Best Penny AI Stocks to Buy in 2025 in the Artificial Intelligence (AI) sectorthat keeps transforming industries and investment environments. Although well-established companies such as NVIDIA come to the forefront, investing in penny AI stocks presents a distinct chance of high returns, though there is a greater risk involved. This article delves into the best penny AI stocks to buy based on financial statistics and prospects. It is important to notice that penny stocks are quite risky and speculative, and their due diligence has to be conducted.

Box, Inc. (BOX) – Undervalued AI-Driven SaaS Innovator

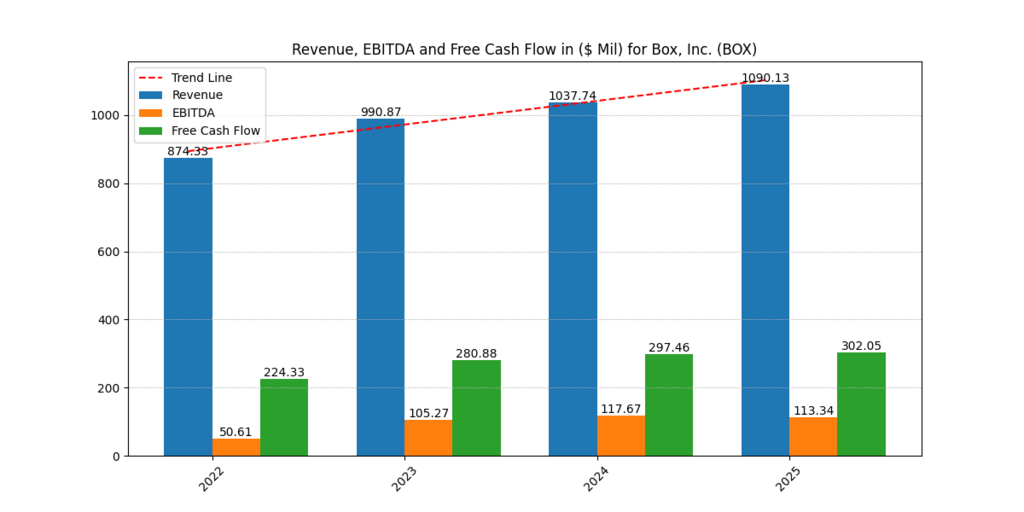

An example of a cloud content management and collaboration platform is Box, Inc., which is gradually integrating AI to make it more productive and secure. It has proved to be financially strong. Between 2022 and 2025, revenue increased by 24.99%, or $874.33M to $1090.13M, and EBITDA doubled, being $50.61M to $113.34M, which also indicates good operational leverage.

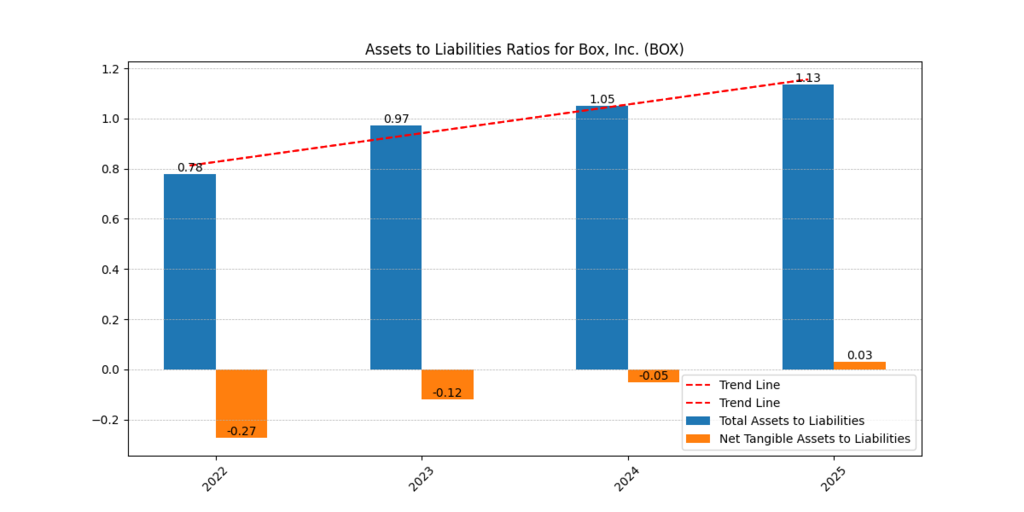

The Free Cash Flow (FCF) of Box has been strong, and it surpassed the margin of $302M M 2025, which is an indication of strong reinvestment capability. Besides, its Assets to Liabilities ratio increased, and in 2025, it was 1.13, compared to 0.78 in 2022 (Box Inc., 2025), reflecting a better balance beyond the liability positions and possible AI technologies or strategic purchases.

