Introduction

Learn about the best growth stocks for 2025 that prioritize dividends and innovation. Examine a list of possible winners that includes Occidental Petroleum, Microsoft, Alphabet, BYD, and Nvidia to obtain both dividend stability and diversification.

The goal of investing is always to balance the possibility of growth with a consistent income stream that informs the investment vehicle’s design. Stocks that will increase in value over time and pay dividends to shareholders produce a premium offering that appeals to investors. These five outstanding options for the “best growth stocks for 2025” are anticipated to foster a strong value proposition strategy in addition to steady growth and dividend yields.

You will learn about the best growth stocks for 2025 in this article: Nvidia Corp (NVDA), Alphabet Inc (GOOGL), Microsoft Corp (MSFT), BYD Co Ltd (BYD), and Occidental Petroleum (OXY). Companies are the best option for long-term investors because they not only set their stocks on an upward spiral but also pay dividends.

Why Growth Stocks with Dividends?

Dividend growth stocks are a versatile investment strategy that offers both appreciation and dividends. These stocks are in businesses with high growth prospects due to factors like sales increases, product differentiation, geographic market coverage, and high operating results. They generate capital profits and receive dividends as revenue shares. These growth stocks are attractive due to their stability and potential returns.

They exhibit financial and shareholder staying power by paying out profits, diversifying risks involved in investments. This strategy allows investors to cover risks associated with discounted stocks while benefiting from steady returns from growth in share value. Growth stocks with dividends are the best because they offer consistent payouts and innovation, providing financial security and a steady way of creating wealth.

Best Growth Stocks for 2025

Nvidia Corp (NVDA)

