Introduction

“Is Shopify a good stock to buy? Learn about the future growth of Shopify Inc., SHOP in the age of AI, how it is fairly valued, some of the important financials, and what its stock estimate could be given different levels of revenue increase. Find out how growth rates affect Shopify’s valuation and future growth rates.

Shopify Inc. (SHOP) is a mega and dominant online selling portal for small, medium and large companies to set up their own online shopping stores. The company has, in recent years, diversified its propositions with, for example, incorporating artificial intelligence (AI) into its products, services, and serving the user interface. This blogpost aims at analyzing Shopify’s performance today, assessing key benchmarks, and analyzing growth expectations based on the selected revenue growth models. Instead of coming up with a ‘buy’ or a ‘sell’ advice here, we will present a ‘value for money’ idea which we believe does not go hand in hand with fast changing markets which take time to re-adjust stock prices to reflect growth trends.

Businesses of SHOP (AI related)

Shopify (SHOP) is heavily investing in implementing AI throughout the store solutions it offers for its merchants as well as making shopping for goods more efficient for consumers. Here’s a breakdown of Shopify’s AI-driven initiatives and its AI-related business segments:

Artificial Intelligence for E-Commerce Applications by Merchants

Shopify Magic

Shopify has lately released the “Shopify Magic” which is an AI package aimed at providing merchants with appropriate and efficient product descriptions, marketing messages, and blog posts. Shopify Magic can write SEO-friendly text using NLP, letting sellers describe their items quicker and makes their offers look more attractive.

Automated Customer Support

AI also works in customer relations providing answers to frequently asked questions, giving updates on orders, and processing of returns in Shopify. This in turn assists the merchants in helping enhance their customers’ satisfaction levels without the extra personnel cost.

Improving Targeted Experience for the Consumers

Product Recommendations

Shopify harnesses artificial intelligence to help identify the most appropriate products from the store, specific to every customer. The power of the Shopify’s machine learning algorithms in providing recommendations can provide better conversion rates and customer interaction.[1]

Smart Search and Discovery

AI search is an additional sales tool on Shopify’s platform that transforms shopping by providing relevant search results even if the user misspelled the word or enters an entire phrase. This tool makes the smart search tool capable of evolving from customer interaction to improve the quality of the search results hence, increase customer satisfaction and sales.

Inventory management and sales forecasting

AI solutions such as the one Shopify offers create forecasts regarding the demand for certain products, thus making the merchants avoid situations where they run out of stock or when they have too many products that no one is buying. These tools work with the sales data, seasonal fluctuations and changes and help to forecast the further demand to avoid extra costs associated with unnecessary purchases and stocks.

Fraud Detection and Security

The platform uses the ability of artificial intelligence in detecting and subsequently eliminating fraud cases. Shopify’s machine learning helps the company assess and identify tendencies in the activity of certain users to fight fraud. This way not only guarantees merchants a source of income but also would prevent consumers from being billed for transactions they never made.

AI Driven Analytics and Intelligence

AI is also integrated into Shopify’s analytics where merchants receive relevant data about their business. It includes the capability of predictive analysis that enables the merchants to predict and know the behaviors of their customers. Due to the application of AI, the platform for analytics of Shopify helps to cultivate efficient marketing campaigns, increase customer loyalty, and increase sales.

Visual search and Image Recognition

Shopimo, an experimentation by Shopify includes image search technology allowing consumers to search for product using images. This feature uses image recognition Artificial Intelligence to filter a list of products that the shopper is likely to be interested in as a photo is uploaded by the shopper.

AI & Machine Learning in Shopify and its future Potential

The recent AI developments of Shopify are extending the company’s prospects to become a single all-encompassing solution for the e-commerce firms who are interested in an AI-powered approach to business. Shopify is able to attract merchants in need of superior tools for development by focusing on AI and providing a safer and more individually tailored experience for shoppers. In particular, Shopify should keep increasing the use of AI to maintain its competitiveness and leverage the expansion of the AI application in the retailing and e-commerce sectors.

These AI tools not only bring value to Shopify’s services, but also enhance the firm’s lock-in effect of its products, thus establishing a solid ground in the e-commerce market while at the same time resulting in substantial positive impact to merchant and end consumers. Find Best AI Stocks here!

