Is the market saying that it is risky to purchase MSFT stock, having dropped 12%? Or not? We discuss the valuation, sensitivity to growth, and what is not captured by the investors.

What the Article Covers?

The Microsoft Corporation (MSFT) has long been considered one of the strongest technology companies in the world, due to its diversified income stream, supremacy in cloud computing, and supremacy in enterprise software. However, the recent fall of MSFT stock by a rough margin of 12 percent is what has prompted a question in the minds of the investors: has MSFT stock become a value trap, or should it be purchased?

The market has been transformed in the recent past concerning the sentiment towards technology firms. The investors are moving towards profit sustainability, AI investment cost, and dependability of the cash flows on a free basis compared to the pure growth narratives. So long as Microsoft continues to make heavy investments in artificial intelligence infrastructure, it will be costly in terms of capital spending, which in its turn may affect the short-term flexibility of finances. The financial performance indicators, including margin, liquidity strength, and trends of cash flows, have become important in determining whether the fall of the stock of MSFT is a purchase opportunity or a sign of hidden threats.

Is MSFT Stock a Buy?

Is MSFT stock a buy? The operational efficiency of Microsoft is good, its balance sheet growth is high, and its revenue and EBITDA are stable. These are the areas that indicate that the firm remains financially strong despite the decline in stock prices.

However, it is not a unilateral response. Short-term financial pressure can be the result of short-term pressure in the trends of the free cash flow and capital expenditures dedicated to investments in AI. It means that msft stock outlook 2026 can still be considered good, but it can become unstable. MSFT may pass off as a well-diversified company in the case of conservative investors, but it may require a slow entry.

The valuation of Microsoft might be attractive to moderate investors in comparison to earnings growth. The decline can be viewed by the growth-oriented investors as an opportunity related to the additional increase in AI. Overall, MSFT is a strategic acquisition rather than a trap game, but risks and scale of investment are also important.

Financial Performance Overview

Revenue, EBITDA, and Free Cash Flow Trends

Microsoft is also performing well in terms of its basic financial growth based on the quarterly reports.

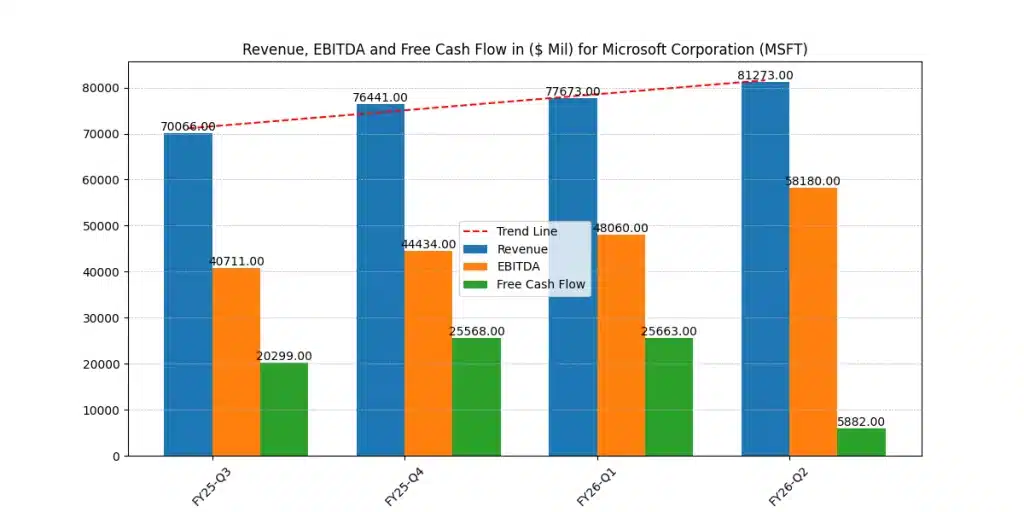

Table 1: Revenue, EBITDA, and Free Cash Flow ($ Millions)

| Quarter | Revenue | EBITDA | Free Cash Flow |

| FY25-Q3 | 70,066 | 40,711 | 20,299 |

| FY25-Q4 | 76,441 | 44,434 | 25,568 |

| FY26-Q1 | 77,673 | 48,060 | 25,663 |

| FY26-Q2 | 81,273 | 58,180 | 5,882 |

The business was also enjoying high demand such as the revenue was increasing at a steady pace in all quarters. EBITDA also registered significant growth which indicates expansion in operating efficiency and the control of costs. However, FY26-Q2 has witnessed a drastic reduction in free cash flow, which is an indication that capital expenditure and investment activities have increased.