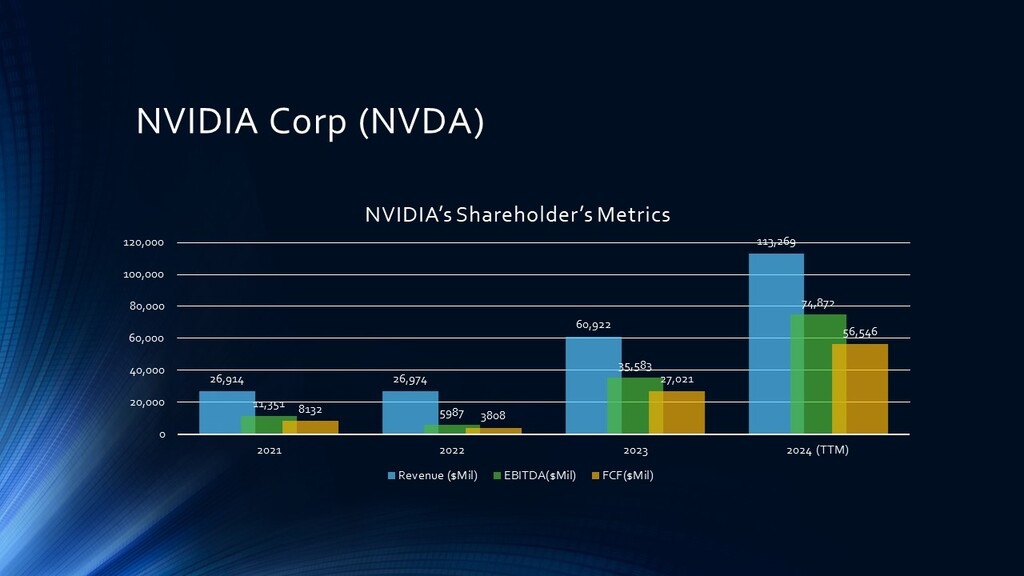

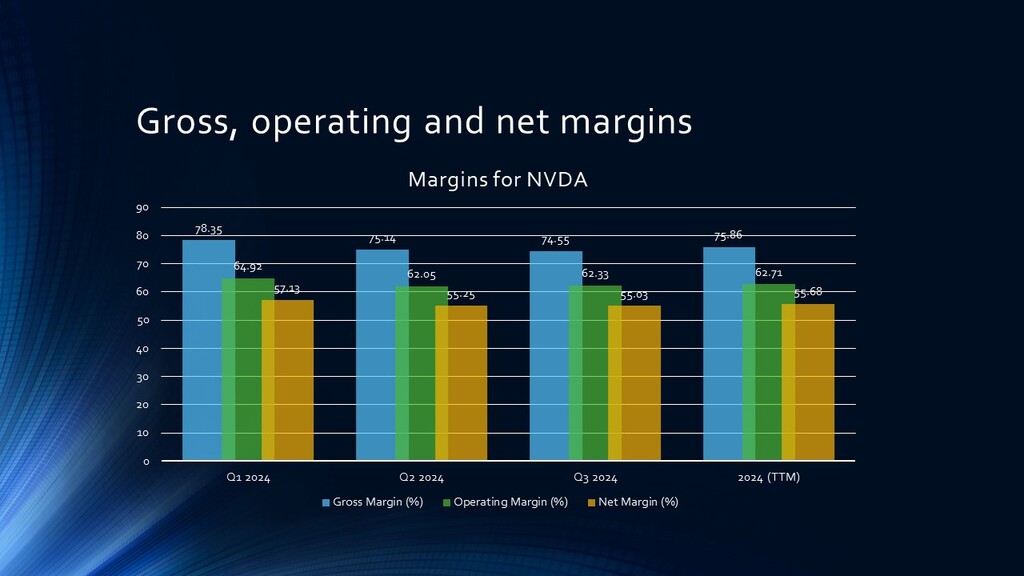

Nvidia continues to dominate Bloomberg, the semiconductor and artificial intelligence markets, and the growing demand for GPUs, AI, and data centers. Despite just paying out a dividend of 0.03%, growth stock investors are nevertheless drawn to this stock due to its exceptional recurrent income growth and innovative market dominance. Nvidia’s overall sales revenue in the fiscal year 2024 was $113.27 billion, with strong quarterly distributions of 30.96% in the fourth quarter, which ended on October 31, 2024, 26.53% in the third quarter, 22.99% in the second, and 19.52% in the first. It maintains the upward trajectory that demonstrates Nvidia’s ability to meet the demands of sectors that are increasingly incorporating high performance computing and artificial intelligence into their operations. The detailed Financial Analysis of Nvidia Corp (NVDA) can be found in this link NVIDIA Stock Analysis Post-Q3 FY25 Earnings.

The company, which has a $3.538 trillion market valuation, is still progressing in its expansion. In 2025, AI is a wonderful option for the finest growth stocks because of its investments and actions, which guarantee its relevance in future technology investments.

Alphabet Inc (GOOGL)

