Find out is Google a good buy now based on the latest results and future outlook. Alphabet’s Q1 2025 earnings reveal strong growth driven by AI, cloud, and advertising.

Alphabet Inc., through its Google subsidiary, reported strong financial results for Q1 2025, indicating growth in key business divisions. Despite complex technological conditions, Alphabet maintained resilience by achieving superior performance metrics in artificial intelligence, cloud services, and advertising platforms. This combination of strategic actions and outstanding financial performance has led many investors to question whether Google is a suitable investment option in the current market. This article examines the recent results and their implications for Google’s upcoming business development.

In the first three months of 2025, Alphabet’s key business units showed strong performance, generating revenue of $90.2 billion, a 12% increase from the previous year. Earnings reached $34.5 billion, a 46% growth from the previous year. The growth was primarily due to the development of Google’s core business operations. Search advertising performance remained strong, with YouTube experiencing a 10% revenue increase. Cloud services saw a 28% increase in sales, reaching $12.3 billion. These earnings have sparked investors to consider purchasing Google shares.

Strong Revenue and Earnings Growth

In the first three months of 2025, Alphabet’s key business units showed strong performance, generating revenue of $90.2 billion, a 12% increase from the previous year. Earnings reached $34.5 billion, a 46% growth from the previous year. The growth was primarily due to the development of Google’s core business operations. Search advertising performance remained strong, with YouTube experiencing a 10% revenue increase. Cloud services saw a 28% increase in sales, reaching $12.3 billion. These earnings have sparked investors to consider purchasing Google shares.

We have maintained our view of Alphabet Inc. (GOOGL) being undervalued, the fair value analysis can be found here!

AI Advancements Driving Future Growth

Alphabet has announced the deployment of Gemini 2.5, its latest large language model, across all its platforms. This model connects with other services like Search and Workspace, providing AI overviews that drive search results. Over 1.5 billion monthly users now have access to these overviews. The strategic use of AI has improved user satisfaction and streamlined Google’s advertising activities. Alphabet’s strong investments in AI innovation serve as evidence for investors considering whether or not to purchase Google, as they consider the long-term horizon of the company’s future.

Solid Cloud and Subscription Performance

Google Cloud generated Q1 2025 operating income of $2.2 billion, demonstrating success with infrastructure improvements and the introduction of the Ironwood TPU. The enterprise market is embracing AI-powered cloud solutions. Alphabet has 270 million paid customers through subscription-based services like YouTube Premium, Music, and Google One, allowing for diversification of revenue streams and reducing reliance on advertising revenue. This business model ensures continuous growth over the long term. [2]