The growth of revenue and EBITDA testifies that Microsoft was growing, and the opposite change caused by the decrease in the free cash flow makes investors think about the intensity of spending. Financial disclosures at Yahoo finance reveal that capital expenditure cycles are known to influence free cash flow of a technology company and more so during the period in which infrastructure is being expanded (Yahoo Finance).

Balance Sheet Strength and Liquidity Analysis

One of the best financial strengths that Microsoft has is the liquidity.

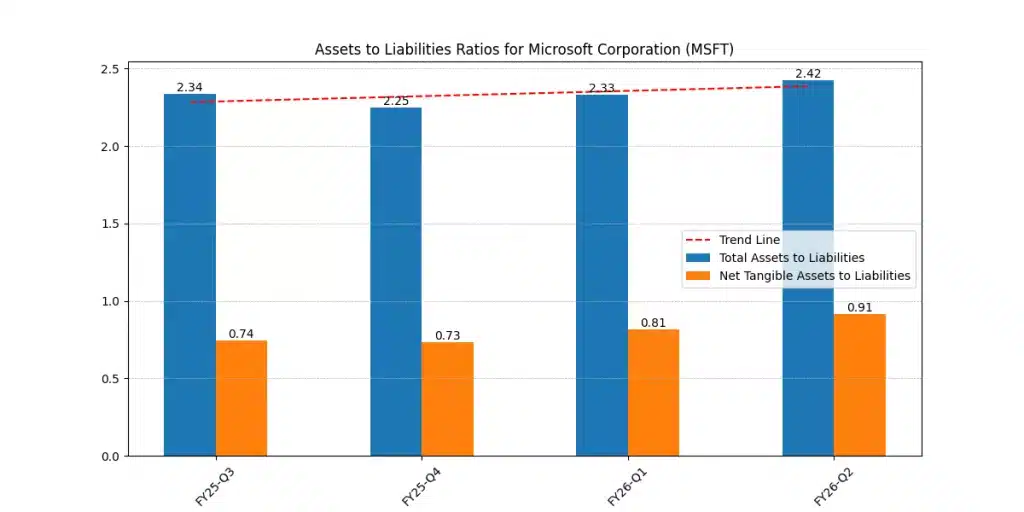

Table 2: Assets to Liabilities Ratios

| Quarter | Total Assets to Liabilities | Net Tangible Assets to Liabilities |

| FY25-Q3 | 2.34 | 0.74 |

| FY25-Q4 | 2.25 | 0.73 |

| FY26-Q1 | 2.33 | 0.81 |

| FY26-Q2 | 2.42 | 0.91 |

One of the strongest financial indicators is also the liquidity of Microsoft. There is a steady growth in the level at which Microsoft covers its liabilities. The expansion of the net coverage of the tangible assets means the financial support and the reduction of the solvency risk.

These developments are a sign that Microsoft is financially flexible. According to a volatile market, the assets coverage ratio of a time-increasing company would be more credit-worthy and stable (Yahoo Finance).

Operational Efficiency and Profitability

One of the core strengths that Microsoft has to maintain the stability of the valuation on the long-term perspective is operation efficiency.

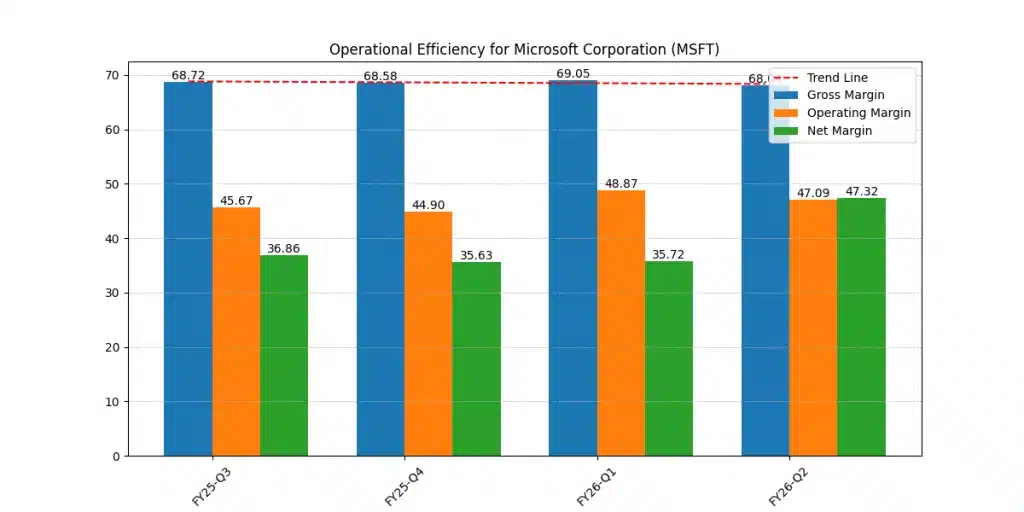

Table 3: Profitability Margins (%)