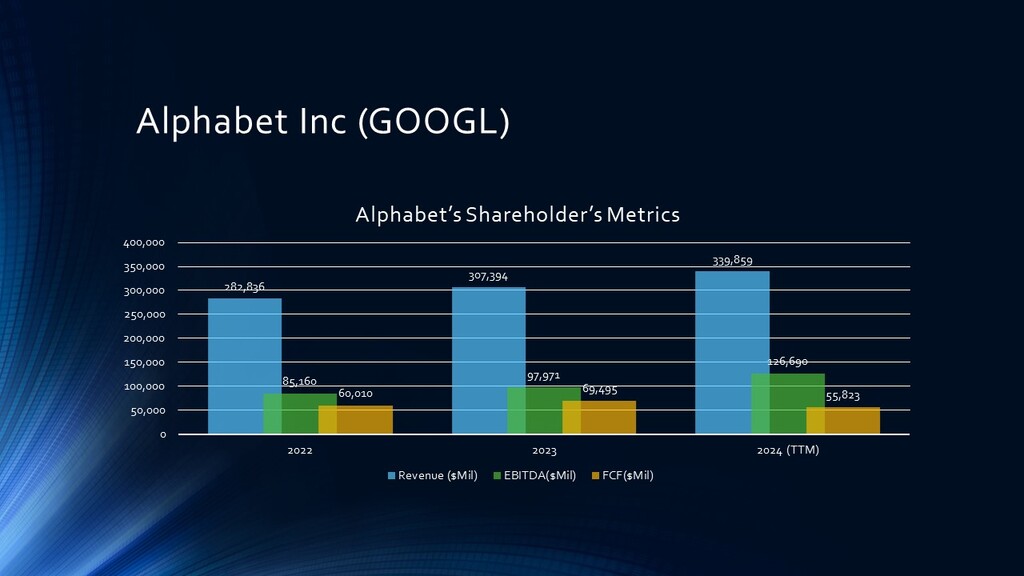

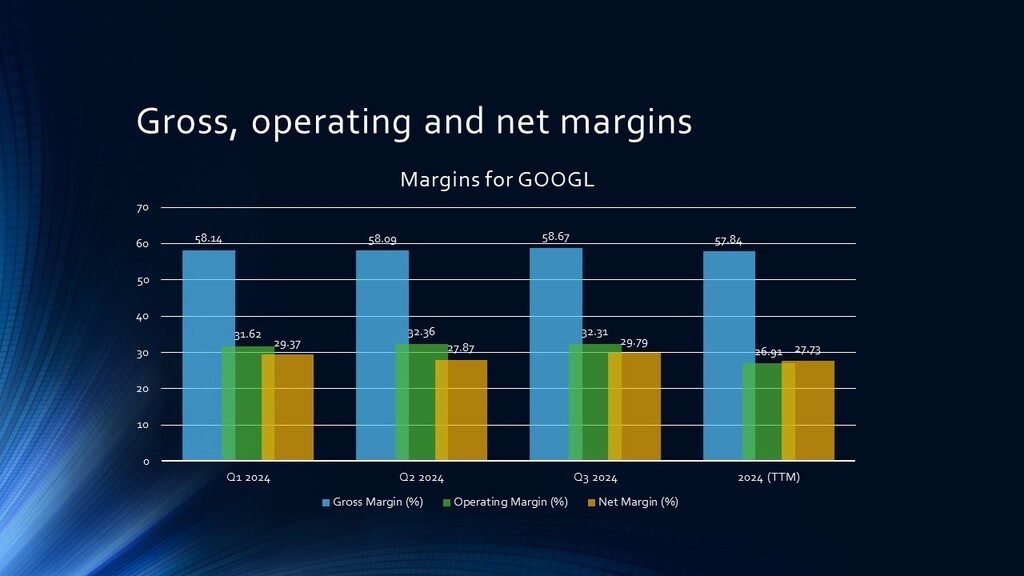

With a yield of only 0.42%, the parent firm Alphabet has turned into a dividend-paying business, demonstrating its sufficient financial stability and concern for its shareholders. The company’s rapid growth rates are shaped by Alphabet’s nearly monopolistic position in online advertising, its constantly growing cloud business, and its growing interests in numerous AI and autonomous driving projects. The company’s projected total revenue for 2024 is $339.86 billion, of which the third quarter’s revenue distribution is expected to be 25.96%, the second quarter’s to be 24.94%, and the first quarter’s to be 23.69%.

Alphabet’s ability to produce innovation at the largest scale and its strength and adaptability in emerging markets are demonstrated by its slow and steady expansion. With a market valuation of $2.355 trillion, it is evident that its influence extends beyond the technology industry to the global arena. For investors hoping to find the greatest growth companies by 2025, Alphabet is the solution because it is not only interested in dividends but also has the capacity to expand. [1]

