Is Microsoft a good stock to buy? We will try to answer this pertinent question in our valuation report. Microsoft Corporation (NASDAQ: MSFT) is one of the many stocks whose interest seems to attract investors as a blue-chip with strong technological merits. Its dominance in many different fields, including cloud computing, enterprise software, productivity tools, and its increasingly extensive presence in AI, has cemented the reputation of the company as one of the most strategically diverse and reliable in the S&P 500 (Financial Times, 2025a).

After the FY26 results announcement, the investors are once again (which is entirely justified) raising the question: Is Microsoft a good stock to buy now? This question is more topical than ever, as Microsoft has such a rare trait, i.e., the provision of growth and financial stability. It has again shown a double-digit increase in cloud revenue and an all-time high free cash flow, which indicates that the business remains strong across all the main business areas (Financial Times, 2025b).

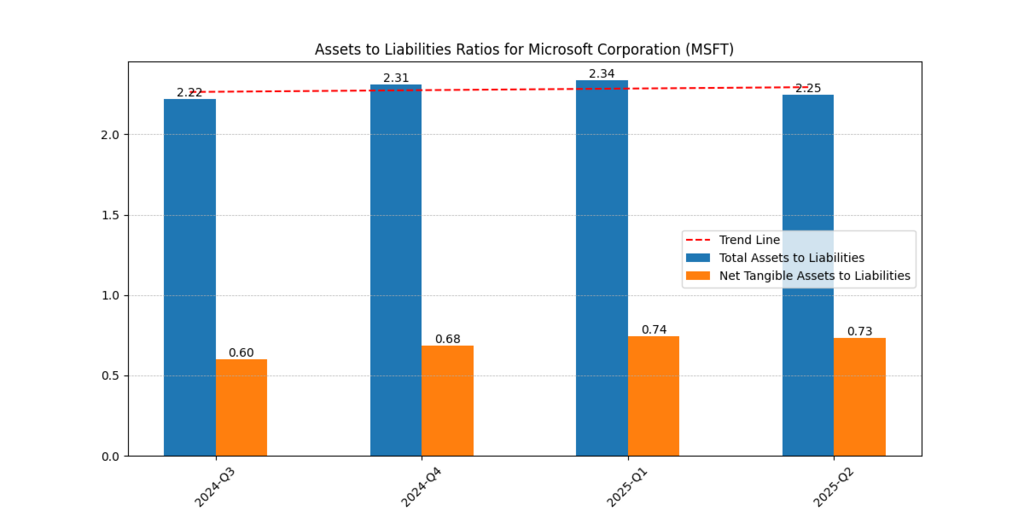

Financial Strength: Solid Balance Sheet Ratios

The balance sheet of Microsoft is outstanding. In the table below, Microsoft has total assets of more than twice its liabilities, which means high solvency. In addition, the Net Tangible Assets to Liabilities ratio is on a historic increase, indicating that the assets are increasingly supported even without intangibles.

Figure 1: Total as well as Net Tangible Assets of Microsoft to Liabilities (2024-2025) Incorporate a steadily high ratio that is greater than 2.0 which reflects on the great solvency and financial strength of Microsoft.

| Quarter | Total Assets to Liabilities | Net Tangible Assets to Liabilities |

| 2024-Q3 | 2.22 | 0.60 |

| 2024-Q4 | 2.31 | 0.68 |

| 2025-Q1 | 2.34 | 0.74 |

| 2025-Q2 | 2.25 | 0.73 |

This supports the idea that the company has low default risk and the ability to support innovations, dividends, and other shareholder returns with its internally generated funds.

