Introduction

Read about the latest Kraft Heinz stock forecast 2025 based on the company’s financial health and performance, key products, and comprehensive evaluation of KHC’s stock dividends. Review fair value estimates, financial ratios, and growth scenarios to get insight into KHC’s prospects in 2025.

Kraft Heinz Co (KHC) is one of the industry leaders in the food sector and has been famous for offering brands, such as Heinz Ketchup and Kraft Macaroni Cheese. Becoming one of the leading global multinational food and beverage corporation, KHC has developed its ability to deliver steady value to its consumers and shareholders. This article will be valuable for anyone looking forward to know about KHC’s market opportunity for investment purposes and dividend history as it outlines the company’s business strategy, identification of its best-selling products, and analytic information on the company’s financial health.

We will also assess KHC’s fair value estimates, applying a range of growth rates in order to give some idea to investors regarding the company’s future growth prospects. This blog will be helpful in assessing KHC’s likely financial outcomes with emphasis on fair value analysis without issuing clear ‘buy’ or ‘sell’ signal.

What is KHC?

Kraft Heinz Co. (KHC) is one of the leading companies in the international food and beverage industry that came into being through a merger between Kraft Foods Group and H.J. Heinz Company in 2015. With its operational houses in Pittsburgh, Pennsylvania and Chicago, Illinois, KHC enjoys the reputation of being in possession of brands that are familiar all over the world. Currently, KHC offers products in the condiments, sauces, dairy meals, and snack segments and offers its products in more than 40 countries.

The organization carries a legacy of trusted food products along with a strong commitment to innovation in a bid to satisfy the emerging trends in the market and at the same time dominating the global food market. [1]

Businesses of Kraft Heinz (KHC)

Kraft Heinz Co. mainly focuses on the food and beverages market to provide their products under various brand names. The segmentation strategy used by the company is based on offering necessity product categories that consist of condiments, sauces, cheese, and dairy products, meats, and snacks.

Many households across the world especially in the developed economies of North America and Europe are familiar with their brands in foods like Heinz, Kraft, Philadelphia, and Oscar Mayer among others. The company has over 100 distribution centers around the world to supply both the retail and food service markets with grocery items around the globe. KHC has a strong international affiliate network as part of its strategic vision as it sells its products to consumers in over 40 countries.

Moreover, Kraft Heinz offers a diverse range of products and aims at product differentiation and enhancement to fit changing markets, which includes shift to healthier and more environmentally-friendly products. Organic and low-sodium products are some new offerings that have been marketed by KHC through research and developmental activities as a result of rising awareness of health and wellness among consumers. Another focus area of the company is digital transformation and e-commerce because people pay more attention to the online groceries now.

This combination of good brand image and innovative interventions also stands firm with the objectives of KHC in relation to sustaining competitive advantage and ensuring an increasing market portfolio in the global food industry. [2]

Find out Best Dividend Stocks to Buy in 2024.

Best Products of Kraft Heinz (KHC)

Kraft Heinz Co. operates great brands that are famous internationally and some of the products bear testimony having set high records in their market categories. Heinz Ketchup is one of the popular products of the company because of its quality and unique taste that stands out in the market and places the company in the list of key producers and sellers of seasonings. In the same manner, Kraft Mac & Cheese is widely accepted and savored by the American population as a simple and enjoyable food item. In addition to this, the Philadelphia Cream Cheese is also known widely for its smooth taste and can be used with anything from bread to baked goods.

In addition to this, Oscar Mayer meats and cold cuts remain as favorite choices, which are best known for their quality brands of deli and packed meat. Another associated famous brand is The Planters, renowned for nuts and snack mixes, also pulls in a crowd of those looking for easy to grab, delicious protein sources. Overall, these products build the brand portfolio and market position of Kraft Heinz in the global food and beverage industry by providing the necessary sustenance to grocery stores, food service providers, and consumer households throughout the world.