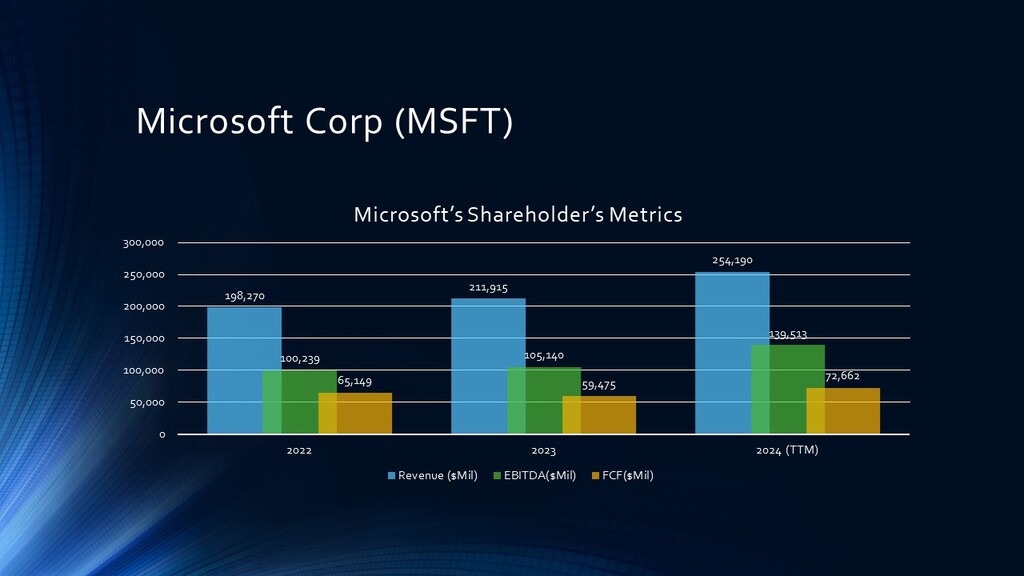

Microsoft Corp (MSFT)

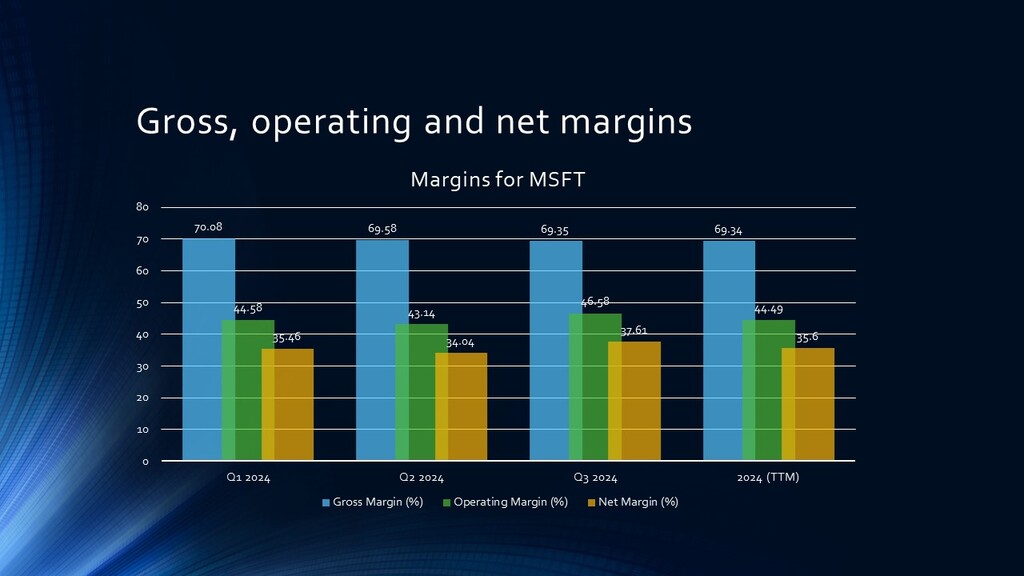

Microsoft has maintained its position as a growth stock and is still a leader in productivity tools, cloud solutions, and artificial intelligence. Microsoft is still a major player in business solutions because to initiatives like Azure that are advancing cloud innovation in the company’s space and AI Copilot that boosts employee productivity. It distributes a 0.79% dividend. The business has presented itself to investors as a growth and income play in an appealing manner.