| Quarter | Gross Margin | Operating Margin | Net Margin |

| FY25-Q3 | 68.72 | 45.67 | 36.86 |

| FY25-Q4 | 68.58 | 44.90 | 35.63 |

| FY26-Q1 | 69.05 | 48.87 | 35.72 |

| FY26-Q2 | 68.01 | 47.09 | 47.32 |

The profit margins are consistently good that means good pricing power and profitability of the products. Operating margins registered an improvement in FY26-Q1 and were high in FY26-Q2. The trend of net margin showed an incredible increase in FY26-Q2 since it proved to be economical in the total expenses.

Microsoft is still able to experience high margins even after the hike in the cost of investments, goes along to argue that is MSFT stock buy or sell is not a reason to worry that the company is about to experience the financial decline but it is a questionable issue that needs to be taken seriously as an investment.

Cash Flow Sustainability and Investment Pressure

Capital expenditure is one of the most significant determinants of the MSFT valuation risk.

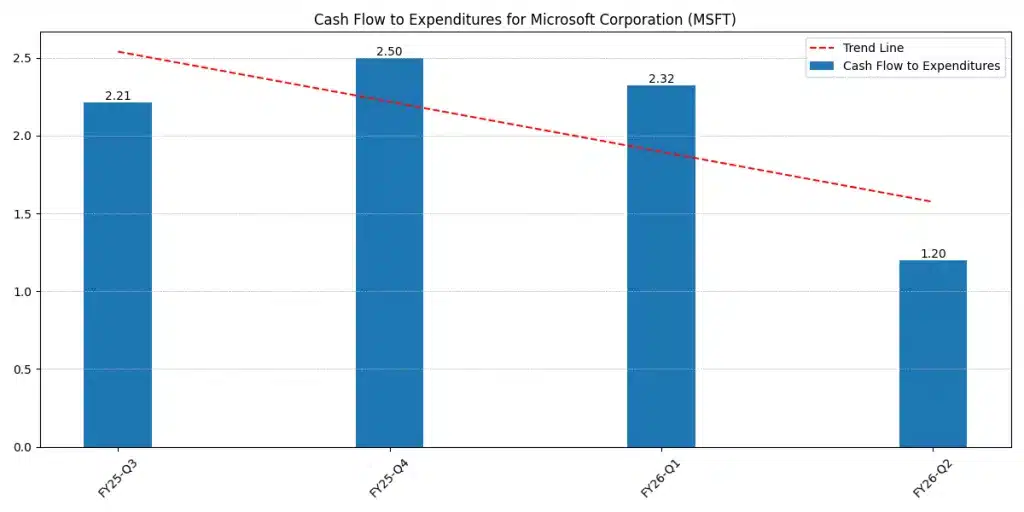

Table 4: Cash Flow to Expenditures Ratio

| Quarter | Cash Flow to Expenditures |

| FY25-Q3 | 2.21 |

| FY25-Q4 | 2.50 |

| FY26-Q1 | 2.32 |

| FY26-Q2 | 1.20 |

FY26-Q2 has been weakened, which indicates that Microsoft is becoming more and more spending on infrastructure expansion and technology development. Even though short-term financial strain is not an advantage, such kinds of investments can guarantee future development.

It is also widely known that large tech companies tend to record a decreased free cash flow throughout their growth, especially when attempting to invest in new technologies (Financial Times).

Portfolio Framework Analysis

Conservative Portfolio Perspective

The capital preservation is the top concern to the conservative investors. Microsoft has good liquidity, zero margins, and rising ratios of asset coverage. These are pointers that suggests it is not in serious financial distress. However, any reduction of a free cash flow may also cause the short-term earnings to be more volatile.

In this regard, the support of valuation and entry price timing reliance makes MSFT stock a buy. The conservative investors may feel that they should not prefer aggressive buying, but gradually accumulate.

Balanced Portfolio Perspective

Balanced investors take care of the risk-adjusted returns. Since Microsoft is characterized by steady growth in revenues, increasing EBITDA, and expansion in operating margins, it is very earnings visible. At the same time, moderate uncertainty is introduced by the risk of capital expenditure.

On the one hand, MSFT stock can be viewed as a purchase in the case of balanced portfolios. The stock is diversifiable, particularly to the investors, who require exposure to technology with comparatively stable performance in earnings.

