Introduction

Explore the IBM stock forecast 2025 to find out about the company’s dividends, financial statistics, technological advancements, and experience with artificial intelligence. Learn about IBM’s current market value and suitability for long-term investments.

One of the first companies in the technology industry, International Business Machines Corporation (IBM) has expanded from a hardware manufacturer to a hybrid cloud and artificial intelligence solutions provider. IBM continues to have a significant impact in the technology sector as a producer of business-grade products and software/consulting services. When considering the company’s performance as it begins 2025, investors and analysts have focused on the following areas: financial health, future ambitions, AI, hybrid cloud, and mainframe technologies.

This article will examine the variables that are anticipated to impact IBM’s share price projections through 2025. First of all, it introduces this global technology company and gives broad details about IBM’s innovative products and research and development. Next, we talk about IBM in the AI era, emphasizing its major advancements and tactics in cloud computing and generative AI. The next sections will look at IBM’s P/E ratio, revenue growth rates, and dividend policies, among other industry averages and ratios. Lastly, we offer a reasonable assessment of the current valuation and briefly discuss some important factors to take into account while investing in IBM stock.

This post will provide you with an understanding of IBM’s future through well-organized data and analysis, regardless of your level of experience investing.

What is IBM Doing in the Technology Sector?

IBM is a prominent innovator in the technology sector, with business software, AI, and hybrid cloud as the primary emphasis. The business has strategically chosen to concentrate on software and consulting, both of which generate substantial profits. IBM successfully provides technological solutions to businesses in a variety of industries, including retail, healthcare, and finance, to help them improve performance and transition to the digital age. Clients can take use of scalable, secure, and effective IT solutions thanks to a solid infrastructure (IBM Z) and astute acquisitions (Red Hat).

Additionally, IBM leads the industry in green technology and has special initiatives related to green IT and data center emissions. In order to establish itself as a key partner for businesses seeking to manage change and accomplish agile digital transformation, IBM offers a wide range of services and solutions.

Products and Research of IBM

IBM’s product line exhibits robust innovation efforts and tends to focus on high-tech services and solutions. Among the main offerings are WatsonX for hosting enterprise AI apps and Red Hat OpenShift for hybrid cloud computing solutions. For businesses with substantial amounts of valuable work that cannot afford downtimes, lack of checks, slowness, or errors, IBM Z systems offer amazing uptime and transaction rates. Businesses may enhance operational performance and safeguard their operations from risks by utilizing IBM Z systems software, automation data, and security.

With an emphasis on cutting-edge technologies like artificial intelligence (AI) and quantum computing, including AI ethics, IBM has one of the top research departments in the world. For example, IBM is being introduced to quantum solutions in a variety of industries, such as logistics and pharmaceuticals, through the Quantum Network. Furthermore, the development of reliable AI with the aim of meeting business and societal demands is the main emphasis of their AI research. IBM’s leadership in the market is further cemented by the availability and delivery of these cutting-edge goods as well as by conducting research. [1]

IBM in the Era of AI

In the era of artificial intelligence, IBM has emerged as a prominent player in the creation of effective and expandable AI business solutions. Their WatsonX platform’s powerful generative AI deployment capabilities enable companies to expedite decisions, reduce procedures, and give a more individualized customer experience. Similar to this, IBM offers thorough analysis and cost optimization for its AI solutions, which have been applied in the supply chain, healthcare, and finance sectors.

AI systems that enjoy creating content have become increasingly important, and IBM has said that it has booked over $3 billion in this area, demonstrating the growing demand from customers. However, in order to have more processing capacity for AI computation, AI is also integrated into several of IBM’s hardware platforms, such as the IBM Z, in addition to software. Moreover, this organization offers strategies to combat ethical concerns in the application of AI and to combat AI prejudice. IBM continues to strategically position itself with organizations as its ally in utilizing AI through the use of AI in its products.

IBM’s Stockholders Metrics

| Metric | 2021 | 2022 | 2023 | TTM (2024) |

| P/E Ratio | 25.80 | 93.30 | 21.19 | 33.10 |

| P/B Ratio | 5.39 | 6.35 | 6.47 | 8.40 |

| Market Cap | – | – | – | $210.274 billion |

| Revenue Growth | $57.351 billions | $60.530 billions | $61.860 billions | $62.580 billions |

| EPS | $5.03 | $1.81 | $8.20 | $6.87 |

| EBITDA | $12.41 billions | $7.17 billions | $14.69 billions | $12.649 billions |

| Free Cash Flow (FCF) | $10.028 billions | $8.463 billions | $12.121 billions | $11.889 billions |

| Dividend Yield | 4.90 | 4.68 | 4.05 | 2.94% |

Quarterly Analysis of IBM’s Stockholders Metrics (2024)

