Analyse Meta Stock Price Prediction 2025 in our latest research article. Meta Platforms, Inc. (META) has completed an outstanding Q2-2025 performance in terms of earnings, which strongly sustains a bullish Meta Stock Price Prediction 2025. Revenues soared by 22 percent on-year to $47.52 billion as diluted EPS grew by 38 percent to $7.14, which is substantially higher than market expectations of ~$5.88-$5.90 (Business Insider, 2025). The accelerated ad monetization by AI, better pricing, and the maintained growth of global users were the beatmakers behind it.

Q2 2025 Financial Highlights

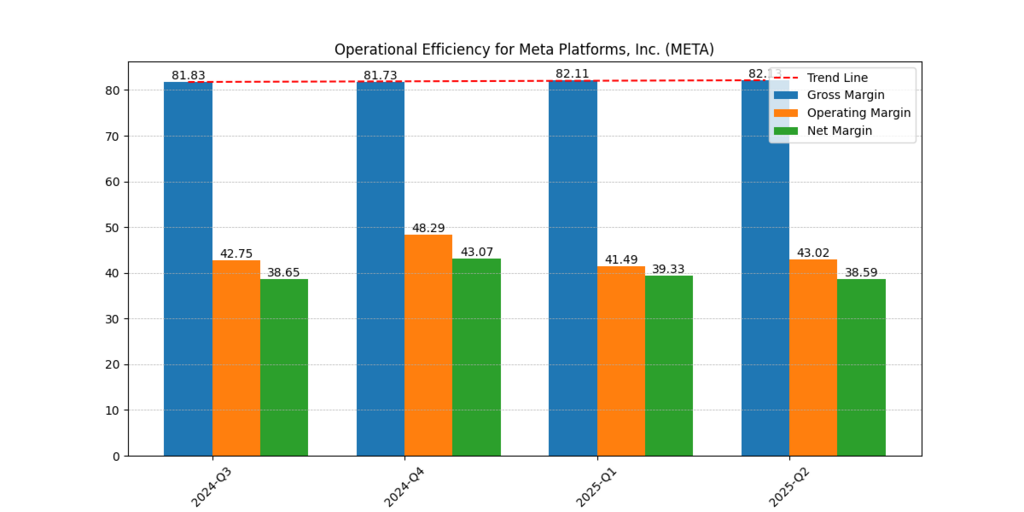

The Q2 2025 performance of Meta was above their expectations based on significant figures. The increase in revenue by 22% YoY to a value of 47.52 billion dollars can be attributed to AI-driven ad targeting and ad pricing. The actual EPS is performing better than expected, at $7.14, or more than 20% higher than the expected EPS. Operational efficiency and disciplined cost control weigh in on the performance. The operating margin grew by 190 basis points to 43%, indicating a more efficient monetization of Reels, Instagram, and Facebook as Capex was increased on AI infrastructure. The guidance of Q3 revenue was based on the parameters of $47.5-50.5 billion, which implied the assurance of maintaining a growth trend (Investors.com, 2025).