In terms of quarterly contributions, the company’s overall revenue in 2024 was $254.19 billion, with Q3 accounting for 25.79%, Q2 for 25.47%, and Q1 for 24.33%. According to this viewpoint, it has consistently performed effectively, which is achievable in marketplaces with intense competition. With a market valuation of $3.148 trillion as of right now, Microsoft is among the top growth stocks for 2025, including growth returns with consistent profitability, thanks to its strategies focused on innovation and client solutions. [2]

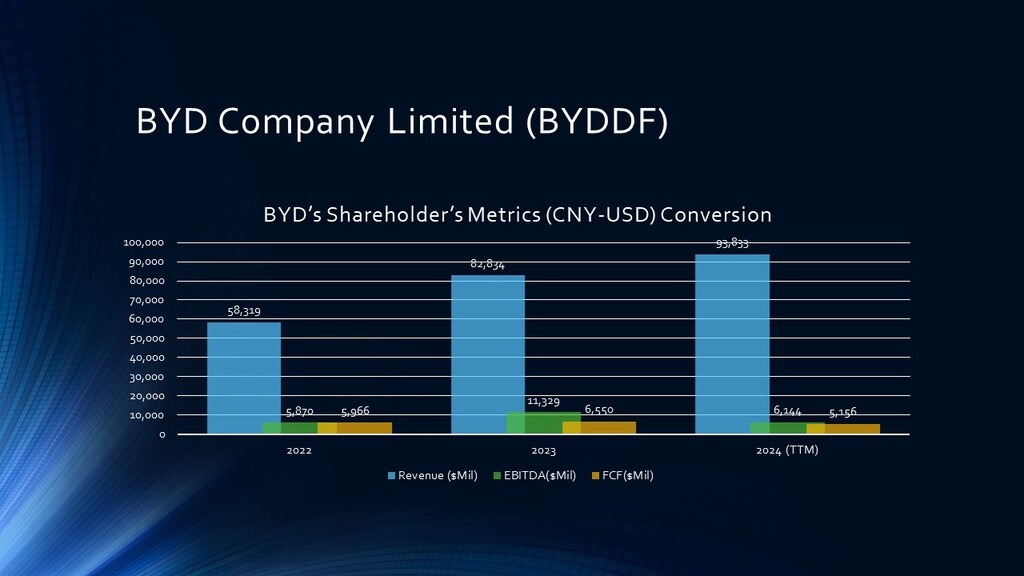

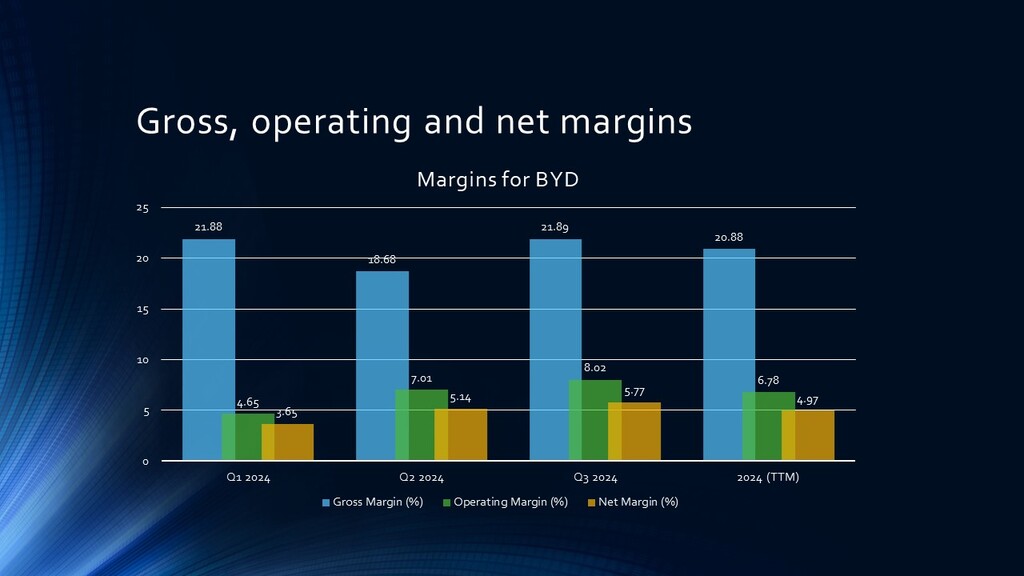

BYD Co Ltd (BYD)