Revenue Growth

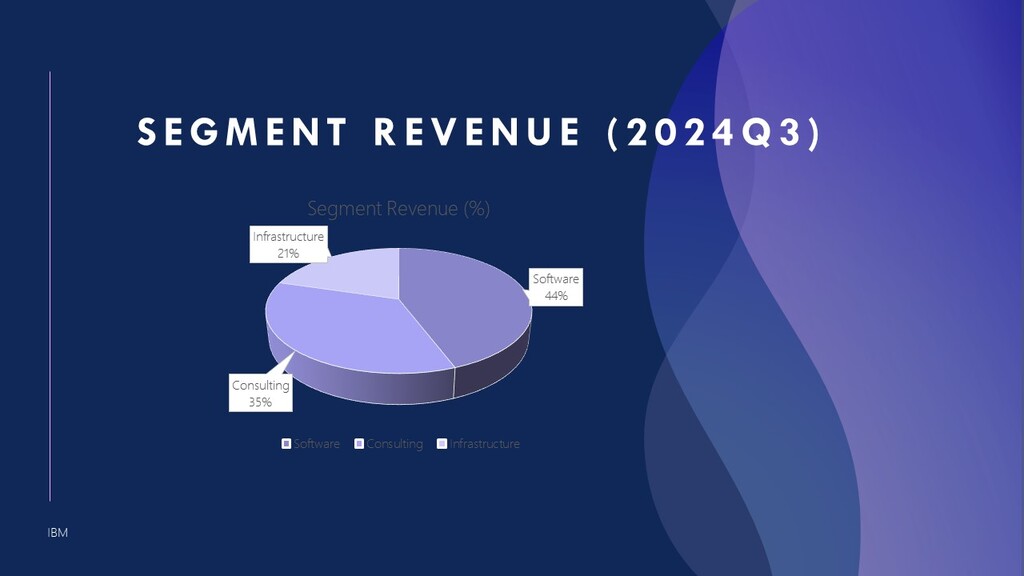

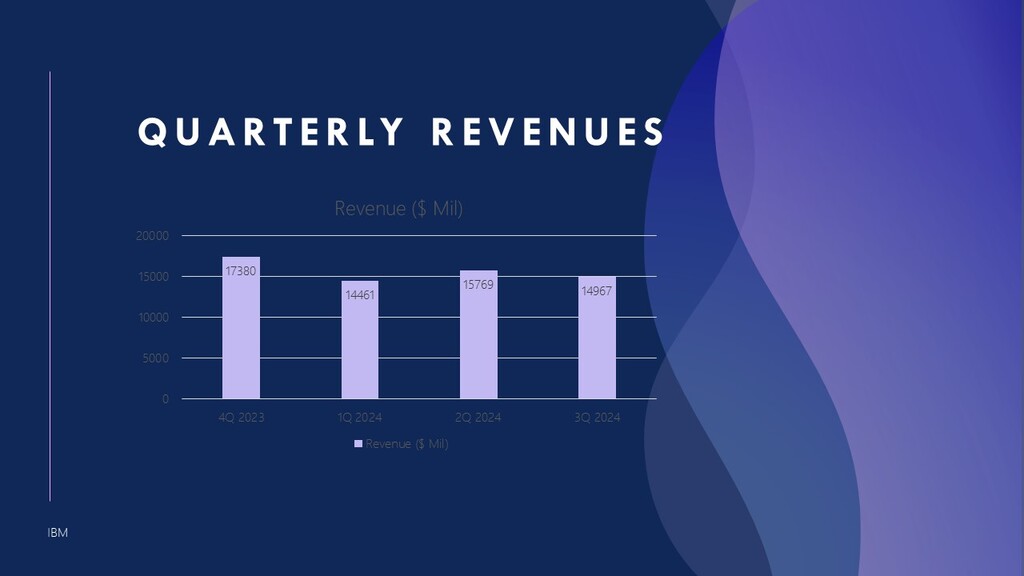

In 2024, the company’s revenues were inconsistent, with $14.461 billion in Q1, $15.769 billion in Q2, and $14.967 billion in Q3. The most recent data shows that IBM generated $62.580 billion in total revenues for the trailing twelve months (TTM), exhibiting a steady but somewhat erratic growth pattern. These results highlight the significance of software and artificial intelligence solutions and demonstrate that IBM has been able to sustain its sales despite competitive conditions. Interested in DELL’s fair value find it out here! Dell Stock Forecast 2025.

