Introduction

Discover the best dividend stocks under $50 for 2025, including Pfizer, Kraft Heinz, Verizon, BYD, and HP. The dividend ratios are analysed in order to build a portfolio that can generate steady income.

Dividend income is one of the best ways for getting a stable income with the potential for long-term financial gains. Many high-quality, large-cap, diversified blue-chip firms with low yields that have produced excellent dividends and strong earnings per share growth are available to investors looking for inexpensive options. In addition to having strong yields, shortlist companies come from a variety of industries, which reduces sector-specific risks.

Five best dividend stocks under $50 for 2025 are examined in this blog: Pfizer Inc., Kraft Foods, BYD, Verizon, and HP. These businesses have all proven sound corporate governance and strong balance sheets, which provide shareholders with high dividend yields. For these companies, we will look at some data on the pay-out ratio, the dividend yield, and if the current companies have raised their dividends in a row.

Both young, inexperienced traders eager to buy inexpensive shares and patient investors seeking a consistent income find these companies to be the most reliable. After reading this study, you will have a better understanding of how likely these dividend companies are to meet your investment objectives for 2025 and beyond.

1. Pfizer Inc. (PFE)

- Dividend Yield: 6.54%

- Dividend Paid per Share: $1.72

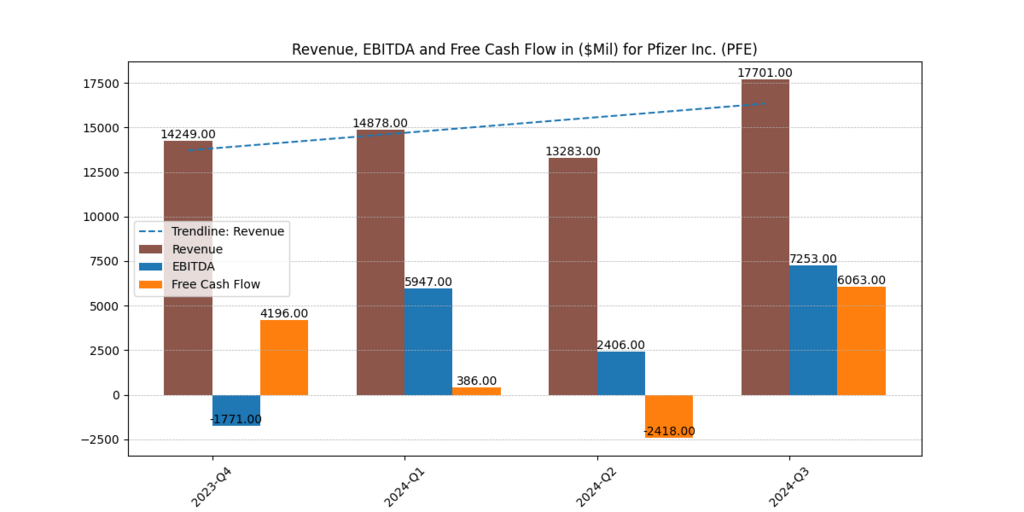

The Pfizer Company, one of the top companies in the pharmaceutical sector, has an appealing dividend yield of 6.54%, making it a great choice for yield-focused investors. The company’s current dividend payment of $1.72 per share per year demonstrates that, despite the difficulties faced in the post-pandemic world, particularly in the pharmaceutical sector, it is still determined to reward its shareholders. Pfizer is another example of a business that has been increasing its dividends annually, despite its growth rate decreasing recently as a result of a drop in COVID-19 vaccine sales.

Additionally, its free cash flow has remained very stable over the past three years, averaging $15 billion annually, ensuring securely dependable dividends. Due to the sales of vaccines, the revenue has varied, reaching its highest point in 2022 at $100.3 billion. This demonstrates unequivocally that future revenue growth is made possible by the novel medicine pipeline for dividend sustainability. [1]

