Introduction

The Best Green Dividend Stocks, which distinctly combine financial success with favourable social and ecological effects, are becoming increasingly popular, which can be attributed to this dual attraction.These companies have two purposes: first, they provide consistent dividend income streams; second, they support the global movement toward sustainable infrastructure and renewable energy. By 2025, investors will be increasingly interested in companies that do more than generate profits; they will want companies that actively promote environmental sustainability and provide steady dividend payments to their shareholders.

In terms of psychology, dividends serve as a stabilising factor. According to behavioural finance research, investors value dividends because they provide a sense of security and control, particularly during times of market volatility (Shefrin, 2020). This consistent income alleviates concerns, encourages sustained dedication, and reinforces the idea that an investment is “working for you” even during challenging circumstances. Investing in green businesses also meets a more profound need by ensuring that capital supports enterprises with a mission focused on the future and promoting climate-conscious progress (Matos, 2021).

Brookfield Renewable Partners (BEP), Eversource Energy (ES), Evergy Inc. (EVRG), NextEra Energy (NEE), and OGE Energy Corp. (OGE) are the top five high-yield green stocks highlighted in this article. These businesses each reflect a unique combination of sustainability, growth, and yield. We determine which companies stand out for long-term dividend investing by examining dividend growth, payout yields, and financial measures, including margins, Return on Equity (ROE), Return on Total Capital (ROTC), equity ratio, and EV/EBITDA.

Why Green Dividend Stocks Appeal to Investors

Dividends are a material benefit that bolsters investors’ faith in a business and serves as psychological assurance. According to behavioural finance studies, investors are less likely to experience short-term panic when they receive consistent rewards, as this reduces uncertainty bias (Shefrin, 2020). Because they provide exposure to sectors with long-term growth potential, like sustainable infrastructure and renewable energy, green dividend stocks amplify this effect.

To put it briefly, these businesses offer:

- Steady Income: Consistent payouts allay concerns about market volatility.

- Sustainable Impact: By supporting sustainable energy, investors believe they are having an impact.

- Long-Term Value: Over time, compounding profits are supported by dividend reinvestment.

Brookfield Renewable Partners (BEP)

As a leader in renewable energy, Brookfield Renewable Partners owns properties in solar, wind, and hydroelectric energy. Because of its steady dividend increases, it is regarded as one of the Best Green Dividend Stocks for investors who prioritise income.

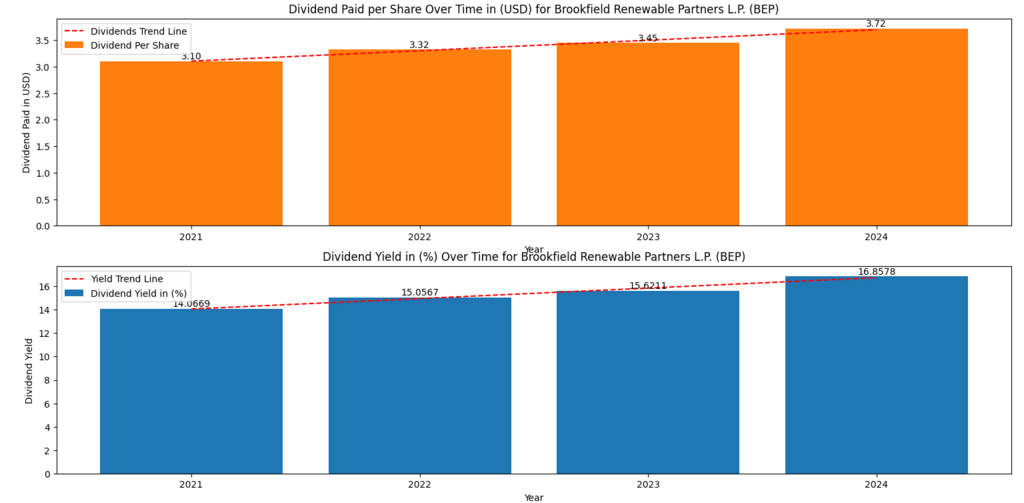

Figure 1: Dividend per Share and Yield for Brookfield Renewable Partners (BEP), 2021–2024.