Shareholder’s Metrics

| Metric | Value |

| PE Ratio (TTM) | 28.95 |

| PB Ratio (TTM) | 0.9 |

| Market Cap (USD) | $42.3 billion |

| Revenue Growth (2021-2024) | |

| – 2021 | $26,042 million |

| – 2022 | $26,485 million |

| – 2023 | $26,640 million |

| – TTM (Trailing Twelve Months) | $26,317 million |

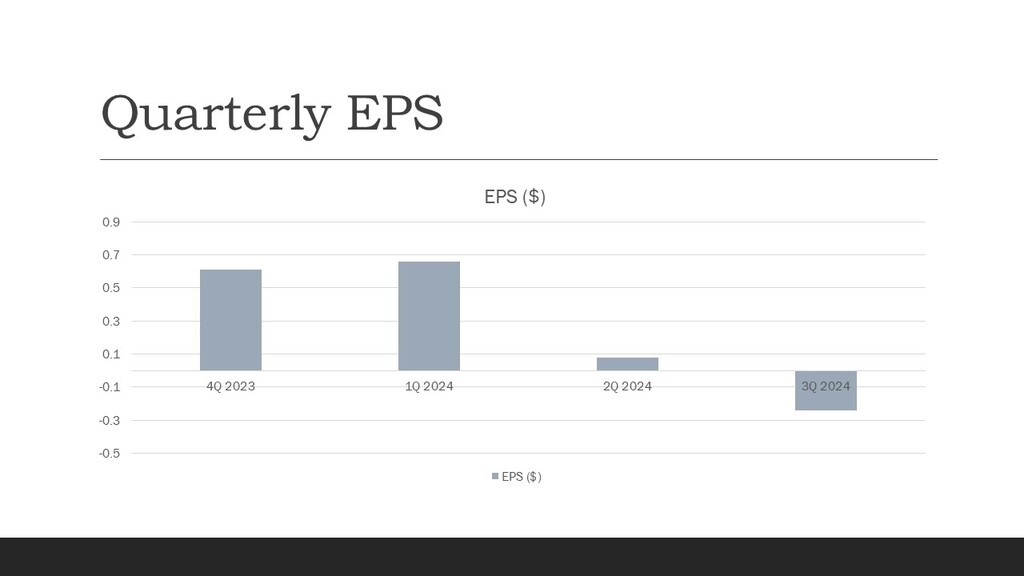

| EPS (TTM) | $1.11 |

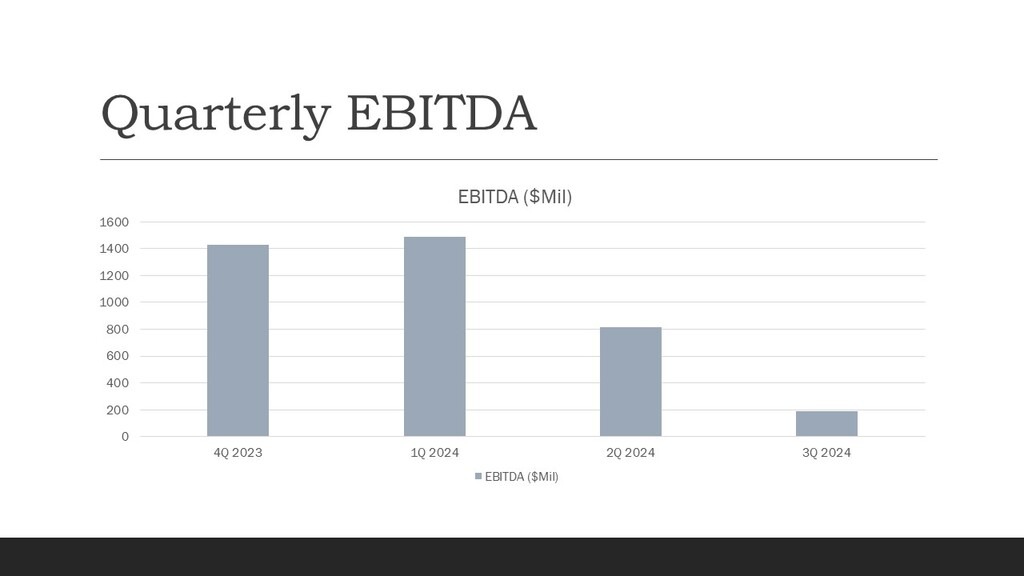

| EBITDA (TTM) | $3.923 billion |

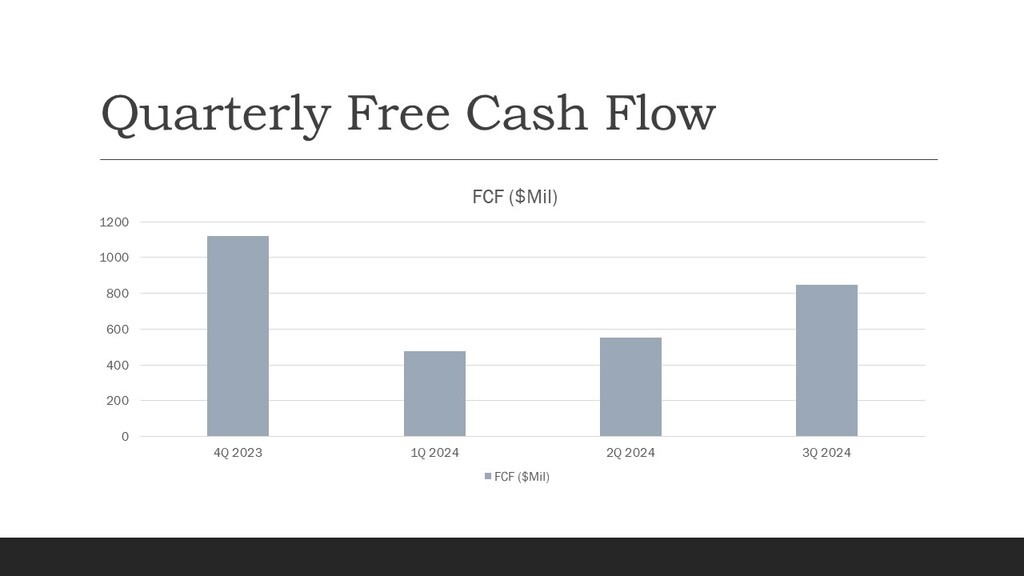

| Free Cash Flow (FCF) | |

| – 2021 | $4,459 million |

| – 2022 | $1,553 million |

| – 2023 | $2,963 million |

| – TTM | $2,917 million |

| Dividend Yield | 4.6% |

Analysis of Shareholder’s Metrics

The current PE ratio of Kraft Heinz is at 28.95 suggests that it is overpriced relative to its earnings, mainly because investors are willing to invest more for every dollar of profit the business produces as a result of future growth or any steady earnings from a less volatile industry. The PB ratio of 0.9 means that KHC stock has a price lower than its book value, though investors have not yet captured most of KHC’s asset value. [3]