Capital Returns and Efficiency Improvements

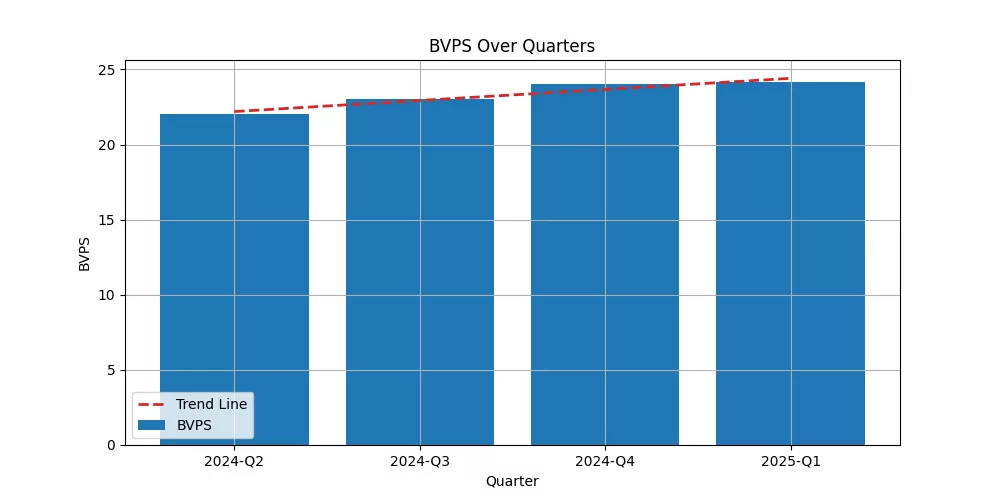

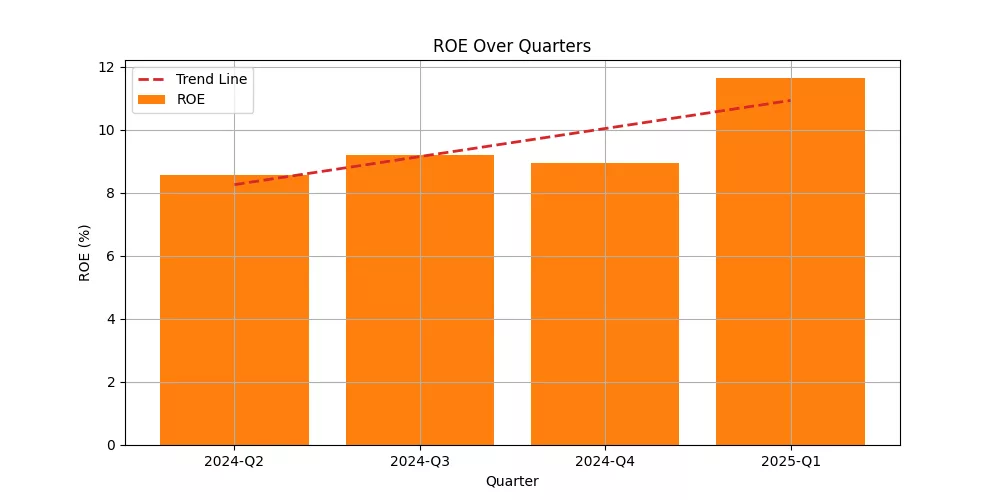

Alphabet has increased dividends by 5% and initiated a $70 billion stock repurchase program, benefiting shareholders. Management is still pursuing funding efforts, indicating positive cash flow and a hopeful outlook. Alphabet is improving administrative and operational efficiency, and is implementing cost optimization methods, including labor consolidations, to accelerate product development while maintaining expense control. Shareholders are satisfied with the investment value provided by Google, which offers a combination of growth and financial discipline.

Regulatory Risks Remain

Alphabet, despite its strong financial and strategic position, faces regulatory challenges, including antitrust decisions in the US and Europe, which could impact its advertising and search operations. Despite this, Alphabet’s diverse revenue sources and ongoing technology advancements allow it to manage risks more effectively than other market participants.

Valuation Looks Attractive

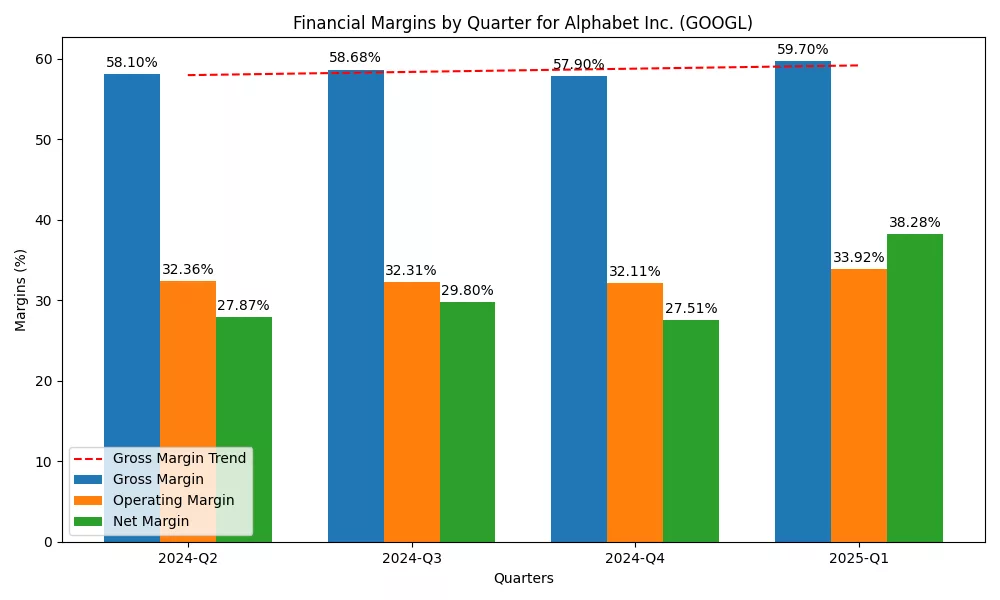

Alphabet’s stock value increased by 5% in after-hours trading due to its results report. Despite a 16% drop since the beginning of the year, investors should find this price level appealing. Alphabet’s forward price-to-earnings ratio of approximately 17 places it in a favorable position, similar to Microsoft and Amazon. Its strong position in artificial intelligence and good profitability performance make it one of the leading big-tech investment options currently available. [1]

Alphabet’s Recent AI Projects

The following projects highlight Alphabet’s ambition not only to lead in consumer AI but also in enterprise, healthcare, creative industries, and cloud AI services.

| Project Name | Description | Year |

| Gemini 2.5 | Alphabet’s latest large language model (LLM) powering Search, Workspace, and more; successor to Bard. | 2025 |

| AI Overviews | AI-generated summaries at the top of Google Search results, serving 1.5 billion users monthly. | 2025 |

| Imagen 2 | Advanced AI model for generating high-quality images from text prompts, competing with OpenAI’s DALL-E. | 2024 |

| MedLM | Specialized medical AI models built on Gemini architecture for healthcare applications. | 2024 |

| DeepMind Gemini | Multi-modal AI system combining text, images, audio, and video understanding, pushing the boundaries of general AI. | 2024 |

| Veo | A video generation AI tool capable of producing high-quality, story-consistent videos from text descriptions. | 2025 |

| Google Cloud Vertex AI | Enterprise platform offering custom AI model training, deployment, and management services integrated with Gemini models. | 2025 |

In short, is Google a good buy now?

Alphabet presents a promising long-term investment opportunity due to its high profitability, rapid AI development, subscriber growth, and favorable market prices, but investors should be aware of current regulatory restrictions. Alphabet has increased dividends and is pursuing funding efforts, indicating positive cash flow. The company is improving administrative and operational efficiency and implementing cost optimization methods to accelerate product development while maintaining expense control. Shareholders are satisfied with Google’s investment value, which offers growth and financial discipline. Despite facing regulatory challenges, Alphabet’s diverse revenue sources and ongoing technology advancements allow it to manage risks effectively. Its stock value increased by 5% in after-hours trading, making it a favorable investment option due to its strong position in artificial intelligence.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.