| Metric | Q2 2025 (Reported) | 2025 Outlook | YoY Change |

| Revenue | $47.52 bn | ~$X–$Y bn range | +22% |

| Diluted EPS | $7.14 | ~$20–$21 (Value-Added Earnings) | +38% |

| Operating Margin | 43% | Stable to +1 pp | +2 pp |

| Free Cash Flow (approx.) | ~$8.5 bn | Gradual improvement expected | −12% |

| Q3 Revenue Guidance | $47.5–$50.5 bn | Growth trajectory intact | — |

Source: Business Insider, 2025; Investors.com, 2025

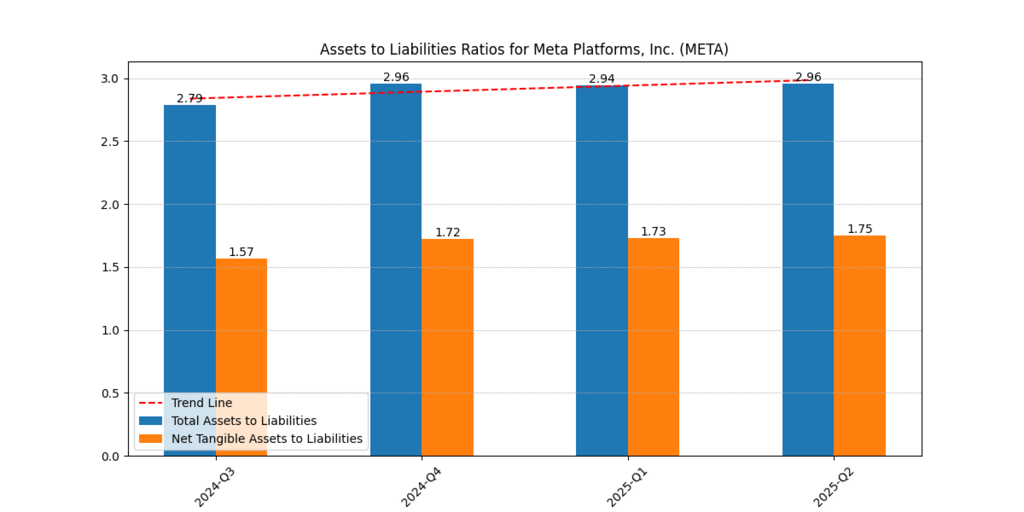

Figure 1: Meta Platform Inc (META) Total Assets to Liabilities as well as Net Tangible Assets to Liabilities Ratios (Q3-2024 to Q2-2025), where the leverage levels remained stable, but with a positive outlook in the long term.

Key Drivers Behind the Beat

AI-Powered Advertising Efficiency

Its advertising algorithms utilise AI elements that increase the placement optimisation and yield, with ad impressions surging by 11 per cent and the mean price per ad increased by 9 per cent (Investopedia, 2025).

Strong User Growth

The number of DAPs within the family increased by 6% YoY, reaching 3.48 billion as Meta further cemented its position in the field of digital engagement across the planet (Markets FT, 2025).

Strategic AI Expansion

As indicative of longer-term growth priorities vs near-term FCF pressures, management increased 2025 Capex expectations to a broader range of $66-72 bn to fund AI infrastructure, including the Superintelligence unit (Business Insider, 2025).

Analyst Sentiment and Price Targets

Meta Stock Price Prediction 2025 is still in a market sentiment; merely as per the proprietary model: a target range of results of around $809-$914 according to the various scenarios of growth rates. This range is reflective of Growth Price Per Share at the 6.5%, 6.7%, and 6.9% growth assumptions with the base case scenario ($~858) in close correlation to long-term monetisation of AI trends. Amid a range of what analysts publicly forecast to be between $698 and $980, the prospects for Meta possibly performing somewhere closer to the upper range of such an estimate, barring any significant macroeconomic changes, but also hinges on the continued momentum and upward AI-led revenue beneficence.

| Source / Model Scenario | Price Target (Range) | Basis |

| Low growth | ~$809 | Growth Price Per Share @ 6.5% |

| Base case | ~$858 | Growth Price Per Share @ 6.7% |

| High growth | ~$914 | Growth Price Per Share @ 6.9% |

| Public Market Range | $698–$980 | Various analyst & algorithmic forecasts |

Value-Added Earnings Perspective

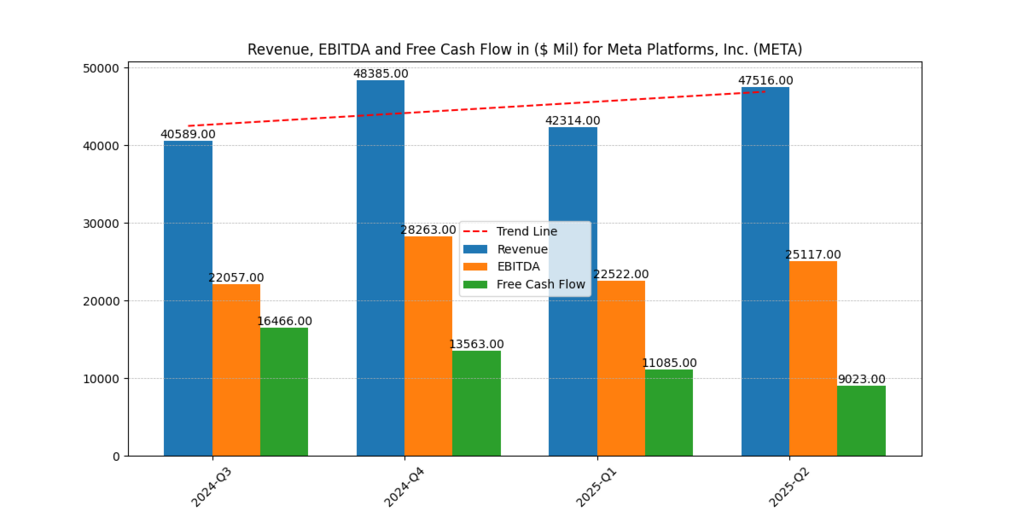

Figure 3: Meta Platform Inc (META) revenue, EBITDA, and free cash flow (Q3-2024 to Q2-2025) showing tremendous top-line expansion and accelerated progression of free cash flow because of high AI infrastructure investments.