2. The Kraft Heinz Company (KHC)

- Dividend Yield: 5.22%

- Dividend Paid per Share: $1.60

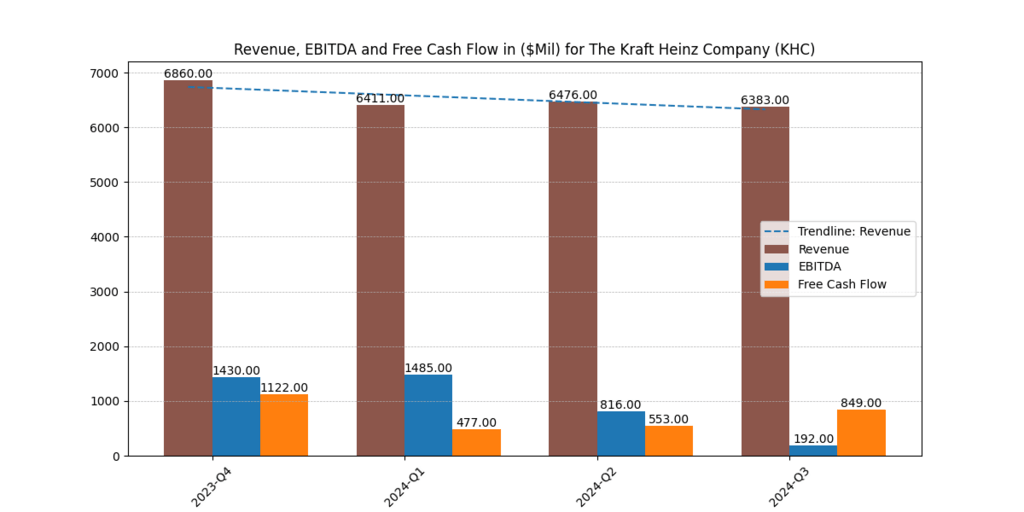

With a strong dividend yield of 5.22%, Kraft Heinz is an internationally recognized name in consumer staples. Even with an annual payout of $1.60 per share, the company has consistently paid dividends on time. Dividends have not increased significantly in recent years, but the company’s distributions may be supported by enabled free cash flow, which has covered $2.7 billion on average over the last three years. The success of its key brands has contributed to consistent revenue, which ranges between $24 billion and $26 billion yearly. Kraft Heinz has prioritized cost-cutting and innovation as a defensive strategy and as a stable, predictable growth organization that focuses on providing steady revenue. [2]

3. BYD Co. H (BYDDF)

- Dividend Yield: 1.32%

- Dividend Paid per Share: $0.44

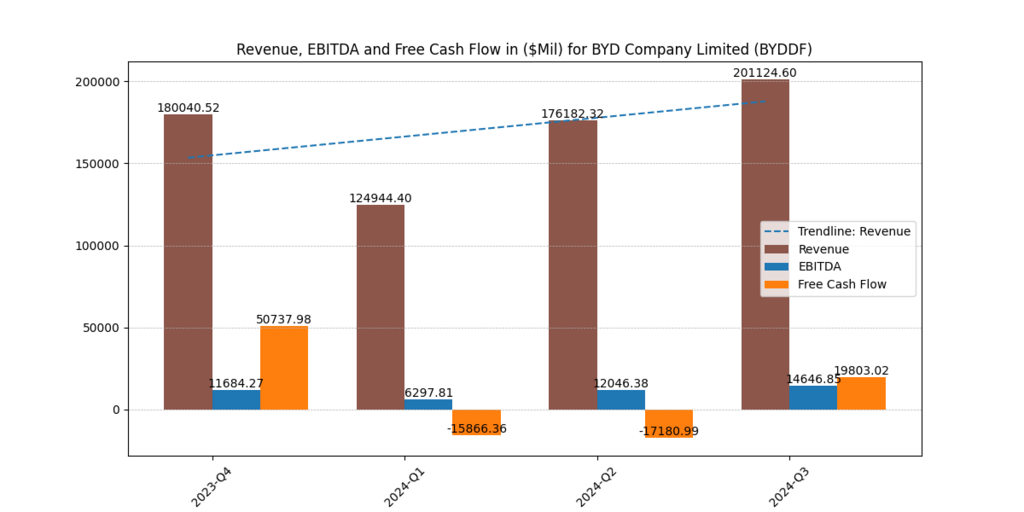

BYD Co., another well-known company in the EV and battery vertical, pays an annual dividend of $0.44 per share, which is a relatively low dividend yield of 1.32%. To show its appreciation for its shareholders, BYD has been increasing its dividends consistently, despite the yield situation being low when compared to classic dividend companies. While revenue is expected to increase from $22 billion in 2020 to $62 billion in 2023, the average free cash flow over the last three years has been $3.2 billion.

Of course, BYD is a good fit for investors seeking consistent growth with low to moderate returns because it places a high priority on reinvesting its profits in expansion and innovation. You can also look at our list of Best Growth Stocks for 2025 with Dividends.