With yields increasing from 14.06% to 16.85%, the graph demonstrates a consistent dividend per share increase from $3.10 in 2021 to $3.72 in 2024. This strong upward trend demonstrates BEP’s tenacity in the face of global market volatility.

Investors consider BEP to be a psychological “safety anchor.” The increasing yield provides certainty that long-term sustainability projects offer stability, even during market downturns.

Eversource Energy (ES)

Eversource Energy is a top American utility with significant investments in renewable energy, including offshore wind.

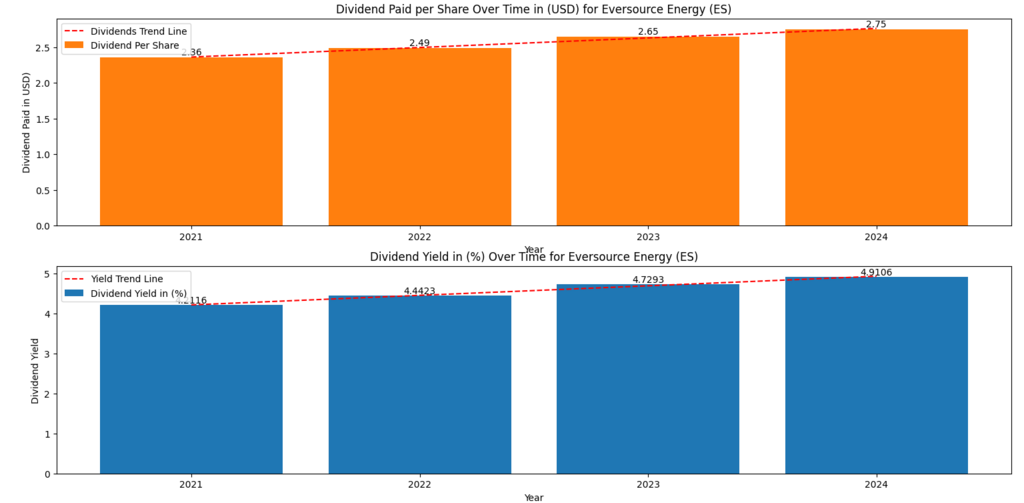

Figure 2: Dividend per Share and Yield for Eversource Energy (ES), 2021–2024.

Dividends went from $2.36 in 2021 to $2.75 in 2024, and the yield rose from 4.21% to 4.91%. ES is slightly less directional but gives a little more defence than BEP. Investors also like ES as a feel-good stock – less volatile yet still growing.

Evergy, Inc. (EVRG)

The Kansas-based Evergy has millions of customers in its service territory across both Kansas and Missouri, and an increasing amount of renewable energy in its portfolio.

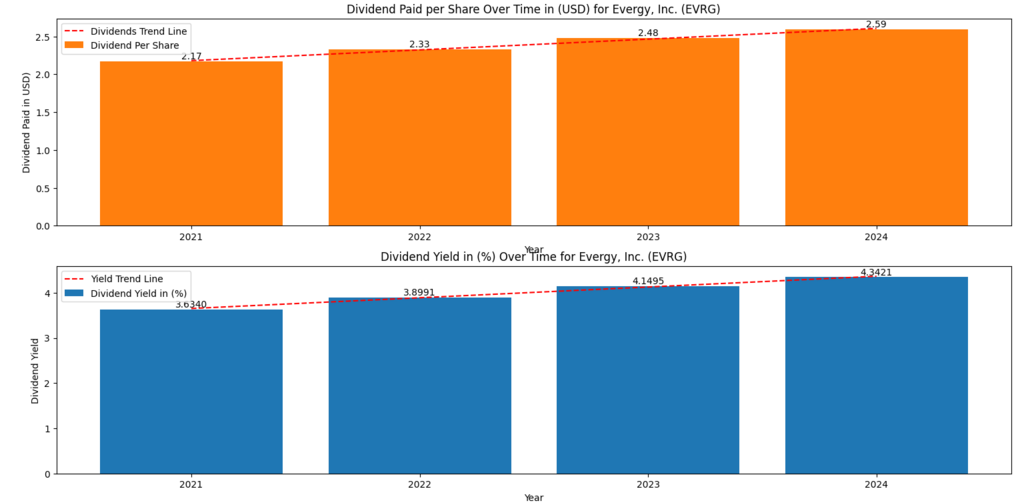

Figure 3: Dividend per Share and Yield for Evergy, Inc. (EVRG), 2021–2024.