The proprietary value-added earnings-based forecast is made through the proprietary value-added earnings framework that addresses expectations of unlevered performance instead of discounted cash flow (DCF) procedures. The model forecasts a Value-Added Earnings Estimate of around $20.9 at current valuations at a market-implied growth rate of about 6.6 percent by 2025.

Using assumptions of 6.5, 6.7, and 6.9 percent growth, the framework gives a range of Growth Price Per Share of $809 to $914 with a base case of approximately $858. The coupled margin expansion and revenue acceleration we are witnessing in Q2 is pushing Meta to surpass this base-case variable and is indicative of it being able to reach the higher half of the internal target range as measured in a fundamentals-driven Meta Stock Price Prediction 2025.

Further Reading : The Best Stocks to Buy in 2025 – A Deep Dive into AAPL and META

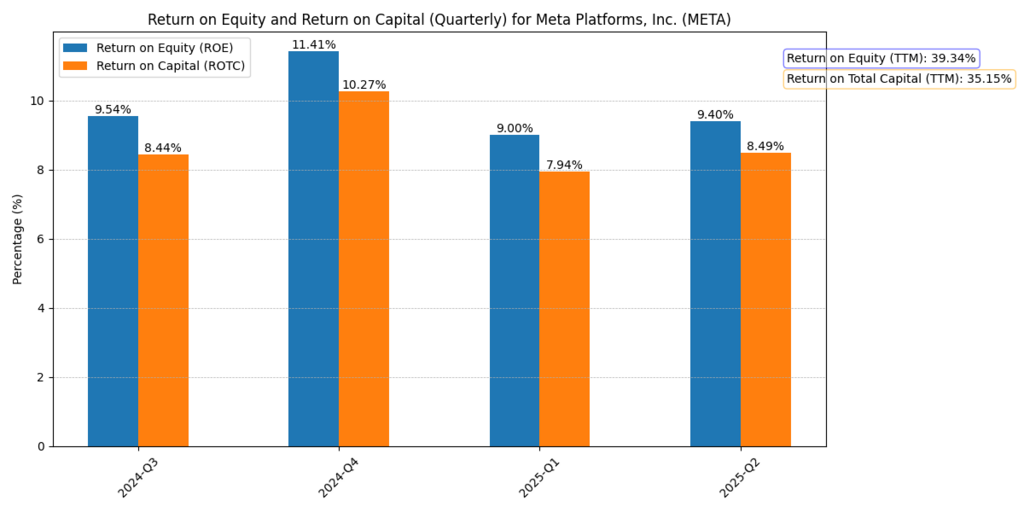

Strategic Opportunities and Risks

The growth projections of Meta are pegged on the increases in AI infrastructure, better monetization of Threads and Reels, and its global user base, which is incomparable to others. Winners of these initiatives may be able to maintain rich dividends on an equity and capital optimism basis. Nevertheless, regulatory oversight in the U.S. and EU, rivalry potentially in the AI field, and possible recession of ad spending across the globe continue as significant risks. For Meta, the question of how to balance aggressive investment with profitability will become a key one in figuring out whether it can hit the high end of price estimates by 2025.

| Factor | Outlook Impact |

| AI Infrastructure Investment | Long-term positive; near-term FCF drag |

| Monetization of Threads & Reels | Revenue upside; enhances DAU engagement |

| Regulatory Pressures (US/EU) | Medium-term risk to margins |

| Competitive AI Landscape | Requires continued innovation |

| Macro Conditions (Rates, Ads) | Could moderate ad spend growth |

Figure 4: Meta Platform Inc (META) Quarterly ROE and ROTC (Q3-2024 to Q2-2025) depicts continuing capital efficiency amidst AI-heavy growth.

Conclusion

The Q2-2025 performance of Meta reconfirms that the company is a giant in online advertising and social interaction. Meta Stock Price Prediction 2025 is optimistic due to the strong fundamentals, revenue acceleration, margin expansion, and regular AI leadership. Nevertheless, the expected volatility based on high Capex levels and macro pressure is possible, so the analyst targets the levels of $809-$914 that can be realistically achieved if Meta continues its momentum.

To conclude, the risk-reward ratio is still favorable, and this holds even in the long term as AI provides the primary factor that will drive the re-rating of valuations until 2025 and beyond when investing.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.