Shopify Inc. (SHOP) Investor’s Metrics

| Metric | Value |

| PE Ratio (TTM) | 79.79 |

| PB Ratio (TTM) | 10.6 |

| Market Cap (USD) | $110,340 million |

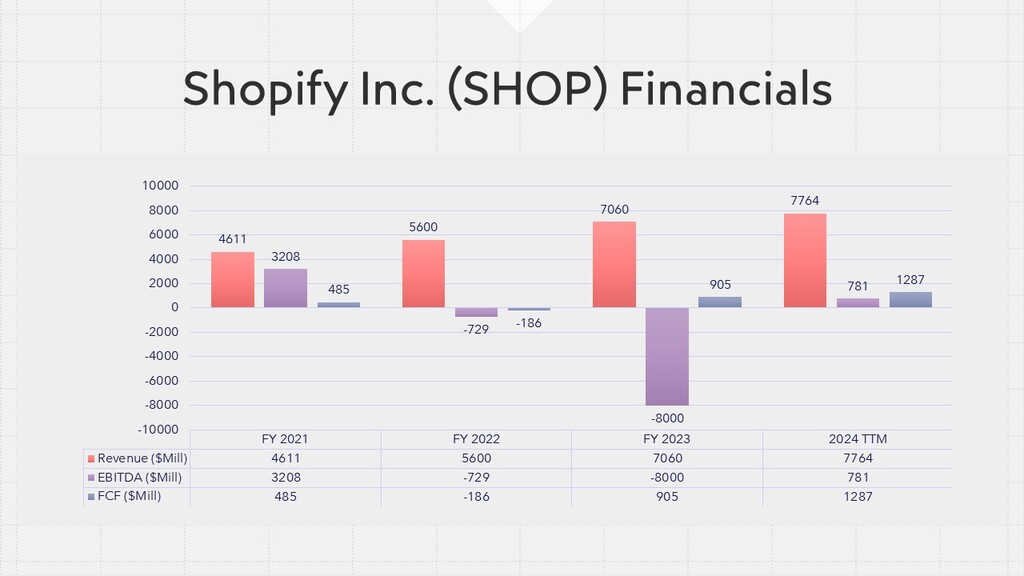

| Revenue Growth (2021-2024) | 2021: $4,612M 2022: $5,600M 2023: $7,060M TTM: $7,764M |

| EPS (TTM) | $0.99 |

| EBITDA (TTM) | $3,940 million |

| Free Cash Flow (FCF) $Mil | 2021: $485 2022: -$186 2023: $905 TTM: $1,287 [2] |

Shopify Inc. Price Prediction

| Revenue Growth CAGR | Estimated Fair Value per Share | Upside/Downside from Current Price |

| 32% CAGR | $44 per share | Downside of 46% |

| 29% CAGR | $36 per share | Downside of 56% |

| 23% CAGR | $26 per share | Downside of 69% |

| 19% CAGR | $20 per share | Downside of 76% |

Analysis of Shopify’s Financials

Valuation Metrics (PE and PB Ratios)

The current PE ratio for Shopify stands at 79.79, thus should be highly valued in relation to its earnings, this is due to the fact that the stock is expected to record high growth rates. Also, PB ratio of 10.6 demonstrates rather high stock prices in respect to book value suggesting that investors expect its assets or revenue-generating capacities to continuously grow.

Market Cap and Growth Potential

Shopify comes with a market capitalization of 110.34 billion dollar and has carved its niche in e-commerce as well as digital solutions. Nevertheless, if this kind of valuation has to be sustained then the company has to deliver robust growth numbers and keep operational expenses under rein.

Revenue Growth (2021–2024)

Shopify has also displayed tremendous growth with its revenue standing at $ 4,612 million in 2021 and it predicts its TTM revenue to $7,764 million in 2024. This kind of annual growth is a clear sign of Shopify’s market and product positioning and growth strategy. However it may not be easy to sustain such high levels of growth as the company grows older and organizational competition stiffens.

Free Cash Flow (FCF)

Shopify operating cash flow has fluctuated over the recent years from $485 million in the year 2021 down to -$186 million in the year 2022, but increasing to $905 million in the year 2023 and $1,287 million trailing twelve months. The increase in FCF in the recent years suggest better cash management firm’s problems remain apparent when it comes to managing growth investment alongside maintaining efficiency.

EPS and EBITDA

The EPS of $0.99 and the EBITDA of $3,940M represent Shopify’s profitability to an extent on the most basic level, relative to the aspect of high operating costs which indeed bring about the idea that margins may be constricting as Shopify heads towards grounds of spending on AI and other business growth mechanisms.

Valuation and Future Outlook

However, its high valuation multiples accompanied by a set of prospecting upside/downside possible CAGR results Shopify might seem overpriced if it will be unable to maintain high revenues growth rates. The fair value estimates suggest that the analysis divulges the fact that Shopify’s stock price would require more moderate growth assumptions in long term especially considering the PE and PB ratios. The markets can take time to re-rate stock relative to the company’s fundamentals and, as such, growth rates are crucial for Shopify’s current valuations to be justified.

Conclusion

It brings a reasonable fundamental valuation insight as to the worth of the Shopify stock based on growth prospects and Valuations. Markets also get up to some time to recognize growth rates and positive growth rates for consistent periods do affect the stock prices. It is critical to review how Shopify has been able to maintain constant growth in a competitive industry as the way of determining the apt investment returns in the firm.

**Please be informed that the content is informational and by no means serve as a buy or sell signal. The company is not responsible for the loss of capital.