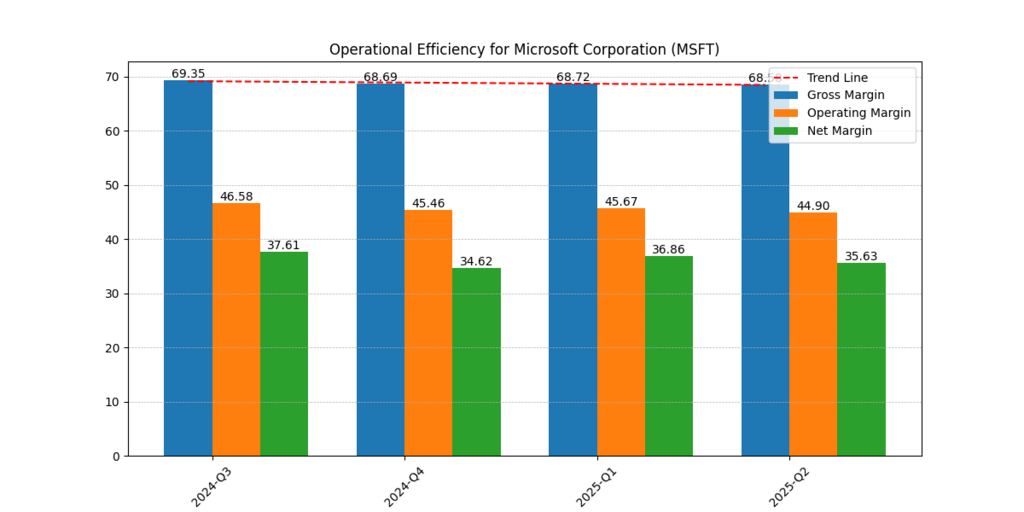

Efficiency & Margins: Stable and Competitive

Microsoft always remains the best in the class. Net margin stayed 35% above about 69% gross margins and reflected pricing power and very robust cost control.

Figure 2: Gross, Operating and Net Margins for Microsoft (Last 4 Quarters) Margins at near all-time highs reflect Microsoft’s ability to control costs and charge for its products.

| Quarter | Gross Margin (%) | Operating Margin (%) | Net Margin (%) |

| 2024-Q3 | 69.35 | 46.58 | 37.61 |

| 2024-Q4 | 68.69 | 45.46 | 34.62 |

| 2025-Q1 | 68.72 | 45.67 | 36.86 |

| 2025-Q2 | 68.58 | 44.90 | 35.63 |

These margins really are clearing the field and placing Microsoft at the top in the tech space, and that further reinforces the notion that Microsoft is a good stock to buy for long-term investing.

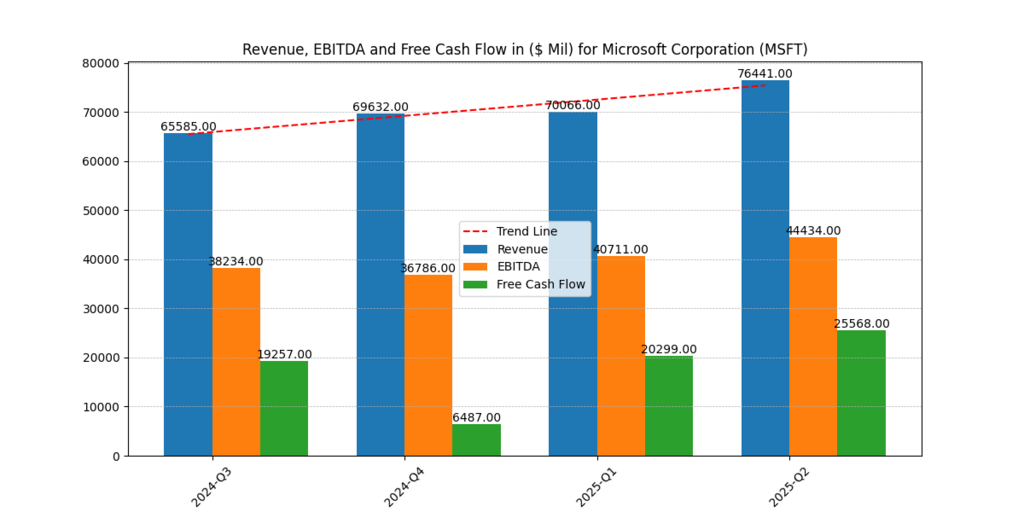

Revenue, EBITDA, and Free Cash Flow Growth

The free cash flows and revenues of Microsoft have been increasing every quarter. Jumping to $76.4 billion by Q2 2025, revenue has risen to $65.6 billion in Q3 2024. Free cash flow also leaped up to $25.6 billion, signifying better working capital management.