Verdict: Box has one of the lowest volatility stocks compared to its peers, decent FCF, and AI-integrated roadmap, making it one of the best penny AI stocks to buy.

MicroAlgo Inc. (MLGO) – High Risk, High Potential

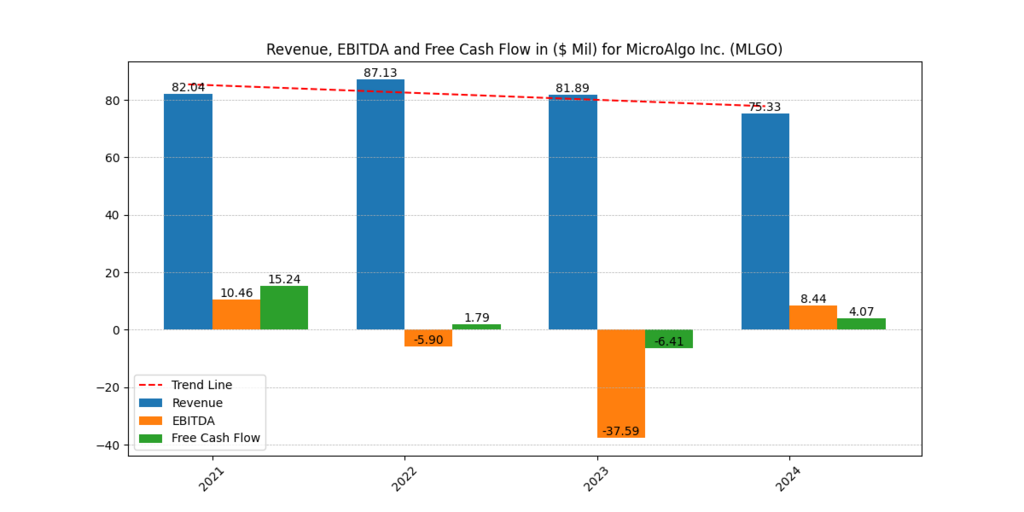

MicroAlgo is a Chinese AI company working on algorithm frameworks in edge computing and industrial automation. Although the revenue decreased slightly, to $87.13M in 2022 to $75.33M in 2024, the EBITDA rebounded, posting a considerable loss in 2023 and rising to $8.44M in 2024, and Free Cash Flow came back to positive figures.

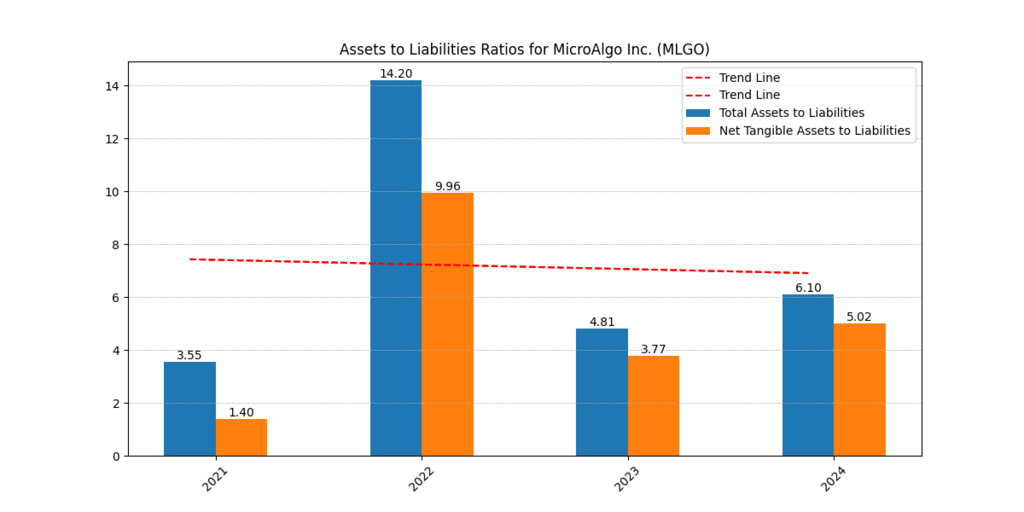

The Total Assets to Liabilities looks impressive as well, reaching 14.20 in 2022 and settling at 6.10 in 2024, reporting good asset coverage. Its Net Tangible Assets to Liabilities are also constantly high, 5.02 in 2024, which means that it contains a healthy amount that is less heavily dependent on intangibles (MLGO Annual Report, 2024).

