Is Nvidia a good stock to buy now? Nvidia Corporation (NASDAQ: NVDA) has grown to become the unquestioned leader in artificial intelligence (AI) hardware, which is an essential piece to the digital future puzzle. Nvidia, which has a product line that includes high-performance GPUs, data centre products, and AI accelerators, is no longer a chipmaker; it is now a pillar of the AI economy. The creation of its graphics processing units (GPUs) drives machine learning models and self-driving cars, cloud computing, and gaming infrastructure.

Nvidia has had an outrageously good run financially over the last couple of years, riffing off soaring demand because of a rush by hyperscalers, startups, and research centres who are eager to roll out AI-powered systems. This has seen the market capitalisation of the company rise to the trillions, making it among the most valuable tech companies in the world.

Amid this rocket, however, one question looms over investors: Has the stock price of Nvidia surpassed its value? As extreme optimism becomes life and retail interest levels are at an all-time high, we ought to take a step back and go back to the most basic of questions: Is Nvidia a good stock to buy now?

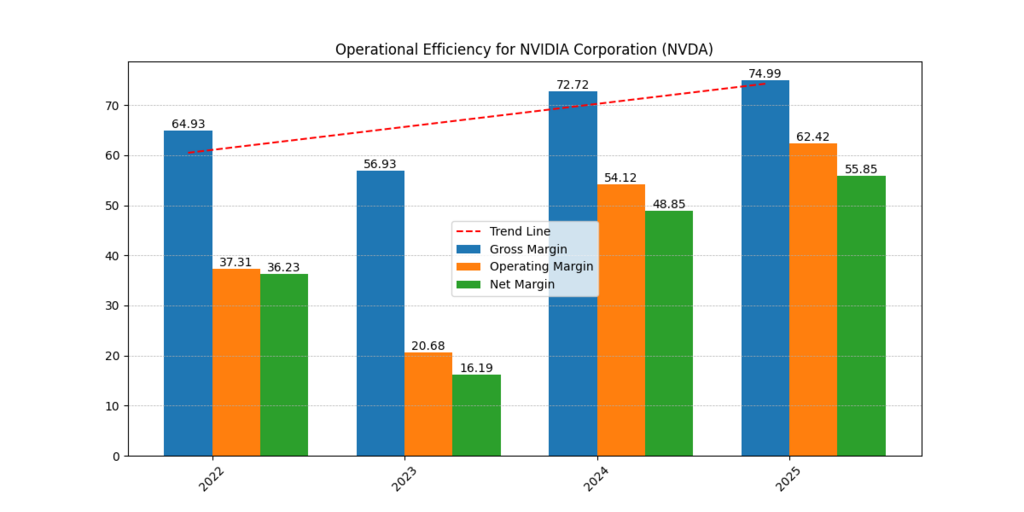

Operational Efficiency: A Rebound in Margins

The temporary decline in the operating performance of Nvidia occurred in 2022-2023 because of a macroeconomic headwind and inventory adjustments. Gross margins reduced 64.93% to 56.93% in 2023, but the operating margin saw a sharp decline of 37.31% to 20.68%. The net margins did the same, falling to 16.19 per cent in 2023.

Nevertheless, Nvidia’s resiliency was consistent during 2024 and 2025, resulting in increases in gross margins by 74.99% and operating margin by 62.42%, and net margin by 55.85% (Yahoo Finance, 2025). The explosive sales of AI and effective supply chain control are partly to be blamed on this rebound. The trendline under gross margin performance shows a positive long-term trend.

| Year | Gross Margin (%) | Operating Margin (%) | Net Margin (%) |

| 2022 | 64.93 | 37.31 | 36.23 |

| 2023 | 56.93 | 20.68 | 16.19 |

| 2024 | 72.72 | 54.12 | 48.85 |

| 2025 | 74.99 | 62.42 | 55.85 |

Verdict: It has good operational efficiency and is gaining strength, and that is a good start; however, is that sufficient?