Dividends rose from $2.17 in 2021 to $2.59 in 2024, and yields rose from 3.63% to 4.34%. EVRG is for those investors “looking to generate a moderate-income stream with a reasonable expectation of increasing income,” those in need of psychological stability over chasing pro-growth.

Further Reading : Best AI Stocks with Dividends for a Super Portfolio Return in 2025!

NextEra Energy (NEE)

NextEra Energy is the world’s biggest producer of wind and solar energy, and is often referred to as a bedrock pick for long-term dividend investing in green energy.

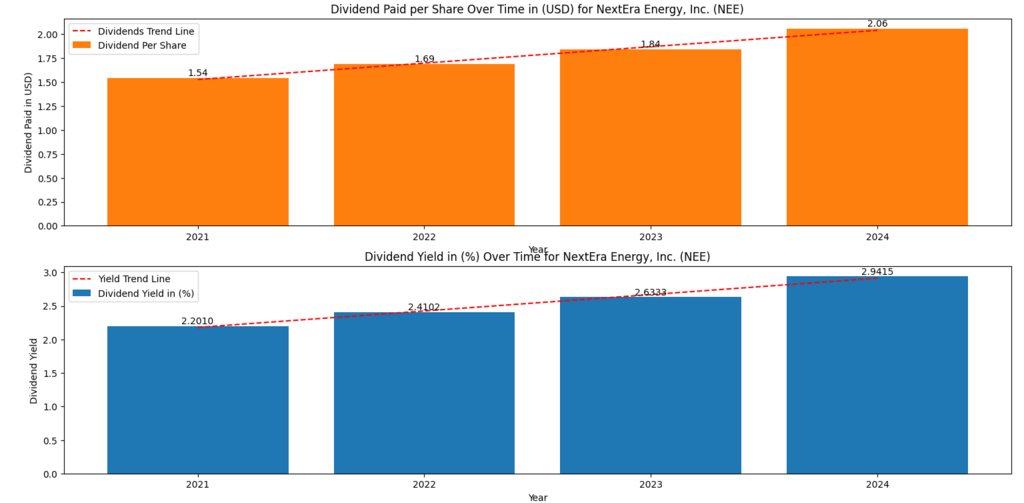

Figure 4: Dividend per Share and Yield for NextEra Energy (NEE), 2021–2024.

Free cash flow doubled from $1.54 in 2021 to $2.06 in 2024, and yields grew from 2.21% to 2.94%. Its P/E ratio is lower than that of its peers, but NEE values its scale and capacity to grow, attracting investors who believe in its leadership for your security.

OGE Energy Corp. (OGE)

OGE Energy is a smaller company in terms of size compared to NEE, and BEP has consistently grown its dividend over the years and expanded its power production towards cleaner sources of energy.

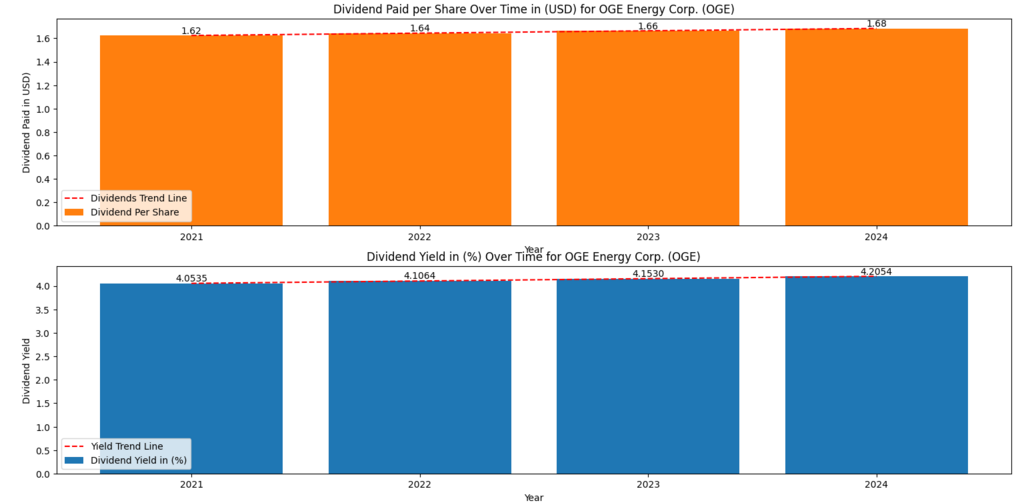

Figure 5: Dividend per Share and Yield for OGE Energy Corp. (OGE), 2021–2024.