Verdict: MLGO is a high-risk option with the best penny AI stocks to buy to pursue people who want to bet on China AI development and excessive asset protection.

Ohmyhome Limited (OMH) – AI Real Estate Tech with Turnaround Signs

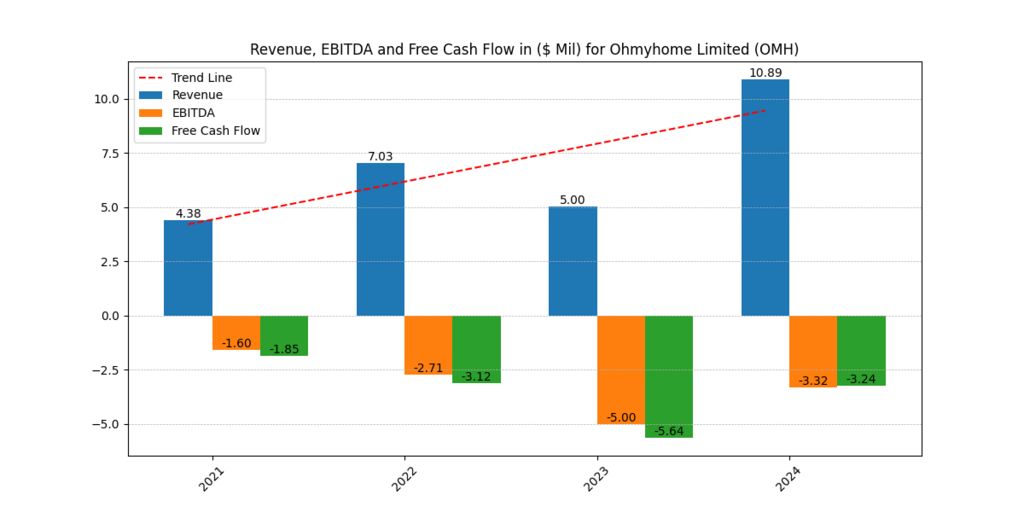

Ohmyhome is a proptech startup that applies artificial intelligence to streamline real estate deals in Southeast Asia. Although the EBITDA and FCF remained steadily negative, the revenue of the firm increased nearly twofold to reach the value of $4.38M in 2021 and $10.89M in 2024. More Penny Stocks with Growth Potential here.

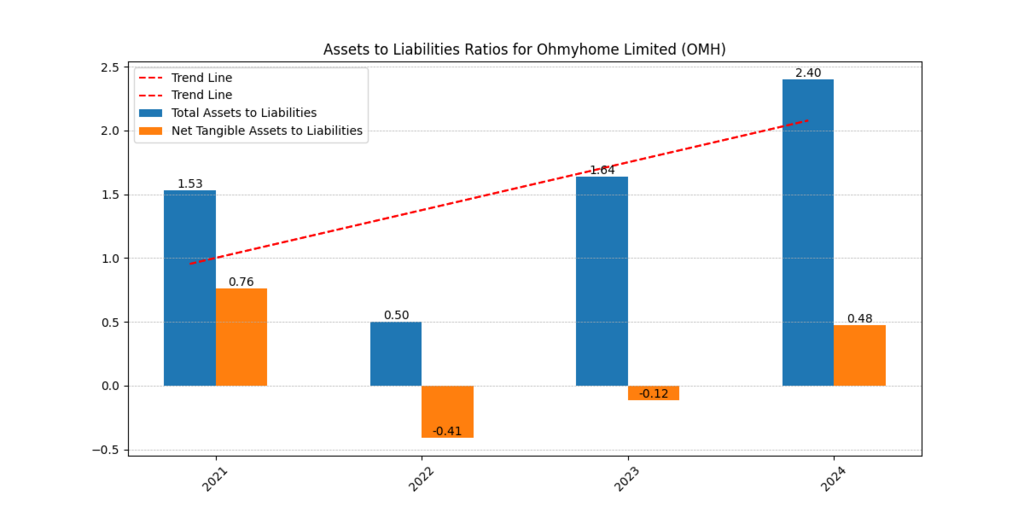

The Assets to Liabilities ratio improved very much to 2.40 in 2024, indicating improvement in solvency, and the Net Tangible Assets became positive (0.48) after 4 years. Such advances allude to an operational turnaround (Ohmyhome Financials, 2024).

Verdict: It is still speculative, but the ratios are improving and AI deployment is expanding, which makes OMH noteworthy to consider as a best penny AI stock to buy in the long term as a tech stock.