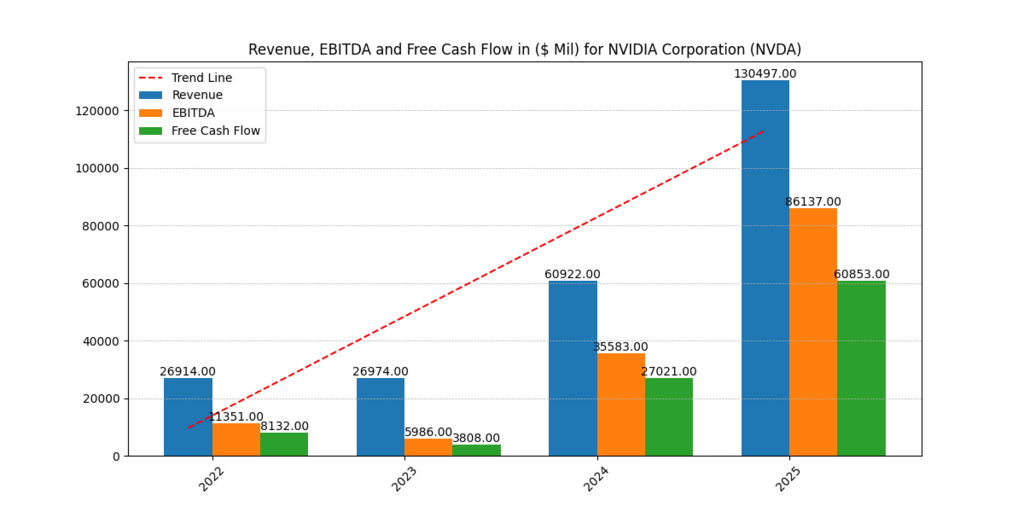

Revenue and Free Cash Flow Growth

Between 2022 and 2025, Nvidia experienced a CAGR of more than 70% with revenue growing from 26.9 billion to 130.5 billion. More notably, EBITDA increased by three times, to 86.1 billion, and free cash flow jumped to 60.85 billion in 2025, pointing to high property of internal reinvestment (Morningstar, 2025).

This is amazing – however, the current stock price of Nvidia already reflects these gains well. The revenue graph shows a near-exponential curve on the trendline, which acts as a set of red flags on the sustainability of the valuation. Read here our Nvidia Earnings Q1 2026 Analysis: Navigating Challenges and Growth Opportunities.

Verdict: Yes, Nvidia is increasing at a fast pace, but the stock might already be priced to this very rapid growth.

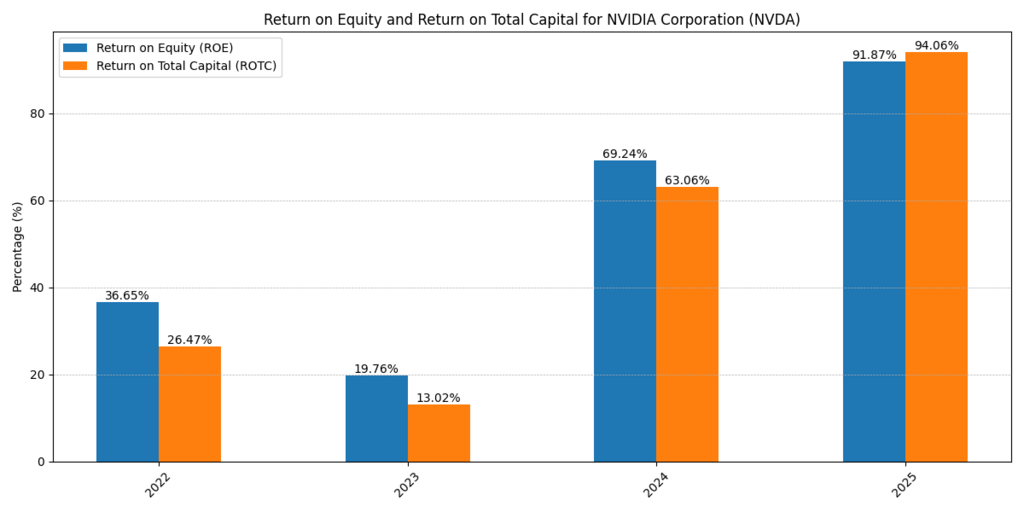

Return on Capital: Exceptional but Peaked?

It yielded ROE of only 19.76 per cent in 2023, but then exploded to 91.87 per cent by 2025. Similarly, the Return on Total Capital (ROTC) increased by 13.02 to 94.06 per cent during the period. These figures show Nvidia is very profitable and efficient with capital (Reuters, 2025).

This may be considered a bullish argument, but it is usually not feasible to sustain this degree of profitability historically. Investors ought to watch out when the performance measures go to extremes as they revert towards the mean.

Verdict: Nvidia is extremely effective today, but we are at the cap.

Valuation Check: Is There a Margin of Safety?

This is where it gets serious.

| Metric | Value |

| Market Implied Growth Rate | 6.44% |

| Price at Market Growth rate | $142 |

| Current Stock Price | $165 |

| Implied Growth in Current Price | 6.90% |

| Margin of Safety | None |

What does this imply?

It implies that the current price of Nvidia presupposes a growth rate of 6.9% as compared to its implied fair value growth, which is a bit higher. It gives little margin of safety, and thus, stock is overvalued at the current levels.

The AI Bubble? Beware the Herd Mentality

Nvidia has succeeded in becoming the poster boy of AI. However, when a stock becomes a story, then fundamentals tend to become secondary. Investors, both retail and institutional, are jumping on the bandwagon with little consideration given to valuation. Once, there was such a case, which occurred during the dot-com boom and subsequent crypto-crash and relied on tales of increasing traction to obfuscate sensible investment logic (Financial Times, 2024).

Final Verdict: Is Nvidia a Good Stock to Buy Now?

- Yes, assuming that you bet on the continued dominance of AI and you think that Nvidia can grow faster than even the most optimistic predictions.

- No, unless you want a margin of safety, value investing objectives, and/or want to be wary of extreme metrics and purchase multiplicities.

Bottom Line: The financial and margin performance of Nvidia is spectacular, but its share price of $165 versus its market growth rate price of $142 using a market-implied growth rate of 6.44% is high. Is Nvidia a good stock to buy now? Not if you are seeking mispriced opportunities with price-adjusted shares to come.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.