Dividends were raised from $1.62 in 2021 to $1.68 in 2024, with yields advancing from 4.05% to 4.20%. Although small, this reliability appeals to averse investors who value steady income flows.

High-Yield Green Stocks: Comparative Financial Metrics

Here is the evaluation of these high-yield green stocks:

Table 1: Financial Metrics Comparison (2024)

| Stock | ROE (%) | ROTC (%) | Equity Ratio (%) | EV/EBITDA | Net Margin (%) |

| NEE | 11.65 | 5.12 | 39.54 | 16.92 | 22.84 |

| ES | 5.48 | 5.43 | 34.70 | 10.64 | 6.60 |

| EVRG | 8.44 | 5.93 | 40.30 | 11.70 | 14.29 |

| BEP | -6.03 | 2.64 | 46.61 | 13.35 | -3.87 |

| OGE | 10.57 | 8.06 | 44.04 | 10.57 | 15.26 |

This comparison shows:

- NEE leads with big margins, but also has an elevated EV/EBITDA.

- ES provides defensive quality, but offers a lower return on profit.

- EVRG fits the bill, with a good combo of profit growth and a reasonable valuation.

- BEP does struggle with negative margins, but a high equity ratio points to a good balance sheet.

- It has solid ROTC and a high equity ratio, so it’s a “quiet achiever.”

Investor Psychology and long-term Dividend Investing

Behavioural finance posits that investors are making a trade-off between security, growth and meaning, and that trade-off explains why green dividend stocks are so appealing.

Safety: Dividends serve as a type of psychological safety net. The guaranteed cash flow minimises uncertainty and allows investors to have a sense of their financial future, regardless of whether the marketplace fluctuates. This dependability eases investors’ concerns since they know they will continue to reap tangible rewards despite any short-term volatility, especially during times of economic upheaval. A dividend essentially converts investments into a source of income, making them less intangible and more tangible (Shefrin, 2020).

Growth: Stability is not enough for investors; they also want the satisfaction that their wealth will grow. This growth story also dispels fears of stagnation. Psychologically, it provides hope and encourages investors to move forward, allowing them to feel confident that their portfolios are invested in industries that are likely to remain stable (Matos, 2021).

Interpretation and Meaning: Investing in green dividend stocks is not based solely on financial reasoning. As (Statman 2021) notes, these investments enable individuals to define themselves not only as wealth maximisers but also as members of society creating value, which reinforces their locus of identity and purpose.

It’s this rare combination that makes the Best Green Dividend Stocks so well-revered. They fulfil not only age-old financial aspirations but also more profound psychological needs for security, development and contribution, making them particularly attractive in and after 2025.

Conclusion

The Best Green Dividend Stocks for 2025 (BEP, ES, EVRG, NEE, OGE) show us that perfect mix of yield, growth, and sustainability us 21st 21st-century investors are always on the lookout for. BEP boasts high yields, solid dividend growth, and a continually expanding global presence in the renewable sector. In contrast, ES offers the chance to achieve moderate yields with the comfort of defensive stability and an ambitious growth story in the renewable space.

EVRG provides a compelling mix of stable returns and regional utility strength, whereas NEE, although yielding less, stands out in terms of scale, renewables, and future growth potential. While OGE is not content for most income investors, it is popular with conservative investors due to its steady and dependable distributions. Collectively, these companies highlight that the real benefit of green dividend investing is not just outperformance, but a psychological cushion of stable income with a persistent focus on sustainability.

Disclaimer

The content provided herein is for informational purposes only and should not be construed as financial, investment, or other professional advice. It does not constitute a recommendation or an offer to buy or sell any financial instruments. The company accepts no responsibility for any loss or damage incurred as a result of reliance on the information provided. We strongly encourage consulting with a qualified financial advisor before making any investment decisions.