Free Cash Flows (FCF)

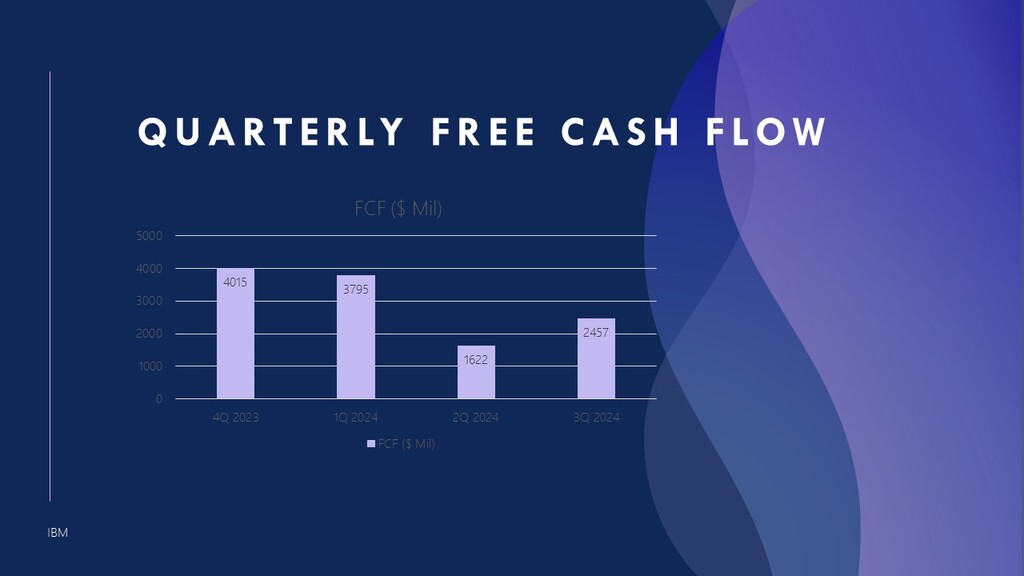

With free cash flow (FCF) figures of $3,795 in Q1, $1,622 in Q2, and $2,457 in Q3, IBM made sure that strong cash flow building was maintained until 2024. The TTM FCF of $11,889m attests to both prudent capital investment funding and excellent operational performance. The company can maintain its dividend policies and make investments in cloud and artificial intelligence (AI) when it has a healthy cash flow situation.

Market Cap and Valuation Metrics

With a market valuation of $210.274 billion in 2024, IBM gained prominence, especially in the technology sector. The P/E ratio (TTM) and P/B ratio (TTM) of 33.10 and 8.40, respectively, indicate that IBM is overpriced, which implies that investors have faith in AI’s ability to support the company’s growth.

EBITDA and EPS

The fact that IBM’s TTM for EPS is $6.87 suggests that the business is in a stable position in terms of profitability. IBM’s operational excellence and its direct correlation to earning EBITDA operating scale were validated by the TTM, which exhibited operating EBITDA of $12.649 billion. [2]

Dividend Yield

Given the history of high shareholder returns, IBM currently pays a dividend of 2.94 percent, which is advantageous for shareholders. These strong FCF support the company’s consistent dividend payments as well as its capacity to maintain financial flexibility with regard to dividend distribution.

All things considered, IBM’s quarterly financial statements for 2024 showed consistent revenue growth, strong cash flows, and a sign of effective shareholder value that enabled the company to adjust its operations to the changing technology industry.

Stock Price Prediction for IBM

Current Growth Levels

IBM’s revenue is projected to be at $57.39 billion for the year ending in 2025, with a minor fall anticipated in 2026 and 2027, based on its growth predictions. Nevertheless, supported by strong operational processes, the company maintains a steady gross margin in the mid-60s percent range.

Valuation Insights

- Current equity valuation: $126.78/share.

- High-Growth Scenario Price: $137.

- Low-Growth Scenario Price: $100.

Perspectives on IBM’s Future

The present condition of the IBM Company’s finances can be described as relatively equivocal, with certain challenges in achieving steady revenue growth in the face of fierce competition. Nonetheless, it is one of the major participants in the technology industry due to its primary interest in the sector and emphasis on software and artificial intelligence. With advancements like WatsonX and its growing significance in generative AI, IBM thus has several opportunities to profit from high-margin industries.

Thus, based on current earnings and price, it can be argued that the stock is slightly more than average, but on the plus side, the company places a lot of emphasis on operational efficiency and shareholder benefits, making it a suitable investment for long-term investors. As the company capitalizes on its strengths as seen by the creation of new technologies and adjusts to or participates in changes in the industry, one can be slightly optimistic. [3]

FAQs

How high will IBM stock go?

During optimistic growth conditions, IBM’s stock is likely to grow up to $137.

What is the stock price prediction for IBM in 2024?

Based on the forecasts, the fair value should be around $137 based on the higher growth, however, the valuations are too high as the current stock market valuations suggest.

Is IBM a buy, hold, or sell?

Investors should sell the IBM stock and take the profits since the stock is overvalued based on our analysis.

Conclusion

Overall, IBM continues to be a leader in the market thanks to the introduction of AI, software, and hybrid cloud. Despite certain challenges related to the company’s capacity to maintain steady and consistent revenue development, basic organizational values in conjunction with strategic choices that favor high-margin and innovative industries can be considered to generate a wholly unique opportunity for success. Even if its share price is slightly high, the company has a history of maintaining dividend payouts and has very good free cash flow. Thus, IBM is prepared to offer a sustainable value in the upcoming years based on the company’s experience and the state of the market.

**Please be informed that the content is informational and by no means serve as a buy or sell signal. The company is not responsible for the loss of capital.