BYD has become a global leader in the electric vehicle (EV) market, selling over 3,625,000 units in 2024, exceeding its annual goal. Domestic EV sales increased by 40% YoY, indicating BYD’s domestic strength. The company’s market occupies the increasing demand for environmentally friendly automobiles due to innovation and affordable production. BYD’s competitive prices and technological solutions make it a strong contender in the segment.

The stock ended at $34.26 per share in 2024, proving the company’s effectiveness and potential expansion. With a 1.28% dividend yield, BYD offers strong growth features and moderate returns, making it an ideal candidate for the best growth stocks 2025. [3]

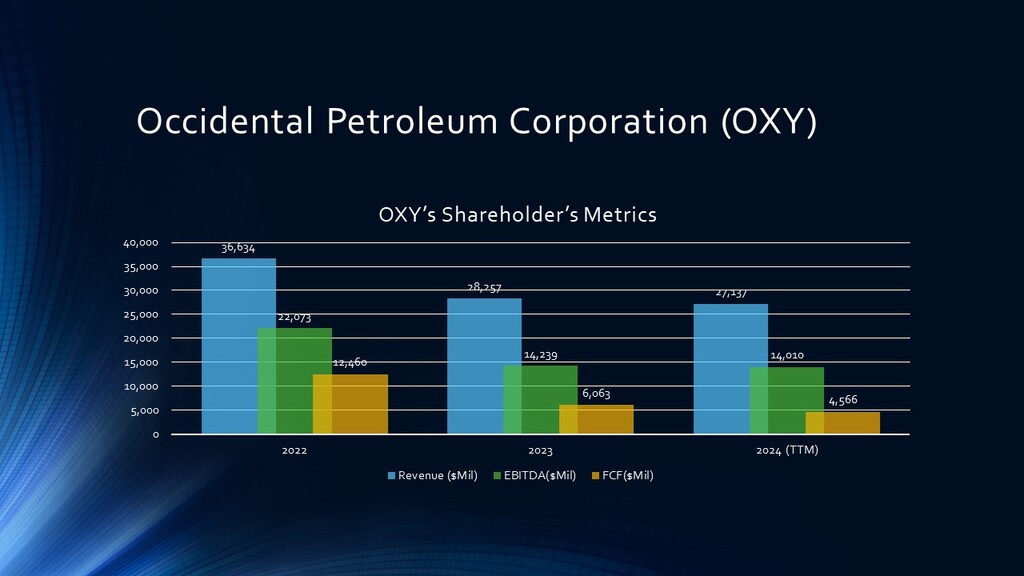

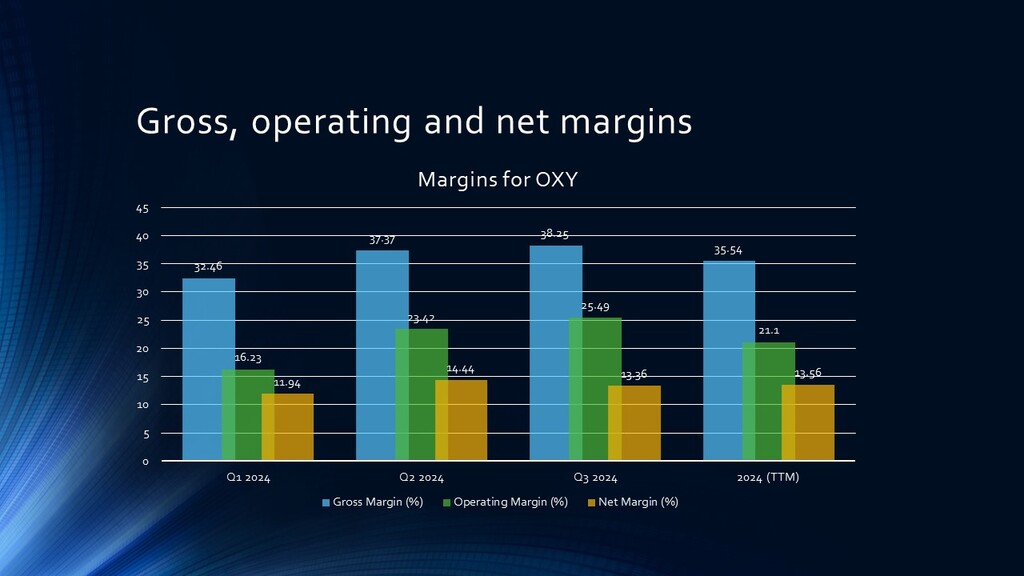

Occidental Petroleum (OXY)

Occidental Petroleum, a major player in the energy sector, is focusing on diversification and investing in carbon capture technologies to meet the growing demand for cleaner energy. This move aligns with the growing demand for cleaner energy and provides a potential hedge against regulatory pressures on fossil fuel industries.

With oil prices increasing, Occidental is well-positioned to benefit from global energy demand. Its consistent cash flow and 1.78% dividend yield make it an attractive option for income-focused investors. In 2024, Occidental’s stock price reflected investor optimism about its shift towards sustainable practices and continued energy market growth. With a market cap of $41.95 billion, Occidental Petroleum offers a mix of reliable dividend payouts and growth prospects in a rapidly evolving energy landscape.

Performance Analysis (2024)

| Company | Initial Price (Jan 2, 2024) | Final Price (Dec 31, 2024) | Percentage Increase |

| Nvidia Corp (NVDA) | $240.15 | $465.30 | 93.83% |

| Alphabet Inc (GOOGL) | $110.80 | $160.50 | 44.89% |

| Microsoft Corp (MSFT) | $248.60 | $376.85 | 51.56% |

