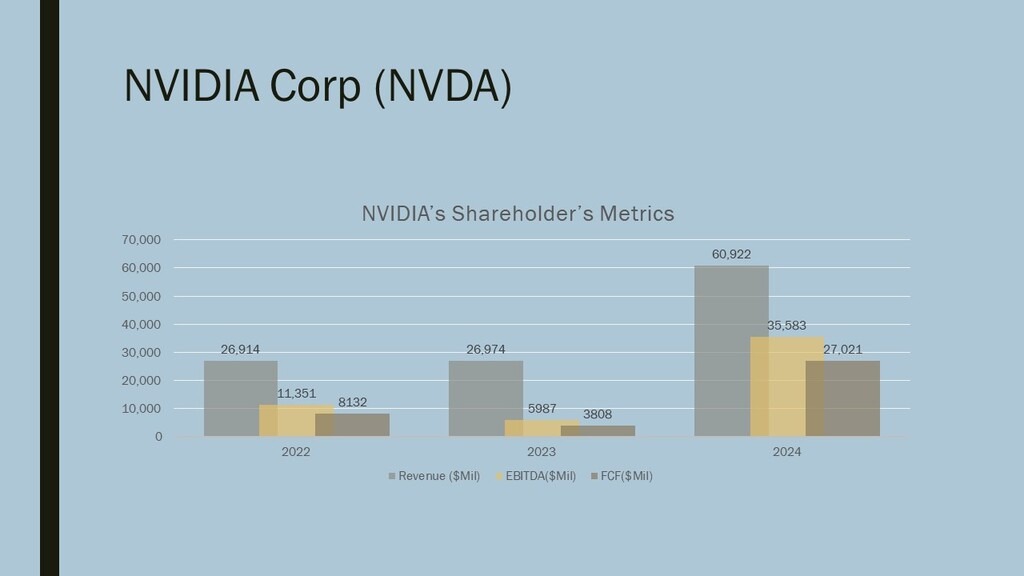

Nvidia Corp. (NVDA)

In 2024, Nvidia experienced a significant increase in revenues, with a 125.89% increase over 2023. The company’s EBITDA increased by 494.31% to $35.58 billion, and free cash flow rose to $27.02 billion, a 609.55% increase from the previous year.

The rise in demand for Nvidia’s GPUs and data center solutions in machine learning and artificial intelligence applications was the main driver of these figures. Nvidia’s leadership in the AI and data center niche is further reinforced by the rise of new generative AI systems, autonomous systems, and systems data analysis. The company’s research and development department has maintained a competitive edge, positioning it for future advancement in the IT sector. More detailed Analysis of NVIDIA here! NVIDIA Stock Analysis Post-Q3 FY25 Earnings.