Growth Portfolio Perspective

Growth investors are less volatile and can expand over a longer period of time. The increasing investments of capital at Microsoft are a sign of a strong commitment to future innovation, especially in artificial intelligence and cloud computing.

The success of AI monetization is highly correlated with the case of MSFT stock purchase. Potential returns can be high in the long term if Microsoft can transform infrastructure spending into scalable revenue growth.

Valuation Context and Growth Sensitivity

The ability to hold the capacity of the margin on the one hand and the ability to convert the growth investments into revenue growth is strongly linked microsoft stock valuation. There was a gradual growth of the level of revenue and EBITDA, and this proves that the level of valuation is stable.

However, valuation is very sensitive. The resulting valuation risk may be higher for the investors due to a situation where capital expenditures continue to rise, and the revenue does not correspondingly rise. Financial analysts have noted on many occasions that the technology companies run into compression of valuation when growth assumptions exceed actual profitability (Financial Times).

Key Risk Factors

AI Capital Expenditure Risk

The technologies involved in AI infrastructure are a massive financial investment. But even as much as such investments are beneficial in regard to long term growth, it constrains short term cash flow flexibility. This brings a doubt to the short-term returns to the shareholders.

Competition Risk

Microsoft stock dip is a part of the sphere of cloud computing and enterprise software that is highly competitive. The sustainability of the margins due to competitive pricing may also be affected if the competitors increase the intensity of investment.

Expectation Risk

When the performance of the financial exceeds the expectation of the investment then these are referred to as expectation risk. The past performance of Microsoft creates the high expectations of the markets. A reduction of returns would lead to volatility of the stocks. Technology companies have more valuation exposure on the point of growth transitions (Yahoo Finance).

Long-Term Investment Outlook

Microsoft continues to do very well in terms of its operational performance and balance sheet resilience. Revenue growth is gradual and margin sustainability suggests business pillars that are sustainable. Although this may be a short term risk because of the fluctuation of the free cash flow, the long run investment indicators are positive.

Investing in MSFT stock therefore must put into consideration capital expenditure pressure on the short term and technology leadership prospects on the long-term.

Final Verdict: Buy Opportunity or Value Trap?

According to financial evidence, Microsoft does not have the characteristics of a value trap at the present. The company is characterized by a good liquidity, improvement in assets cover ratios, and stable increase in profits. However, there is the short-term confusion caused by the intensity of investment.

All in all, is MSFT is a buy, basing on the risk factor and period of investment primarily. Moderate investors may prefer cautious accumulation. The existing valuation can be desirable to moderate investors. Growth investors can consider the drop in stock as the long-term chance.

Microsoft is financially well placed and in a strategic position to grow in the future. Therefore, the stock will be closer to a computed buying opportunity and not a structural value trap.

Conclusion

The recent decline in Microsoft shares has caused concern in investors but financial performance measures may prove to be a helpful indicator. The company is experiencing a high increase in revenue, improvement in operational performance, and strengthening of balance sheets. These causes show that Microsoft has continued to operate in a stable and competitive financial state in the technological sector. The profitability levels also show consistent growth in the profitability which means that Microsoft is managing costs efficiently and simultaneously expanding the business.

The decline in the free cash flow is mainly attributed to intensive investment particularly in infrastructure and development of new technologies. This would reduce the short-term financial flexibility but such an investment is normally associated with the companies that are envisioning to grow in the future. The possibility of making huge returns on the long run basis can be high in case of Microsoft translating these investments into scalable revenue streams. It is one thing that investors should know that financial pressure in the short term, does not imply financial weakness, but it is a pointer of strategic expansion decisions.

Lastly, the question is Microsoft stock a buy cannot be discussed as a universal one. It is rather a question of the plan, risk and time to invest on by the individual investors. Conservative investors would prefer to wait until they have more visibility of stability of free cash flows before exposure. The recent decline gives investors an opportunity to be considered as it was a good entry point given that earnings are stable and the fundamentals are good. Growth oriented investors will see the existing round of investing in Microsoft as an opportunity to experience additional revenue increase due to innovation.

In summary, Microsoft has a long-term investment potential although short term fluctuations on basis of financial performance trend, consistency in operations and strength of the balance sheet. Investors who look at microsoft long term investment and those who consider the investment cycle of the company may see Microsoft to be in a sustainable growth position compared to the nature of value trap company.

Usama Ali

Usama Ali is the founder of Financial Beings and a self-taught investor who blends classic valuation study with insights from psychology. Inspired by works from Benjamin Graham, Aswath Damodaran, Stephen Penman, Daniel Kahneman, and Morgan Housel, he shares independent, data-driven research to help readers connect money, mind, and happiness.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.