Figure 4: Revenue, EBITDA, and Free Cash Flow of Microsoft (in millions of dollars). The revenues and FCF have increased significantly in Q2 2025, which means that there is potent operational leverage.

| Quarter | Revenue ($Mil) | EBITDA ($Mil) | Free Cash Flow ($Mil) |

| 2024-Q3 | 65,585 | 38,234 | 19,257 |

| 2024-Q4 | 69,632 | 36,786 | 6,487 |

| 2025-Q1 | 70,066 | 40,711 | 20,299 |

| 2025-Q2 | 76,441 | 44,434 | 25,568 |

Such financial flexibility allows Microsoft to make new investments in artificial intelligence, cloud infrastructure, and returns to shareholders: this is a solid indicator of the fact that Microsoft is a good stock to buy for both growth- and income-oriented investors.

Further Reading : The 5 Best AI Stocks to Buy Now in 2025: A Comparison

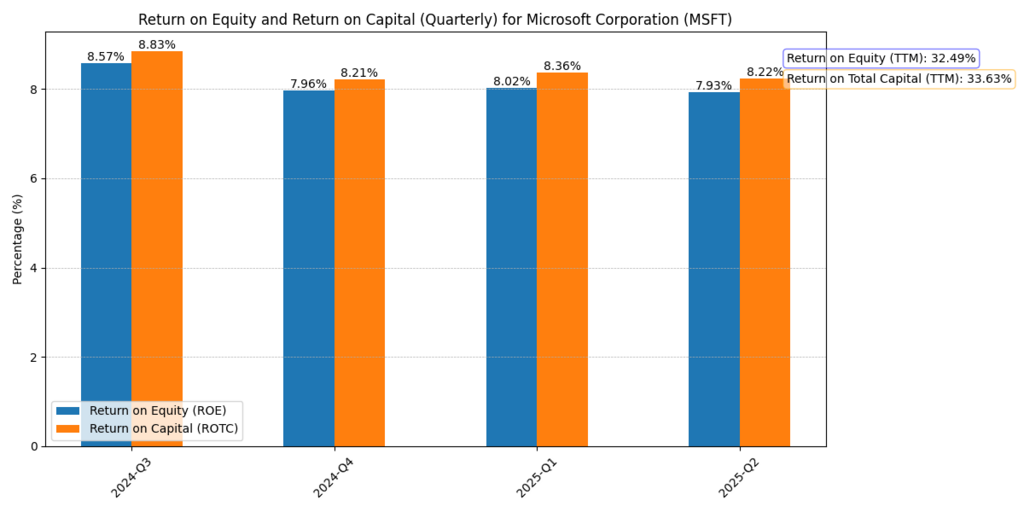

Shareholder Value: Returns on Equity and Capital

Microsoft has good returns on equity as well as capital employed. Its TTM Return on Equity stands at 32.49% and Return on Capital at 33.63% signs of its effective use of capital deployment and creation of shareholder value during the past four quarters.

Figure 4 shows the ROE and ROTC trends of Microsoft (Trailing Four Quarters). The fact that Microsoft has maintained a high rate of returns to equity as well as capital indicates the efficiency with which it has allocated capital.

| Quarter | ROE (%) | ROTC (%) |

| 2024-Q3 | 8.57 | 8.83 |

| 2024-Q4 | 7.96 | 8.21 |

| 2025-Q1 | 8.02 | 8.36 |

| 2025-Q2 | 7.93 | 8.22 |

These metrics provide more fuel to an argument that Microsoft is a good stock to buy for investors looking for steady returns.

Price Forecast: How much upside is left?

With the company’s value-added earnings, we make a strong case that.

- 2025 Value-Added Earnings: $10.84/share

- Value-Added Earnings 2026: $13.42 /share

- 23.75% Growth in Value-Added Earnings

These estimates are also presented as the following fair value scenarios:

| Scenario | Estimated Price per Share ($) |

| No-Growth Scenario | 153.49 |

| Growth Scenario (7.5%) | 585.27 |

| Market-Implied Growth Scenario | 381.82 |

With a relatively low growth estimate (7.63 percent), the share price results in a fair value of $585.27, which is a high growth potential considering its current price of $535.32. Its current market growth is priced at 7.06 percent, which is less than the current estimates of our projection. This shows that Microsoft is undervalued, according to the fundamental growth.

Conclusion

The pointers are all in the affirmative, with asset safety, margin consistency, value-added earnings, and upside potential being recorded. The AI strategic investments and increasing high returns on equity, strengthened by the growing free cash flows, maintain the status of Microsoft even more.

Microsoft is a good stock to buy considering the earnings confirmation during FY26, as long-term investors are interested in growth, stability, and exposure to tech.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.