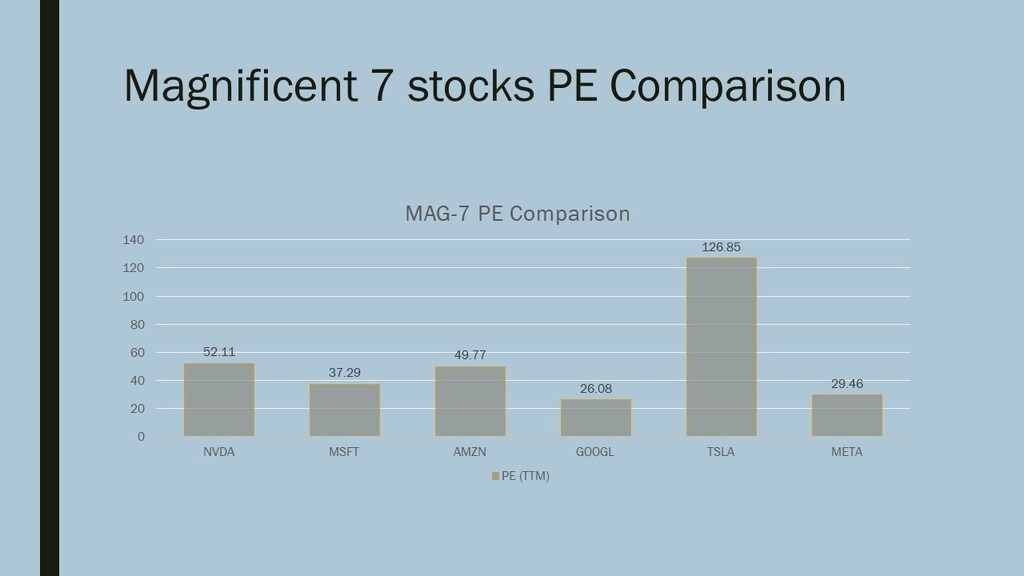

Magnificent 7 Stocks PE Comparison

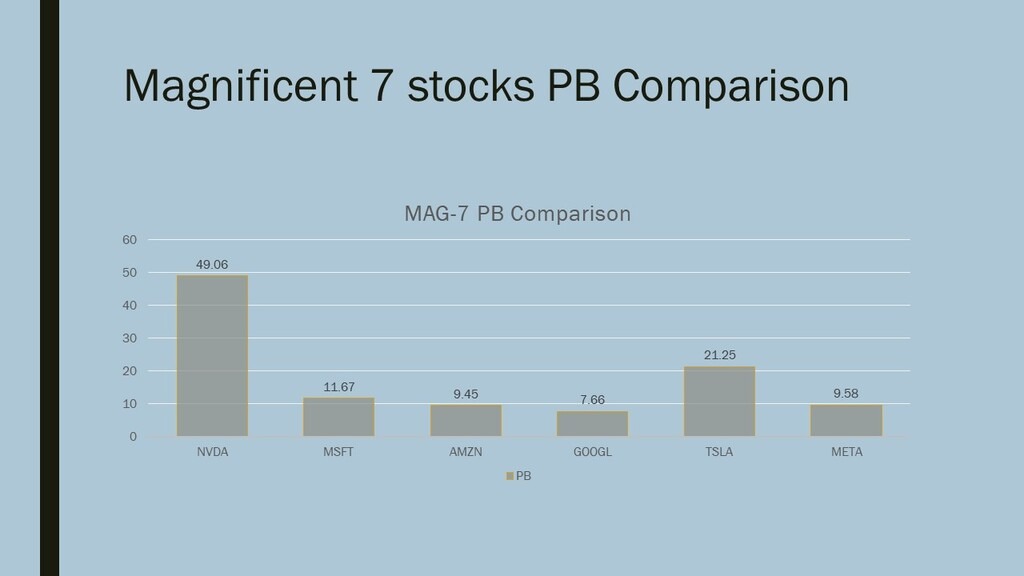

Magnificent 7 Stocks PB Comparison

With a PB of 126.85, which indicates that it is overpriced relative to its book value, Tesla (TSLA) is once again at the top. This demonstrates that despite Tesla Inc.’s low profitability, investors have faith in the company’s ongoing technological innovation and potential for future growth. With a PB ratio of 52.11, Nvidia (NVDA) comes in second, indicating a strong presence in the AI and GPU areas and a high level of market optimism.

With PB ratios of 49.77 and 37.29, respectively, Amazon and Microsoft were valued at relatively high but steady multiples in relation to their positions as market leaders. Given its steady market activity and strong financials, Meta (META), in particular, has a substantially lower PB ratio at 29.46, and Alphabet (GOOGL), at 26.08. It is clear from the variation in PB ratios that market valuations are influenced by perceived innovation and growth forecasts. Alphabet, Microsoft, and Meta are more stable and closer to the value, but Tesla and Nvidia are high-growth and highly valued corporations.

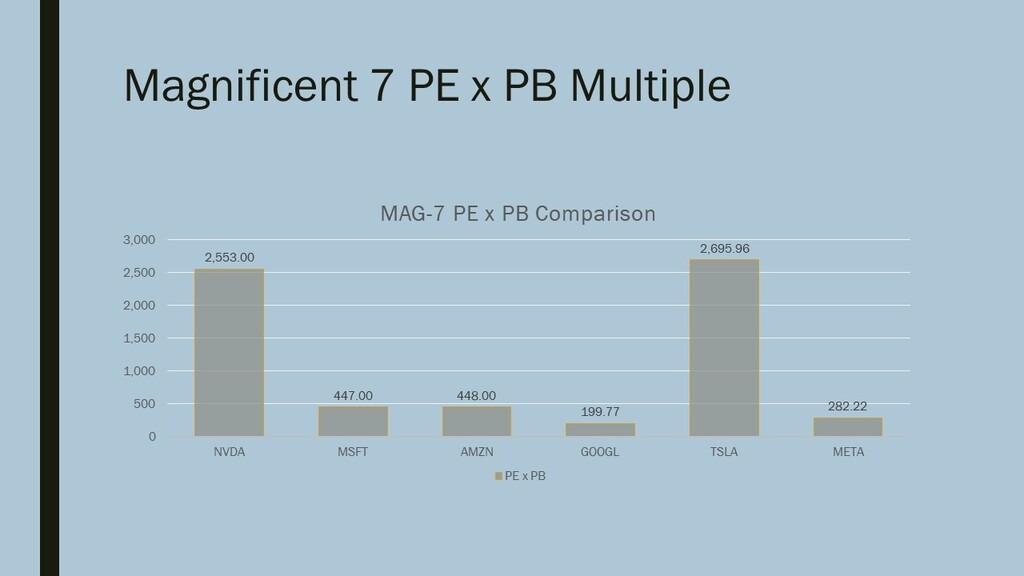

Magnificent 7 PE x PB Multiple

The “Magnificent PE x PB Comparison” chart shows that Tesla (TSLA) is the most overvalued stock due to its overvalued future-oriented growth. Nvidia (NVDA) follows closely at 2,553.00, driven by its explosive growth rate due to AI chips and GPU technologies. Technological-oriented companies like Amazon and Microsoft have moderately high valuations, with values of 448.00 and 447.00 respectively. Google and Meta have lower multiples, suggesting they have wealthy fundamentals but are not overvalued. The chart highlights the high-growth and technology-dependent nature of high-growth firms like Nvidia and Tesla.

Conclusion

The “Magnificent 7” stocks, including Tesla, Nvidia, Microsoft, Amazon, Alphabet, Meta, and Apple, represent a diverse level of stock market capitalization based on their specifics, potential, and investors’ expectations. The PE and PB Ratio was examined as an additional factor that indicates their market value. In contrast to Apple, which has a higher valuation and more uncertainty, Tesla and Nvidia are the two stocks that will satisfy the needs of growth investors in terms of innovation and prospects in their business models.

Investors that seek unwavering dependability and excellent investment efficiency are drawn to Microsoft, Alphabet, and Meta. PB and PE ratios implies that in order to achieve financial results, investors need to keep a healthy balance between their objectives and their risk tolerance. It is employed in assessing potential and investment in this dynamic and cutthroat sector of IT and innovative operations.