D-Wave Quantum Inc. (QBTS) – Quantum AI on the Edge

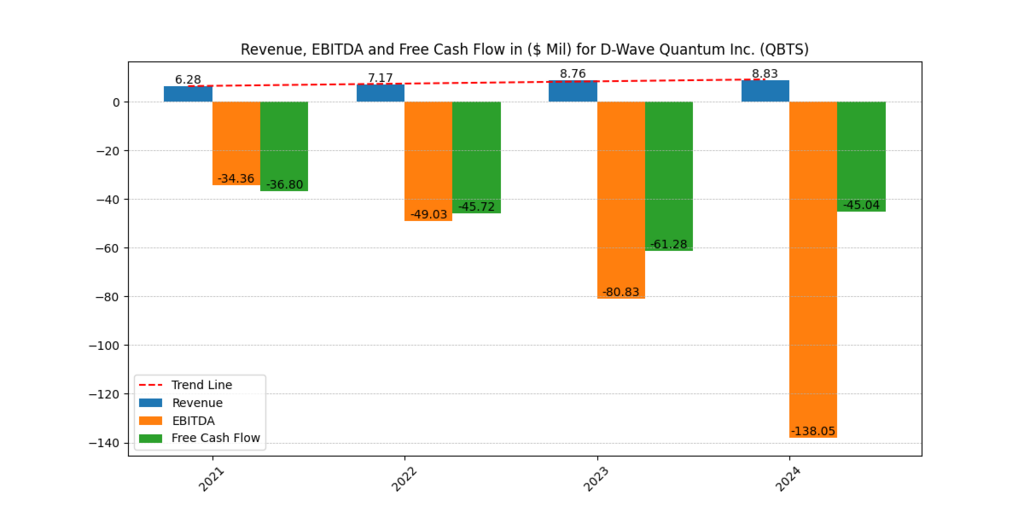

D-Wave focuses on the use of quantum computers in optimisation problem-solving, which it calls quantum annealing. The finances are not encouraging, though, a story that warns of a worsening trend of EBITDA losses -34.36M to -138.05M between the years 2021 and 2024, and the FCF position is very negative.

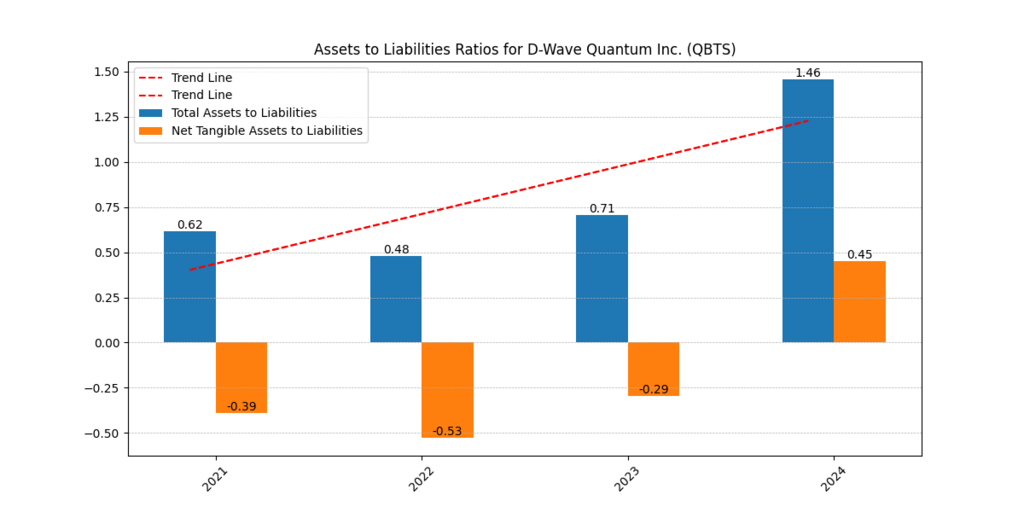

This notwithstanding, the Total Assets to Liability ratio climbs drastically to 1.46 in 2024 suggesting a better solvency. The company is also spending extensive resources on AIs fortified quantum solvers to improve logistics as well as machine learning (D-Wave Systems, 2024).

Verdict: Extremely speculative with big potential if quantum-AI integration becomes a thing. Some of the best penny AI stocks to buy that only risk-tolerant investors can consider wagering on disruptive innovation.