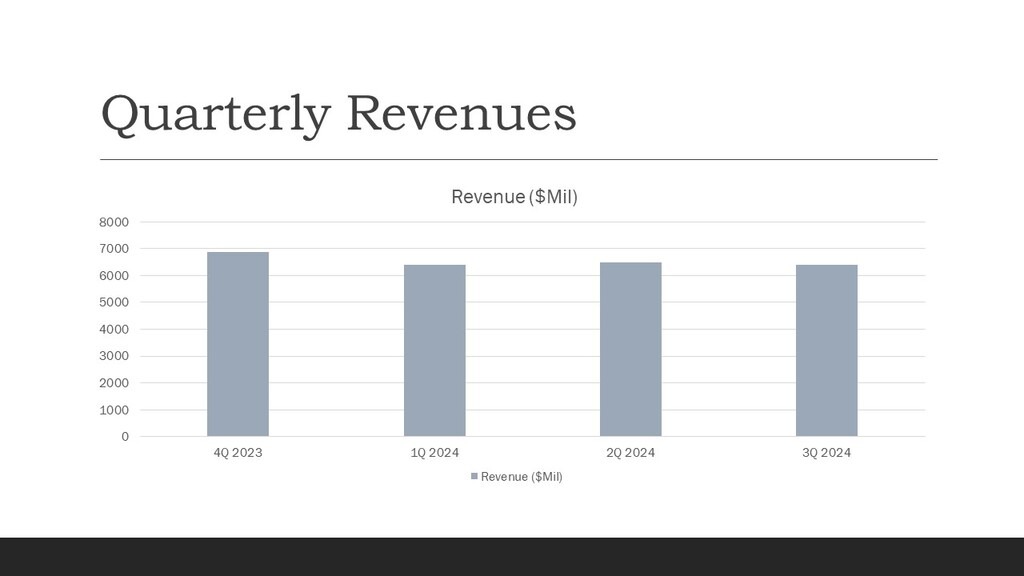

As for the revenue growth, KHC has been relatively consistent in improving its overall revenues, from $26,042 million in 2021 to slightly increase to $26,640 million in 2023; however, it’s most recent TTM revenue is slightly lower, recording $26,317 million. This consistency shows KHC has a strong brand recognition thus making its performance quite reasonable but it has slowed growth, it could be due to increasing competition, or reduced consumers’ demand.

KHC has a PE ratio of 25, the EPS is only $1.11, and therefore, it is good to know that KHC is indeed profitable but its earnings may not be sufficient to support such a price. Nevertheless, the EBITDA of $3.923 billion shows good profit before taxes, interest and depreciation are taken to consideration. This speaks about good operating cash flows as well as cost controls that the firm has demonstrated in its main operations.

Similar to net income, KHC’s free cash flow has exhibited volatility in the last couple of years; $4 459 million in 2021, $1,553 million in 2022 and $2,963 million in 2023. The TTM FCF is at $2,917 million proving that there is moderate cash flow stability after the crash. This fluctuation could be occasioned by capital expenses, restructuring expenses or fluctuating operational cash flow from continuing operations. FCF is a useful measure in determining the company’s ability to both fund the dividend and invest in growth.

However, it appears that KHC presents an excellent entry for those investors specifically interested in getting a good return from their dividends as they attest to a dividend yield of 4.6%. This, along with its regular dividend payments indicates KHC’s focus on shareholder returns, although short term instability in cash flows may present issues for maintaining such a yield if the company’s future cash flow does not become stabilized.

Kraft Heinz (KHC) Price Prediction

| Growth Scenario | Fair Value Estimate (Price per Share) |

| Low Growth | $33 |

| Medium Growth | $41 |

| High Growth | $42 |

The expected value per share for KHC is $33 in the slow-growth scenario, implying stagnant revenues and earnings due to market reach and competition, and/or fluctuating consumer tastes and preferences. The medium-growth scenario gives an appropriate value of $41 per share based on reasonable growth rates pertaining to the introduction of new products, geographic markets, or cost controls.

The case of high-growth rate results in a fair value of $42 per share based on the hypothetical assumptions of accelerated growth prospects of the business, new and competitive growth initiatives, dominating innovations, strategic acquisitions, or major business digitization. It could also stem from good results in new product segments or significantly higher market share gains, provided that such advancement is supported not only by the commitment of existing stores but also by immediate improvements in operating effectiveness and timeliness of response to consumer preferences by KHC. This optimistic view takes into account possible sources of strong growth.

Conclusion

KHC is an industry giant in the global food and beverage market thanks to its reputable brands and stable revenue streams. While some of these strategies may pose difficulty in the pursuit of rapid growth, KHC boasts of consistent revenues, moderate cash flow visibility, and an above-average dividend yield of 4.6% attract the investors’ attention, and make this company a cash-cow that is alluring particularly to dividend-seeking individuals.

The fair value estimates of the stock range from $33 to $42 per share, assuming varying growth rates with the conservative outlook that corresponds with the KHC’s strength and brand solidity. Potential threats include the changing customer trends and emerging competition, but solid strategies and initiatives in new product development and digitization present the opportunities for incremental growth for KHC. This analysis proves valuable in offering insight into what kind of market KHC could deliver for those thinking of investing in the firm that likewise avoids providing a direct signal of buying or selling the KHC’s stocks.

**Please be informed that the content is informational and by no means serve as a buy or sell signal. The company is not responsible for the loss of capital.