4. Verizon Communications Inc. (VZ)

- Dividend Yield: 6.79%

- Dividend Paid per Share: $2.69

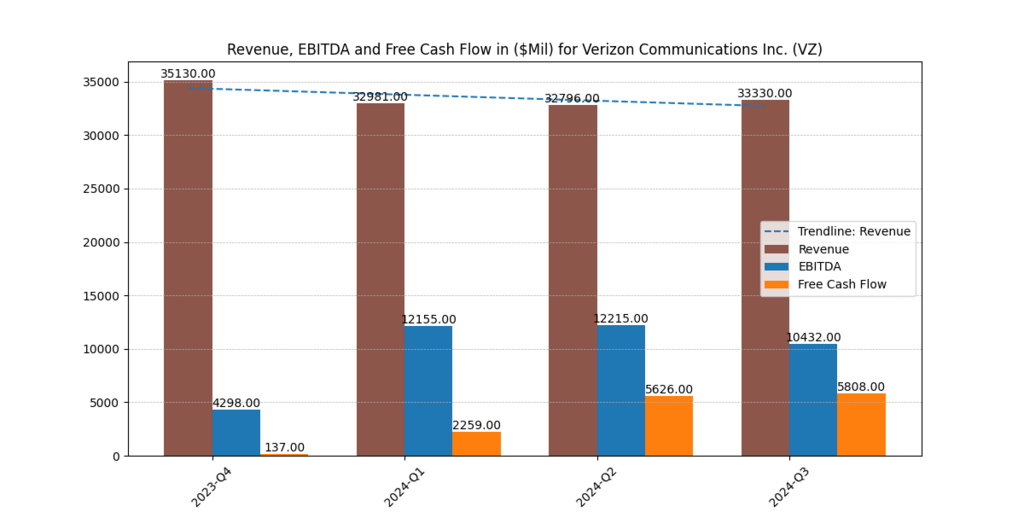

Verizon is appealing to investors looking for high returns because of its remarkable dividend yield of 6.79%, which places it among its rivals. For more than 15 years, the company has been growing its dividend annually, and it currently distributes $2.69 per share.

Verizon has demonstrated its ability to sustain a high dividend policy in light of the high capital intensity of its businesses by averaging an astonishing $17 billion in free cash flows over the last three years. Continued expansion in its internet and wireless operations has resulted in more stable total revenues, which have been between $128 billion and $136 billion yearly. Verizon is a staple of income-oriented funds due to its comparatively high yield and steady cash flow. [3]

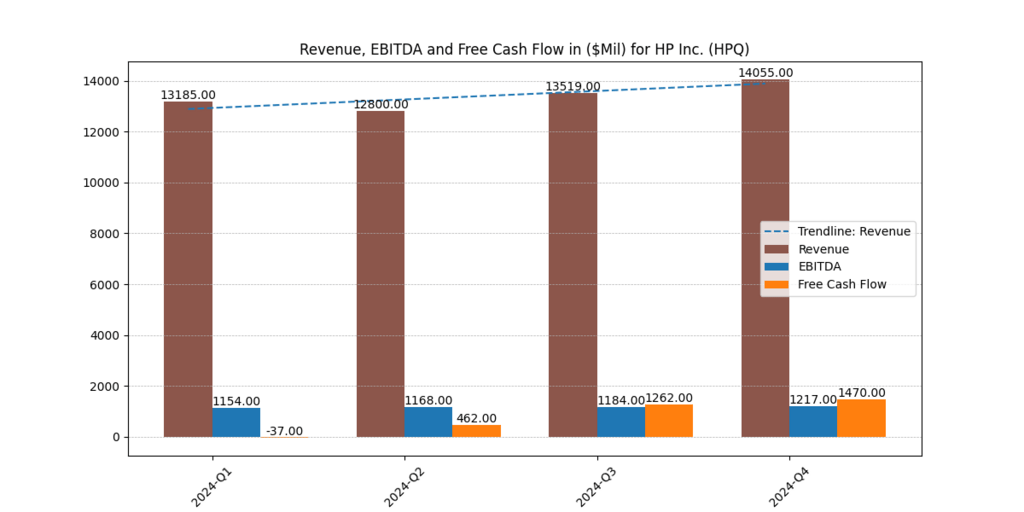

5. HP Inc. (HPQ)

- Dividend Yield: 3.26%

- Dividend Paid per Share: $1.16

With an annual dividend per share of $1.16, HP Inc., a company that specializes in personal computing and printing solutions, provides its stockholders with a 3.26 percent dividend yield. As a result of the company’s focus on shareholders, dividend payments have increased steadily.

With an average of $4.5 billion in cash generated over the last three years, HP has demonstrated that it has the capacity to meet its dividend obligation through free cash flow. However, the company’s consistent revenues, which averaged $58 billion, were unaffected by the cyclical issues facing the technology sector. In terms of value and stability, HP is a dependable option among technology businesses due to its emphasis on innovations, capacity to buy its shares, and ability to pay dividends to shareholders. [4]

Conclusion

The yield, strong financials, and sector diversity of these five best dividend stocks under $50 for 2025 offer some cushion in the event that any sectors perceive another significant drop. Verizon offers investors substantial returns, but investors focused on BYD receive modest yields with room for growth, providing a wide market for these companies. By adding them to your portfolio in 2025, you can potentially able to achieve the ideal balance between growth and income.

**Please be informed that the content is informational and by no means serve as a buy or sell signal. The company is not responsible for the loss of capital.