| BYD Co Ltd (BYD) | $24.85 | $34.26 | 37.87% |

| Occidental Petroleum (OXY) | $59.35 | $74.20 | 25.05% |

Why These Are the Best Growth Stocks for 2025

The typical approach to growth stocks is to reinvest all of a company’s profits back into expanding its business. However, by looking at the companies mentioned above, investors can see that a variety of dividends can be accepted throughout growth. Because of this, it appeals to investors who are looking for growth as well as income.

The companies on this list, which includes the energy giant Occidental Petroleum, the electric vehicle manufacturer BYD, and the tech giants Nvidia, Alphabet, and Microsoft, may all be anticipated to have strong growth in fiscal 2025. Growth shareholders benefit even if the yields are significantly higher than those of conventional dividend equities. With yields of nearly or more than 1%, Microsoft and BYD are more likely to be able to afford fixed earnings in addition to rising stock values.

Conclusion

The aforementioned companies are the greatest investments for investors looking to invest in growth stocks for 2025 because they strike a balance between increasing product innovation and providing dividends to shareholders. Whether it is Nvidia’s AI, Alphabet’s revenue stream diversification, Microsoft’s continued relevance in enterprise solutions, BYD’s EV revolution, or Occidental Petroleum’s ideal positioning to capitalize on energy market movements, there are more than enough reasons why each of these companies is an appropriate choice for a growth-oriented portfolio. In the constantly shifting market landscape of 2025, anyone seeking equity should anticipate such stocks in order to benefit from both dividend income and the appreciation of their investments.

**Please be informed that the content is informational and by no means serve as a buy or sell signal. The company is not responsible for the loss of capital.