Rigetti Computing Inc. (RGTI) – Declining Metrics with AI Hopes

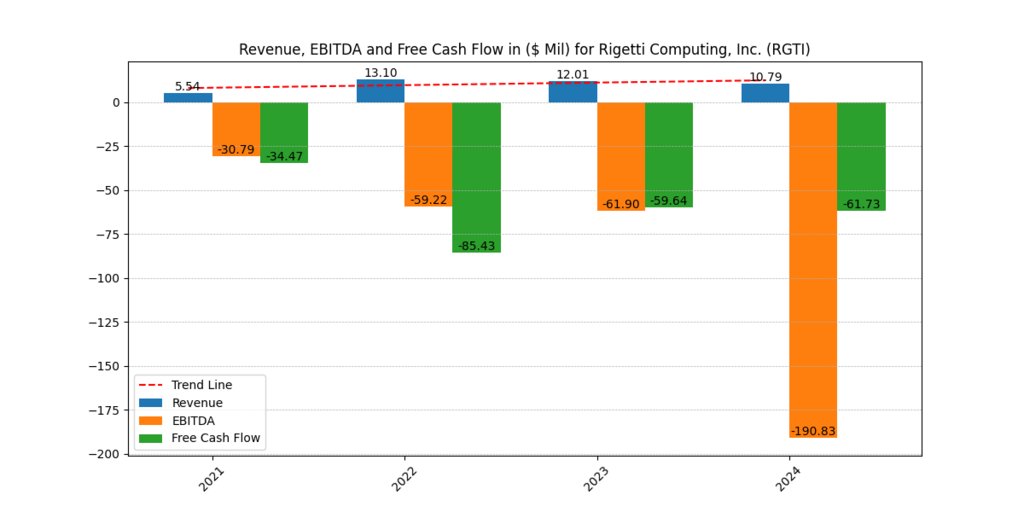

Another quantum computing company is Rigetti, which is trying to incorporate AI in complex system simulations. The revenue increased to $5.54M in 2021 to $10.79M in 2024 , which is ninety percent higher in 2024, but EBITDA has plummeted to -$190.83M, the worst in the group. FCF is extremely negative.

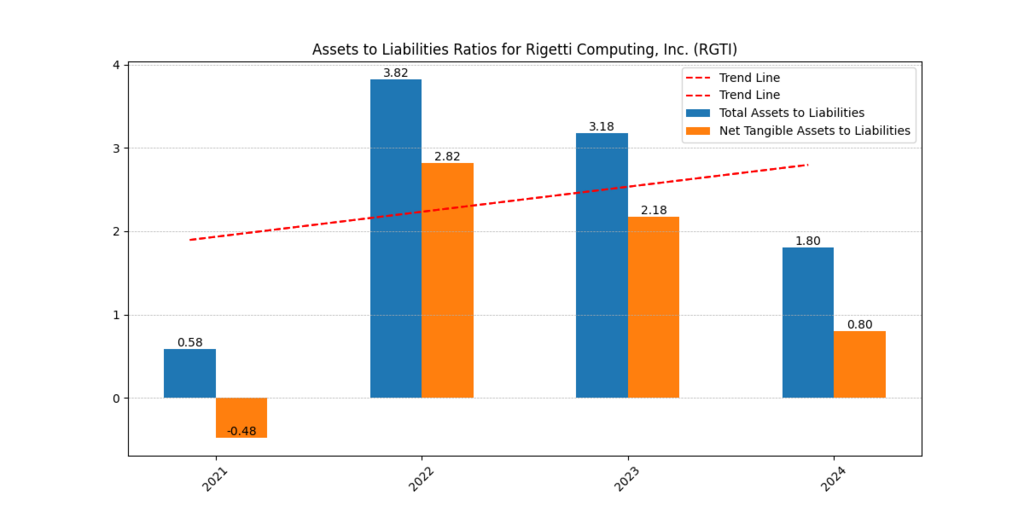

Nonetheless, in 2024, the Total Assets to Liabilities ratio continued to exceed 1.80 at Rigetti, which is also a good indicator of solvency. It is developing AI-enhanced quantum-control systems and is partnered up with DARPA and other entities (Rigetti Research Blog, 2024).

Verdict: Despite its being financially weak, the technology niche is what keeps Rigetti trending in the category of best penny AI stocks to buy speculative bets.

Conclusion

Although none of the five companies shared their financial and technological characteristics, they all provide access to specific AI applications. Box Inc. is characterised by a moderate financial health and sensible enterprise AI approach. MicroAlgo and OMH indicate a current in asset robustness and technological advancement, whereas QBTS and RGTI are one of the riskiest trades with the hope of a quantum-AI breakthrough.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.